Netflix’s Q3 Earnings Report – Slowing Subscriber Growth

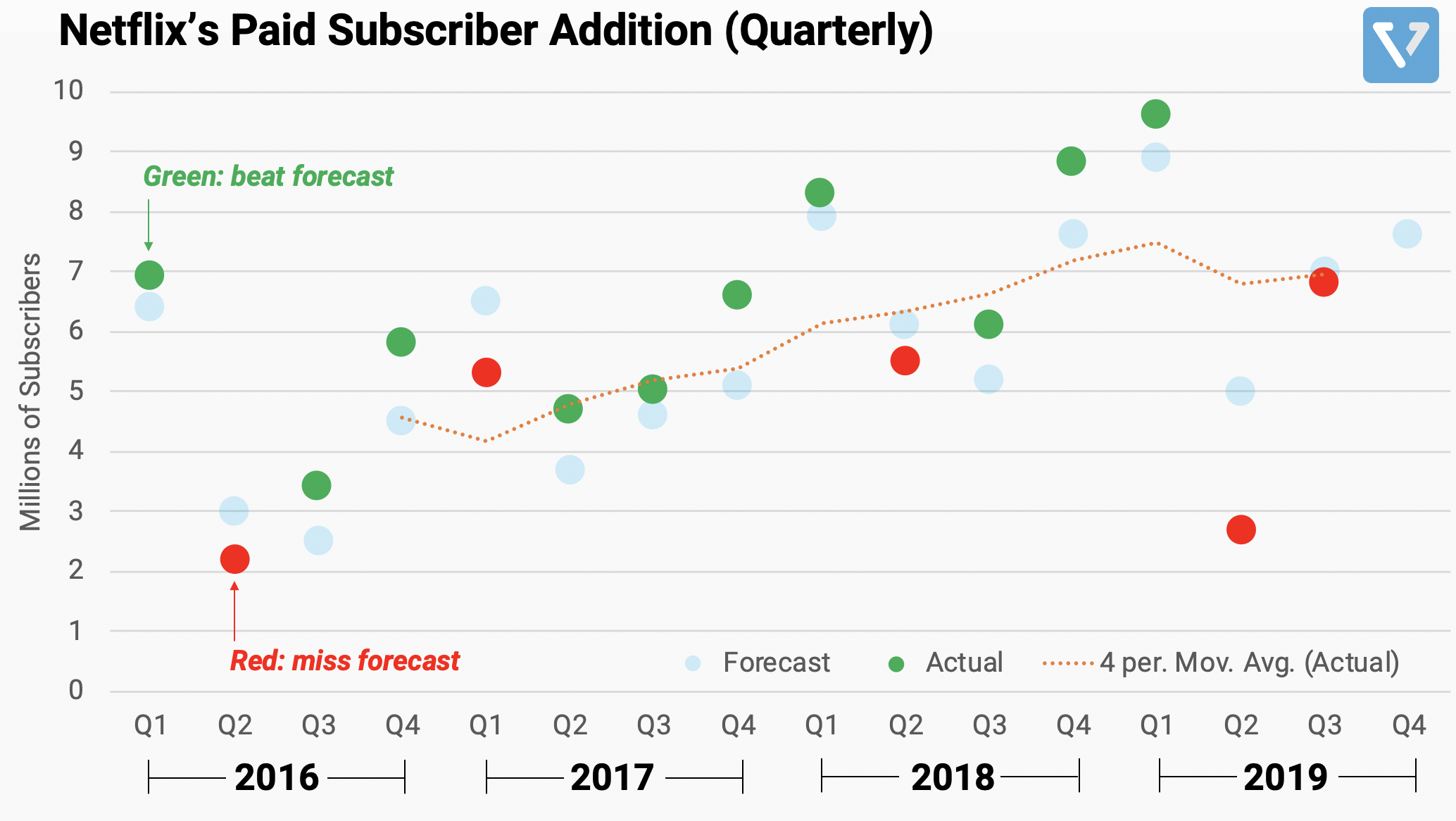

Figure 1: Netflix’s paid subscriber addition (quarterly basis). Green = the company beat forecast. Red = the company missed forecast. Dashed line = 4 quarter trailing average, indicating that growth is slowing down. Data from company.

Netflix reported its Q3 2019 earnings this week. The company reports that international growth was slightly stronger than expected, while US growth remained tepid. The company’s share price jumped 8% after the report but has since declined, and is currently trading slightly below the pre-earnings release price. Here are four takeaways:

- Good international growth. Netflix added 6.3 million new paying subscribers in Q3 (23% increase vs. the same period a year ago). This number is slightly above the 6.2 million the company forecasted.

- Disappointing US domestic growth. In the US, the company added 0.5 million new paying subscribers (below the 0.8 million it forecasted). To be fair, Netflix has saturated the US market, with more than 50% market penetration, so growth in the US will likely continue to be flat/slow especially after the recent price hike. Now that there is no longer significant room for growth in the US, Netflix is transitioning to a revenue optimization phase and has increased its price to boost its margins in the region.

- As a result, the total global subscriber growth is slightly below target (see Figure 1 for Netflix”s paid subscriber addition from the last 15 quarters). The dashed line represents the average growth (4 quarter moving average). It is showing that growth is slowing down.

- Margin expansion continues. Despite slowing growth, the company’s strategy seems to be working. Netflix’s strategy is: (1) Raise cash from debt. (2) Spend heavily on content. (3) Increase its margin as it can spread out the fixed cost of content to an ever-increasing user base. Currently, operating margin is 18.7%, which is up from 10.2% from January this year. To read more about how Netflix is expanding its operating margin, read our deep dive.