Today, we give you a primer on the coal crisis.

The coal crisis explained

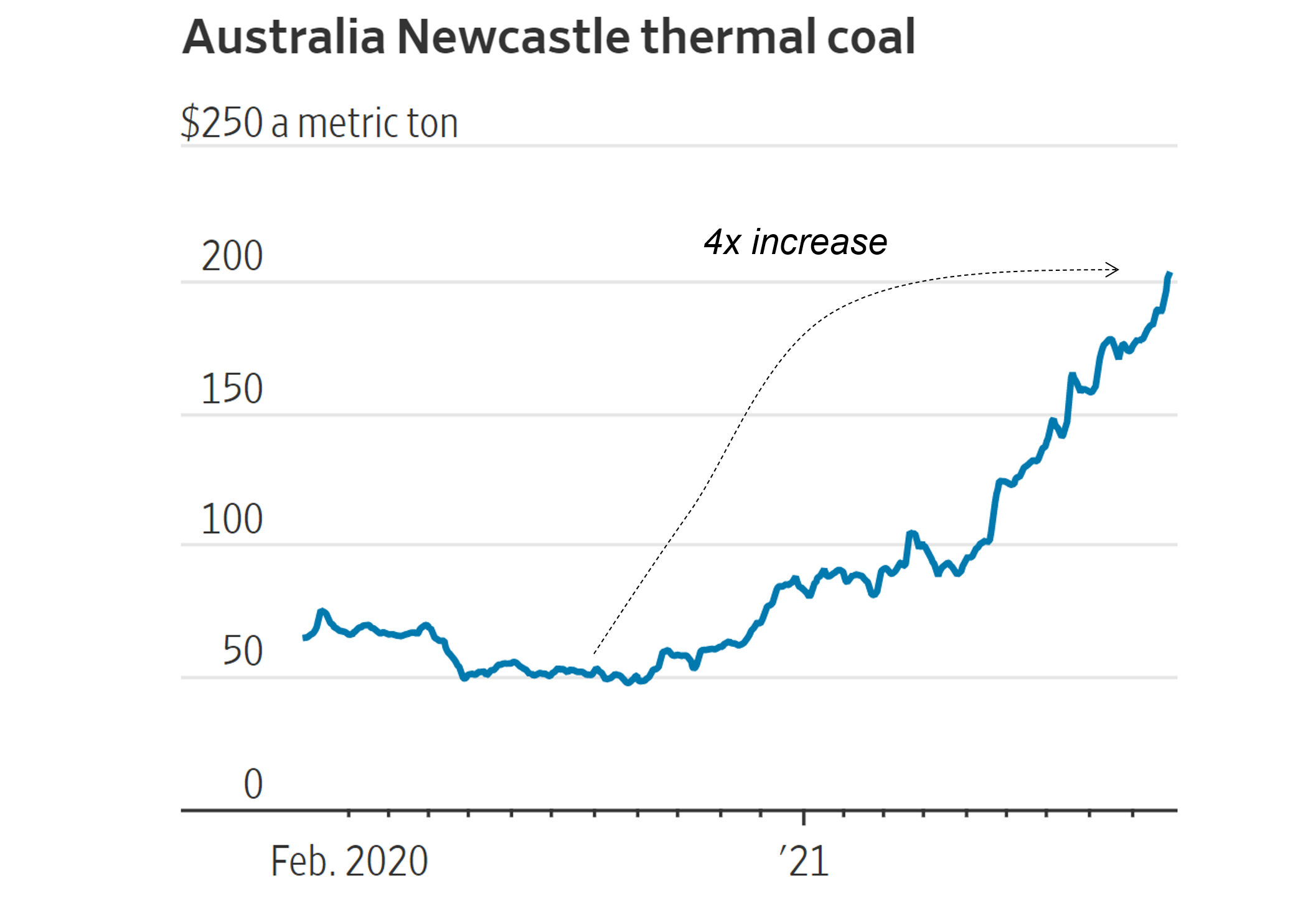

There’s a massive supply and demand imbalance in the coal market, resulting in a surge in prices. Australia’s Newcastle thermal coal, a global benchmark, has gone up from $50/metric ton to about $200/metric ton (Figure 1).

The imbalance occurred because supply went down at the same time demand is increasing.

Increase in demand

There are two reasons for the increase in demand.

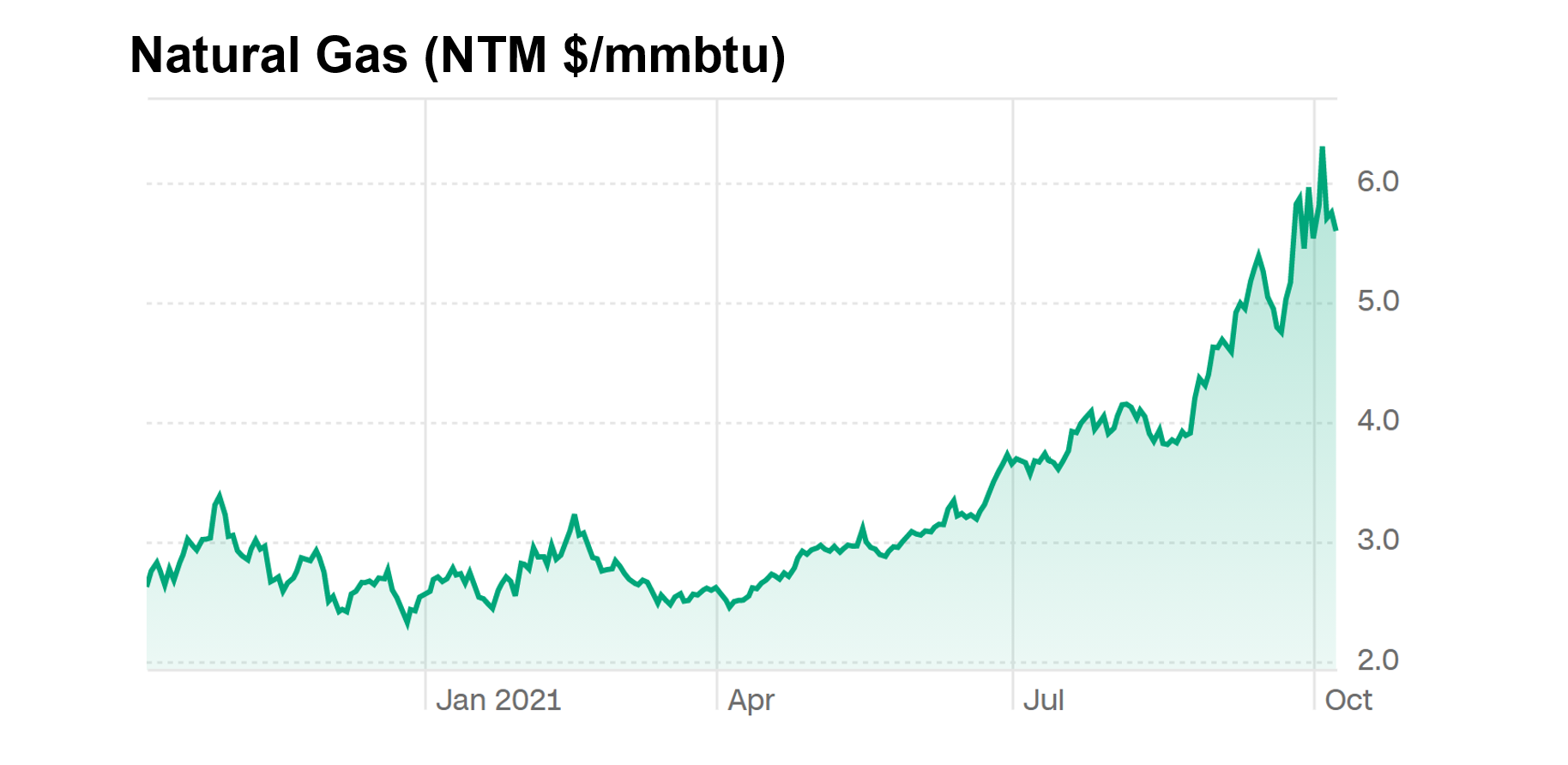

The first is that gas prices have increased. Thanks to colder than average winter temperatures last year, inventory in Europe is lower than normal. This, coupled with a rebound in economic activities, led to a surge in gas prices (Figure 2).

As gas prices have increased, electricity producers are switching back to coal, which in turn drives coal prices up.

The surge in coal prices affects different countries differently. The US is affected, but by a smaller amount than China and other countries. In many Asian countries, coal is still the primary energy source. As economic activities rebounded, coal imports (especially from Australia) by emerging countries increased. For example, India doubled its import of Australian coal, on a year-over-year basis.

Meanwhile, China has banned imports from Australia (in retaliation to Australia’s call to investigate the origins of the coronavirus pandemic). As such, China searched far and wide for replacement supplies. It’s buying up coal from the Philippines, Kazakhstan, and other countries. Yet, supply is still inadequate, leading the country to ration power usage, which in turn will hurt Q3 GDP output.

Fortunately for Australia, other Asian countries stepped in to fill in the demand. Demand for Australia’s coal went up by 56% and 65% in South Korea and in Japan, respectively.

Decrease in supply

At the same time, supply has been declining due to incentives in moving towards a greener source of energy. Miners in the US have cut capacity by 40% in the past 6 years. Spain shut down about 50% of its coal production last year, and plans to phase out all of its coal powered power plants by 2030.

Despite the recent increase in prices, coal producers in the western world are not incentivized to build capacity. It not only takes a while to expand additional mines or build new ones, but long term prospects of coal are just not there. A month ago, China pledged to stop funding the construction of coal powered plants abroad. The expectation is that as soon as prices stabilize, everyone (in developed economies) will switch back to natural gas or renewable energy.

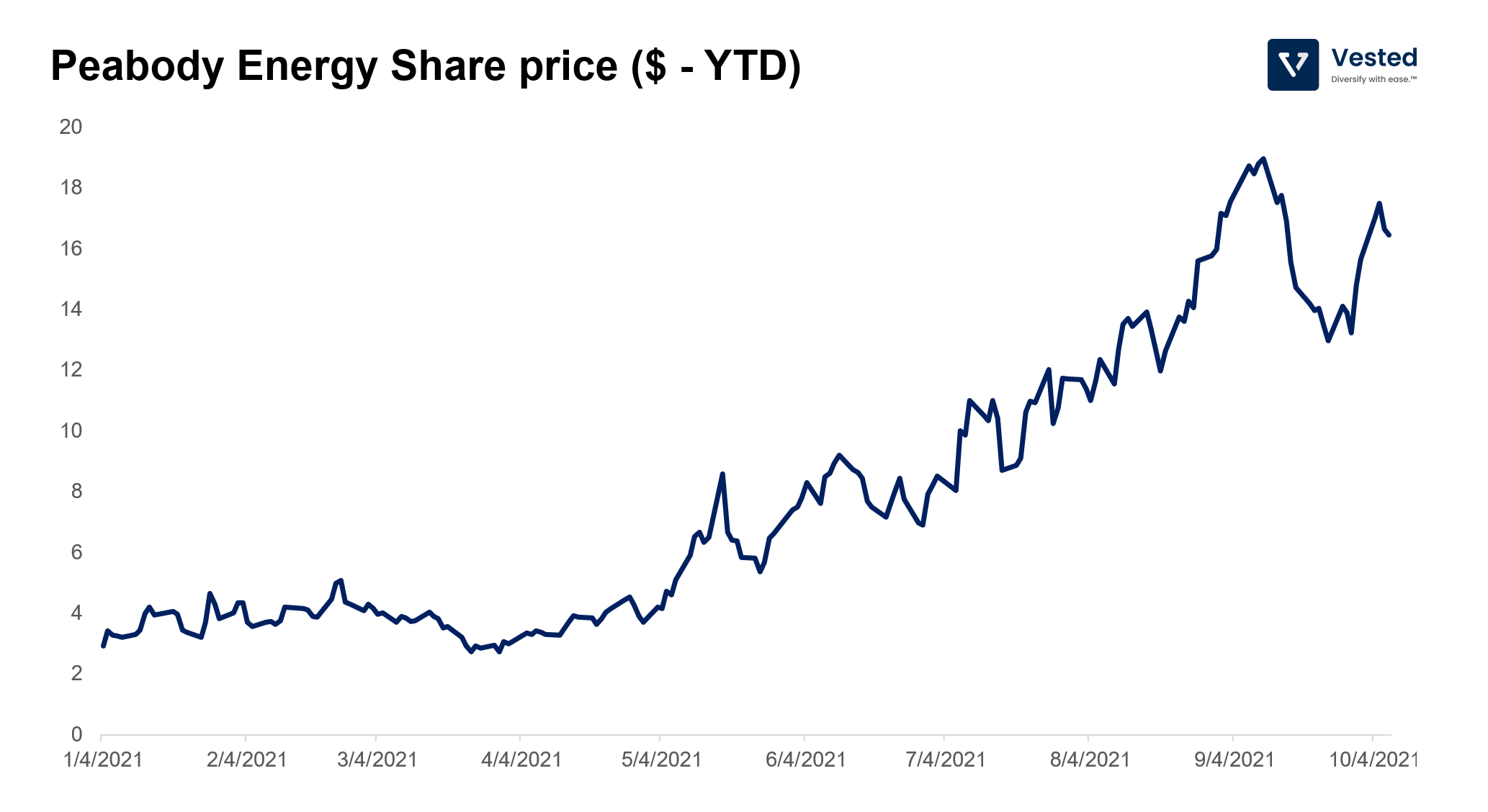

This has been a boon for Peabody Energy. Early in 2021, the company’s prospects were rather dim. Coming out of a recent bankruptcy and high levels of debt, the company was trading at ~1x EV/EBITDA. It was a stock no one liked, operating in an industry (coal) that everyone hated. Its valuation was depressed. But in this “perfect storm†environment, the company’s business (mostly exporting Australian coal to Asian countries, where appetite for coal is still high) all the sudden became in vogue.