Tesla’s increasing profits

Tesla announced its earnings for Q1 2022 last week. Once again, the results beat expectations. Revenue increased by 81% to $18.8 billion. But what is most striking is that operating margins are up 3.5x over the same period last year (an increase from 5.40% to 19.20%), despite supply chain issues and increased raw materials costs. The company posted record earnings.

How did Tesla achieve this?

In the short term, the company has been able to mitigate headwinds in rising raw material, logistics, and operating expenses by:

- Increasing rate of vehicle delivery: The more vehicles you can make for the same investments in personnel and manufacturing capacity, the more profitable you can be. This is a benefit of scale.

- Increase in regulatory credit sales: Tesla sells carbon credit to other car makers to enable them to be compliant with emission standards. In the past quarter, Tesla made $679 million from this, which is 100% profit.

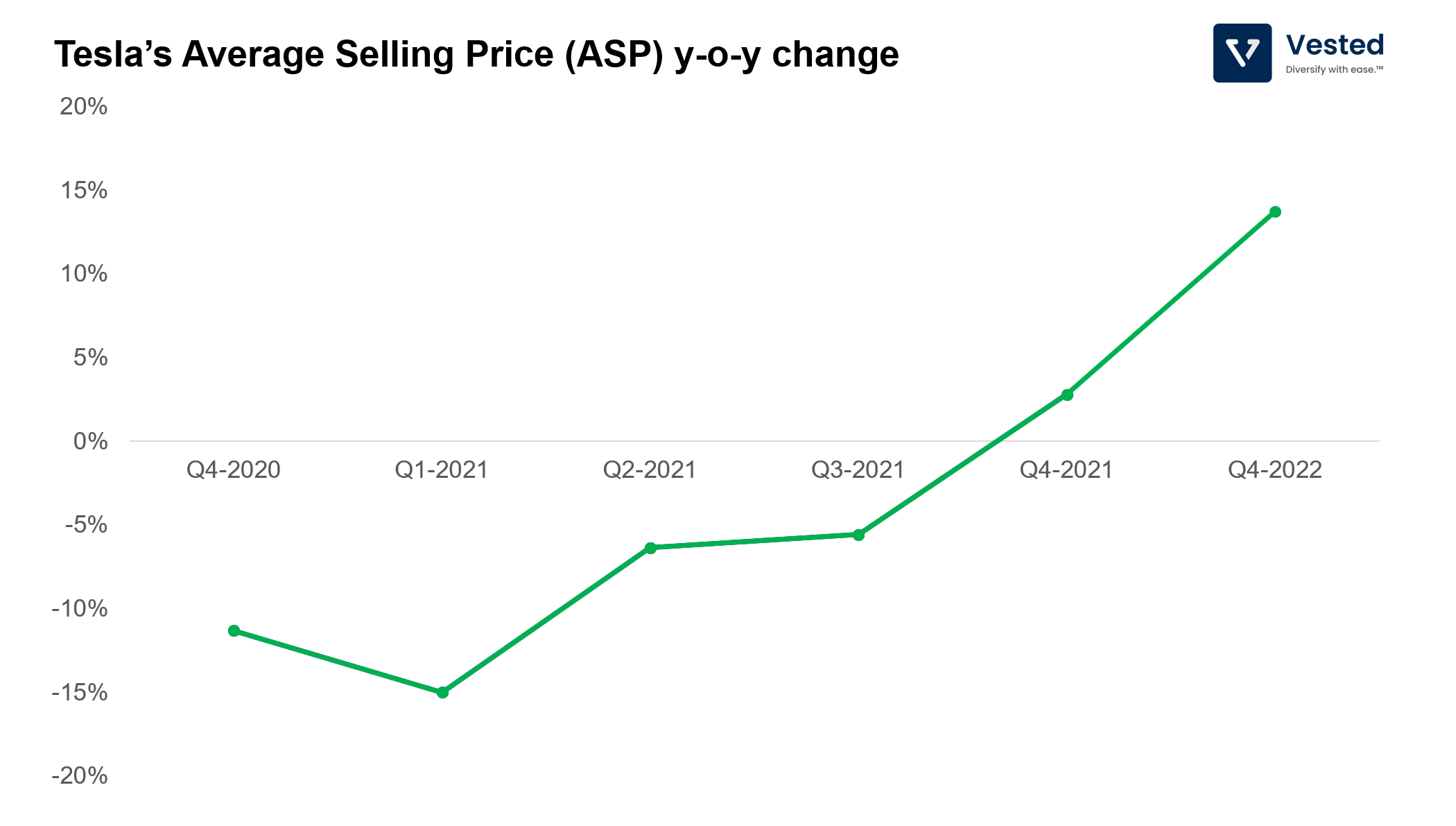

- Raising prices: Due to high demand, Tesla has been increasing the prices of its cars. See Figure 1 for the year-over-year change of Tesla’s average selling price (ASP). Tesla’s ASP is calculated from the amount of revenue the company makes from selling cars (excluding regulatory credits), divided by the number of vehicles delivered. As you can see, up until Q3 2021, Tesla’s ASP had been trending downwards due to an increased sales mix of the cheaper cars (Model 3 and Y). But in the past two quarters, prices have increased.

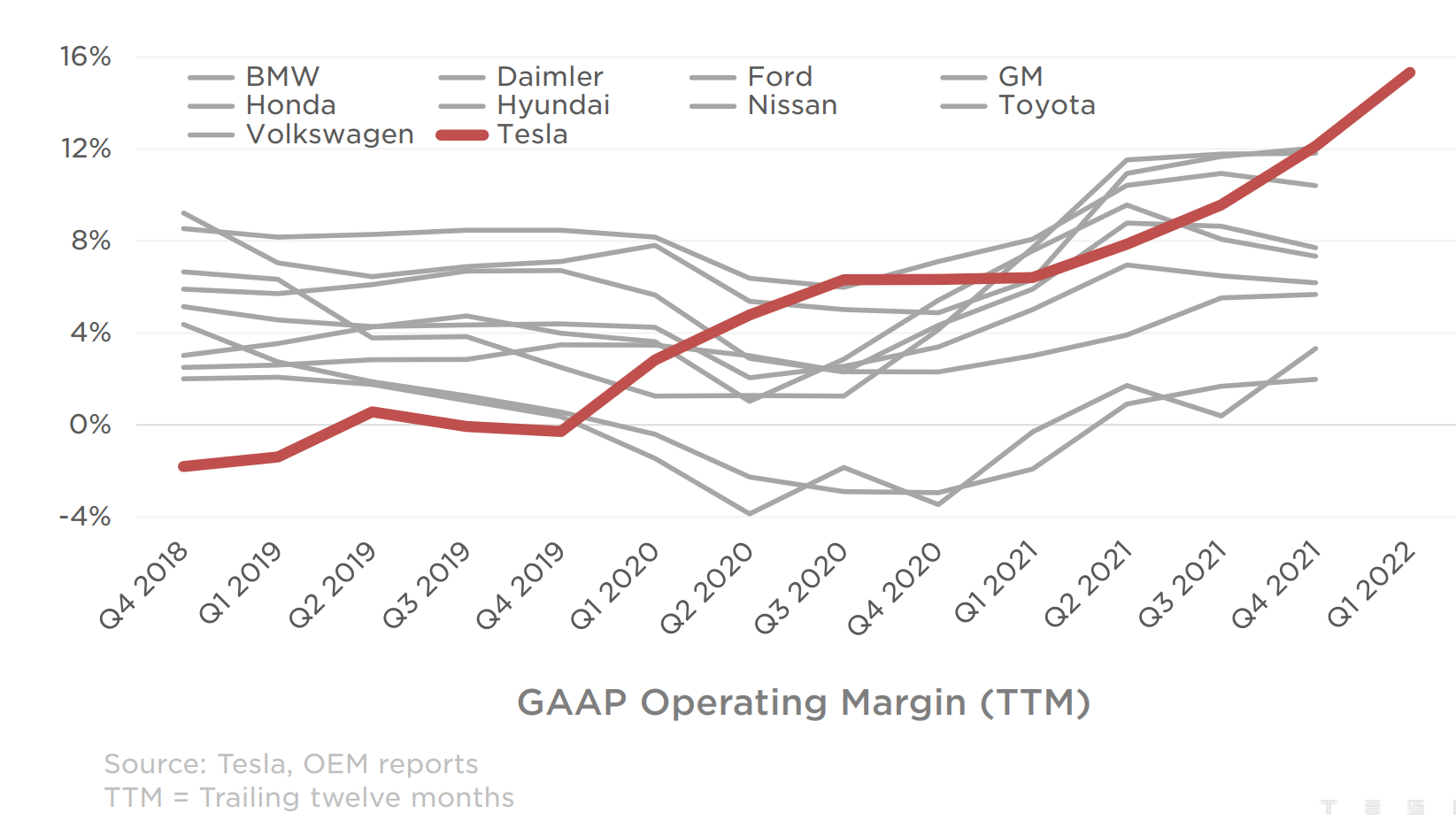

To put this into perspective, we compared Tesla’s profits (red line) to other car makers (grey lines). See Figure 2 below.

As you can see, the acceleration in Tesla’s operating margins started in 2020, which coincided with the ramp up of its Shanghai factory. Tesla’s operating margins of 19.2% in Q1 2022 is almost double that of Toyota’s and quadruple that of GM’s and Ford’s (based on the other car makers’ latest available earnings reports).

In the short term, the factors above are great. But the company cannot continue to increase prices forever, nor can it rely on regulatory credits, since demand for regulatory credit will go down as other carmakers increase their EV sales.

So, how will Tesla continue to increase profitability in the medium to long term? There are several ways.

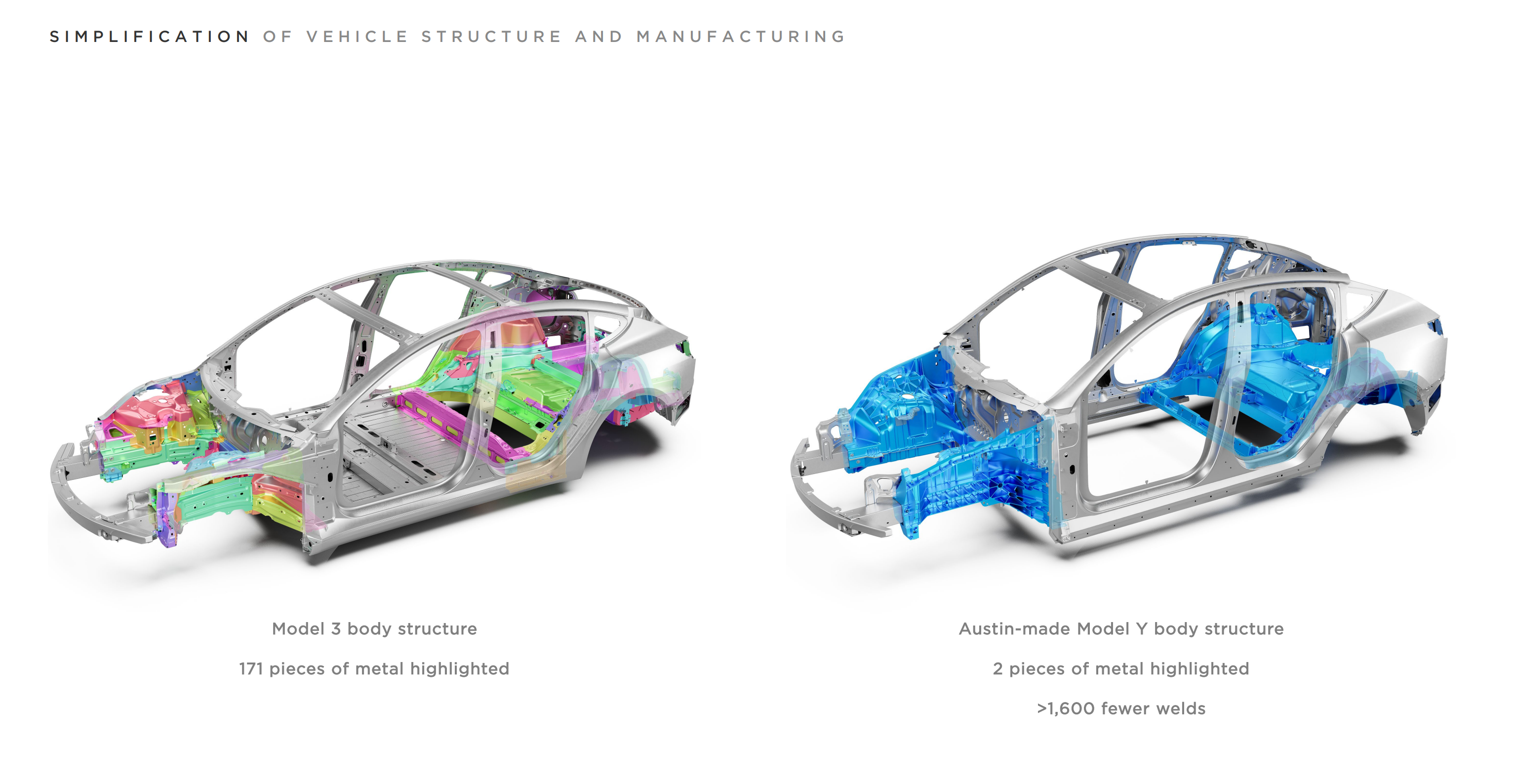

Further increase its throughput: One of the pillars of Tesla’s strategic strength is its relentless focus on vertical integration (which we covered in great detail). Because of this integration approach, Tesla can make continuous breakthroughs in its manufacturing process. For example, with the new Texas factory, Tesla introduced the world’s (according to them) largest die casting machine.

This new technology allows the company to further simplify the manufacturing process. According to Tesla, the new Model Y from the Texas factory will employ this process first, eliminating more than 1,600 welds per car, accelerating throughput (see Figure 3 below).

More software products. Tesla plans to widely release its advanced driver assistance (the “Full Self-Driving†or FSD) to the general public in the US region before the end of 2022. Currently, the FSD is in beta, being used by more than 100,000 people (who pay Tesla anywhere between $10,000 – $12,000 or $200 per month for the privilege).

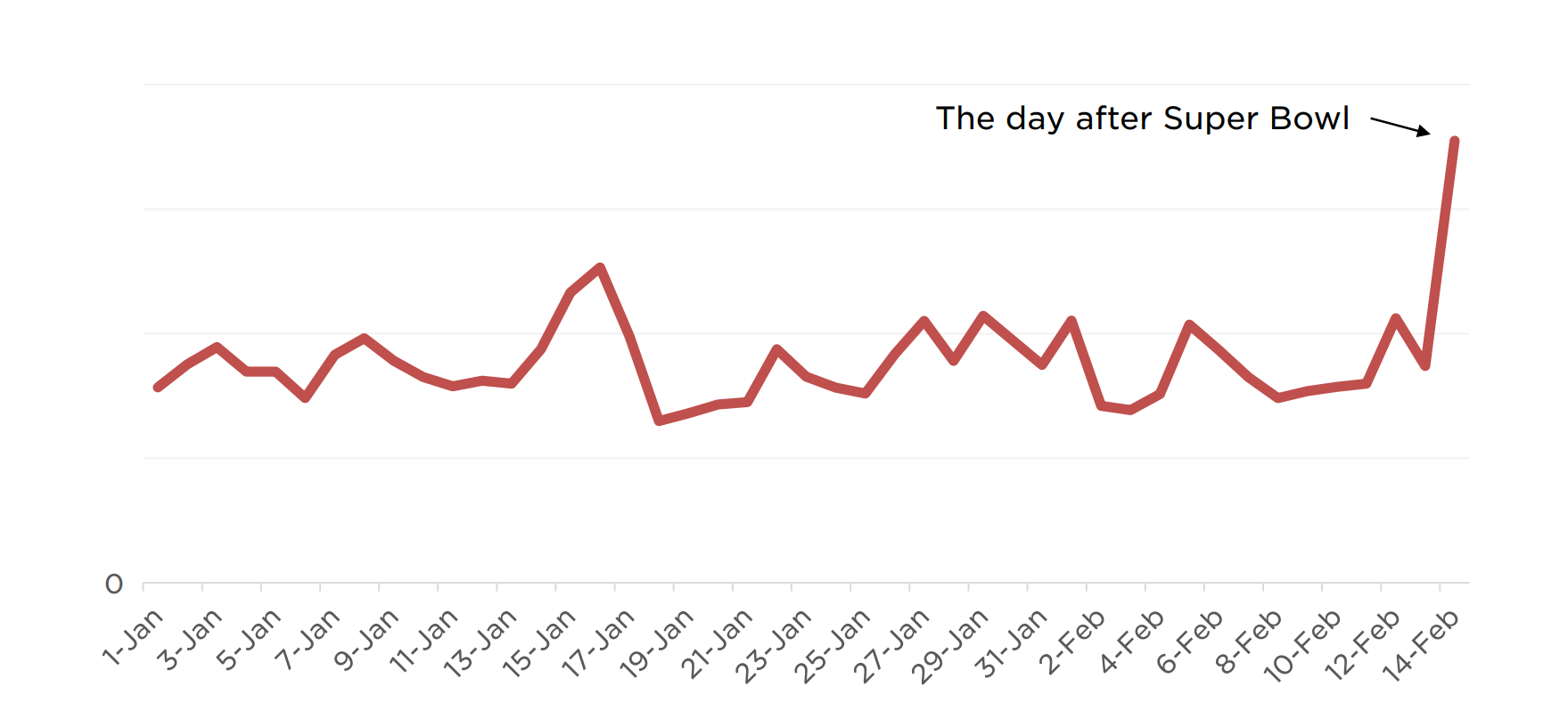

Don’t pay for ads. The ability of Tesla to convince its customers to beta test its software and have them pay for the privilege is not the only superpower the company has. Tesla is also famously known for not spending money on ads. I mean, why spend money on ads, when you can boost your orders when your competitors advertise (see Figure 4). This is the benefit of having a leading brand (and having Elon tweeting). In contrast, GM spends north of $3 billion a year on marketing.

Open up its fast-charging network. Tesla also announced that it is planning to open its supercharging network to other EVs. This will enable Tesla to gain incremental margins on existing infrastructure investments. In the US, Tesla has more than 1,300 supercharging locations, which is almost 10x larger than the second largest network.

Sell car insurance. Tesla’s car insurance is live in 8 US states, and it plans to have the service available to 80% of its US customers by the end of the year. Since Tesla cars are technically an advanced mobile surveillance tool, the company can leverage the data it collects from your driving habits (how much you drive, your speed and safety, location, etc.) and create the most accurate risk profile. Knowing your risk profile and the costs associated with maintaining and repairing each Tesla vehicle, the company can theoretically create a low cost insurance product that is more profitable.

A useful comparison to the Tesla insurance are Root and Metromile, two publicly traded telematic based car insurance companies (they monitor your driving habits via an app or a device that you plug into your car).

While on paper, closer driving habit monitoring can offer a more efficient insurance product, it has not translated to a better insurance business for these two telematic insurance companies. Neither are profitable and incur higher direct losses (they pay more on insurance claims than total earned premiums – the higher the losses, the worse the insurance business is). For FY 2021, Metromile’s direct loss ratio is 78.4%, while Root’s is higher, which is higher than the industry average that ranges from 57% – 70%.

Will Tesla be able to do better? Possibly. Two key advantages of Tesla’s insurance business:

- Tesla cars are safer than the average vehicle. They also do not get into accidents as frequently.

- Tesla won’t have to spend on marketing and customer acquisition (since you buy the insurance through the app), Marketing cost is the single biggest expense item for most insurance companies; for Metromile, marketing expenses is 50% of its total costs.

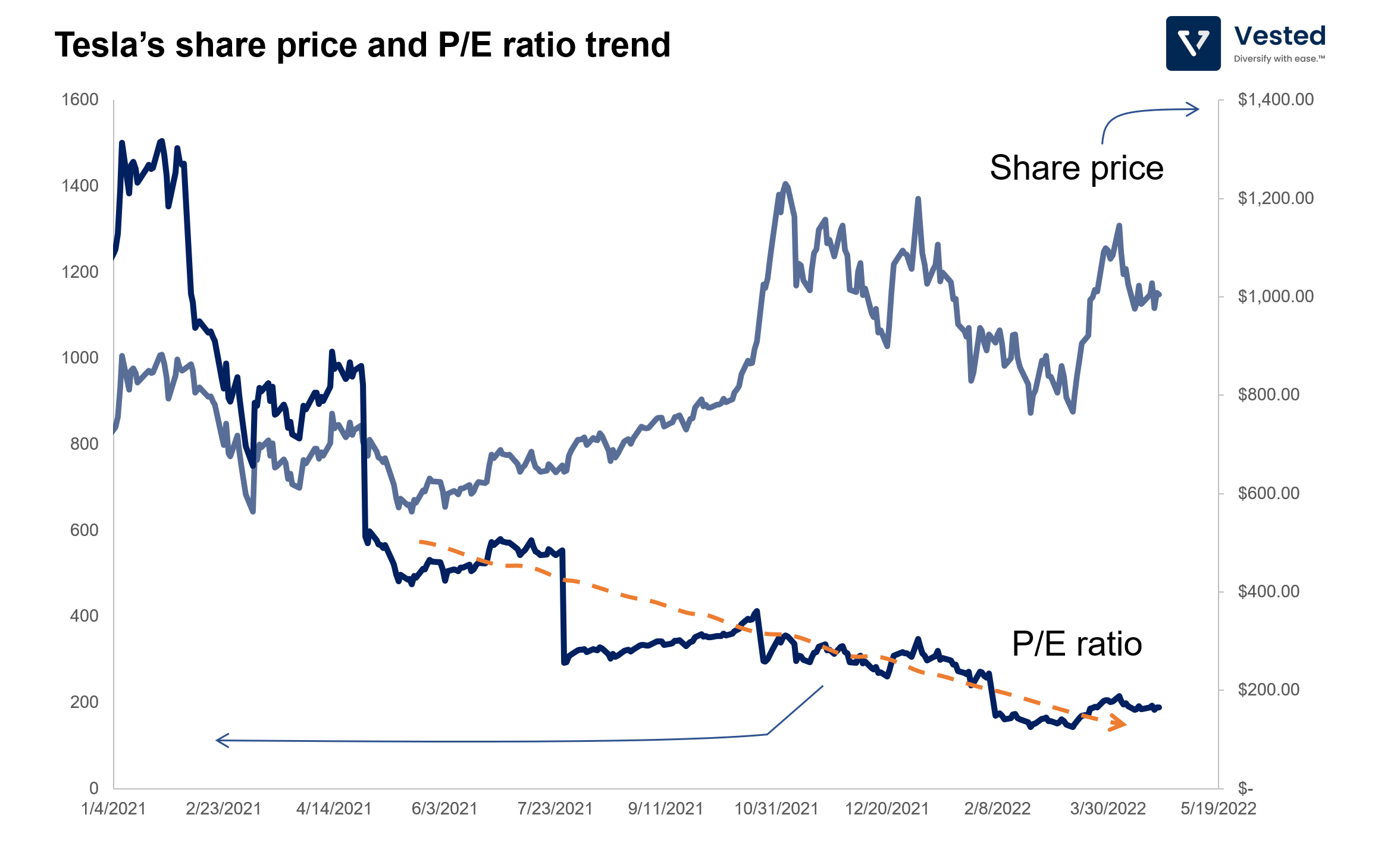

Tesla’s valuation

The company has always been richly valued. That is probably part of the reason Bill Gates has a $500 million short position in the company. But the rapid increase in its profitability has lowered Tesla’s valuation from some absurd number to a lower one (which is still very high – about 12x the current S&P 500 average P/E ratio).

Are we at peak Netflix?

It would be remiss if we talk about major market moving earnings reports from the past week and not talk about Netflix. As of this writing, the company’s share price has dropped more than 38% after it announced that it lost subscribers for the first time in more than 10 years and are projecting a much lower growth rate in Q2 2022.

Here’s the breakdown of the subscriber loss:

- Lost 300,000 subscribers from the EMEA region (Europe, Middle East, and Africa), which included a loss of 700,000 subscribers after suspension of its services in Russia. Note that without the losses in Russia, the company would’ve added 500,000 new subscribers.

- Lost 600,000 subscribers in the US and Canada (the most profitable region).

- Lost 400,000 subscribers in Latin America.

- Added 1.1 million subscribers in APAC.

In total, the company lost about 200,000 subscribers globally and is projecting a net loss of another 2 million subscribers next quarter. Sure, some of the losses are because of the suspension of service in Russia. But even without that impact, the company would have gained only 500,000 new paying subscribers, much lower than the 2.5 million forecast.

In the shareholder letter, management explained that the loss of 600,000 subscribers in the US and Canada is inline with expectations, as a response to Netflix’s aggressive price hikes in recent years. Even with this subscription base shrinkage, the total revenue from the US and Canada still increased by 5% thanks to the price hike.

What is unexpected is the losses in the other regions, LATAM and EMEA. In the past decade, Netflix’s global expansion has largely been unabated and has happened under the backdrop of favorable macroeconomic expansion. But with higher inflation and surging fuel prices, economies of various regions are either at the edge of a recession or are facing a significant slow down

So what’s next for Netflix?

Ads finally?

Adding a free ad supported tier to Netflix’s plan can help stop the bleeding. This help the company in two ways:

- In a saturated market (US & Canada), where Netflix is losing its most price sensitive consumers, the company can add another way to monetize its content.

- In other markets, it can help counter the effects of recession. In a recession, Netflix’s premium subscription becomes a luxury that may get cut off. But if it’s free, then it becomes a distraction that a lot of people may seek.

With more than 222 million subscribing households, there’s a significant high margin revenue upside for Netflix from ads revenue. It can do so in two ways: (1) Be a publisher and sell ad inventory to others. Hulu does this (by partnering with a 3rd party tech provider). (2) Doing this themselves.

There’s a lot of technology in selling ads (matching the ad format to the screen type, serving relevant ads, programmatically inserting ads at the right frequency and grouping, etc.), so Netflix may choose option (1) to start with (as is what Reed Hasting, Netflix CEO signaled during the earnings interview), and possibly acquire a provider in the future. Considering the rapidly changing global macroeconomic environment, there’s some urgency to making this shift.

Charging the free loaders

Of the 222 million subscribing households, there are more than 100 million households enjoying Netflix but are not paying for the subscription. Out of this 100 million non-paying watchers, 30 million are in the US and Canada (that represents about 40% of the currently paying 74.6 million subscribers in the region). It was not long ago that Netflix encouraged sharing. But now, it is time for the company to monetize.

One way for Netflix to extract subscriptions from these non-paying watchers is to show them a pop up and tell them to subscribe or lose access. But this is not the path that the company is taking. Rather, Netflix plans on asking the password sharer to remind non-paying watchers to subscribe, making the person who shares Netflix’s unofficial bearer of bad news and sales representatives. The company is testing this approach in South America.

Whichever path Netflix chooses, there’s no quick fix. Netflix’s COO, Greg Peters, said that it may take a year before the changes are rolled out globally.