In this article, we will be discussing the increasing trend of electric vehicle companies going public through SPAC.

SPACs and Electric Vehicle Companies

We covered Nikola’s recent fraud allegations in a previous blog post. This past week, the cofounder and executive chairman of the company, Travis Milton, stepped down, and Nikola’s share price has continued to spiral. Although the SEC and DOJ have only begun their investigation and the outcome is still uncertain, some argue that there’s a bubble in the EV space; a bubble that is driven by a combination of easy access to public funds via SPAC and EV (Electric Vehicle) companies fetching lofty valuations even before launching any product.

What’s a SPAC?

SPACs (Special Purpose Acquisition Company) is a blank check company that raises funds from public investors (typically through a traditional IPO). The money raised from the IPO is placed in an interest-bearing trust account. The goal of the blank check company is to find another business to buy within two years. If that doesn’t happen, the company shuts down and investors get their money back.

SPAC has been around for decades, but most recently experienced a resurgence, thanks to the work of Chamath Palihapitiya, who famously took Richard Branson’s Virgin Galactic (ticker: SPCE) public last fall with money it raised in 2017.

Growth of SPAC

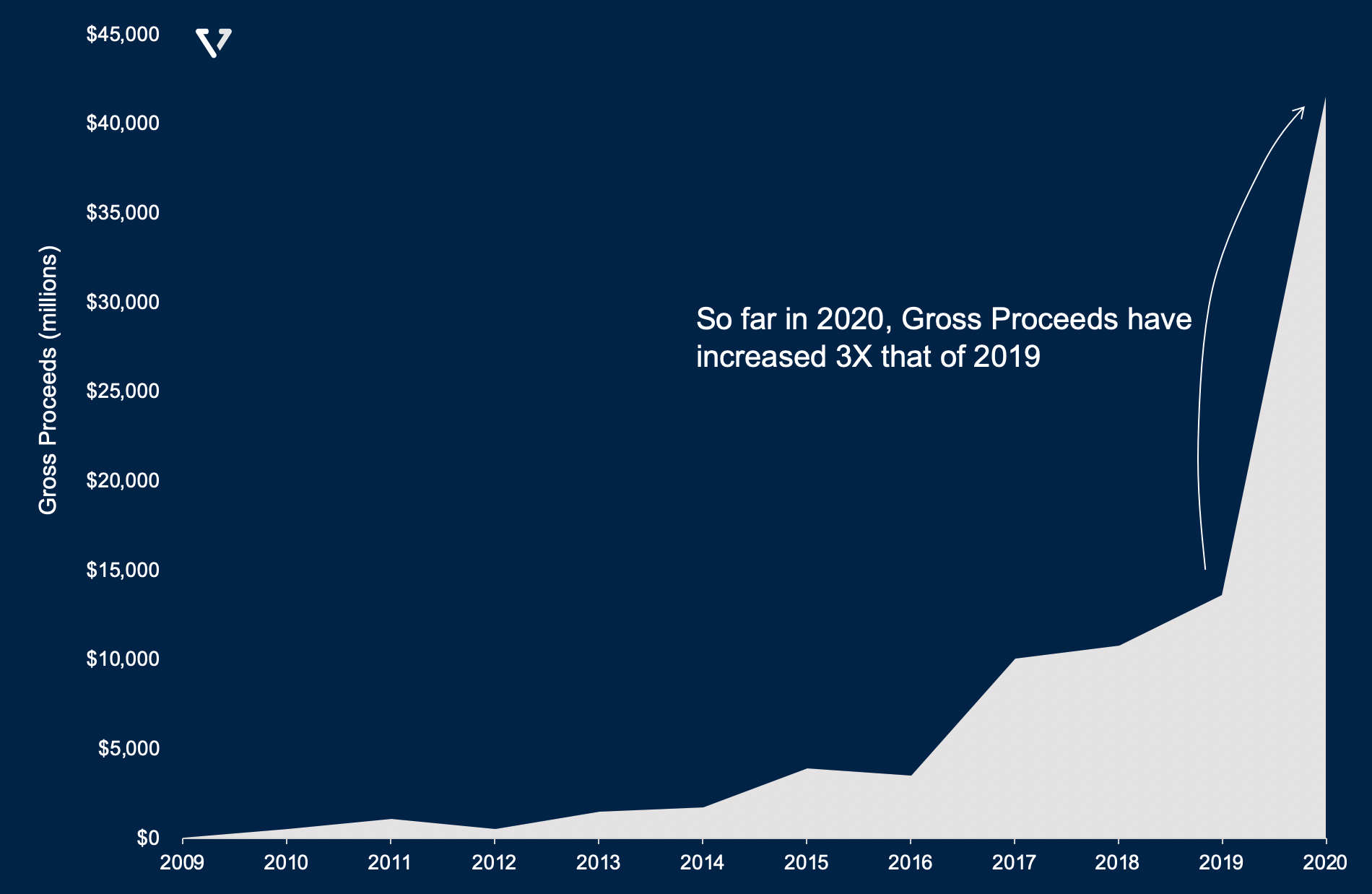

As of Q3 2020, there are 108 SPACs that have IPO’d, raising more than US $40 billion, more than the past 10 years combined. See Figure 1.

SPACs love EV

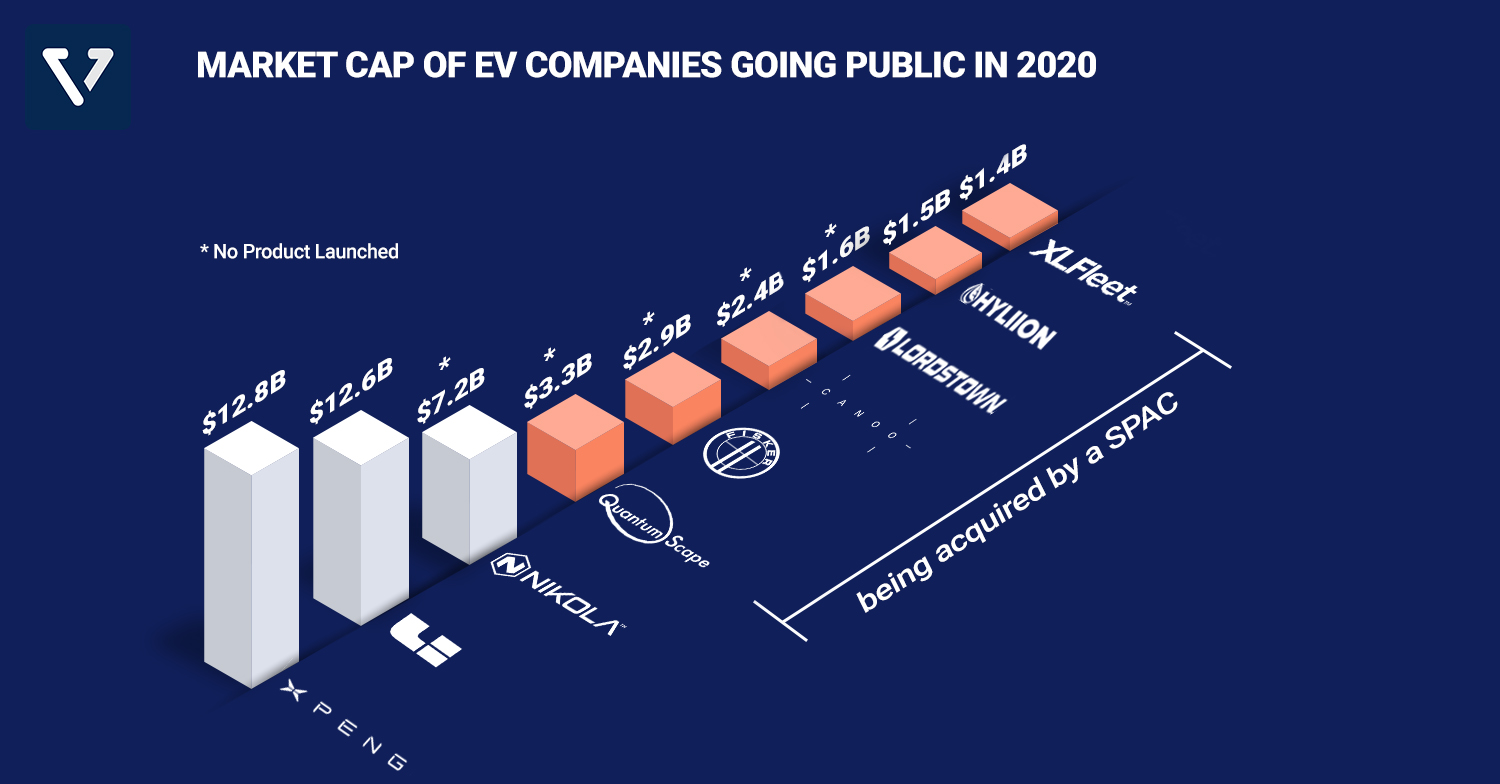

These SPACs have become the favorite way many of these electric vehicle companies go public. Here are some that went public this year alone:

These EV companies prefer to go public via the SPAC route because:

- It’s much faster. The window to go public can close very quickly (if you don’t believe us, ask Airbnb, and the traditional IPO process can take up to a year and a half. Meanwhile the SPAC due diligence takes only 6 – 8 months.

- It’s cheaper. The cost associated with SPAC merger is typically lower than traditional IPOs, which typically costs about 7% of funds raised.

- These companies are unlikely able to go public through the traditional route. Similar to Nikola, the companies mentioned above, Fisker Inc., Canoo and Lordstown motors, have not launched their first product yet.

Note that in contrast, Tesla had been producing its first model (the roadster) for 2 years before it went public via a traditional IPO.

The downside of SPACs for investors

The way some SPACs are structured might lead to misaligned incentives between public investors and the SPAC sponsors (the management that raises the funds carry out the selection on which company to buy and perform the due diligence).

The sponsors are usually entitled to purchase 20% of the SPAC’s equity at a nominal value of US $25,000, incentivizing the management to find a suitable company to merge with, and if the merger is successful, the equity value can be worth much higher. However, this structure can also encourage the sponsors to pick companies that are popular in the market without conducting proper due diligence, in the hope that the combined merged stock pops.

[mc4wp_form id=”1064″]