Government policies accelerating adoption of EVs

The secular shift towards electrification of transportation has begun. According to the Intergovernmental Panel on Climate Change, transportation accounts for a quarter of global energy-related greenhouse gas emissions, and road transportation makes up 72% of that.

In an effort to curb greenhouse gas emissions and to develop industrial capabilities for the future, major global economies have set aggressive targets for CO2 emissions and EV adoption. From a policy perspective, Europe and China have led the way.

England and France both plan to ban the sale of internal combustion engines by 2040, whileGermany is currently offering financial incentives for consumers who adopt EVs. China has adopted aggressive requirements that mandate car makers to produce/import at least 12% of EVs as part of their fleet. It has also provided tax exemptions and credits for the purchase of EVs.

Meanwhile, in the US, with the election of Joe Biden as the 46th US president, it is expected that the US government will ramp up introduction and implementation of regulatory and fiscal policies towards increasing adoption of electric vehicles and other sustainable technologies.

Decreasing battery cost

However, even with an increase in regulatory and fiscal policies aimed at accelerating EV adoption, widespread adoption will only occur when cost parity between EVs and internal combustion vehicles has been achieved. That cost parity milestone is US $100 per kWh

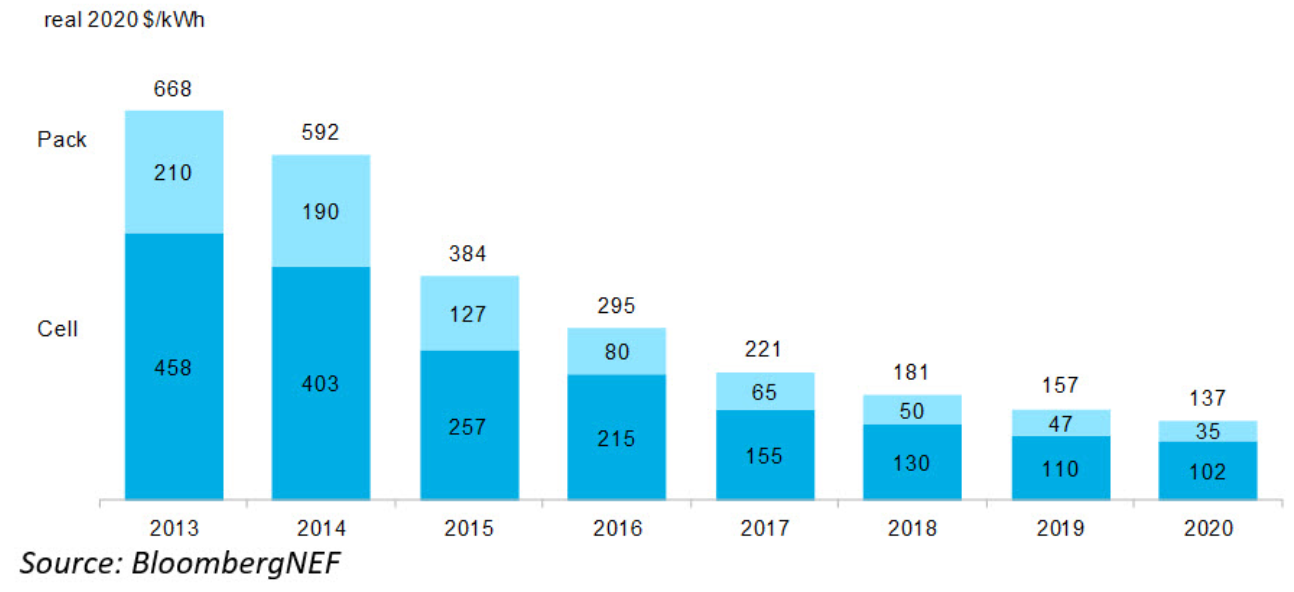

As of 2020, the average price of battery cells is about US $137/kWh, 80% lower than 2013 (see Figure 1). According to a Bloomberg survey, we are close to achieving the aforementioned breakeven milestone of US $100 per kWh (expected in 2023).

Projected increasing demand

As a result of the regulatory pushes from European countries and China, it is expected that the adoption in these regions will precede that of the US. However, due to the global nature of the automotive supply chain, OEMs and their suppliers will prepare for the shift toward EVs and away from ICE vehicles regardless of where they are based, further reducing the cost basis for consumers globally.

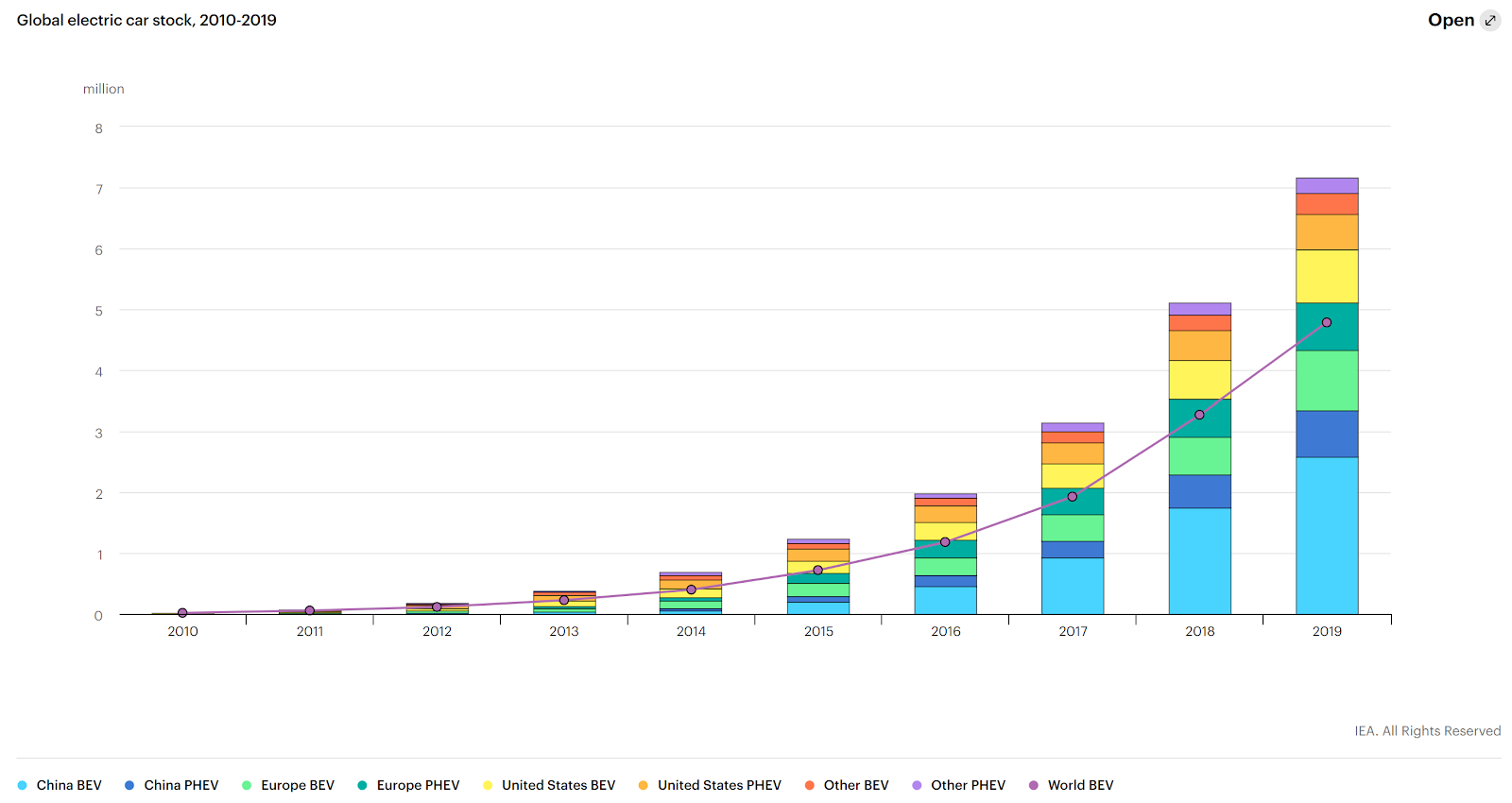

Between 2010 and 2019, the global EV car stock increased from 200,000 to 4.8 million. This figure is expected to continue to increase. EV shares of total vehicle sales is currently at 2.7% (in 2020) and is expected to increase to 58% by 2040.

Note: Even though the trend towards increasing EV adoption is real (driven by government policies in Europe, China and the US, combined with continued decline in battery prices), there are also real risks of overvaluation in some of the companies within this sector. Read more about the potential EV bubble.

In order to make it easier for our users to invest in the Electric Vehicle (EV) sector, we have created a new EV collection. In it, we have curated a list of investments (either ETFs or shares of companies listed in US exchanges or available to be invested via ADRs).

- Raw Materials

- Battery Assembly

- EV Manufacturers

- Charging Infrastructure

[mc4wp_form id=”1064″]