NVIDIA’s latest earnings

NVIDIA recently reported its latest quarterly earnings. NVIDIA’s earnings are always interesting because it can be a barometer for multiple verticals within the tech industry (since its products are the go-to hardware for AI, data centers, self-driving cars, gaming, and cryptomining).

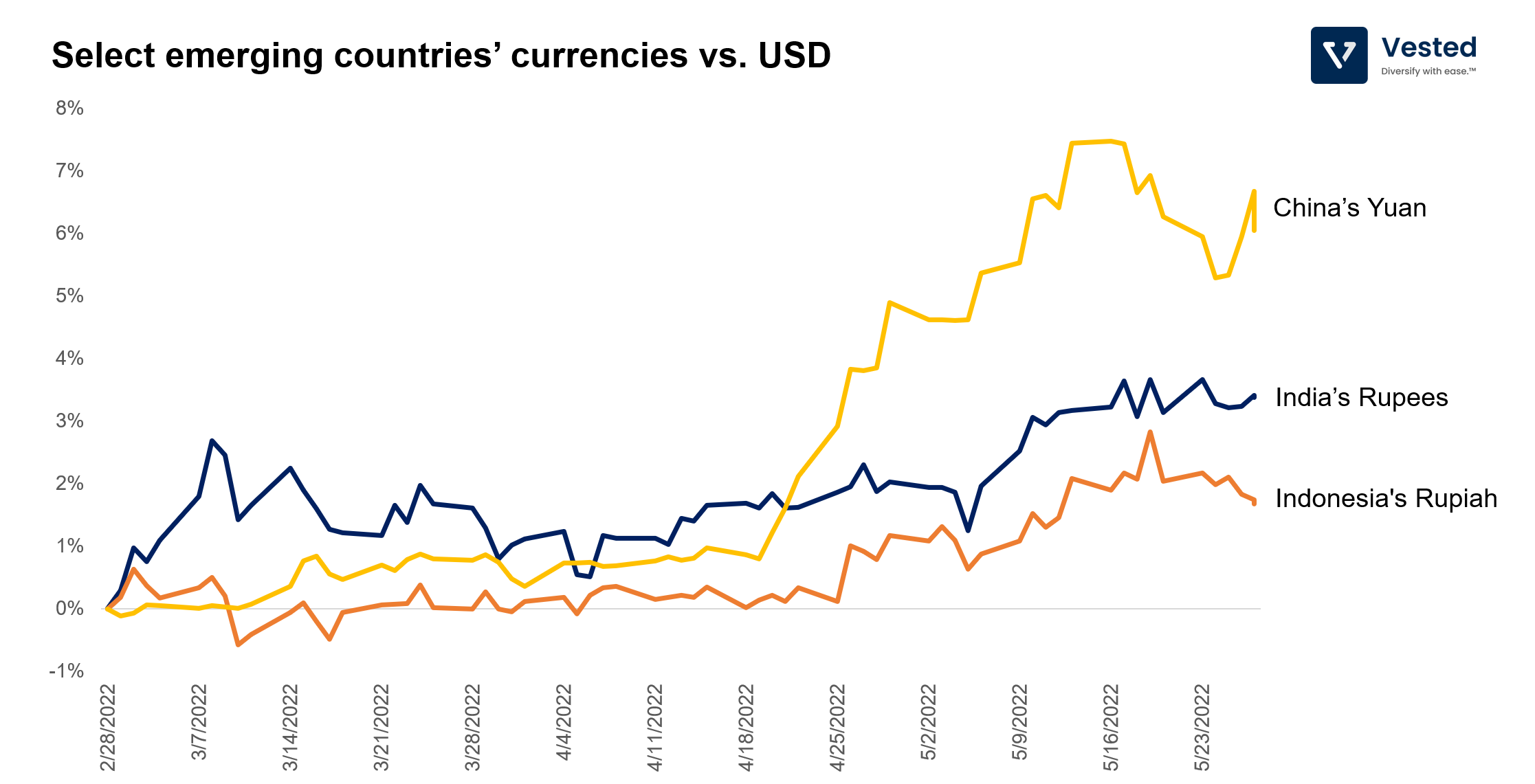

Here’s the company’s quarterly revenue trend by segment (Figure1).

Two key takeaways from this data:

- Total revenue went up 46% to $8.29 billion (another record quarter).

- The company is officially a data center company, rather than a gaming company. It made 45% of its revenue from its Data Center segment, surpassing its Gaming segment (which contributed 44% to total revenue).

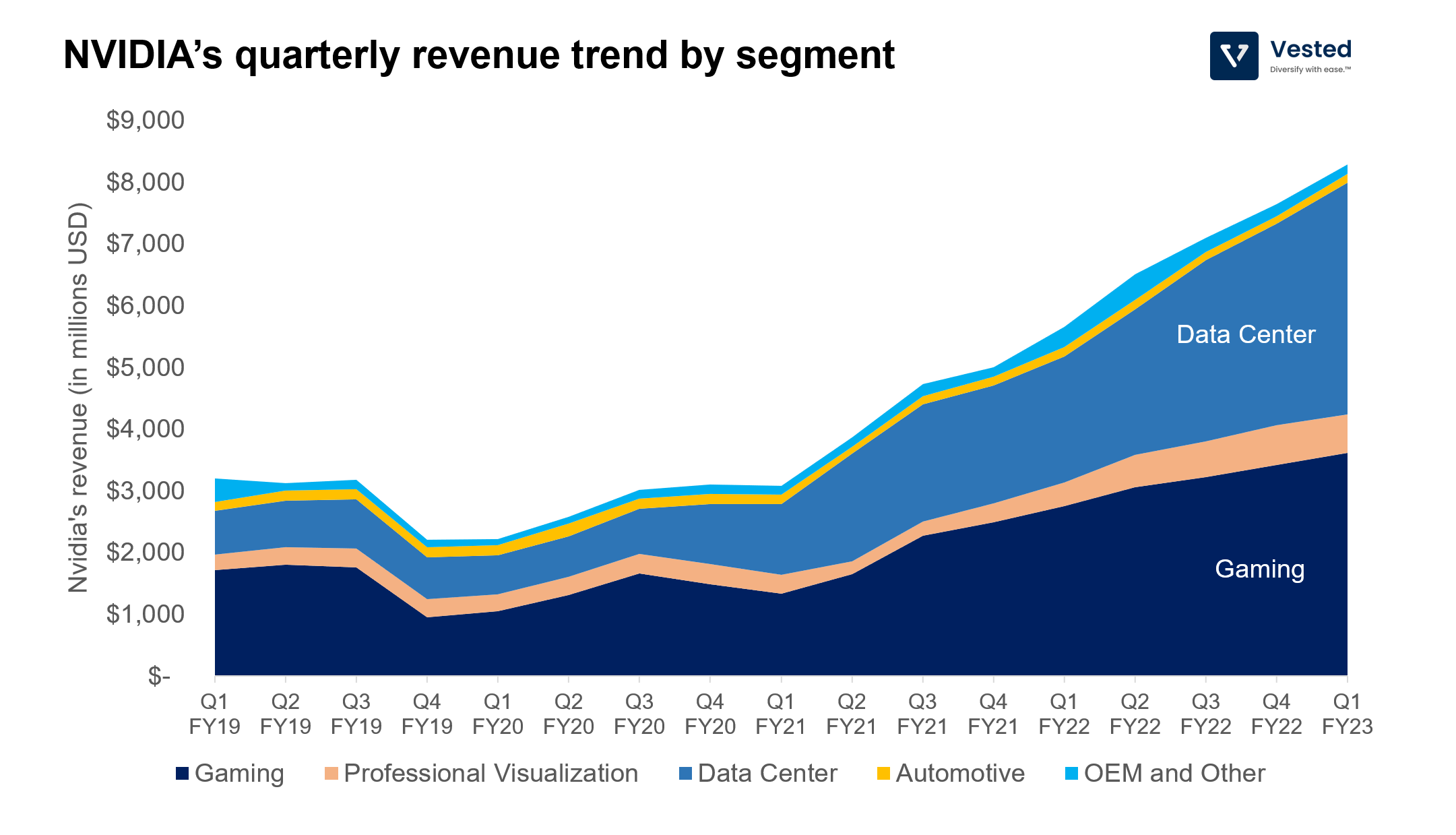

Despite macro headwinds, the company continues to post impressive top line numbers. Let’s dive deeper into the growth rate of the different segments (Figure 2).

The Data Center segment continues to drive growth. Despite the large numbers, it’s still growing 83% year over year, and appears to be accelerating (see gray line). We’ve discussed the importance of NVIDIA’s AI chips and networking components for AI applications , and it seems the appetite for these products continues to grow, especially by the hyperscale cloud providers (Microsoft and Amazon).

Growth in the gaming segment is slowing down. Although the year-over-year growth rate is 31%, the sequential quarter-over-quarter growth is only 6%. The big uncertainty here is the demand from cryptocurrency mining (NVIDIA’s gaming GPU is being purchased by crypto miners for proof-of-work or PoW mining). NVIDIA tried to direct its GPU use for gaming by imposing limitations for crypto mining. But so far, they’ve failed. The company claims to have limited visibility into volume that has gone to crypto mining. As a result, they are unable to effectively forecast demand fluctuations from crypto mining.

As we enter the second half of 2022, there are two headwinds impacting the crypto market within the gaming segment: (i) crypto prices are cratering, and (ii) Etherium is moving from PoW to PoS (proof-of-stake), which means, miners do not need the GPUs to mine anymore.

The last time we were in a crypto winter (in 2017), the miners stopped buying NVIDIA’s GPUs. This caused NVIDIA to miss its sales target and forced it to clear excess inventory of old products as the new model was starting to hit the market, causing a price crunch. At that time, the market punished NVIDIA (their share price declined by 18%, wiping out $23 billion in market cap) and its chief GPU competitor, AMD.

The same pattern in the crypto market is happening again. As Ethereum prices have gone down (more than 53% decline this year) and in preparation for the transition to PoS (expected in August 2022), many miners have been re-selling their hardware back to the market. As a result, GPU prices have started to go down.

But this time, NVIDIA’s business is very different. In 2017, the Data Center business was about 1/3rd that of the Gaming segment. Now, the Data Center segment has outgrown the Gaming segment. Considering the growth and size of the Data Center business, the company’s business might be more insulated from the volatility in crypto demand.

The trickle down effects of the US raising interest rates

The Fed recently reaffirmed their plan to increase the interest rate at least two more times this year (one 0.50% increase in June and another 0.50% in July), which leaves them some flexibility to reassess in the fall.

In last week’s blog post, we discussed the impact of interest rate hikes on tech valuations. Today, we also discuss the good and bad of rising interest rates for banks, fintechs, and emerging markets.

Good for banks

At its core, banks take deposits from customers, give the consumers interest on those deposits, and lend some of the cash out as loans to others at some higher interest rate. When interest rates are low, it’s hard to make money this way. But when interest rates are high, banks have more room to take advantage of this arbitrage.

This business model is codified in the old 3-6-3 adage (which originated from the 50s) where, as the saying goes, banks give 3% interest on depositors’ accounts, lend out the cash at 6%, and are in the golf course by 3 PM (not to be confused by the 9-9-6 rule!). But the 3-6-3 rule has been less true in the past few decades, and especially not true in the past 10 years, due to the extremely low interest rate environment, which makes generating revenue from interest spread difficult.

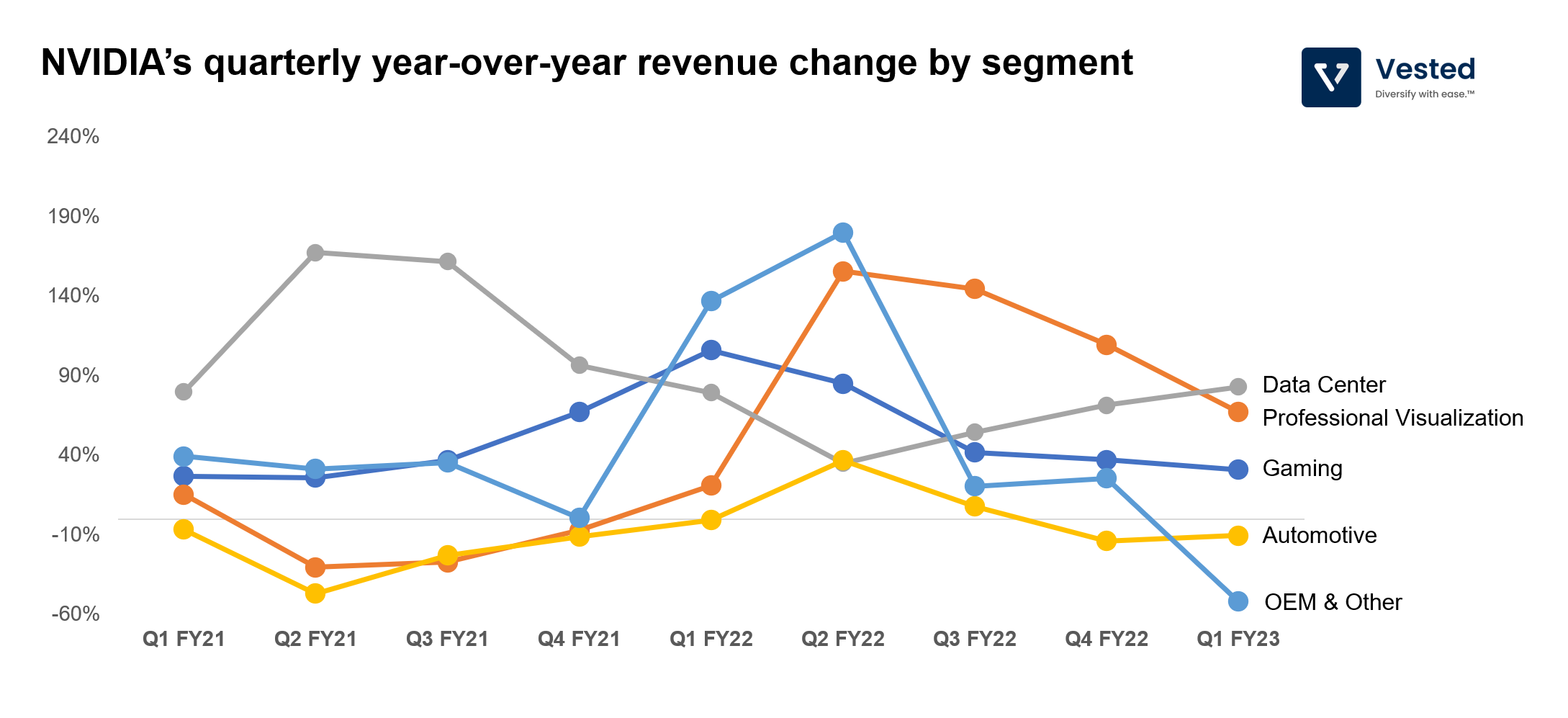

But all that might be poised to change. As interest rates have increased, banks have been increasing the rate of interest for debt they have issued, while giving consumers no increase in interest rates on their deposits (despite the Fed rapid increases, the current savings interest rate in the US is still 0.60% per year. See Figure 3 below for the average national US savings interest rates). This effectively increases the banks’ ability to monetize the interest rate spread.

As a result, most banks are poised to generate more than expected net interest income this year. This past week, JP Morgan revealed that its profits will be higher than expected thanks to the increase in interest rates. In 2022, it expects to generate $66 billion in net interest income ($20 billion higher than in 2021). And JP Morgan is not alone in this, other large US banks also expect a similar revenue growth from net interest income.

Bad for lending fintechs

Banks are not the only ones that generate revenue from interest rate spread. Fintechs whose products are loans also do the same. They acquire low cost funds and lend them out at a higher rate. One critical difference between the banks and fintechs, however: the source of capital.

- Banks acquire the capital from customer deposits, which are very cheap to acquire.

- Meanwhile, Fintechs acquire capital from other sources (wholesale funding or repackaging and reselling of debt in the form of asset-backed securities (ABS)).

In a world where interest rates are super low, Fintechs can compete on cost of capital because they can acquire cash for cheap, as investors are chasing higher yield and are willing to lend to or buy bonds from Fintechs at a favorable rate for the Fintechs. But in a world of higher interest rates, Fintech’s cost of capital will increase, as investors want even more premium for buying these ABS and bonds. This will make it harder for Fintechs to compete with banks’ cheap deposits. In recent months, Affim, a buy now pay later firm (BNPL) had to cancel its loan sale after one of its purchasers demanded a higher interest rate on the deal.

Expect this trend to continue. Increase in cost of capital will be true for a lot of Fintechs. This is another reason why the share prices of these companies have tumbled so much.

Bad for emerging markets

As rates increase in the US, investors may seek to move their investments back to the US, seeking the safety of the US financial system, making emerging markets less attractive from a risk adjusted perspective. This capital flow back to the US can the following impact on emerging markets:

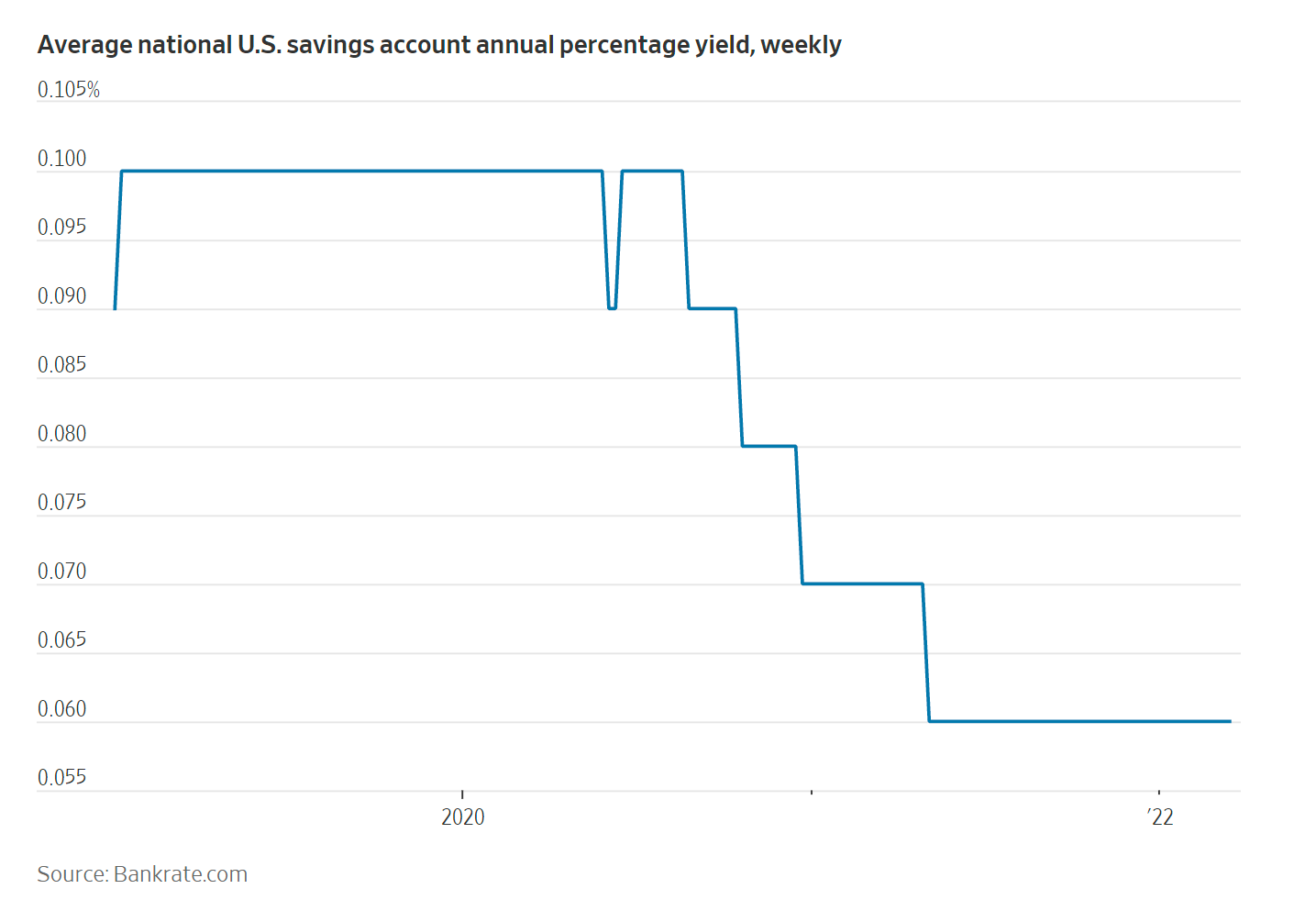

- Weakening of currencies against the dollar. In the past three months, India’s Rupee, Indonesia’s Rupiah, and China’s Yuan have declined by 3%, 2%, and 6% respectively. See Figure 4 below

- Weakening of the stock market of these emerging markets.