Indian Investors: how inflation is hurting your returns

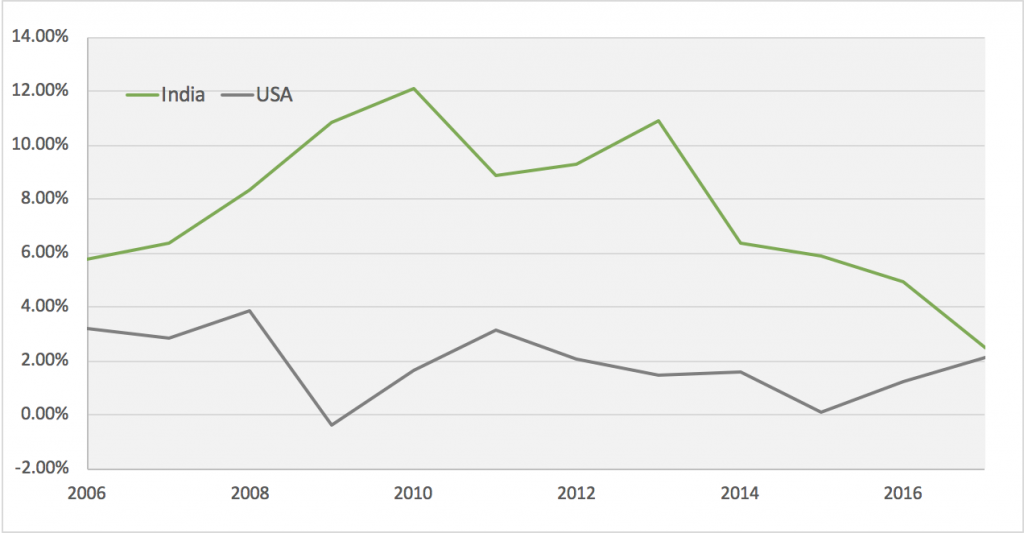

When investing in equities, Indian investors must be aware that the realized return is driven by both performance of the stock and by the change in value of Indian Rupees. If an investor invests in Indian stocks that give 10% return, while at the same time the INR experiences inflation of 10%, then in absolute term, the investor breaks even, before taking into account any associated trading costs. On the other hand, if the investor invests in US stocks that give 10% return, while the Indian rupee experience 10% inflation against the US dollar, then the investor enjoys a 21% return. Figure 1 below illustrates the difference in inflation rate between India and US. In contrast to US’, India’s inflation rate has been much more volatile, ranging from less than 12% to about 2% in recent months.

Figure 1: Inflation rate comparison between India and the US

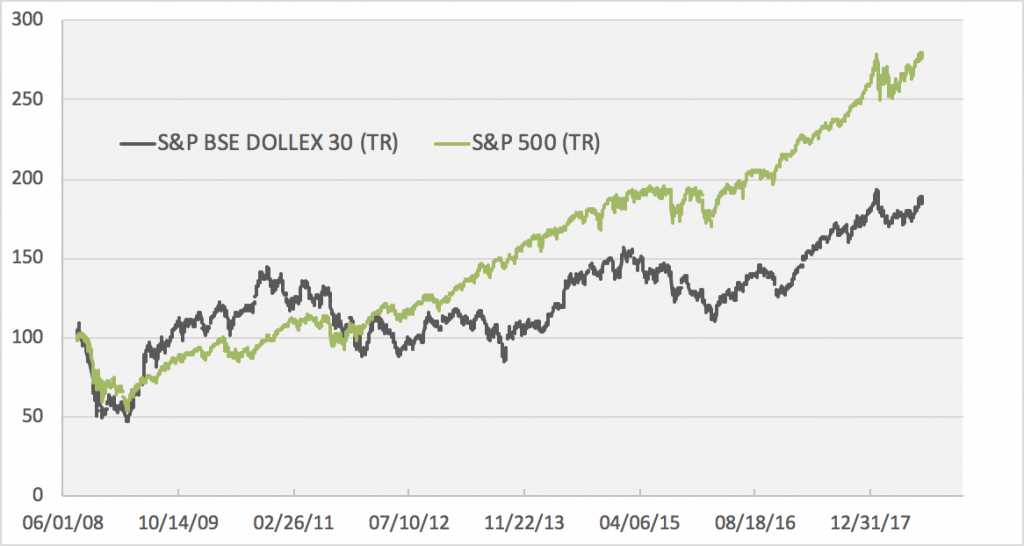

To take into account effects of inflation, an apt comparison between the performance of the Indian stock market vs. the US market is to compare the S&P 500 with the Dollex-30. The S&P 500 is the index that captures the top 500 companies in the US, while the Dollex-30 is the USD version of the SENSEX, India’s top 30 stocks-index. The Dollex-30 allows investors to measure return after controlling for currency fluctuations. Figure 2 compares the performance of the two indexes from the past ten years. The data was taken from S&P Dow Jones indices. It shows that, after taking into account the effect of inflation, the S&P 500 outperforms the Dollex-30. The S&P 500 gives an average compounding annual return of 10.58%, while the Dollex-30 yields 6.17%. This means if an investor invests USD$ 100 in the S&P 500 ten years ago, this investment would have become USD$ 272. In contrast, the same investment made in the indian stock market, controlling for the effect of inflation would have given USD$ 182. Note that this result does not take into account dividends paid by the S&P 500 companies.

Figure 2: Performance comparison between S&P 500 and Dollex-30 (source: S&P Dow Jones Indices)