Navigating Uncertainty Around The Trade War

It’s hard to follow the news about the US economy without hearing about the US/China trade war. In this article, we want to demystify the trade war and its impact on the US stock market. The US/China trade war started in earnest in March 2018. Since then, the US has announced tariffs on more than US $550 billion of Chinese goods, while, the Chinese government has announced more than US $185 billion tariffs on US goods.

Why is this Trade War happening?

There are several reasons why it is happening, chief among them are:

(1) The large trade deficit between the US and China that has grown rapidly over the years.

(2) Concerns around Chinese espionage of US’ intellectual properties (IP), whether it is through outright theft or forced IP sharing through mandatory joint ventures that give Chinese companies access to US companies‘ IP in exchange for market access.

(3) The final, and perhaps most important reason is likely political. The Trump administration ran on the platform of being hard on China on trade; and thus, he is appeasing his supporters – despite strong pushback by American corporations against the tariffs.

The impact of the trade war on investors

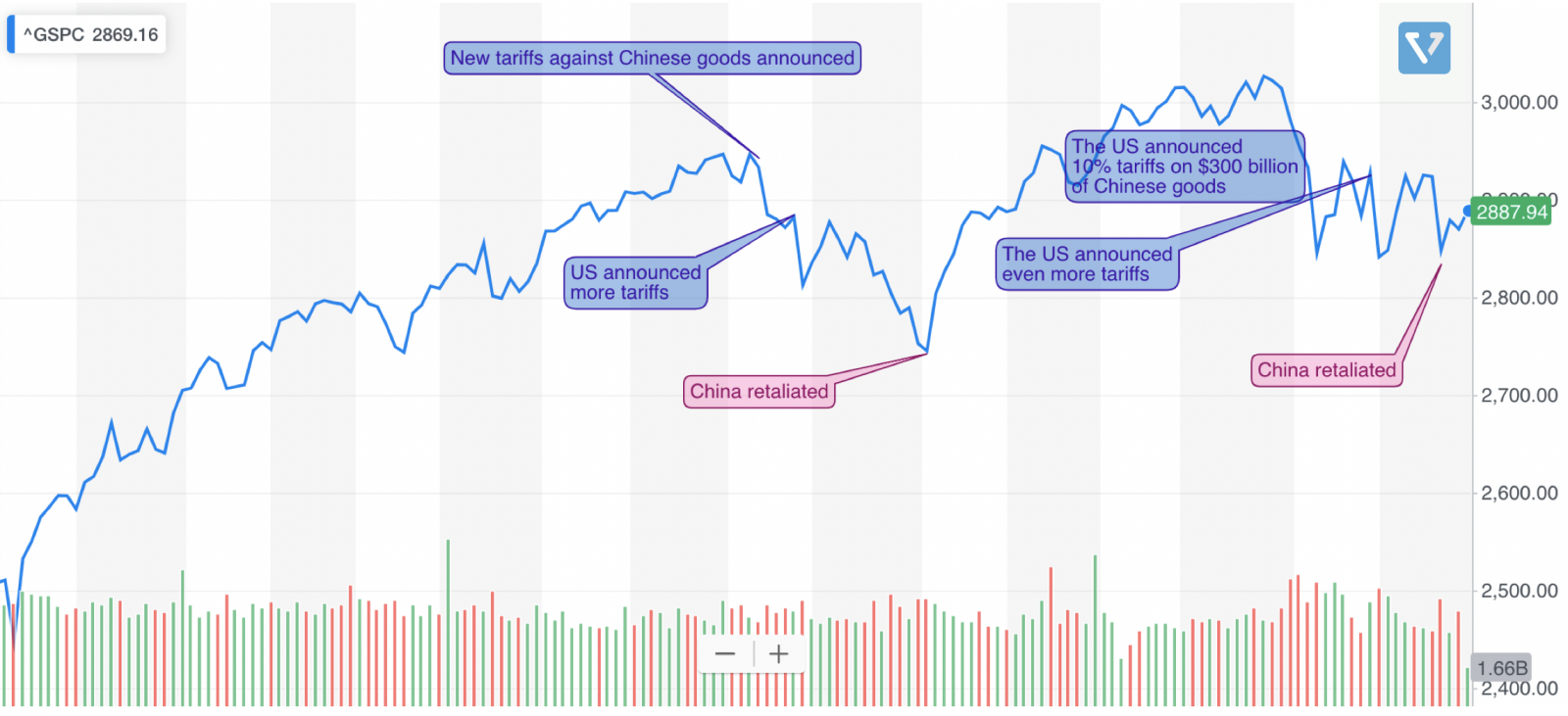

In Figure 1 you can see that after every tariff announcement the US market (the S&P 500 index) reacts negatively. However, these temporary downturns may not be reflective of the overall health of the US economy.

Figure 1: How US/China trade war tit for tat is impacting the US stock market (S&P 500)

There are two opposing views on how the trade war is impacting the US economy

The first view believes that the effect of the trade war is overblown and that the impact on the US economy is minimal. Foreign trade only accounts for 12% of the US GDP, and exports from the US to China account for less than 1%. The US economy is largely driven by local consumer spending (68% of GDP), and on this front, consumer confidence is still high.

The opposing view believes that the trade war will trigger a recession in the US. Thus far, the majority of the impact of the trade war has been experienced in sectors that have high exposure to China. The US manufacturing sector, although not a big contributor to the GDP, has experienced two sequential quarters of declining output. While in the agricultural sector, the number of farm bankruptcies have jumped 13%.

Nonetheless, the largest impact of the US trade war might be at a global level. In July 2019, the International Monetary Fund (IMF) cut its forecast for global growth this year to 3.2% (weakest since 2009), and downgraded its expectations for 2020 to 3.5%, a figure that may fall another 0.5% if the trade war continues to escalate. A slowdown in the global economy may have a spillover effect that can impact the US, as 40% of the companies in S&P 500 relies on foreign sales.

What should an investor do?

Industries likely to be most affected negatively by the trade war are industries that have high Chinese exposure, either through market (their customers live in China) or supply chain (they make their products in China – therefore higher tariffs will mean to higher costs). These industries are tech (hardware, semiconductors), manufacturing, automotive and agriculture.

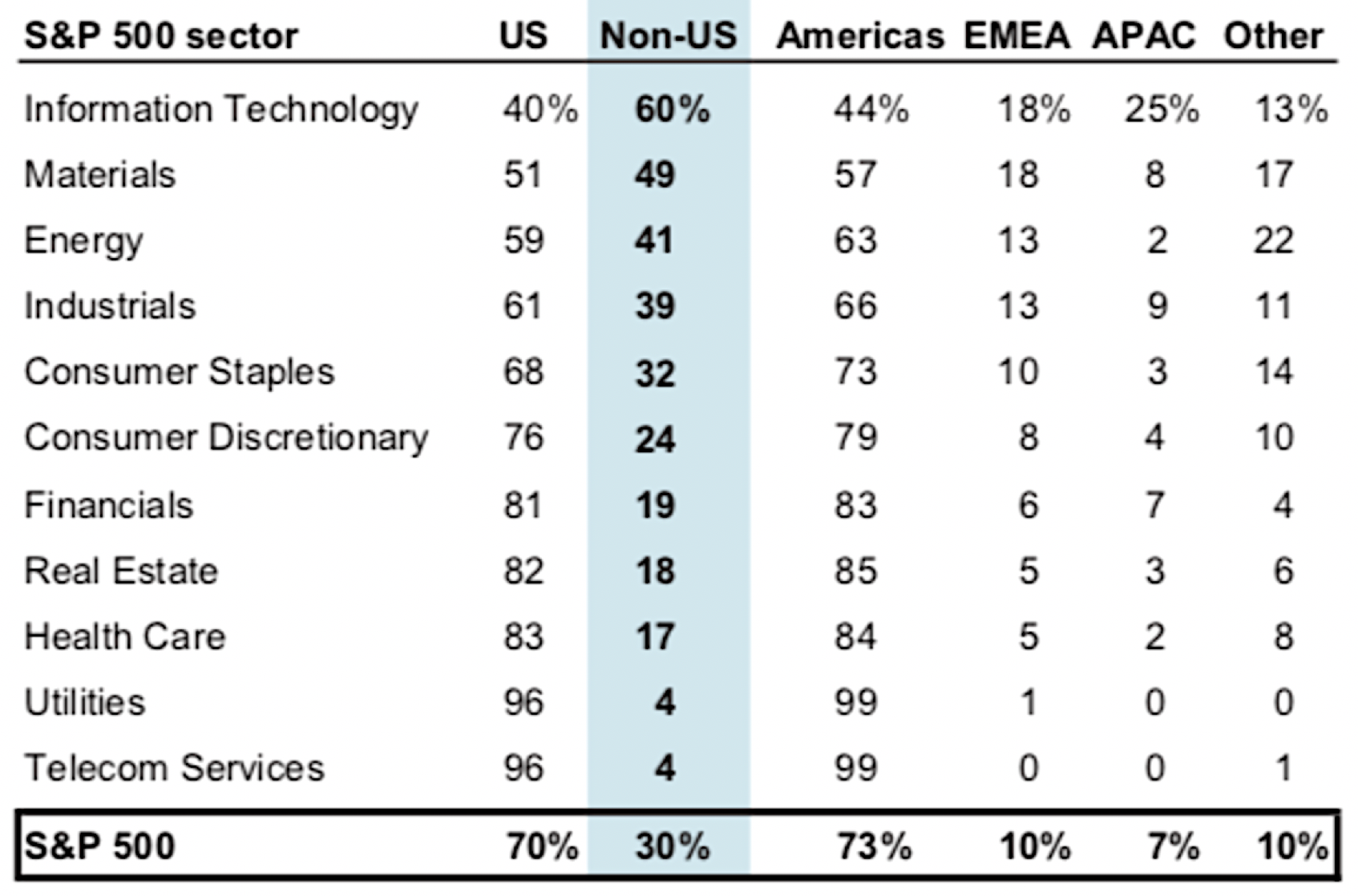

One strategy to minimize the impact of the trade war and potential global slowdown is to invest in sectors with minimum Chinese/non-US exposures. Figure 2 (data from Goldman Sachs) lists the different S&P 500 sectors and their non-US revenue dependance. As you can see, Information Technology and Materials sectors have highest non-US dependence, while sectors that are more domestic focused (health care, utilities, telecom services) have the least.

Figure 2: Revenue sources of the different S&P 500 sectors

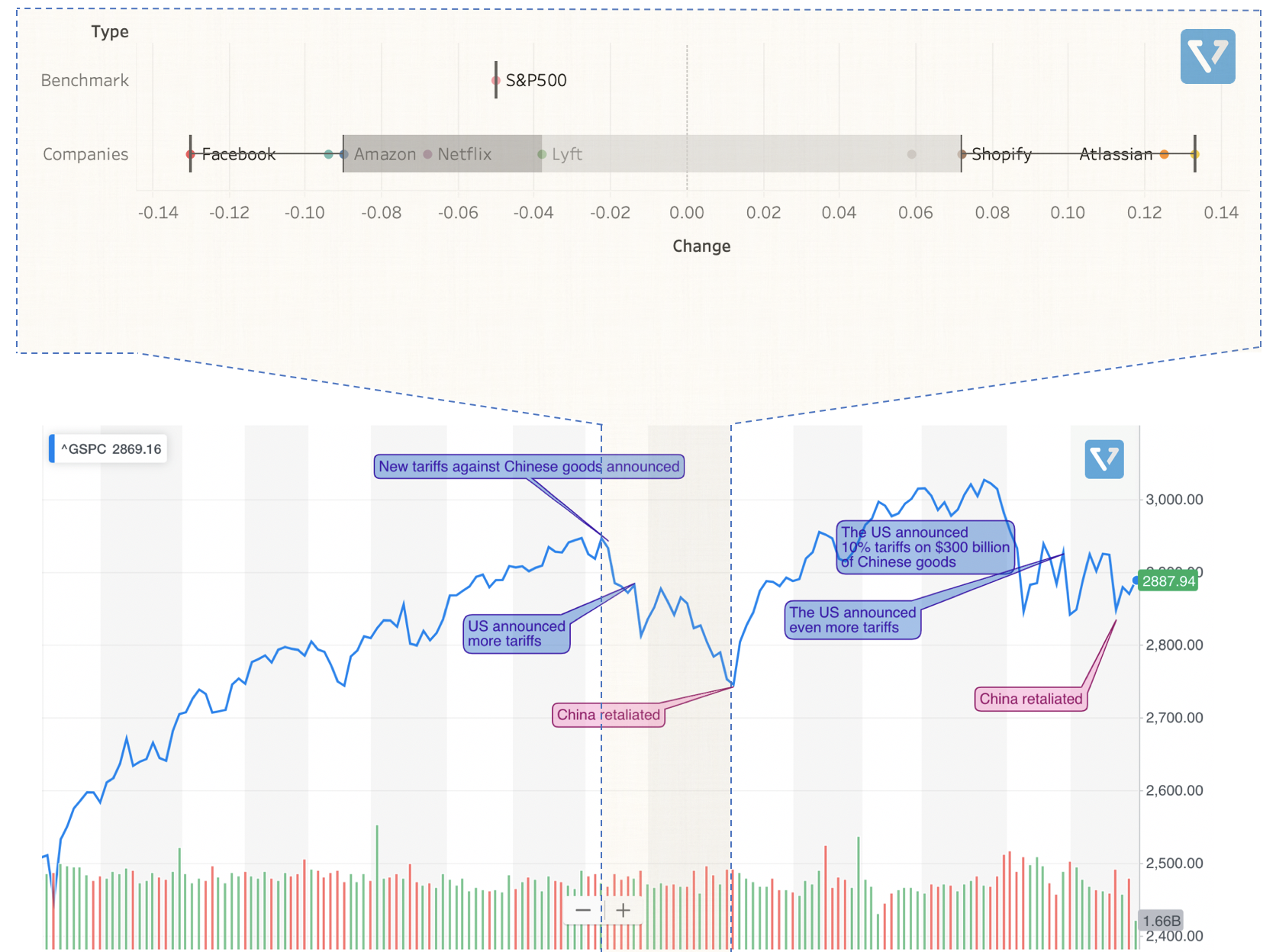

Another strategy could be to find companies within the sectors affected by the trade war, but have comparatively lower exposure to China. Figure 3 lists several of these companies within the tech sector (note that this list is not exhaustive). In the month of May of 2019 (shaded yellow) several trade war announcements led to a 5% drop in the market. However, the drop of the overall market doesn’t affect all companies equally. In this figure, we show the loss/gain of the share price of several companies that have zero/minimal revenue exposure to China. It is to be noted, however, that in addition to the impact of the trade war affecting the share prices of these companies, the performance of these stocks is also affected by the idiosyncrasies of the company itself.

Figure 3: Share price change of S&P 500 and several tech companies in the month of May 2019

The trade war may continue in the foreseeable future, and when the dust settles, the world’s supply chain would be changed for good. After the Huawei ban by the US government, the Chinese tech giant will surely find an alternative, non-US, chip supply chain and operating system provider for its products to mitigate adverse effects of possible future US/China conflict. China will find an alternate source of soybean, which is the primary feed for pigs, which China is the world’s largest producer of (Brazil is the prime candidate here). Meanwhile US companies will try to diversify their supply chain and manufacturing ecosystem by moving them outside China.

Once these moves happen, they are permanent.

Thanks for reading!