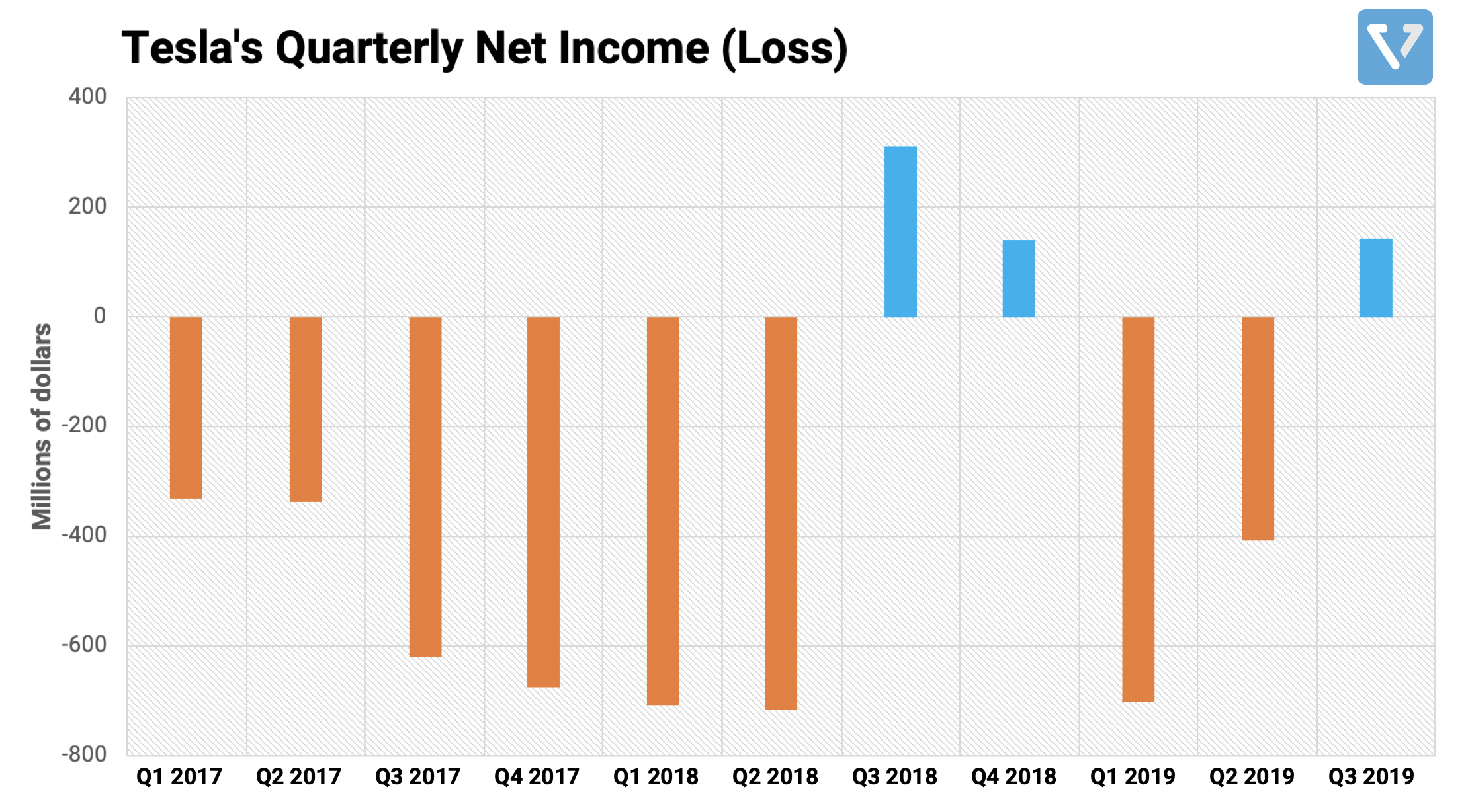

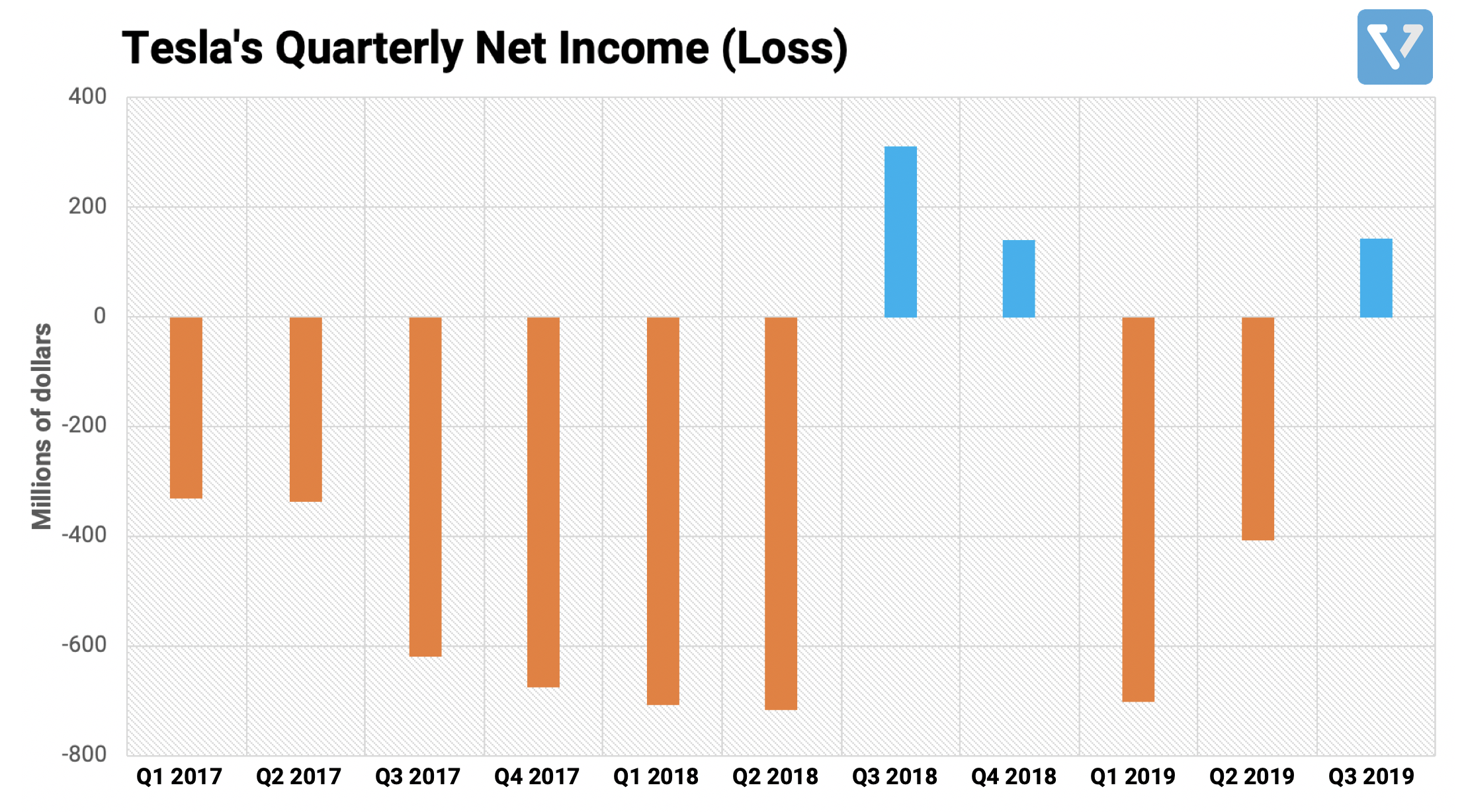

Tesla reported a return to profitability. Last week, we reported Tesla’s strong Q3 vehicle delivery numbers, and this week, the company reported its latest earnings. Tesla finally returned to profitability, posting a US $143 million profit (or 78 cents per share). This result is better than what analysts expected (but still 54% lower than the same quarter last year, which was a record quarter). As a result, the company’s share price surged more than 18% after the announcement.

Figure 1: Tesla’s Quarterly Net Income. After strong vehicle deliveries in Q3 2019, the company has returned to profitability

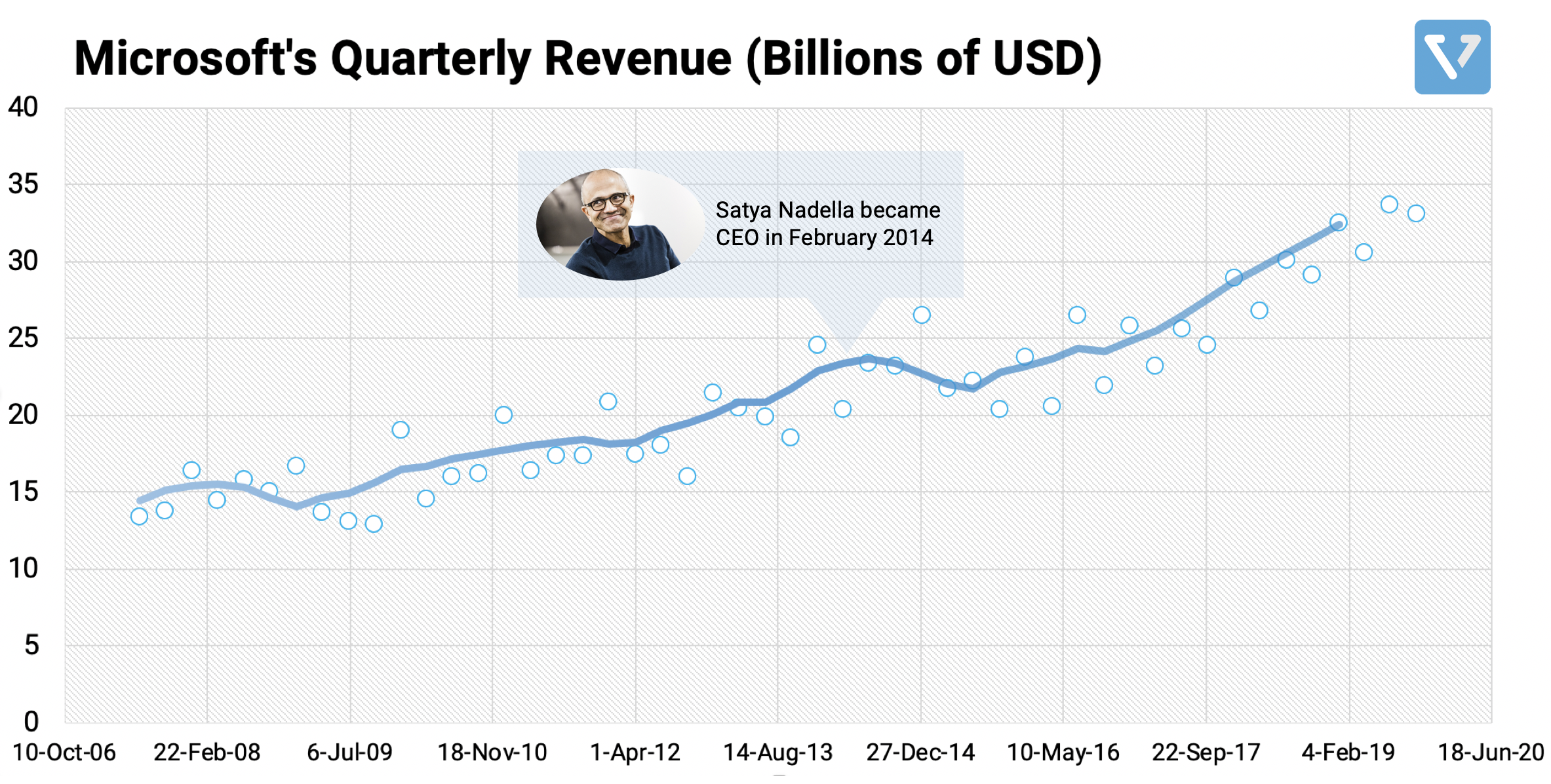

Microsoft delivered another stellar earnings report. The company reported a revenue of US $33.06 billion for the past quarter (Q1), beating analysts’ expectations. This translates to a per share revenue of $1.38 (a 21% increase compared to the same quarter last year). Nonetheless, some analysts are concerned that the growth of Microsoft’s cloud computing business is slowing down faster than expected. The cloud business grew 59% this quarter, lower than the 64% growth rate in the previous quarter.

Figure 2: Microsoft’s Quarterly Revenue. After Nadella became CEO in Q1 2014, the company has surged – largely powered by growth in the cloud business.