One of the largest M&A announcements in the past week has been that Square is buying Afterpay (for $29 billion in stocks, and up to 1% in cash). In this week’s article, we deep dive into the strategy of the acquisition.

The History Of Square

Square was founded in 2009 by Jim McKelvey and Jack Dorsey (who is also a cofounder of Twitter and currently the CEO of both companies). As the story goes, McKelvey, who at the time was a glass artist, was unable to complete a $2,000 sale, because his small glass shop did not have the capability to accept credit card payments. After researching the problem further, he realized that he was not alone. So him and Dorsey (who used to intern for him) started Square.

Square had humble beginnings. It started off as a company that provided a square shaped credit card reader that plugged into a 3.5 mm audio jack (remember those?). The hardware was nothing special – it was commoditized hardware that did not really offer competitive moat. But Square’s real genius was the business model.

Unlike the incumbent point-of-sale companies at the time, Square went after the more than 30 million small businesses that were too small (and therefore could not afford the sign up fee + transaction costs) or were deemed not to have the requisite credit worthiness. In what can be described as a textbook example of low-end disruption, Square went after this underserved segment of the market. The company did not only offer favorable pricing (2.6% of transaction + $0.10 for credit card swipes), but also gave away the hardware for free.

According to McKelvey, “combining simple and free causes our growth to explode.†After its initial launch, Square grew 10% every week for two years without advertising.

In 2014, Amazon decided to enter the space. It copied the dongle hardware, undercut Square on pricing, and even had better customer service! Yet, Square survived. By Mckelvey’s account, Square survived because it was able to continue to innovate at a fast pace throughout the attack (it has its own vertically integrated innovation stack, rather than just copying a feature or two). Less than a year later, Amazon terminated its competing product.

In 2015, Square went public, at a market cap of approximately $2.9 billion. The company continued to innovate and is now valued north of $126 billion.

How did Square accrue so much value for its investors?

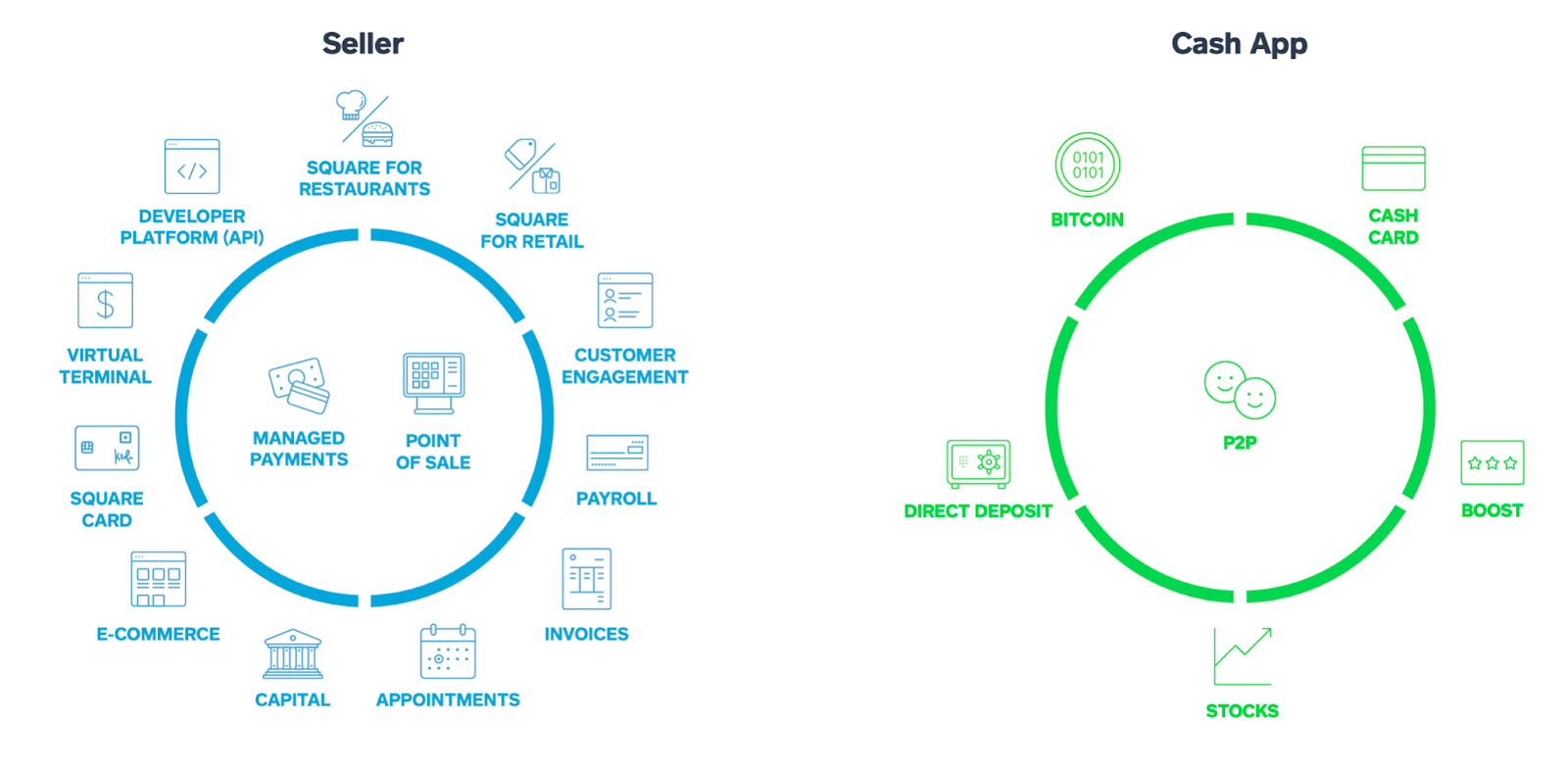

Square’s ambition has grown. The company currently strives to be the financial application that powers both sides of economic activity: the Seller (merchant) and the Consumer (Figure 2).

The goal is to combine the two sides, which allows it to run its own payment system that supplants the traditional payment rails (Visa, MasterCard, others), driving more economic activities between the two ecosystems, and capturing the economic upside for itself.

The Merchant Side

Over the years, Square has diversified its product features to include savings accounts, loans, and payroll solutions, which work seamlessly with their point-of-sale solution. This gives any business a unified look of their finances in real time.

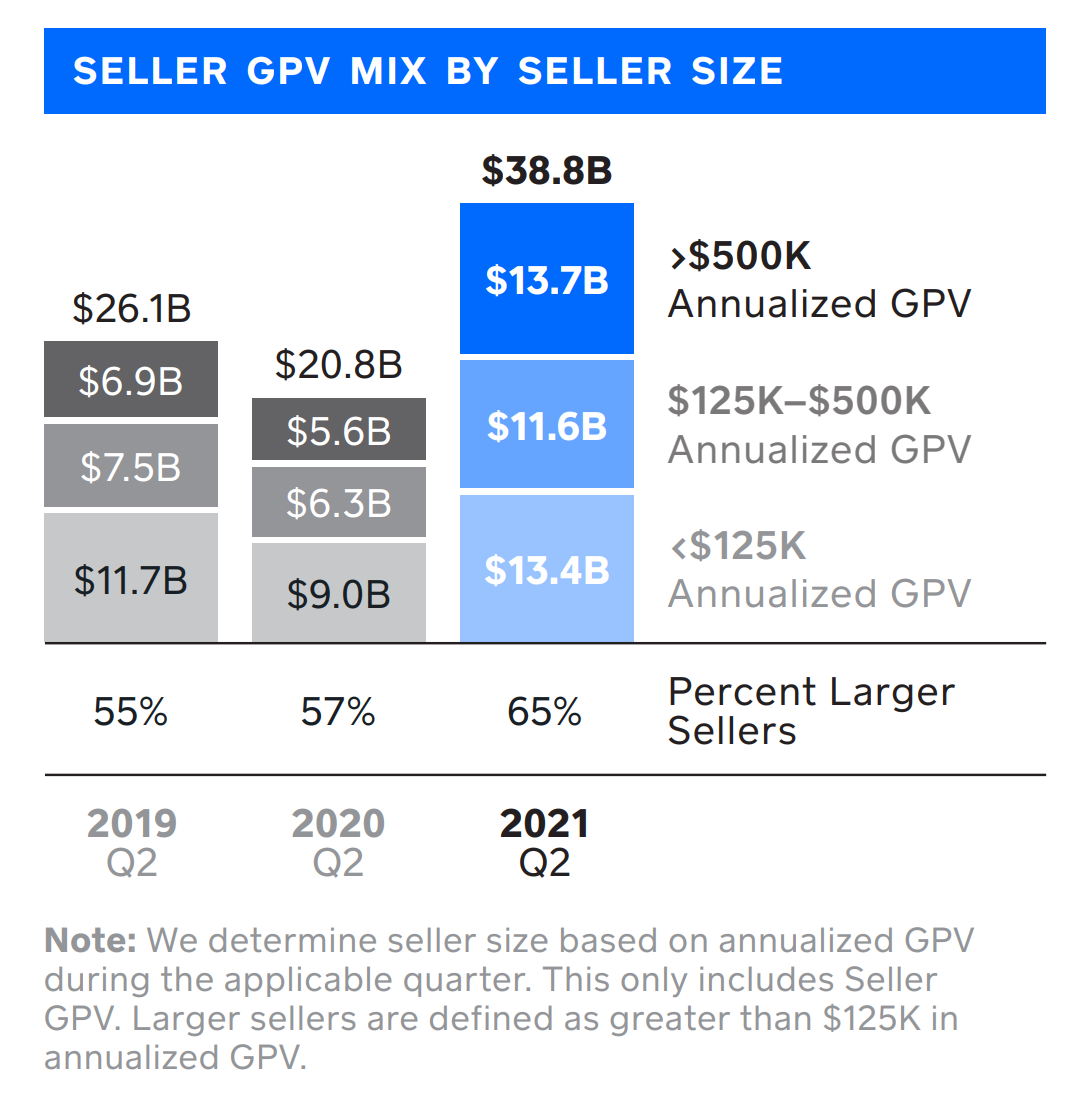

As a result of this continued innovation, Square has been able to increase shares of larger merchants (as measured by gross payment value or GPV). Since Q2 2020, Square has increased the payment volume of global merchants by more than 2x). See Figure 3. These sellers are more profitable for Square since they use more products on average. In the second quarter, software and integrated payments accounted for approximately 75% of mid-market seller gross profit.

The Consumer side

In 2013, Square launched Cash App. When it first launched, P2P money transfer (where users can send money to people they know for free: to split restaurant bills, share loding rental, etc.) was its anchor feature. The Cash App competed head-to-head with Venmo (which is owned by PayPal). Having P2P payments as the anchor feature meant that Cash App leveraged network effects to drive organic growth.

As of the end of 2020, Cash App had 36 million monthly active customers (10x increase over the past 4 years, with a customer acquisition cost < $5 per user in 2020. Following the same land and expansion strategy as the merchant side, Square targeted the under-banked population. It acquires users with the P2P feature and offers them adjacent financial services:

- US investing: As of Q2 2021, 4.5 million customers hold a stock or ETF in their brokerage account (a 3x increase from a year ago).

- Crypto investing: This became a large revenue driver in recent months due to the spike in crypto prices. In Q2 2021, Bitcoin revenue was $2.72 billion (or 58% or net quarterly revenue) which contributed $55 million in gross profit.

- Debit card

- Tax preparation: In November 2020, the company bought Credit Karma’s tax preparation service. With it, Cash App acquired a service used by more than 2 million people, with an average refund of $2,000. This is another product expansion that increases engagement and keeps users’ money in Square’s ecosystem.

Bridging the merchant and the consumer ecosystems

This is the long term objective of Square. If the company can do this, it can create a close loop money movement system between buyers and sellers. This is what the Afterpay acquisition is all about.

Square has had multiple attempts to achieve this convergence in the past. Its efforts can be classified into two categories: (i) Consumer paying merchants and (ii) Merchants (businesses) paying individuals (in the form of salary).

Consumer paying merchants: Square’s first attempt to do this was Square Wallet, a digital wallet partnership between Square and Starbucks, launched in 2014. In exchange for Square processing debit and credit card payments for Starbucks (and a $25 million investment in Square), the coffee chain would accept Square Wallet as payment method. The partnership ended in 2014. It was disclosed that Square lost about $25 million in 2013 from the deal.

Merchants (businesses) paying individuals (in the form of salary):

- On-demand pay: A cash advance system that allows employers to advance salary.

- Instant Payments: Give out salary with as little as 1 day notice.

As you can imagine, the money flow from consumer paying merchants (the first category above) is far larger than the second category. Afterall, the US consumer contributes about 70% of the US GDP. So in order to stitch the ecosystem together, Square will require a much larger channel to tap into consumer spend flow.

That’s where the Afterpay acquisition comes in.

Afterpay

Afterpay is an Australian Buy Now, Pay Later (BNPL) company. It competes with Klarna (based in Europe) and Affirm (in the US). If you are interested in learning more about the BNPL business model.

Afterpay offers payment service, allowing consumers to make a purchase and spread the payments over a period of time (a four payment installment plan). The installment plan acts as a short term loan to the consumer (although in Australia these are not considered loans, and as such Afterpay is not regulated as a lender, does not have to do credit checks, and has no KYC/AML requirements).

Although the BNPL industry is relatively new in the US, it is increasingly replacing credit cards, especially for younger consumers who prefer to use debit cards and not carry credit card balance. They connect their debit card to make the BNPL payments, effectively converting debit purchases to credit, at no risk to the retailers (with marginally higher costs of 1-2%), and no interest penalty for the consumer.

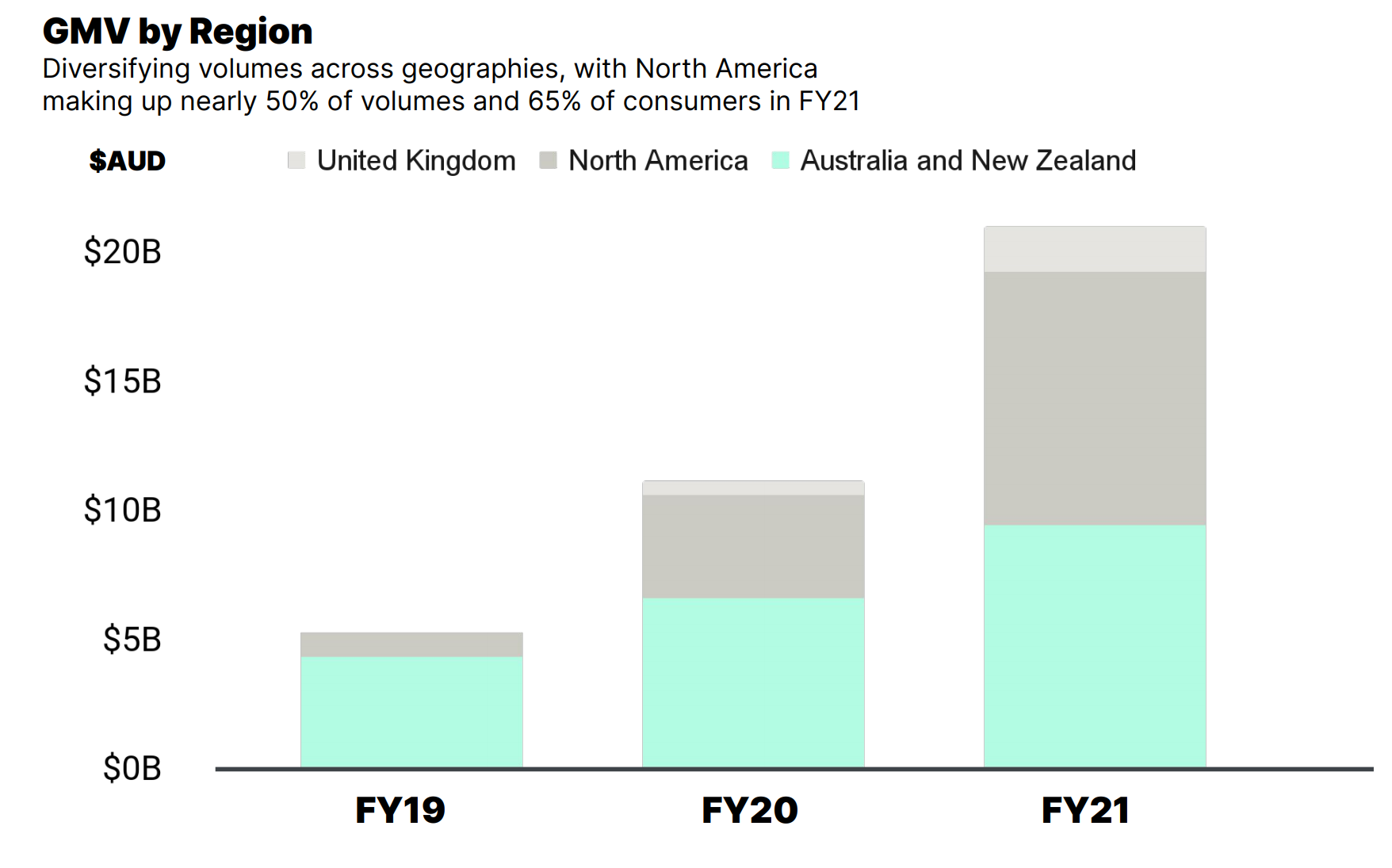

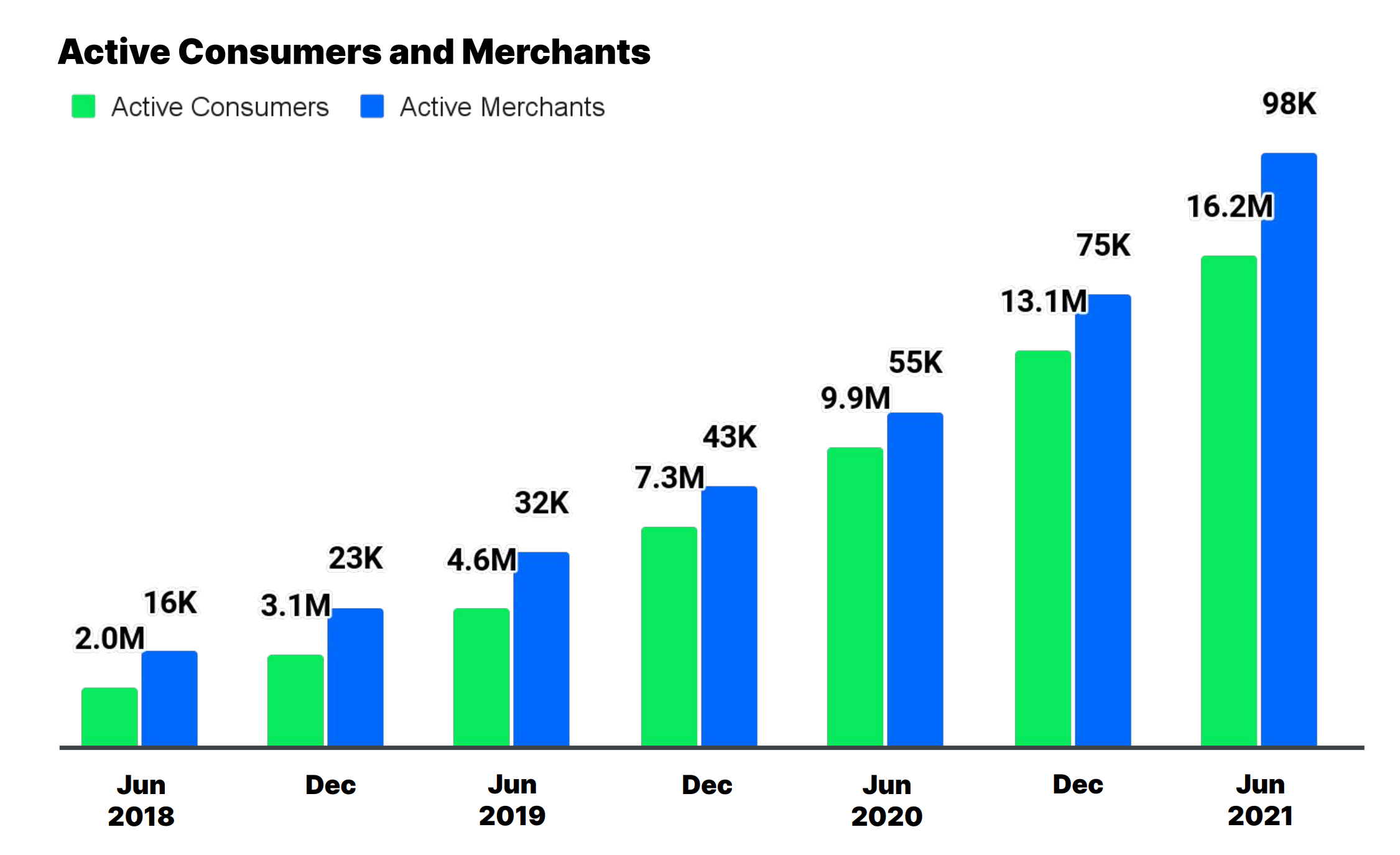

After listing in the Australian stock exchange in 2016, Afterpay quickly expanded its services into other countries. In mid 2018, the company launched in the US. And by FY 2021, the North America region contributed to about 50% of payment volume.

Afterpay’s benefits for its customers

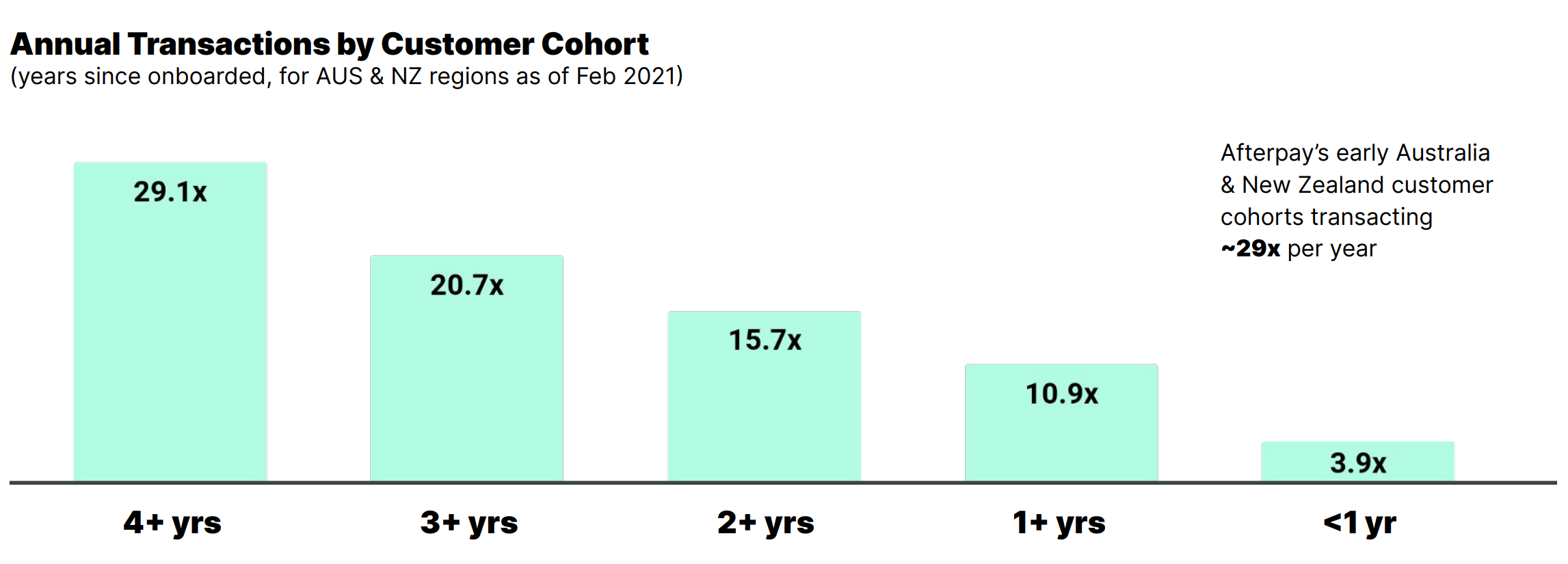

The driver of this rapid GMV growth is repeat purchases. Customers love Afterpay. The company has never enforced debt and only charges relatively mild late fees (especially when compared to credit cards). Late fee is $10 and is capped at 25% of the purchase price or $68, whichever is lower. Despite this, Afterpay’s net loss rate is relatively low at about 0.07% of GMV.

Customer love is also the fruit of the company’s customer acquisition approach. It has strategically pursued merchants in retail fashion where the customers have more emotional connection with the brand which leads to more repeat purchases. As a result, Afterpay’s average customer is 33 years old and is typically female (78%).

Afterpay’s benefits for the merchants

For merchants, Afterpay helps them get more return on investment from their marketing efforts and helps boost revenue:

- The ability to spread out the payments into multiple smaller installments helps increase larger order sizes. Afterpay claims that it helps the average merchant increase their average order size by 30-40%.

- Merchants shift the credit risk to Afterpay and get improved cash flow. Afterpay pays the purchase price upfront to the merchant (after deducting 3.8% as commission).

- But the biggest benefit of Afterpay is the cost of a lead. Afterpay has its own shopping app that showcases items from all its merchants. As a result, merchants no longer have to pay lead acquisition costs to either Google or Facebook. Leads from the Afterpay app are not only free, they also convert at a higher rate. Afterpay seeds more than 14 million leads to its merchant partners and they tend to convert between 10-15%, a much higher rate than from search and social media advertisements.

Square + Afterpay

Square’s hope is that Afterpay can provide a way to connect its merchant and consumer ecosystem together, driving more commerce between the two ecosystems. From a size perspective, Square’s size far suprasses that of Afterpay. Afterpay has ~100,000 merchants while Square has millions. In terms of gross purchase value, Afterpay’s is about $16 billion, 8.75x smaller than that of Square’s.

How will the Afterpay acquisition help Square?

From the merchant’s perspective

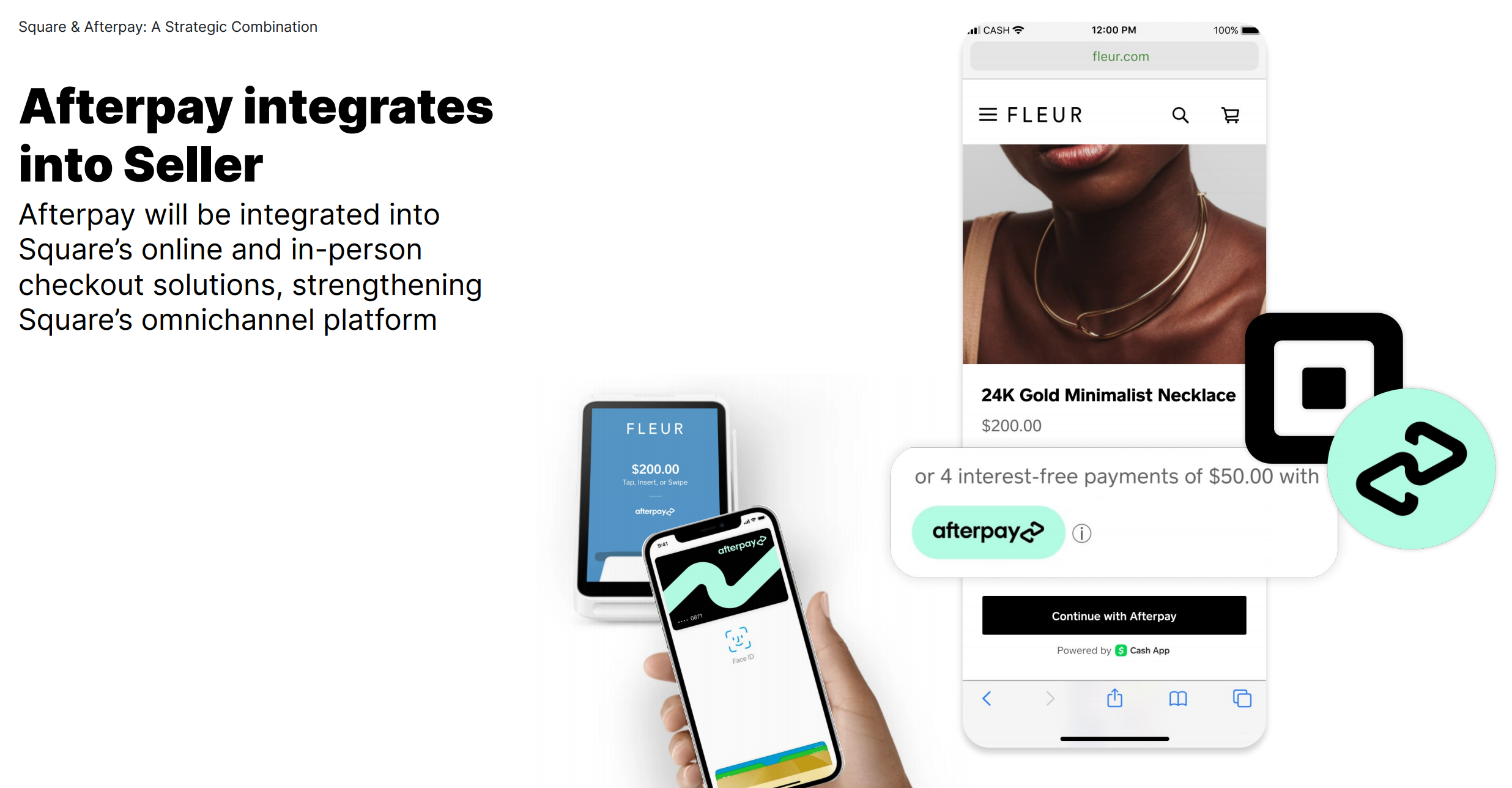

Despite Square’s extensive product suite, Square does not help increase merchants’ revenue. It helps merchants take payments and do pretty much everything else, but it doesn’t help merchants get leads or increase order sizes. In contrast, as we outlined above, Afterpay can help the millions of merchants that use Square increase their revenue. Square plans to integrate Afterpay into all of its point of sale systems (POS).

From the consumer’s perspective

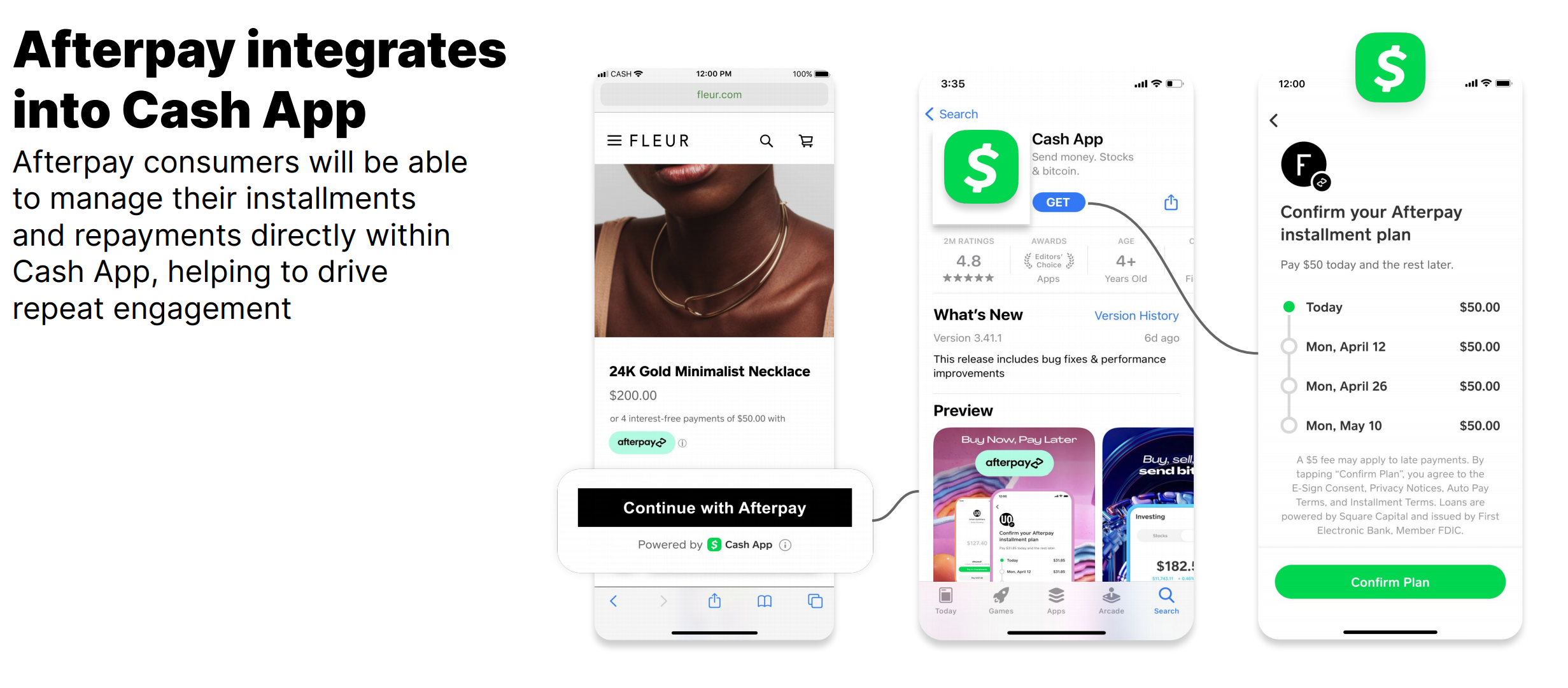

Afterpay users can track their purchases through the Cash App. Conversely, the 36 million monthly active Cash App users will see Afterpay’s shopping in the Cash App, making Cash App a destination for not just finance related functions, but also shopping.

Investors seem to love the move

To put the positive market reaction in perspective, at the time of the announcement, Square’s market capitalization was ~$112 billion. The company is much larger than Afterpay – in terms of gross profit, Square is 7x larger. Despite this, Square planned to buy Afterpay for about $29 billion with an all stock deal (or 26% of its market cap). In other words, Square plans to buy a company that is more than 7x smaller than itself by diluting existing shareholders ~26%. But investors loved the deal so much, that rather than the share price decreasing commensurately with the dilution, it went up by 11% instead, effectively allowing Square to recoup 60% of the purchase value.