Lyft IPO, and Lyft vs. Uber

On Friday March 29th 2019, Lyft (a ride-sharing company that operates in the USA and Canada) was publicly listed on Nasdaq and successfully raised more than US$ 2 billion of fresh funding from the public market. The share price was initially listed at US$ 72 per share, but due to high demand, the share price opened at US$ 87.24 per share, only to finally settle at $78.29 per share at market closing on Friday.

The company is now valued at US$ 26 billion on a fully diluted basis, significantly higher than its last private valuation of US$ 15.1 billion.

This is a momentous day, not just for Lyft, but for the tech industry as a whole. Lyft is the first transportation-as-a-service company to become available for the public to invest in. Its valuation will be setting a precedent for Uber when the latter IPOs in April 2019. At a US$ 26 billion market cap, Lyft is valued at a 9.7X revenue multiple (based on Q4 revenue of US$ 670 million – projected to a full year).

Judging from the high demand of the stock, investors are optimistic about Lyft’s future. Other than the potential irrational exuberance over the opportunity in investing in the first ride sharing company, there are some reasons why investors are optimistic about Lyft. Here are some data (most are taken from Lyft’s S-1):

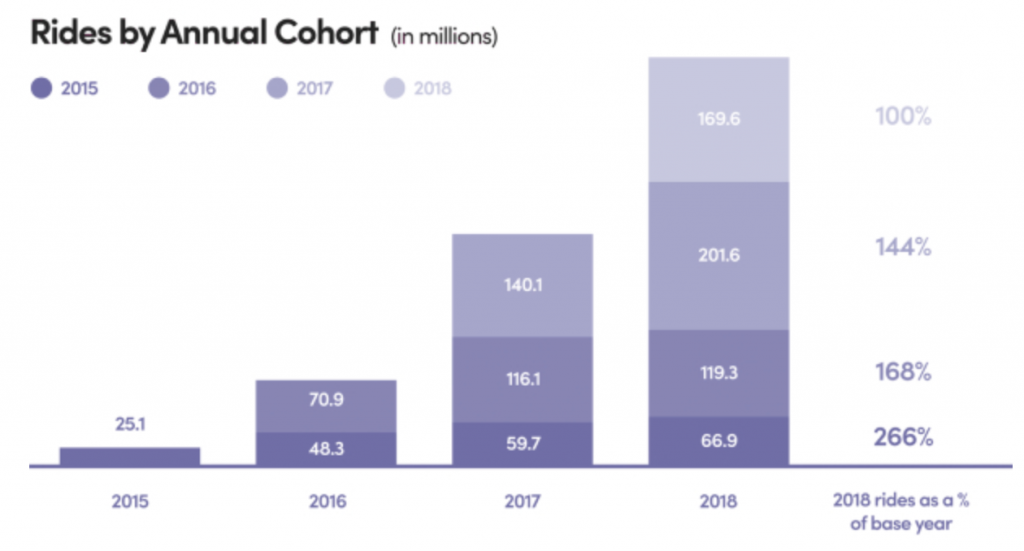

(1) The product appears to be sticky. Usage of Lyft’s services has increased over time. Riders that signed up in 2015 have increased their usage from 25.2 million rides to 66.9 million rides in 2018.

Figure 1: Lyft’s Rides by Annual Cohort

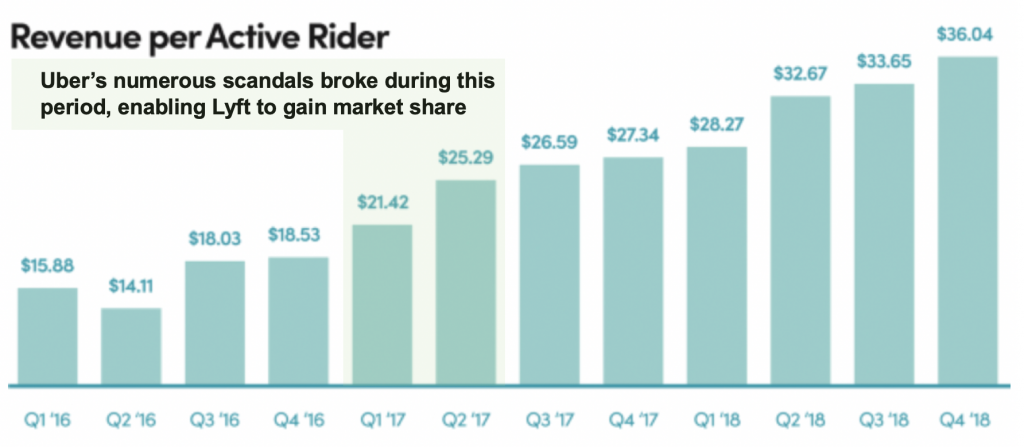

(2) Revenue per active rider is also trending upwards (Figure 2). The company can more effectively extract revenue from its customers. The inflection occurred in early 2017, thanks in no small part to the self inflicted wound that Uber experienced at that time. In Q1 to Q2 2017, news broke about Uber’s numerous management issues, questionable business practices and toxic work culture. This allowed Lyft to gain market share. As a result, Lyft experienced a jump in revenue per active rider. This lucky break came at a very opportune time, considering Lyft was looking for a buyer – without success – as recently as the second half of 2016.

Figure 2: Lyft’s Revenue per Active User

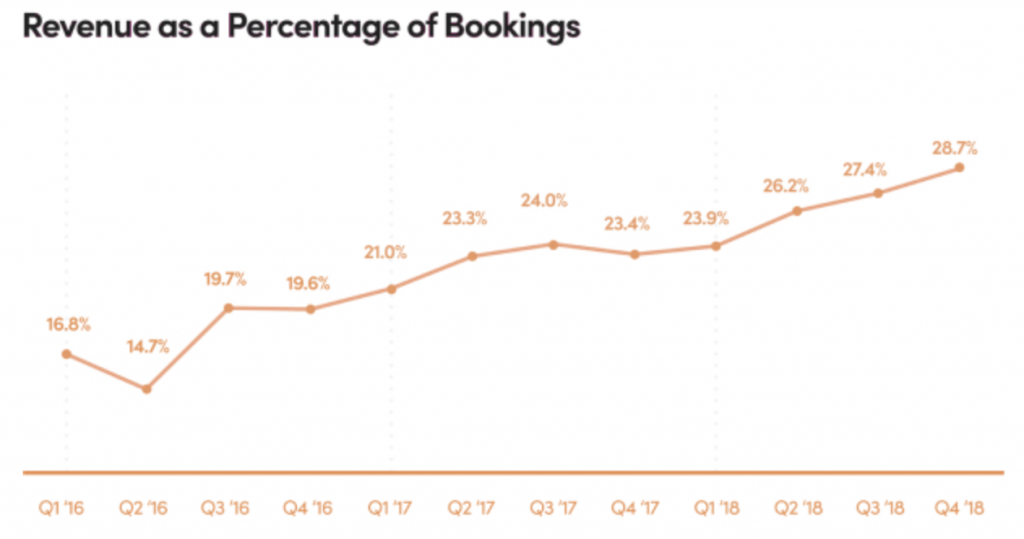

(3) Lyft’s revenue as a percentage of bookings is also trending upward, from 16.8% in Q1 2016 to 28.7% in Q4 2018 (see Figure 3). This means that Lyft is generating more revenue on a per ride basis. This is driven by multiple factors: (1) Lyft is increasing its take rate from drivers. Now that Lyft has control over enough users’ demand for rides, it has pricing power over drivers. This pricing power is likely true for the no. 1 player, Uber, as well. (2) The company is getting better at increasing utilization of its network of bikes and scooters, which likely is more profitable on a per ride basis because Lyft does not have to pay drivers on these transportation modes.

Figure 3: Lyft’s Revenue as a Percent of Bookings

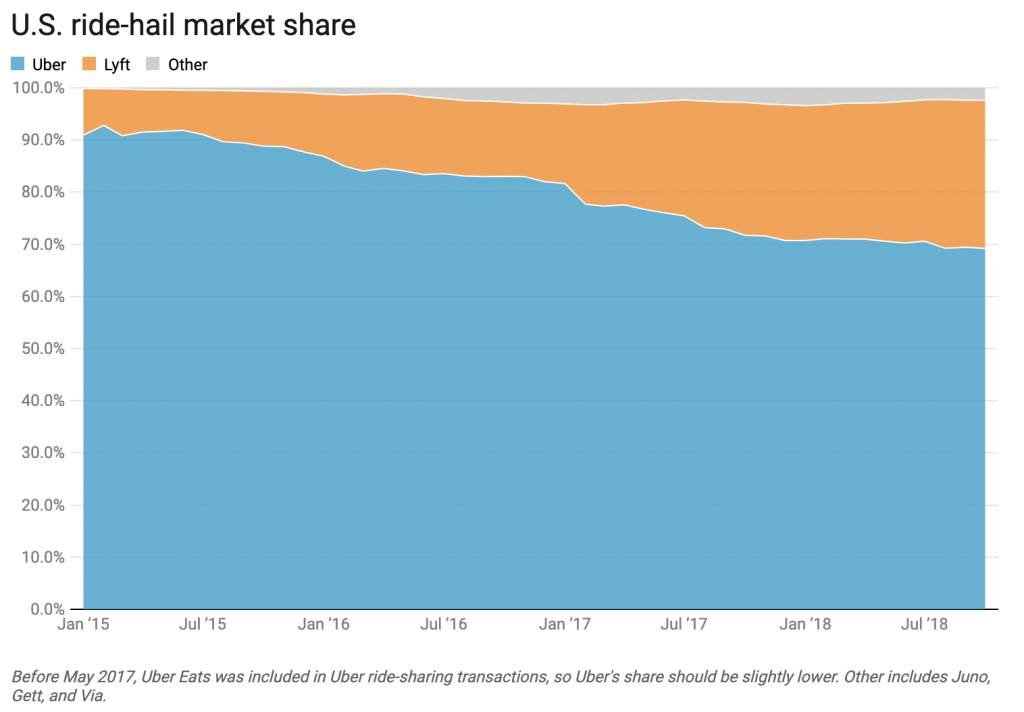

(4) Even though Uber is still the market leader in the US, Lyft continues to grow its market share.

Figure 4: Lyft Continues to Increase Its Market Share

Despite the optimism, there are many significant risks in Lyft’s business:

(1) The company has never turned a profit. In fact, it has the largest net losses of any pre-IPO business. It posted a total loss of $911 million, with a $2.2 billion revenue, in 2018. However, the company also has the largest revenue, behind only Google and Facebook, for a pre-IPO company. This is until Uber lists in the coming weeks.

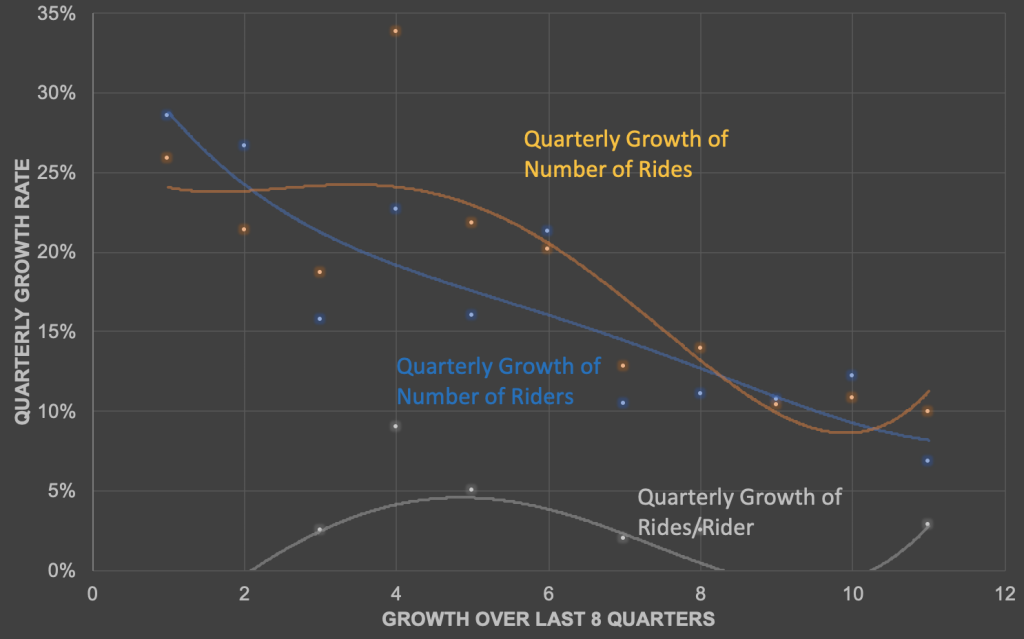

(2) Lyft is operating only in the US and in select cities in Canada, and its growth might be slowing. The quarterly growth rate of rides and number of riders are in 10% and 7% respectively in the last quarter. See Figure 5. In many ways, this is inevitable as the market in North America is becoming saturated. The company needs to find a path to profitability before its growth stops.

Figure 5: Quarterly Growth Rates of Rides, Riders and Rides/Rider for Lyft

How does Lyft compare to Uber?

Despite both being transportation-as-a-service (TaaS) companies, Uber’s business is much more expansive. Uber operates in more than 400 cities, in more than 60 countries, not to mention ownership stakes of other TaaS companies in other parts of the world (South East Asia, Russia, China, and Middle East). Meanwhile, Lyft operates only in North America (US and Canada). Uber’s business is also more diverse. It has fast growing Uber Eats and Uber Logistics. It is also trying to develop its own self driving technology. Meanwhile, Lyft continues to focus on its core (TaaS) offerings.

Nonetheless, let’s compare Uber and Lyft

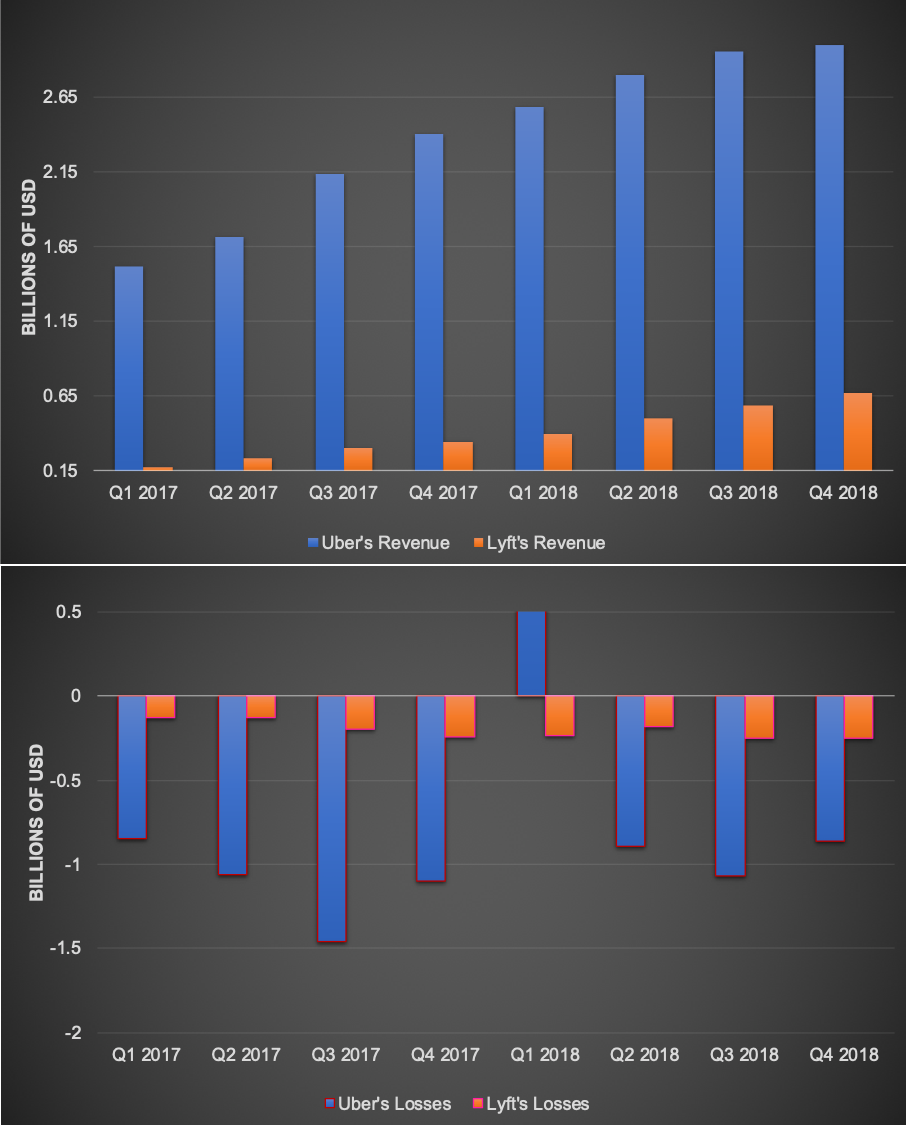

(1) Both companies generate hundreds of millions in revenue per quarter (or billions in the case of Uber), while running a significant loss. Uber’s numbers dwarfs Lyft’s.

Figure 6: Uber’s vs. Lyft’s Revenue and Losses. Note that Uber generated a profit of US$ 2.5 billion in Q1 2018 after the sale of its Russian and South East Asian operations to local competitors

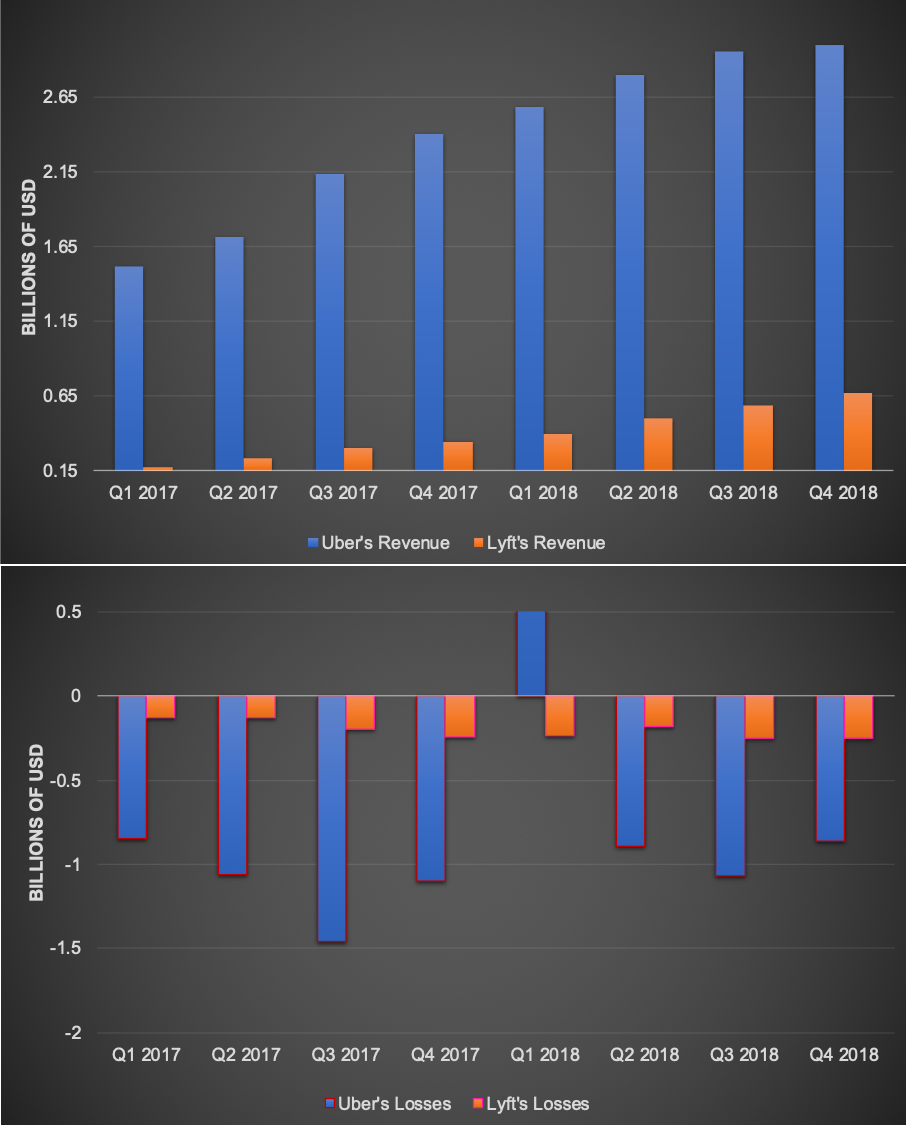

(2) But Lyft is still growing its revenue at a faster pace compared to Uber. In Q4 2018, Lyft was growing 15% quarter over quarter, while Uber only grew 2% over the same time period.

Figure 7: Quarterly Revenue Growth Comparison Between Uber and Lyft

All in all, Lyft had a very successful IPO. Despite the differences between Uber and Lyft, Lyft’s IPO and the resulting valuation will impact how investors see Uber’s offering in a few weeks. If we apply the same forward revenue multiplier approach on Uber, a 9.7X revenue multiple (based on Q4 revenue numbers), then it is expected that Uber will be valued at US$ 116 billion, very close to the rumored US$ 120 billion evaluation that we dissected. Likely, this number is on the low end of the valuation range. Unlike Lyft, Uber has many other businesses that give it higher operational leverage (Uber Eats leverage the same driver network as UberX). Uber also has stakes in other ride sharing companies in other parts of the world that can propel its growth.