In this week’s update we show why the stock market is not the economy, and dive deeper into Lemonade’s sky high valuation.

The stock market is not the economy

Many in the media have been scratching their heads as to why the US stock market continues to rebound even while the US economy is in a deep recession (with record unemployment numbers and a prolonged lockdown). Is the market disconnected from reality? Not really – it was never connected to begin with.

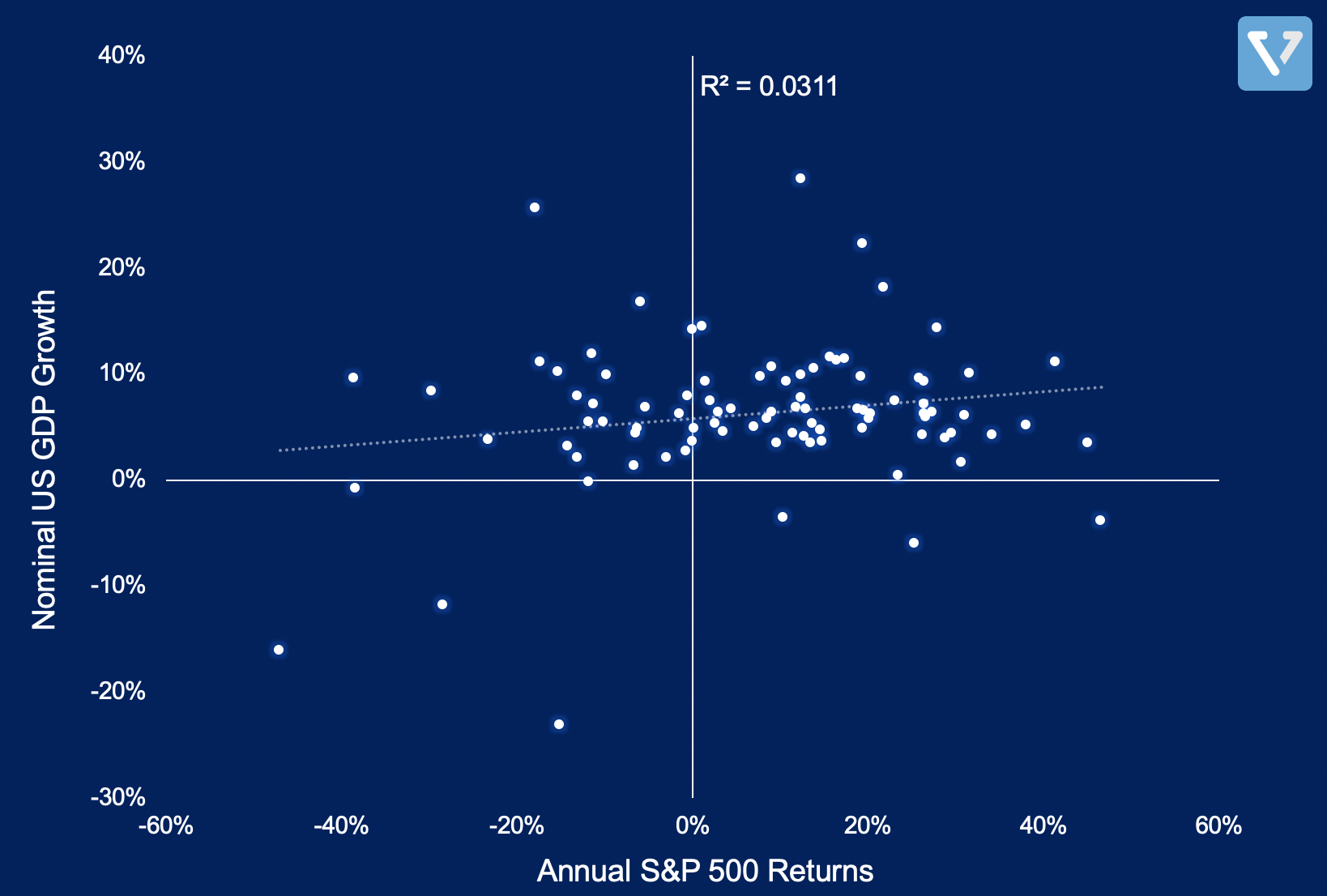

In Figure 1 we plot the S&P 500 annual returns against the US nominal GDP growth from 1930 to 2019, a period of 90 years. The correlation (R-squared) between the two is 0.03 (note: R-squared ranges from 0 to 1. A value of zero denotes that there’s no relationship). This means there’s no correlation between the S&P 500 returns and GDP growth rate, so it should not be a surprise when the stock market deviates from economic recovery.

In this 90 year period, the S&P 500 had positive annual returns 68% of the time, while the US GDP grew 91% of the time.

The stock market is not reflective of the current economic situation, but rather a reflection of investors’ expectation of what will happen in the future. The stock market is also a repository of capital. Capital flows in and out of the market as a function of inflation, interest rate, and Fed (US central bank) policies. When capital flows into equities, the price of stocks tend to go up. And this is what we are witnessing in recent months, with the Fed’s unprecedented (in size and speed) stimulus, injecting liquidity into the system while maintaining interest rates low into the foreseeable future. As a result, stock prices went up.

Lemonade

Lemonade, the internet-first insurance company, IPOed last week. Its share price popped after the first week of trading, settling at about US $76 per share or about a 33% increase, a sign that investors’ appetite for tech company IPOs is still high. But are investors’ exuberance warranted? We take a look at the company’s public filing (based on its June S-1) to better understand the business.

Valuation is sky high

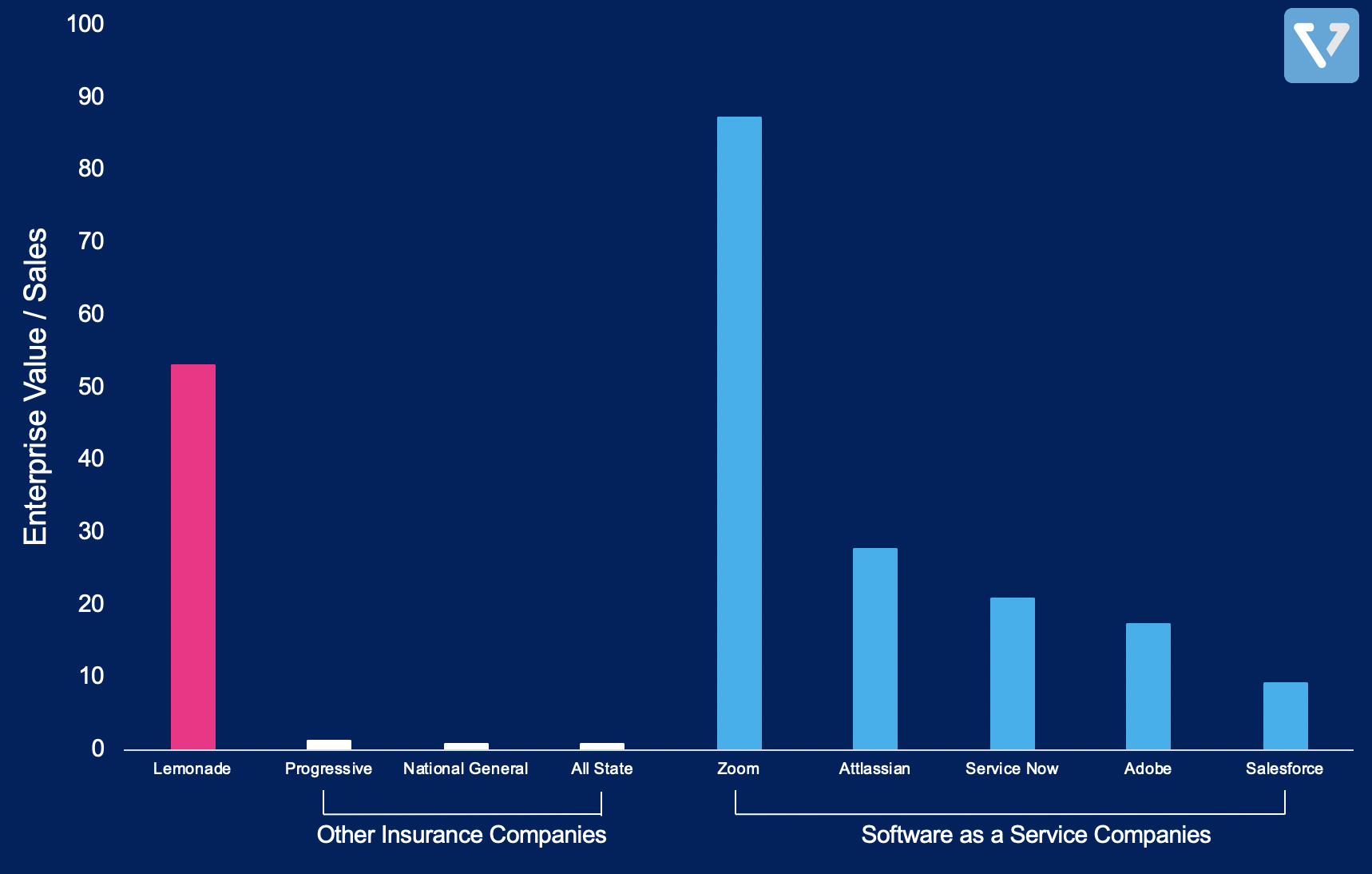

The company’s valuation is sky high. In Figure 2, we compare the company’s EV/Sales ratio against other traditional insurance companies (where EV/Sales ratio ranges between 0.8 to 1.4) and SaaS companies (between 9 to 87). Lemonade currently has an EV/Sales ratio of 53X, a high value even when compared to SaaS companies. Unfortunately, the company does not have the high gross margins that typically accompany SaaS companies (Zoom for example, has a gross margin close to 80%, while Lemonade had a gross margin of 18% in Q2 2020).

Long payback time for customer acquisition leads to capital inefficiency

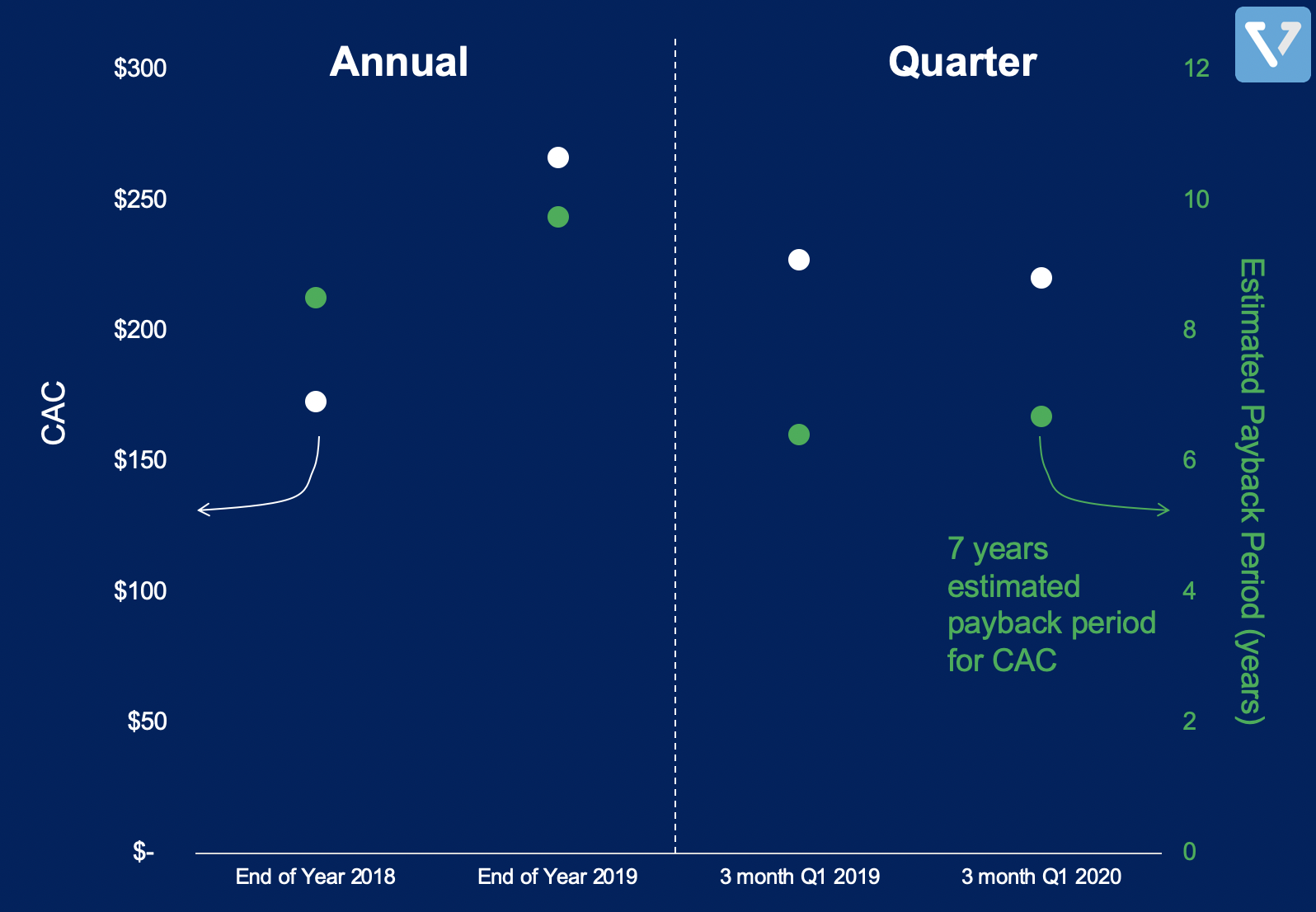

In a typical SaaS company, the cost of acquiring customers (CAC) is typically recouped within the first year. This is not the case with Lemonade, where its S-1 claims that the company recoups CAC within 2 years. Not only that, while their calculation of CAC is technically correct, it is misleading. The company calculated CAC using Gross Written Premium (which is similar to bookings in a SaaS company) over marketing spend. However, Gross Written Premium (GWP) is not the take home revenue. In reality, for every US $1 of GWP, the company only gets to keep US $0.18 (18% gross margin after taking into account payments for claims). If you use the gross profit values, then the time it takes to recoup CAC is closer to 7 years. This means that the business will require a lot of capital to fuel further growth.

Other Risks

We also identified additional points of concern when looking at the company’s S-1:

- The mix of insurance that the company offers is mostly renter’s insurance, where the company earns US $150 per year. A small portion of its user base pays for homeowner’s insurance, which generates US $900 per year. The key assumption of the business is that Lemonade can continue to serve renters as they purchase homes. But due to COVID-19, home sales have cratered. This may slow this transition and therefore slowing the company’s revenue growth

- The company has significant concentration risk. 61% of its policies are located in three states: California, Texas and New York. A natural disaster occurring in just one of these states can cause significant impact on Lemonade’s bottom line