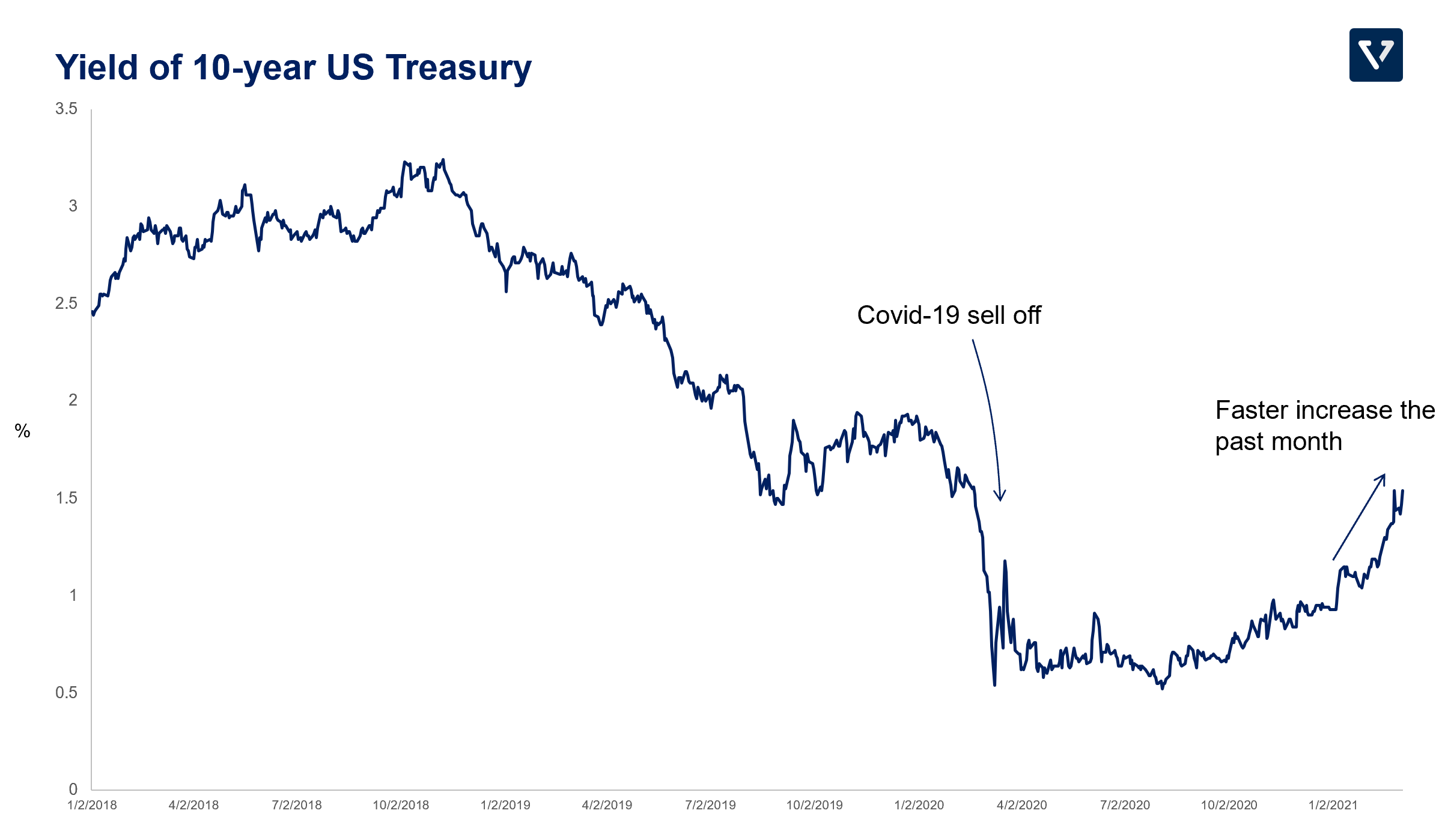

The US 10-yield is rising, and that’s causing a market sell-off. In this article we discussed why the yield is rising and the implications on the US stock market and the economies of the emerging markets.

What is happening?

The US Treasury yield is rising. The 10-year Treasury yield is the benchmark for other interest rates (mortgages, corporate bonds, and even other countries’ debt rates). So when it goes up, the interest rates of other debts typically go up. This also has an impact on the stock market and emerging markets.

Why is the 10-year US Treasury yield going up?

There could be several reasons why this is happening:

- Investors are becoming more optimistic about return to normalcy, especially in the US, as the US government continues to vaccinate its citizens at breakneck speed.

- The Fed signaled that it will keep its ‘easy money’ policy for now (keep interest rates low and continue its asset buying program).

- The combination of increased demand and cheap money supply lead investors to expect higher inflation rates (and higher interest rates in the near future).

- As a result, investors are not buying US Treasury bonds at the same rate, causing its prices to go down, increasing the yield (if you purchase the bonds at a lower price, but get the same interest rate, you generate more yield).

Why does this matter?

Decline in stocks, at least in the short term

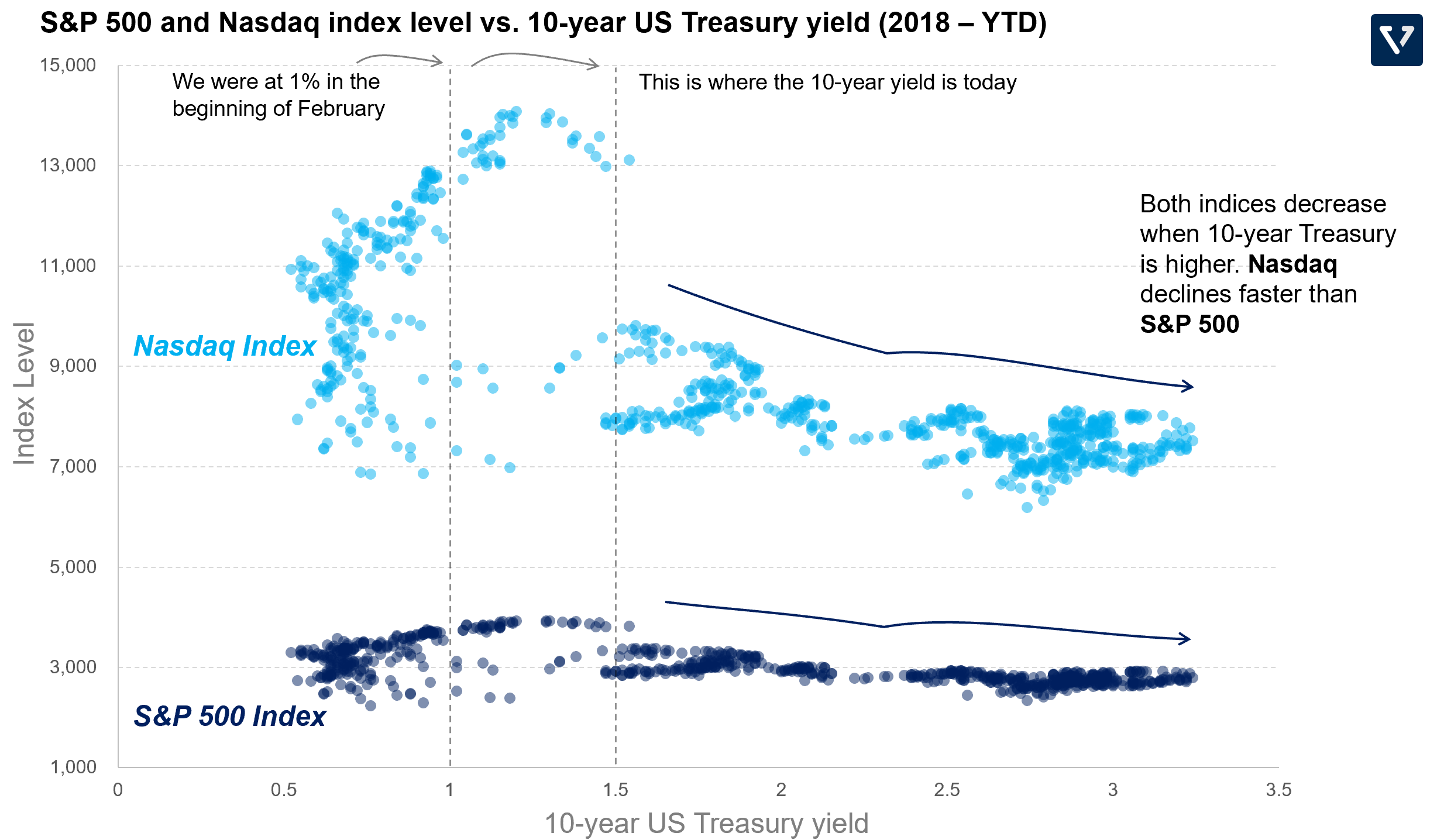

As of this writing, the 10-year US Treasury yield is 1.56%. Meanwhile, the S&P 500 dividend yield is about 1.48%. This means investors can expect to get the same return rate by investing in low-risk, long-term US government bonds than in the more volatile US stock market. This causes investors to sell off their risky assets.

The high flying tech and other speculative stocks are the most sensitive to this yield change. Figure 2 shows how the level of the S&P 500 and Nasdaq indices change as a function of the 10-year yield. This is data from 2018 to YTD. As you can see, when the 10-year yield goes up, the indices values tend to go down. Nasdaq (as proxy for tech stocks) is more sensitive to this yield change (steeper slope).

The last time there was a market sell-off due to a change in the 10-year yield occurred in the fall of 2018. That episode was short lived however; it lasted about a quarter.

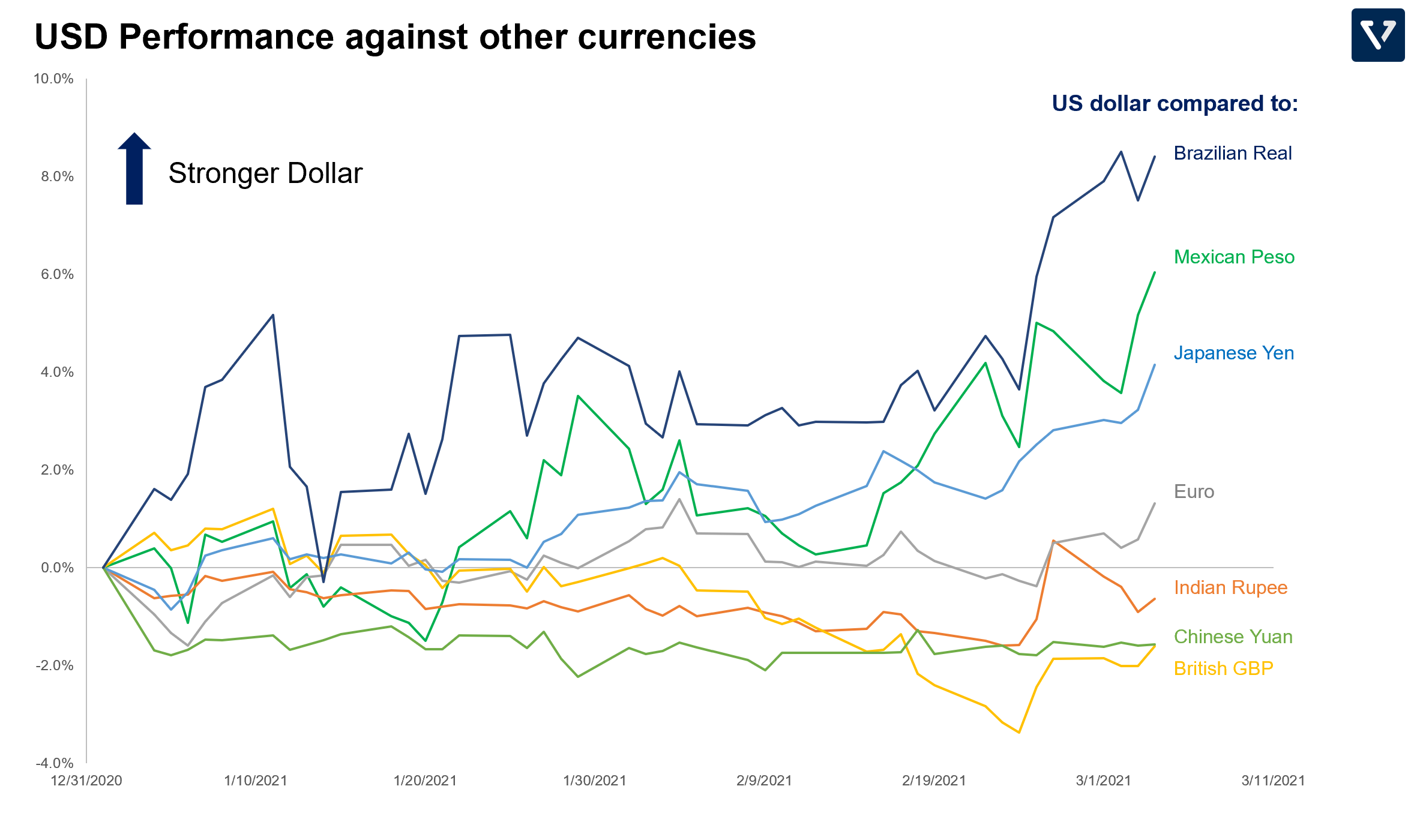

Stronger US dollar

A higher 10-year yield makes fixed income assets (US Treasury bonds, corporate bonds and others) more attractive to investors. This means, they will move their capital from riskier assets such as stocks (see the sell off in the previous section) to bonds and to some extent, the US dollar. The result is that rising yield is typically accompanied by a stronger dollar.

The problem is that most investors were not expecting this. The consensus is that the US dollar will weaken with continued easy money policy by the Fed, large stimulus package and higher fiscal spending by the new Biden administration.

Stronger Dollar and higher yield in the US can mean trouble for emerging markets

Just a couple of months ago, in January 2021, the global consensus was that:

- Dollar was weakened and would remain weakened for the foreseeable future.

- This was good for emerging market economies since their dollar denominated debt became cheaper.

- And with interest rates being so low, investors flocked to chase the higher yield in emerging countries. In the last quarter of 2020, capital flow to emerging markets was at its highest since 2013 (mostly to China).

In the weeks since, we have seen that this consensus might not be correct:

- The US dollar is getting stronger.

- A stronger dollar has a negative impact on emerging market economies. These emerging countries have been borrowing a lot of money to help stimulate economic recovery (to the tune of US $847 billion in 2020). Higher interest rates and a stronger dollar mean that their debt just becomes more expensive, increasing risk of default.

High yield in the US may incentivize investors to draw their money back home to the US. This happened in the Taper Tantrum of 2013 that weakened the currencies and growth of these emerging markets.