In the olden days, software was stored in physical media (CD/DVD), packaged in a box and delivered through retail. This meant that software was dependent on physical distribution, and that the sale process was transactional – users only paid once during the sale, and developers never knew when users would purchase the next iteration of the software. This model made it difficult to patch security issues, fix bugs and add additional features. Furthermore, developers often stopped updating old softwares as there was no monetary incentive to do so. This meant that many softwares eventually were running with severe security holes that never got updated.

With the advent of zero marginal cost internet distribution, software makers began to transition away from physical distribution to digital distribution. Users paid upon download and installation on a local computer. This resolved a lot of the challenges that physical retail posed, but still, the sale process is transactional.

Over time, this digital delivery method evolved into what we know today as Software as a Service (SaaS). In the SaaS model, users do not even download the software (software is no longer stored in a local computer). The software and data are hosted in the cloud, which is accessible via the internet browser. This has several massive implications: (1) Since the software lives in the cloud, it can be updated in real time and is impossible to pirate. (2) Users have to pay a subscription fee to access the software. (3) This continuous payment aligns the incentives of the users and software makers: since software makers are receiving the revenue from sales on an on going basis, they are incentivized to continue to update and develop the product. In turn, users receive continuous support for the product and pay less upfront costs. (4) Less upfront fees means it is easier for users to try the product.

SaaS’ impact on a company’s business can be profound, and it is something that any savvy investor must be aware of.

Most software companies built today leverage the SaaS business model. However, Adobe is a rare example of a software company that has successfully transformed itself from selling software in a box to a SaaS model. In the old model, Adobe‘s product development cycle was ~18 months, producing products costing between US $1,300 to US $2,600. With the new subscription model, the company changed the pricing to US $9.99 per month for a single product and US $52.99 per month for all apps in the Creative Cloud.

At the end of 2012, the company started selling its products via the SaaS model, and by mid 2013, the company completed the transition to SaaS. It stopped selling the non subscription version of their Creative Cloud solution altogether. During this transition, the company faced significant backlash from its users. Revenue was flat for over a year during this period. But alas, Adobe’s product was crucial to many people, so users returned to the service.

From the perspective of the investor, the shift to a SaaS company means that Adobe’s business should be more robust. Specifically:

- Adobe should have lower marketing spend (normalized to sales) since the company does not have to market every new release to encourage users to upgrade

- With the subscription business model, Adobe should be able to gain more revenue per user (due to less customer churn that is inherent in a subscription business model)

- Adobe should enjoy higher predictability of recurring revenue.

- And this overall should translate to more cash flow from operations

So did Adobe’s business enjoy these benefits after the shift?

More bang for Adobe’s buck

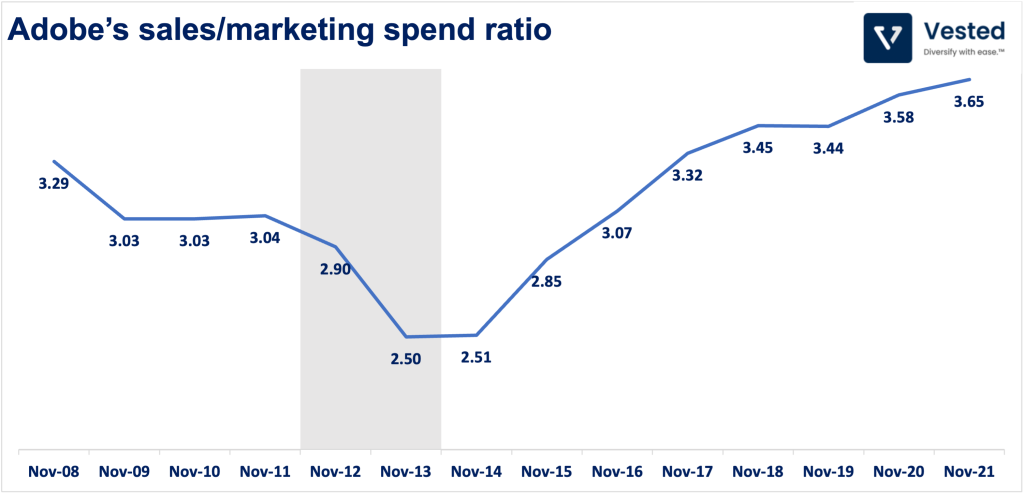

One way we can ascertain if Adobe is gaining more return on its marketing spend (the amount of sales it is generating for every dollar of marketing it is spending) is to see the ratio of sales to marketing spend. Figure 1 shows this ratio over the years. In the four years between 2009 – 2012, the sales/marketing ratio average is 3.2x, while from 2017 – 2021, the average is 3.5x, a 10% improvement. The below graph clearly shows how the return on Adobe’s marketing spend increased since their transition to SaaS in 2013.

Figure 1: Adobe’s sales/marketing spend ratio over the years. 2013 is when the company transitioned completely to SaaS model

More average revenue per user

In the old model, Adobe had customers that would upgrade every single cycle (once every 18 – 20 months), but it also had customers that would skip multiple cycles . With the old model, Adobe was garnering about US$ 30 per user per month. In comparison, with the subscription business, the company flattened this variability and in Q2 2013, the company achieved US$ 37 per user per month. At end of 2018, the average revenue per user is over US$ 73 per user per month (albeit this now includes more products as Adobe has managed to up-sell higher subscription packages).

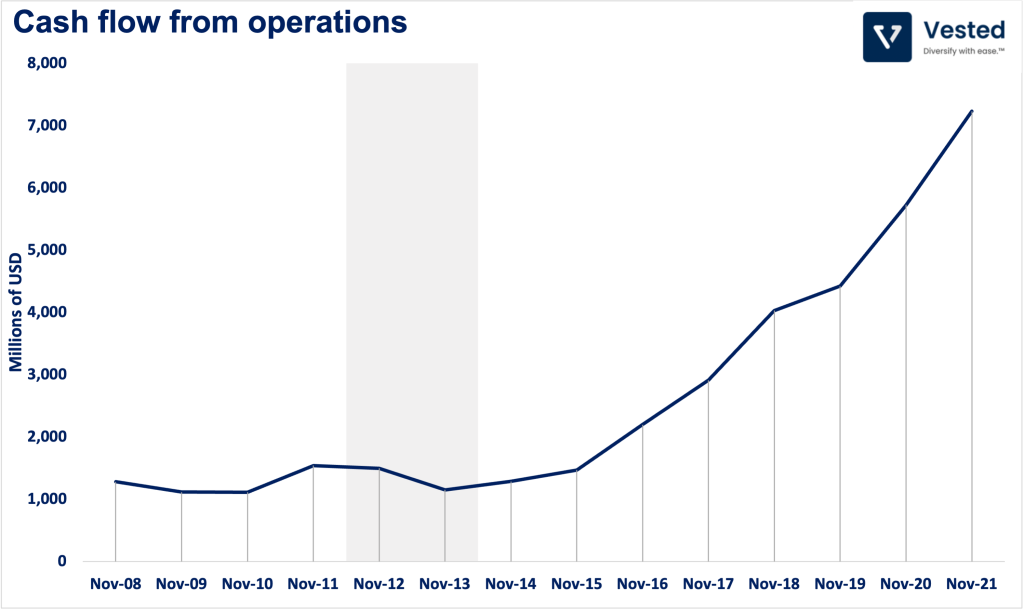

Subscription means more steady cash flow

After switching to a SaaS model, Adobe cash flow from operations skyrocketed. After remaining relatively flat up to November 2013, the cash flow grew at a 28% compounding annual growth rate from 2014 to 2021.

Figure 2: Cash flow from operations have increased significantly after Adobe’s transformation

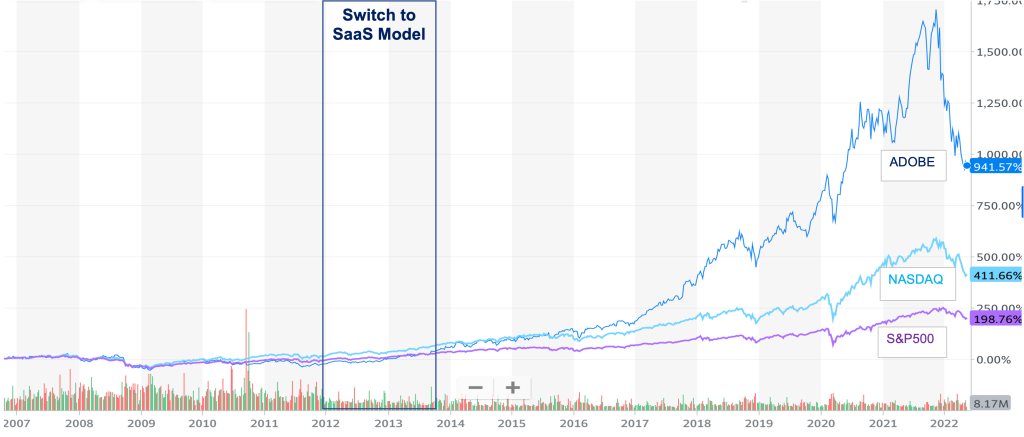

Overall, as a result of Adobe’s successful transformation the company’s share price has outperformed the overall market and the Nasdaq.

Figure 3: Adobe share price has outperformed the overall SP500 and NASDAQ composite

Thanks for reading!