The economic impact of lockdown to Indian Economy – based on learnings from the US, China and Europe

As the world continues to grapple with the global pandemic, early economic data and earnings reports from both the US and China are out. These reports may give a glimpse of what is to come in India, as these places are ahead of the curve in terms of lockdown and economic recovery.

US banks brace for high loan default numbers.

This past week, major global banks in the US reported their earnings. All the banks observed similar trends in Q1 2020.

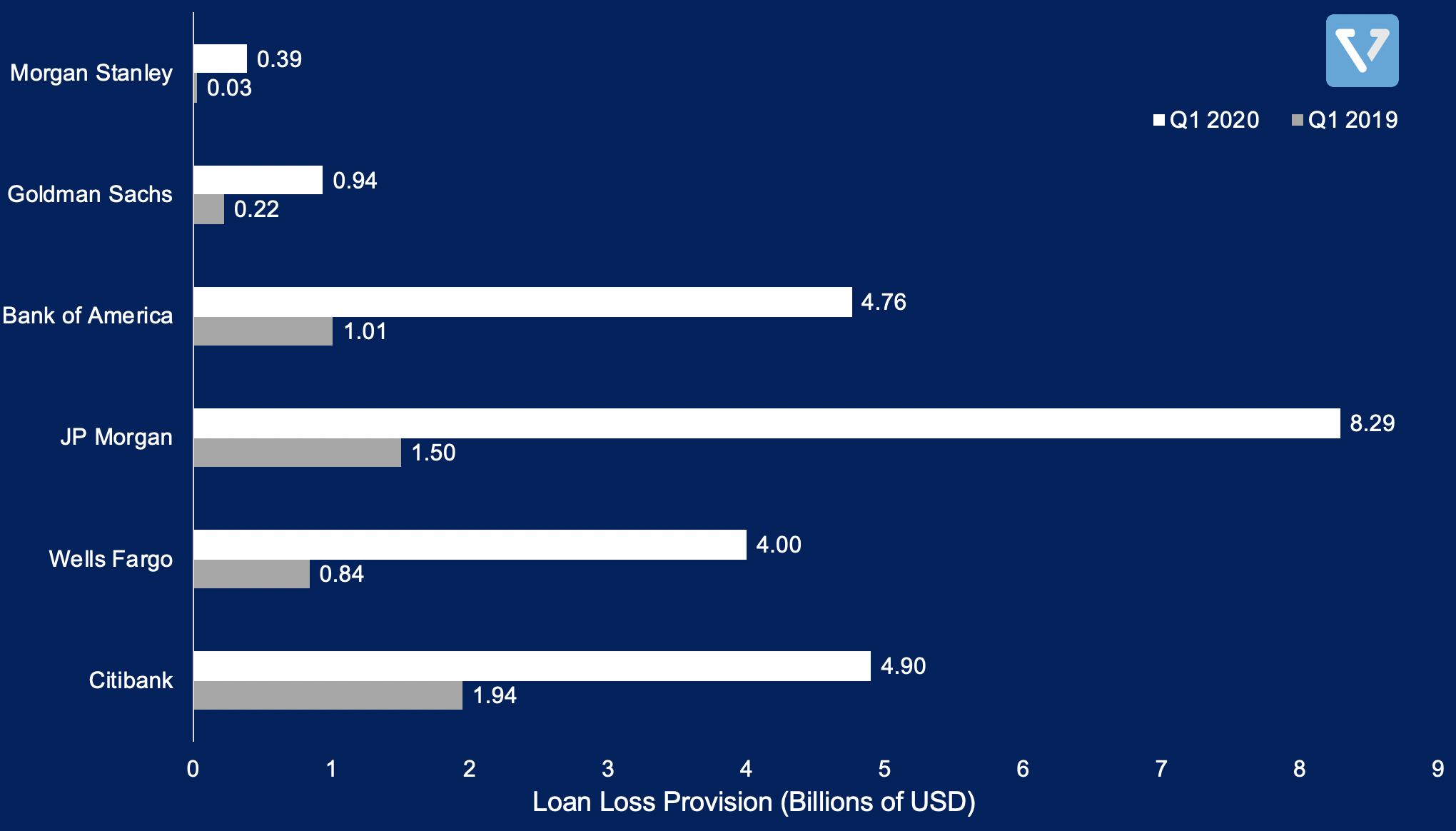

They all reported lower profitability. This is predominantly due to increased loan loss provisions. All the banks set aside large sums of funds (highest in a decade) in preparation for loan defaults that they expect to occur due to the global lockdown. We compare the amount set aside by the six largest banks in Figure 1. In total, these banks set aside more than US $23 billion for expected loan losses.

Figure 1: Loan loss provisions for 5 major banks: Morgan Stanley, Goldman Sachs, Bank of America, JP Morgan, and Wells Fargo. Amount in Q1 2020 is compared to the same period from last year. These numbers are the highest in a decade for all these banks.

Notice that Morgan Stanley and Goldman Sachs have the least amount set aside. These two have the least exposure to individual consumers and small businesses.

During these uncertain times, exposure to consumer lending (credit cards, mortgages, etc.) has become liabilities for financial institutions. As lockdown in the US enters its second month, approximately 3.74% (as of April 5th) of home loans are in forbearance (a situation where homeowners cannot pay their mortgage but the lender agrees to delay foreclosure), up from about 2.73% the prior week.

For investors from India, expect a similar trend to play out for Indian banks. It is unlikely that the 3-month moratorium of loan repayment that the RBI issued will be sufficient for consumers and small businesses in India. Indian banks will likely face similar challenges as these US banks – the risk of non performing loans will increase significantly. As such, indian banks with high lending exposure will face greater risk with expected high unemployment and slow economic recovery.

Unemployment numbers shoot through the roof.

Unemployment is the leading indicator of future income. After two months of lockdown, China reported an urban unemployment rate of 6.2% in February (up from 5.3% in January). This figure is the highest reported in 20 years. The ~1% increase translates to about 5 million additional jobs lost. Even this high number is likely an underestimation.

The official Chinese government figures (which you always have to take with a grain of salt) only includes urban workforce (about 442 million people), but does not include a significant population of migrant workers (about 290 million people). One analyst estimates that if you loosen the strict definition of unemployment used by the official statistics, the unemployment number might be as high as 205 million people (out of the total workforce of 775 million people), which is about a 26% unemployment rate.

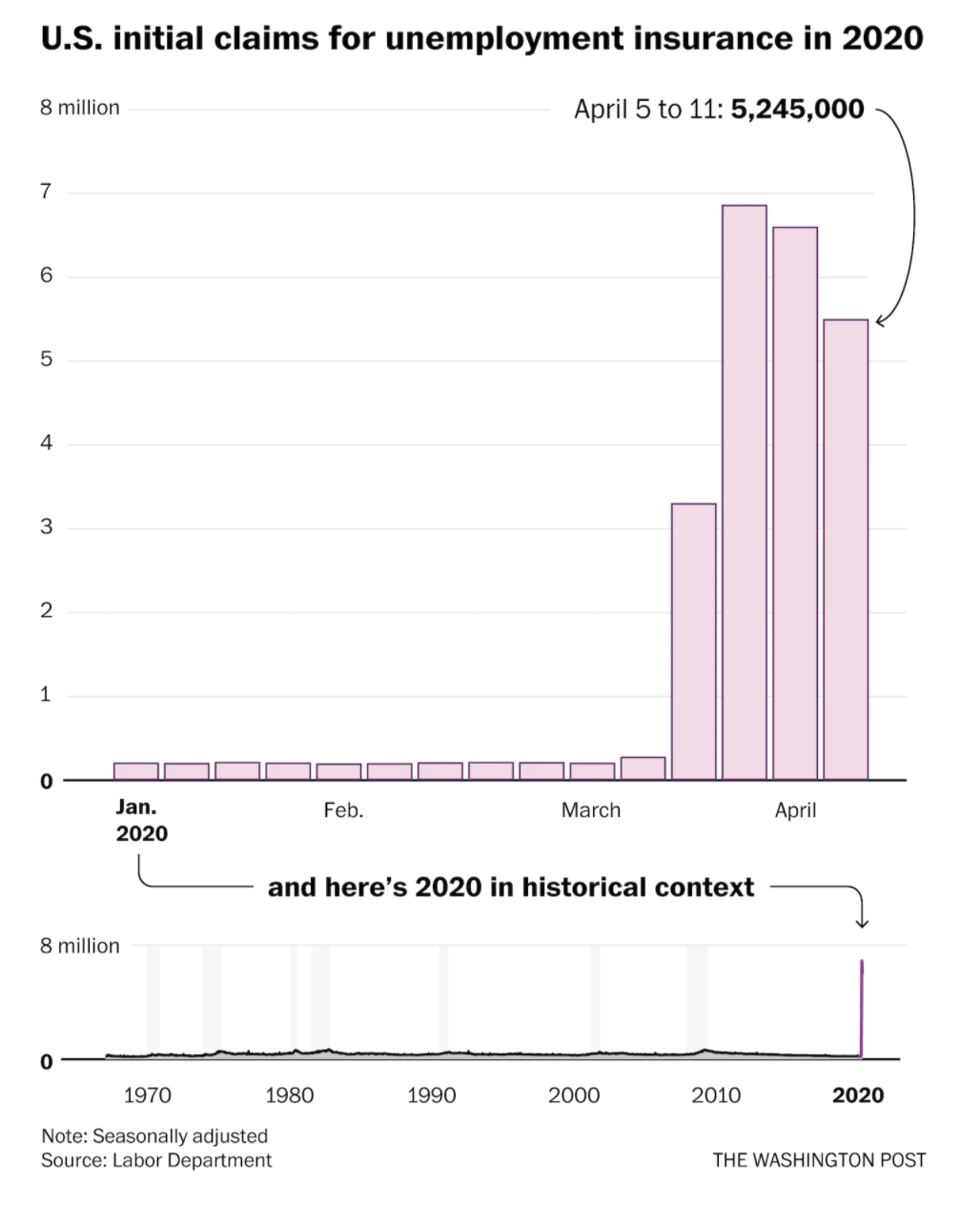

The US is facing a similar problem. Since the national emergency was declared, about 22 million people have filed for unemployment insurance, at an unprecedented speed. See Figure 2. Some economists estimate that the true unemployment rate could be as high as 20% by end of April.

Figure 2: Claims of unemployment insurance in the US. Source: Washington Post

This is the devastating impact of a two-month lockdown.

The unemployment challenge with countries as large as China (and India) can create a snowball effect. As jobs are lost, the pool of unemployed workers expand, while every year, a large number of fresh graduates enter the workforce (China had 8.3 million University graduates last year, while India had an estimated 9.3 million fresh graduates).

This combination of large unemployment, shrinking economy and a large addition to the workforce every year can slow down employment recovery.

So what does this mean for India? Expect unemployment numbers to rise significantly (by several times) in both rural and urban areas.

Furthermore, stoppage of economic activities unsurprisingly leads to GDP contraction. China reported that its Q1 2020 GDP declined by 6.8% (less than the expected 8.3% decrease expected – take these official numbers with a grain of salt, however). Meanwhile, the consensus for the US appears to be GDP decline between 3 – 7% in Q1 and more than 30% in Q2.

What will reopening of the economy look like?

The first step to normalcy and economic recovery is to get the pandemic under control. This means getting the spread of the disease to slow down enough such that further tracing and narrow containment actions can be carried out.

Reopening of the economy will be slow and gradual. Businesses that rely on large gatherings of people will be the last to recover.

Europe has also seen growth of new cases slowing down. As such, several countries have outlined plans to gradually re-open the economy. Here are some common patterns:

- Small businesses and schools will reopen in the least hard-hit areas. Social distancing protocols and mask wearing might be compulsory in some countries.

- Large gatherings might still be prohibited even as the economy gradually re-opens.

Until vaccines are widely available, it is unlikely that large gatherings will return to normal. This means businesses that rely on the congregation of a large number of people (Disney theme parks, NBA games, music concerts, cruises, shopping centers, etc.) will take the longest to recover.

As the US and India reopens, we expect to see a similar pattern.

Manufacturing might rebound first, while recovery of physical retail will be slower than expected.

As the economy reopens, manufacturing activities might be the fastest to rebound, while retail and services will be slower. China has been down this recovery path for several weeks now. So far in China, we’ve seen that:

- Manufacturing activities were the fastest to rebound. After lifting most of the lockdown in the country, China’s manufacturing index began to rebound in March. Nonetheless, demand for goods and services are still fragile – due to the fact that most of the world is still in lockdown.

- Recovery of retail and services businesses is much slower. People are not visiting retail stores over fears of COVID-19 and concerns of layoffs, which puts consumers in a money-saving mode).

In China, even though the lockdown has been lifted, revenue recovery in the retail and services sectors have been slower than expected. About half of publicly listed Chinese retailers face bankruptcy within 6 months if revenues do not recover soon. As a result, China may face a second wave of bankruptcy in these sectors.

This trend is especially pertinent in India where the services sector contributes to about half of the GDP.

Minimizing job losses is first priority (after getting the pandemic under control)

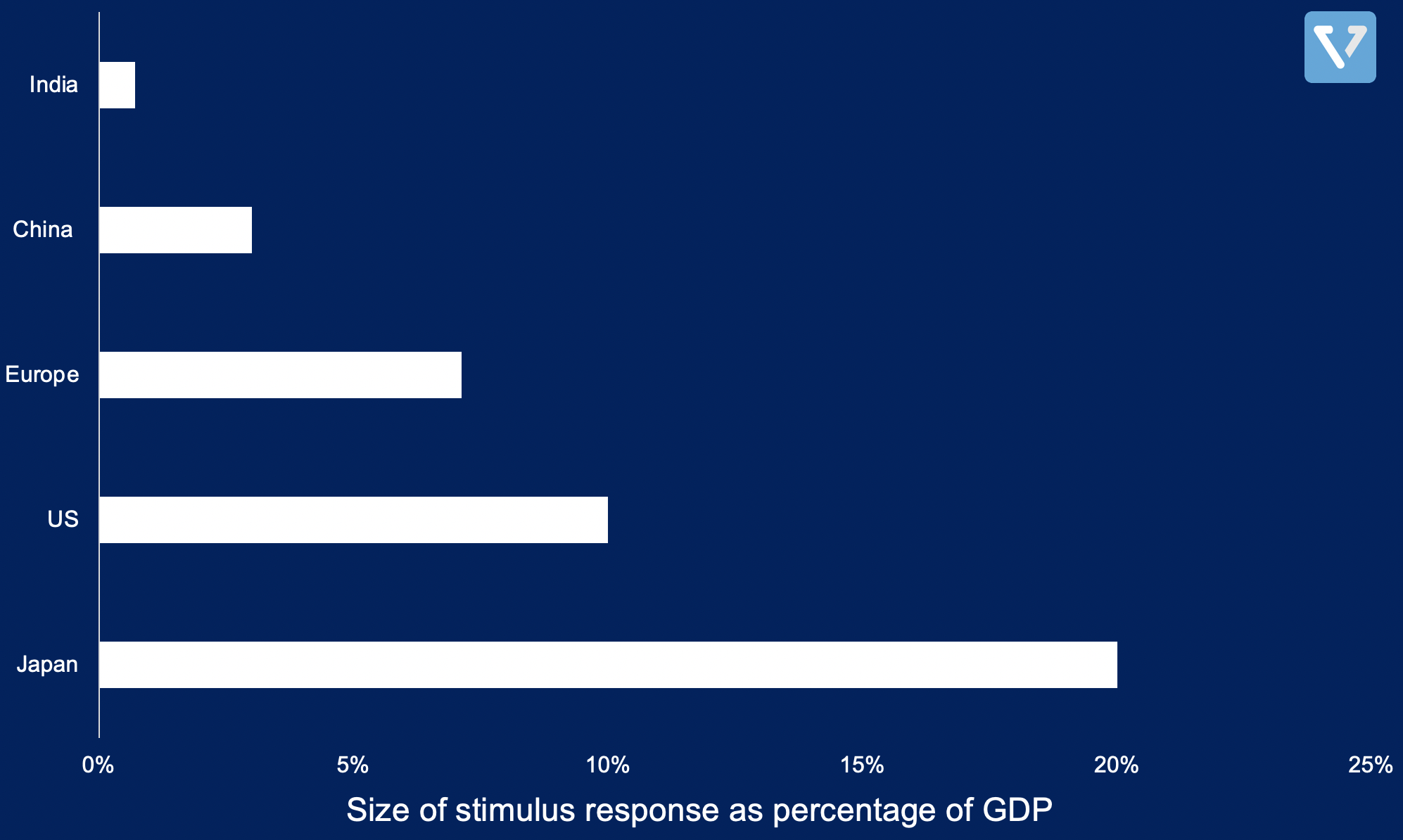

Government stimulus to ensure job losses are minimized is very important. You have seen this in the US, Europe, Japan, and China. All these programs are providing stimulus in excess of hundreds of billions of USD. Figure 3 summarizes the total support (both in fiscal and monetary policies) as a percentage of GDP.

Figure 3: Size of stimulus response as a percentage of GDP (as of the writing of this article)

India so far has committed US $23 billion (or 0.7% of GDP) in the form of health insurance for health workers, cash transfers, free food, and gas distribution. However, looking at the extent and impact of support other countries have provided, it is likely that a second larger stimulus will be necessary for India to prevent significant collapse of small businesses.