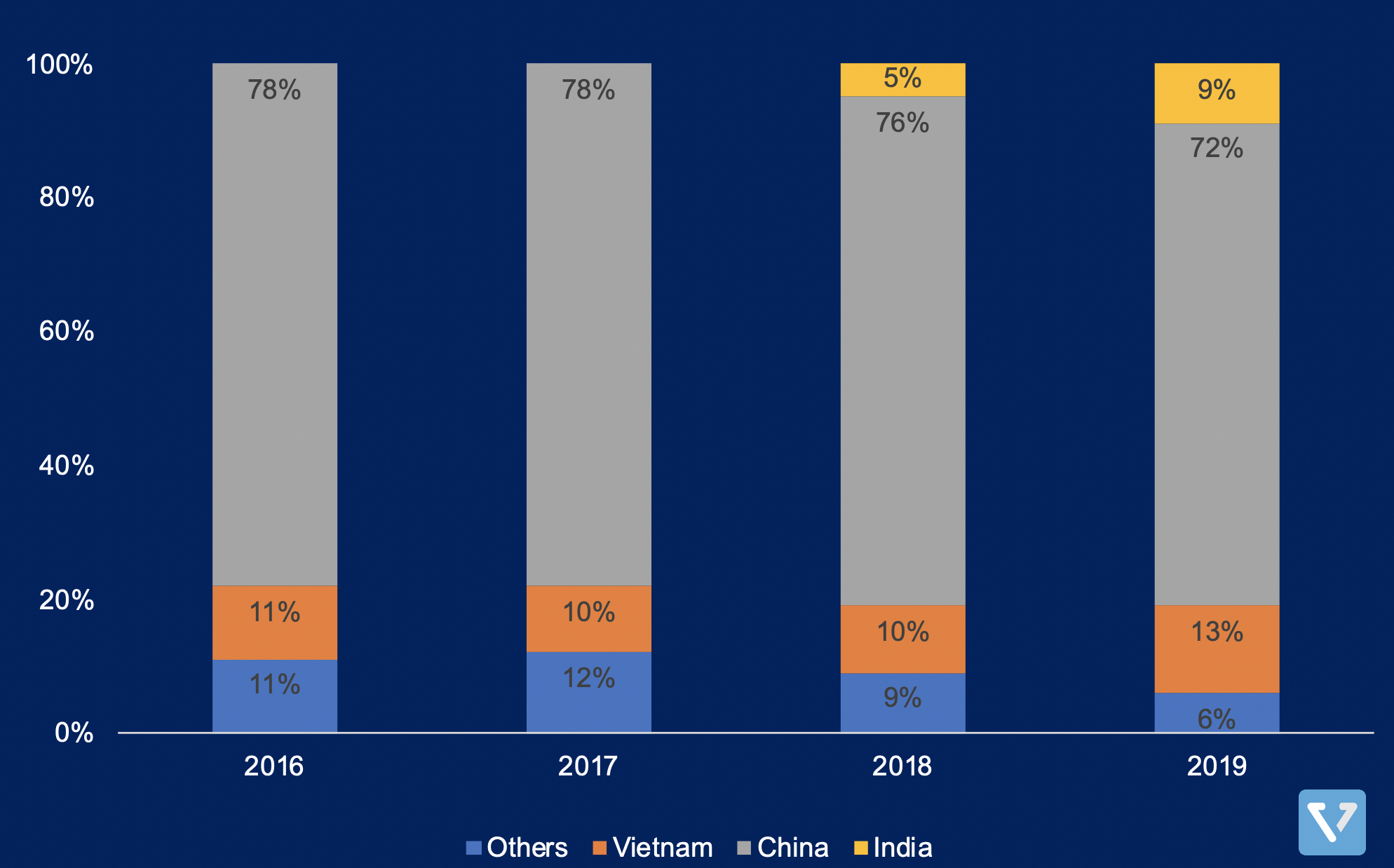

RBI defends the Rupee

India’s foreign exchange reserve fell by US $5.35 billion (or about ~1%) to US $481.9 billion as the RBI intervened and sold USD to defend the Rupee (see Figure 1 – INR has weakened when compared to the dollar). This fall is due to foreign investors selling their Indian investments (they have pulled out US $10 billion thus far) as the Indian stock market dipped to a 3-year low. This decline is the largest in about 8 years.

Figure 1: INR to USD exchange rate. INR has been weakening in recent days due to sell-off by foreign investors

Nonetheless, this pressure might be alleviated by two factors: (1) Reduced domestic consumption, leading to reduction in imports, and (2) The price war that is causing oil prices to drop at record lows, which is beneficial to India as India imports the majority of its oil (and pays these imports with USD).

Apple’s supply chain issues linger – likely leading to delayed new product launch in the fall

Despite China slowly ramping back to normalcy, Apple’s supply chain issues might just be starting. Product development, scale up, and inventory building processes for electronics manufacturing require several months of lead time. Typically, this lead time includes Apple engineers traveling to China to work with Apple’s Chinese vendors. However, due to COVID-19, this travel is not possible.

Apple has suppliers and operations in other countries that have been hammered by the virus as well, including Italy, Germany, the UK, Israel, Malaysia and South Korea. All of these countries are either in partial or complete lockdown.

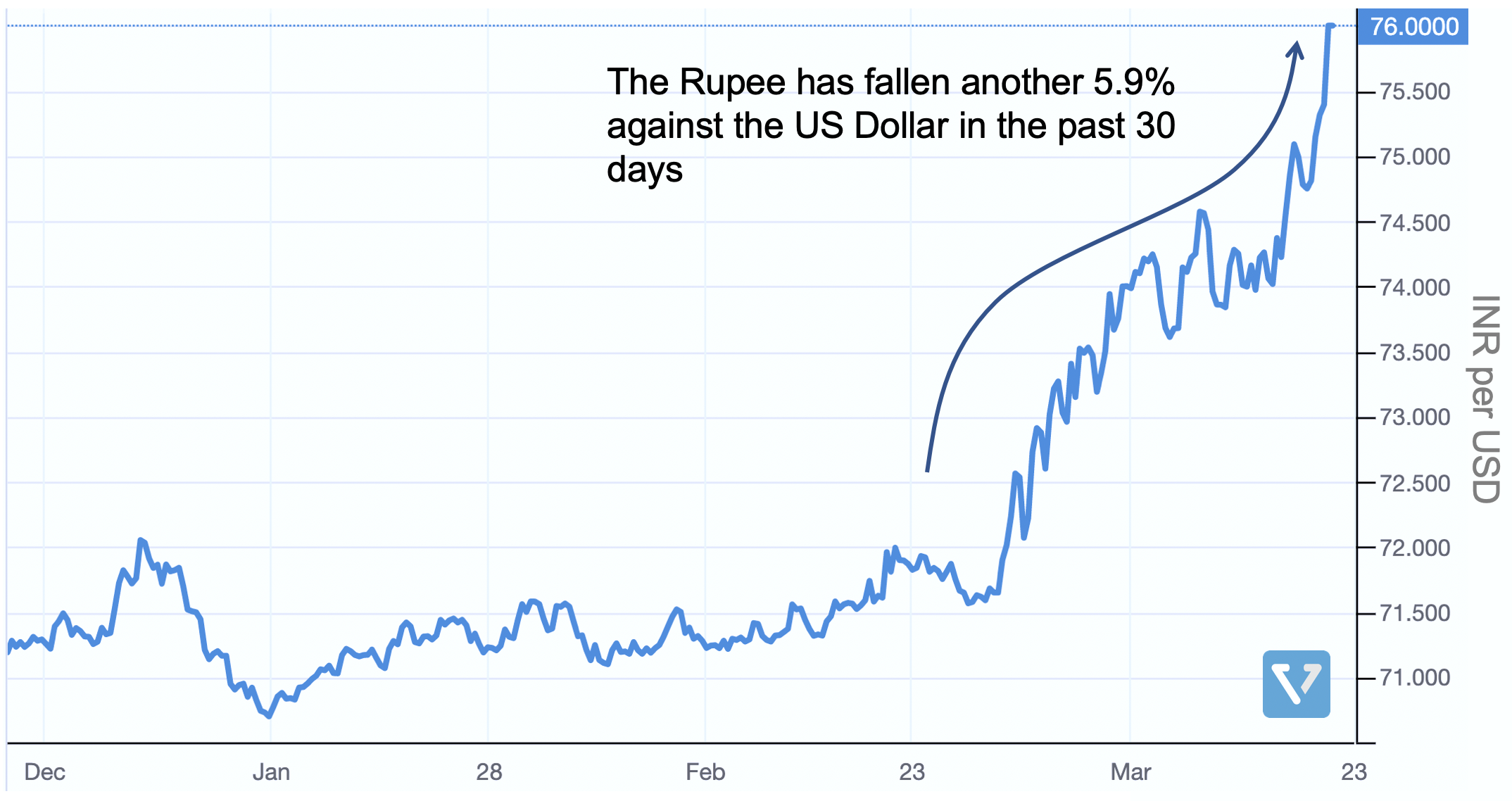

Apple’s Dependence on China’s Manufacturing

It’s no secret that even though Apple has a global footprint, the company has a very large dependence on China. The trade war and COVID-19 pandemic have forced many companies to rethink their supply chain strategy. So far, Apple has been unable to transition away from China. This is due to: (1) complex manufacturing processes and (2) China’s population and infrastructure advantage.

Complex manufacturing processes

Apple’s iPhones have a complex design (more so than other smartphones) that requires insertion of tiny screws and thin printed circuit boards during assembly. This results in a manufacturing learning curve that is steeper compared to that of other devices, and after decades of being the factory of the world, China has developed the skilled workforce necessary to carry out this work. As a result, it is harder for Apple to diversify its manufacturing to other countries. In contrast, Samsung was able to shift to Vietnam because the company uses larger pre-assembled components. Samsung also glues the phones together, which makes automating the assembly process easier (vs. inserting the tiny screws on an iPhone).

Thus far, Apple has only transitioned manufacturing of AirPods out of China (to Vietnam), largely because of tariffs on headphones made in China, which were imposed during the US/China trade war, and because AirPods have less parts and are glued together (rather than screwed).

China’s population and infrastructure advantage

It takes a city to make more than two hundred million iPhones a year. Located in Zhengzhou, Apple, through its manufacturing partner – Foxconn, has done just that – built a city-sized manufacturing complex. The facility enjoys special diplomatic status, close proximity to the airport, and has the capability to house more than 200,000 workers at a time. Supported by government subsidies, tax breaks, and infrastructure spending, the city has become a critical aspect of the iPhone’s manufacturing ecosystem. Supporting this facility requires a very large population. Only India is second to China in terms of number of workers, but currently, its roads, ports and infrastructure lag those in China.

In addition, Apple is granted access to the Chinese market (about 20% of Apple’s revenue comes from China). Meanwhile, China receives a boost in economic development (Foxconn is the largest private employer in China, employing more than one million people) and receives training on how to build new technologies (which then spreads to the entire supply chain ecosystem in China).

Nonetheless, Apple has started to shift to other countries – to the aforementioned Vietnam and India. In India, Apple has set up an iPhone manufacturing facility, partly to avoid India’s 20% tax on imports, but also to comply with a law requiring single-brand foreign retailers to buy at least 30% of their manufacturing materials from India.

As you can see in Figure 2, Vietnam’s and India’s share of global smartphone manufacturing are increasing, from 5% to 9% for India and from 10% to 13% for Vietnam.