Slack’s Financials

Slack S-1 filing. The company has filed with the SEC and is expected to IPO on June 20th, 2019. Slack plans to IPO via the direct listing method (similar to Spotify), which allows insiders (current investors and employees) to sell their existing shares instead of issuing new shares. Some of these insiders have been selling their shares in the secondary market at US $28 per share, this values the company around US $17 billion. Is the company’s valuation justified? Let’s look at its numbers (note that financial data is sourced from Slack’s S-1).

What is Slack?

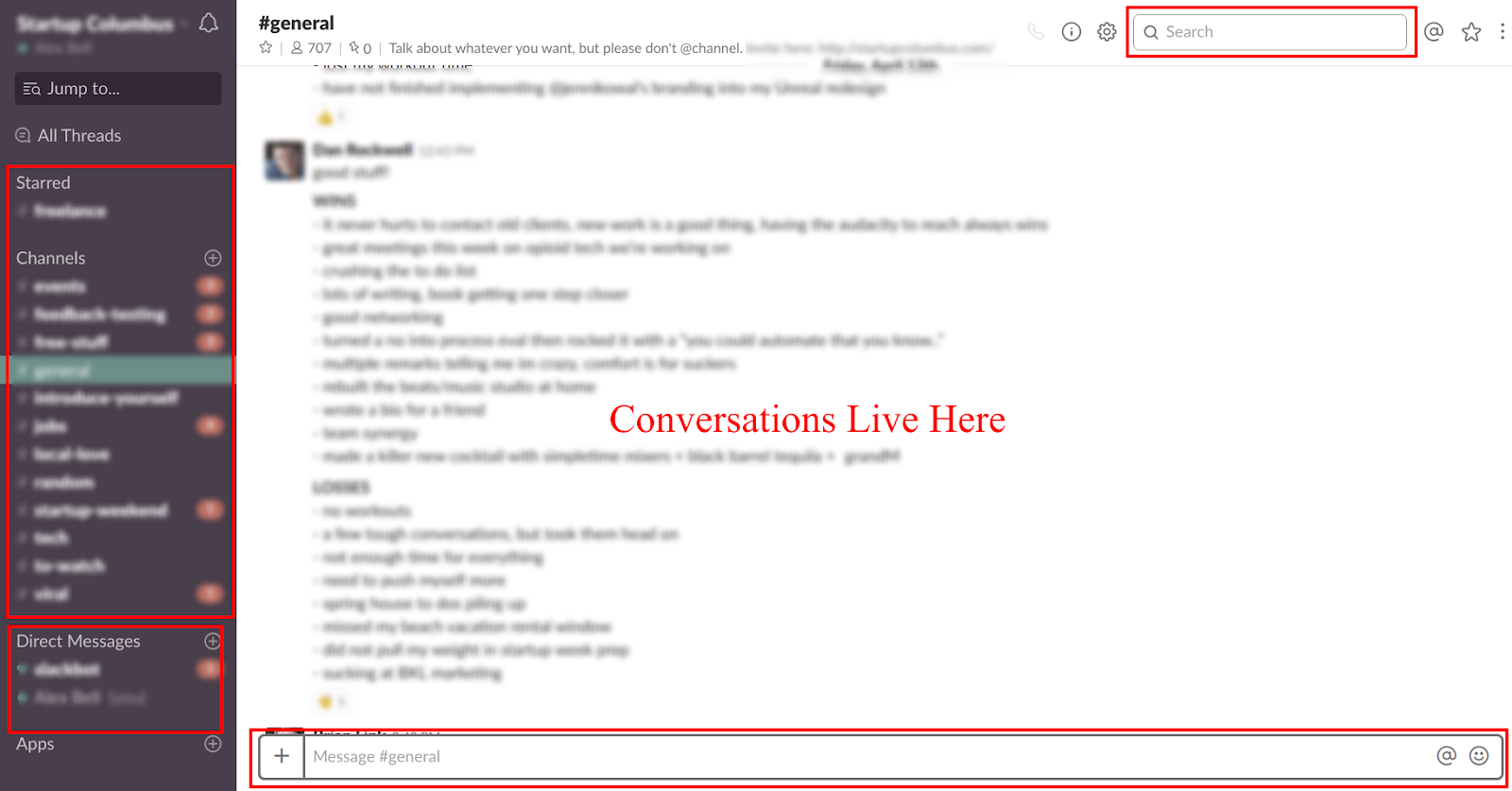

Slack is a multi-device collaboration tool. We won’t go into too much detail on how it works, but essentially its goal is to replace email as a communication tool. Stewart Butterfield, the founder of slack, initially founded a social gaming company that went defunct. Slack was actually an internal communication tool that was used by his gaming company. After failing to gain traction with the game, the company pivoted and found success in selling Slack (oddly – this is the second time Stewart has tried to create a gaming company, failed, and pivoted into success. The first was Flickr, a photo sharing app that was bought by Yahoo!).

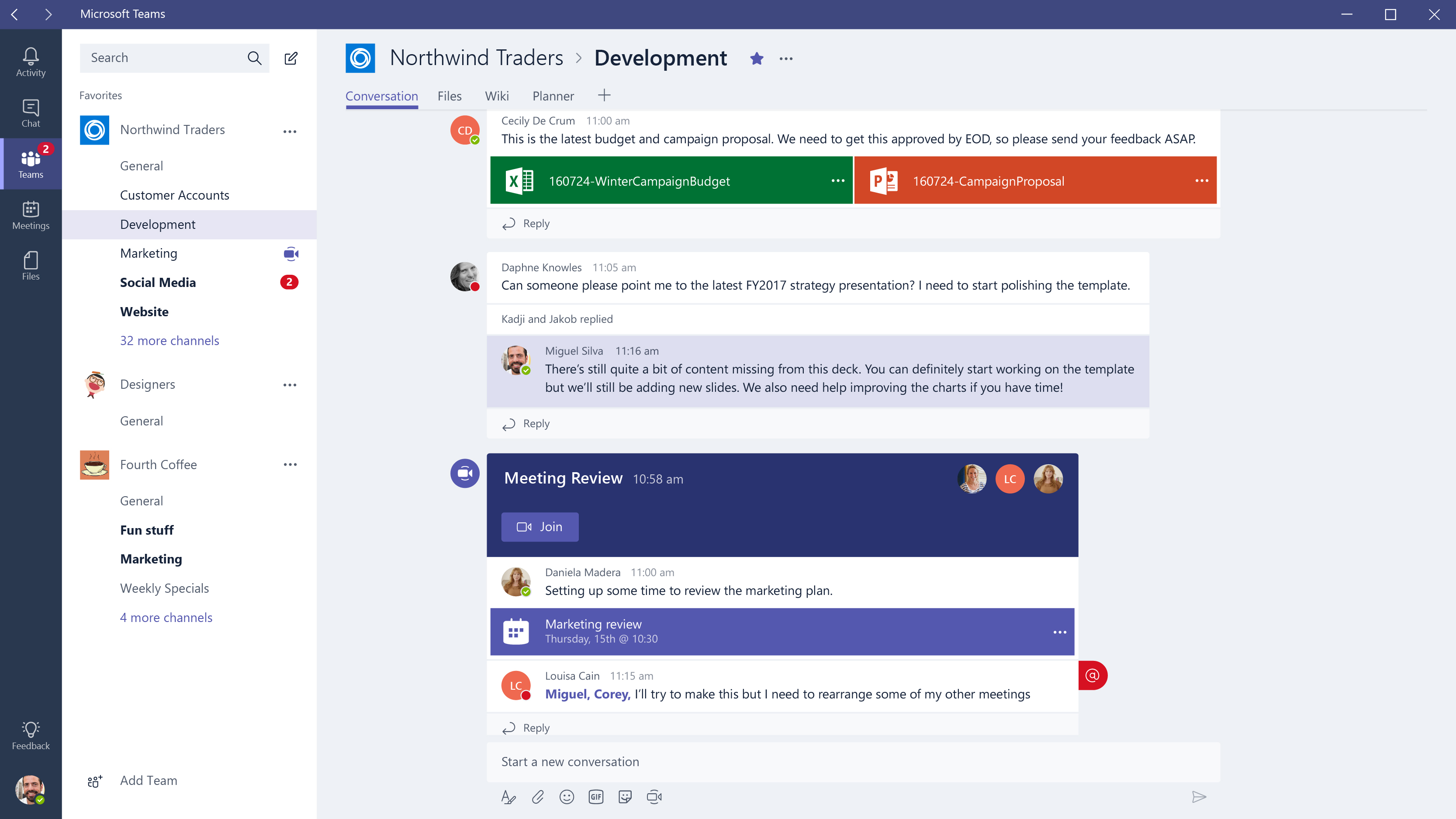

Figure 1: What Slack looks like. The UI is quite simple. You join a Workspace (shown above) for different companies/organizations that you are a part of. Each Workspace has different channels (threads) where you can have a running conversation thread for different subjects. In addition, you can have direct (private) messages with others, share files, and perform video/audio calls.

Similar to many other software as a service (SaaS) companies, Slack is currently not profitable. It is heavily investing in growing its user base with the hope of earning revenues in the future through recurring subscription. Therefore it is important that the company shows continued growth in revenue and number of users. It is also important for Slack to show that the customers will stick around long enough for them to recoup their initial investment.

Slack’s Growth

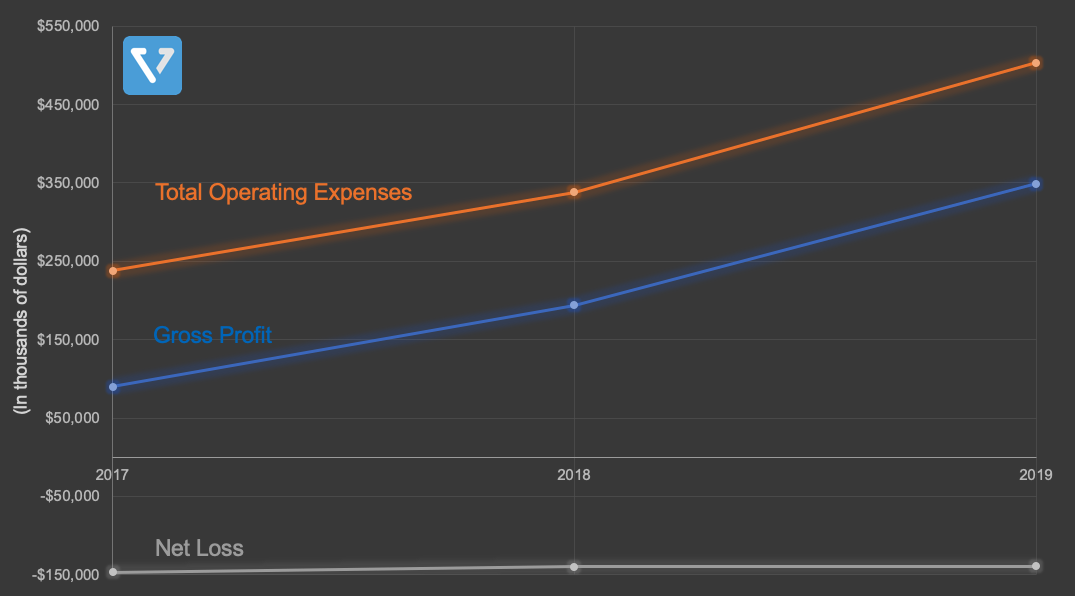

Slack’s revenue has been growing rapidly. It grew from US $105 million for fiscal year ending January 2017 to US $400 million for fiscal year ending January 2019. That is a 280% growth.. Figure 2 shows the trend of Slack’s Gross Profit (Revenue – Cost of Revenue), its Operating Expenses (R&D, G&A and Sales and Marketing), and its Net Loss. The company has maintained relatively flat Net Loss levels as it continues to invest in revenue growth. It has done so by maintaining a relatively flat gross margin (between 85 – 87% for the past three years). These are strong gross margins that are about double that of Uber’s, and rival another strong recent SaaS IPO, Zoom, which had a gross margin of 81% (for fiscal year ending in January 2019).

Figure 2: Slack’s Gross Profit is growing at the same pace as its Operating Expenses. Net loss remains flat.

Where is the revenue coming from?

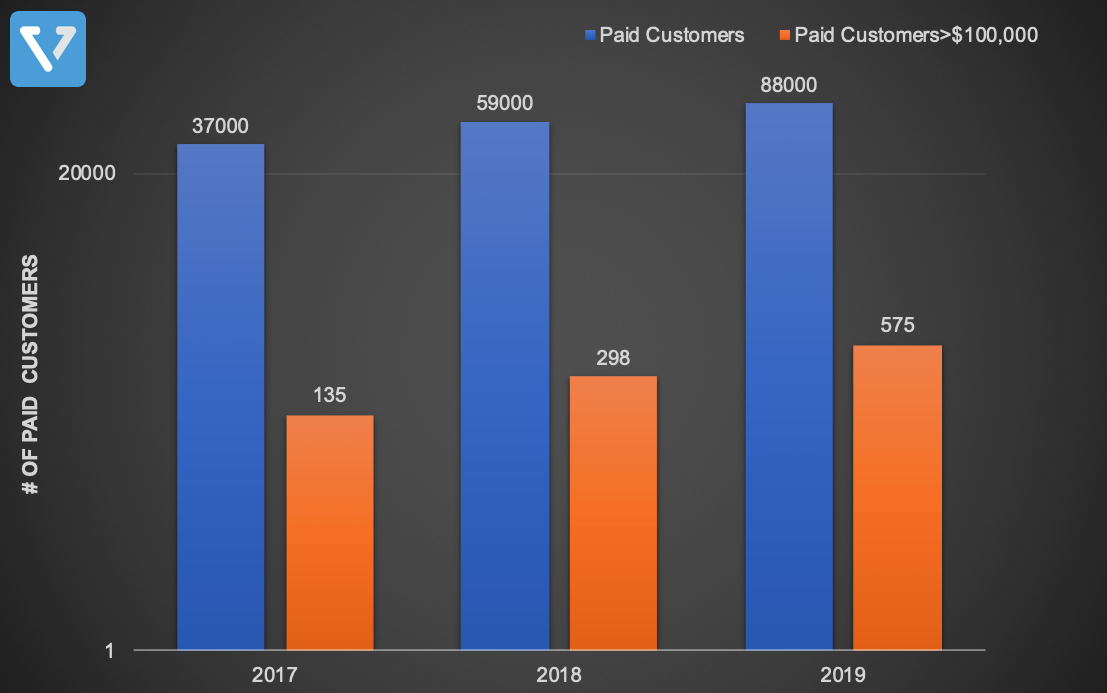

As of January 2019, the company has more than 500,000 organizations on their free subscription plan. They also have 88,000 paying customers (or about 15% of customer base). 575 of these customers pay more than US $100,000. These are essentially their enterprise customers. Figure 3 shows the growth of paying customers and customers who pay > US $100,000 over the last three years. From 2017 to 2019, the number of paying customers more than doubled (from 37,000 to 88,000). Meanwhile, the paying enterprise customers have grown by 326%. The ability of Slack to continue this growth will be crucial to its success.

Figure 3: Slack’s growing paying customer base.

From the breakdown of paying customers above, we can estimate that 40% of Slack’s revenue comes from fewer than 0.1% of its user base. Some investors argue that the high concentration of paying customers in such a small consumer base could pose a risk to the business. But others think that this is natural for large SaaS companies serving the enterprise market. In fact, this may boost margins, as it requires less resources to serve a few large customers than many small customers.

Is the model sustainable?

In order for Slack to have a path towards profitability, investors must evaluate several key SaaS business metrics:

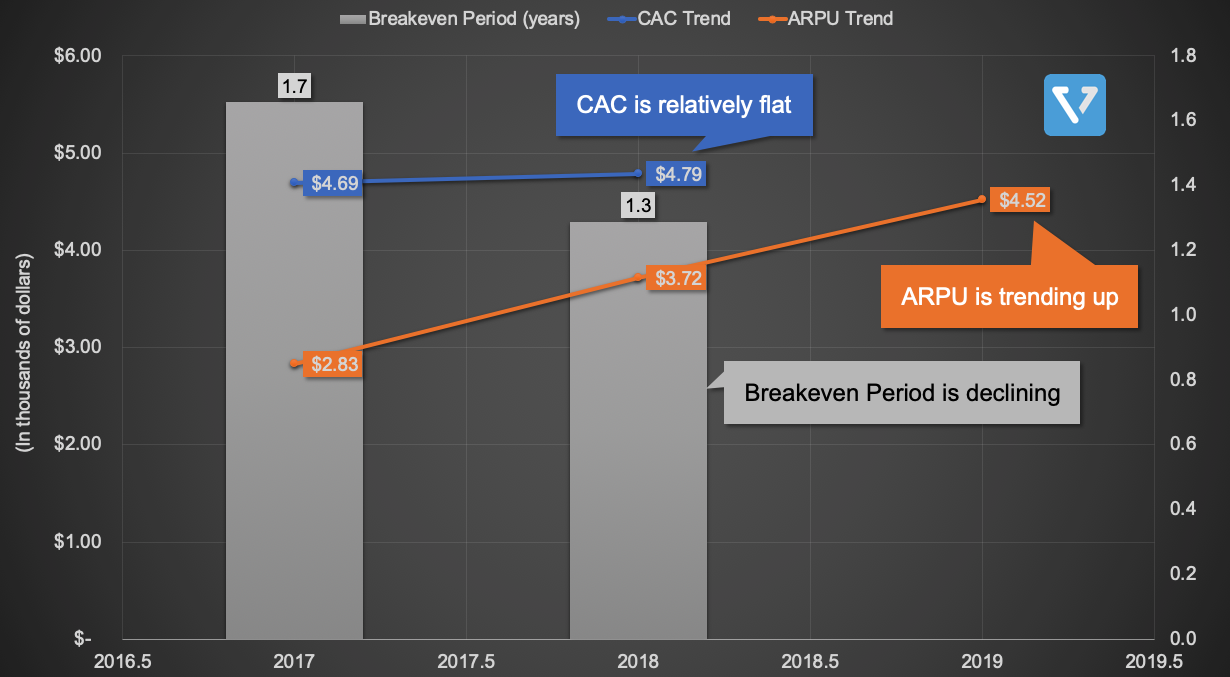

(1.) The costs Slack incurs to obtain a paying customer (CAC = customer acquisition cost). CAC estimation = Sales and Marketing Expenses for a particular year / Net paying subscriber addition in the following year.

(2.) The average revenue per paying user (ARPU). ARPU estimation = total revenue/number of subscribers.

(3.) Breakeven period (the time it takes to recoup CAC). Breakeven period estimation = CAC/ARPU.

Okay, enough of the definitions. How do the numbers look for Slack? The numbers appear to be trending in the right direction, Over the last 3 years, average revenue per user (ARPU) has increased from US $2,830 to US $4,520 (largely due to users spending more on Slack’s services over time), while CAC has remained relatively flat (from US $4,690 in 2017 to US $4,790 in 2018). As a result, their breakeven period is declining.

Figure 4: Slack’s metrics appear to be trending in the right direction: ARPU is increasing year over year. CAC is stable. As a result, breakeven period is declining.

Microsoft competition

All the above are predicated by Slack’s ability to continue its growth, especially in the enterprise segment (large customers). In this space, Slack’s largest competitor is Microsoft. After Microsoft’s cancelled bid to acquire Slack three years ago (a reported US $8 billion bid), the company released its own competitor to Slack, called Teams, in 2017. As of April 2019, more than 500,000 organizations have used Teams. In the long term, this may pose a significant challenge to Slack, since Microsoft’s offerings may have better integration with other Microsoft’s tools (whiteboard, Skype, Office 365, etc). What is most important here is that Microsoft already has a foothold in large enterprises, through its cloud offering, enabling the company to potentially up-sell much easier.

Figure 5: Microsoft Team’s UI. Similar to Slack.

Potential Volatility Ahead

In the short term, Slack’s share price will likely be more volatile than other recent IPOs. The company is foregoing the traditional initial public offering (involving road show to institutional investors, underwriting banks, and lockup periods – all the things that may help stabilize the share price immediately post IPO). Instead, Slack will directly list its existing shares on the market, which means that insiders (current Slack shareholders) can sell immediately and that investor demand will drive short term share price. This listing method can result in higher volatility in the share price, although this did not happen to Spotify.