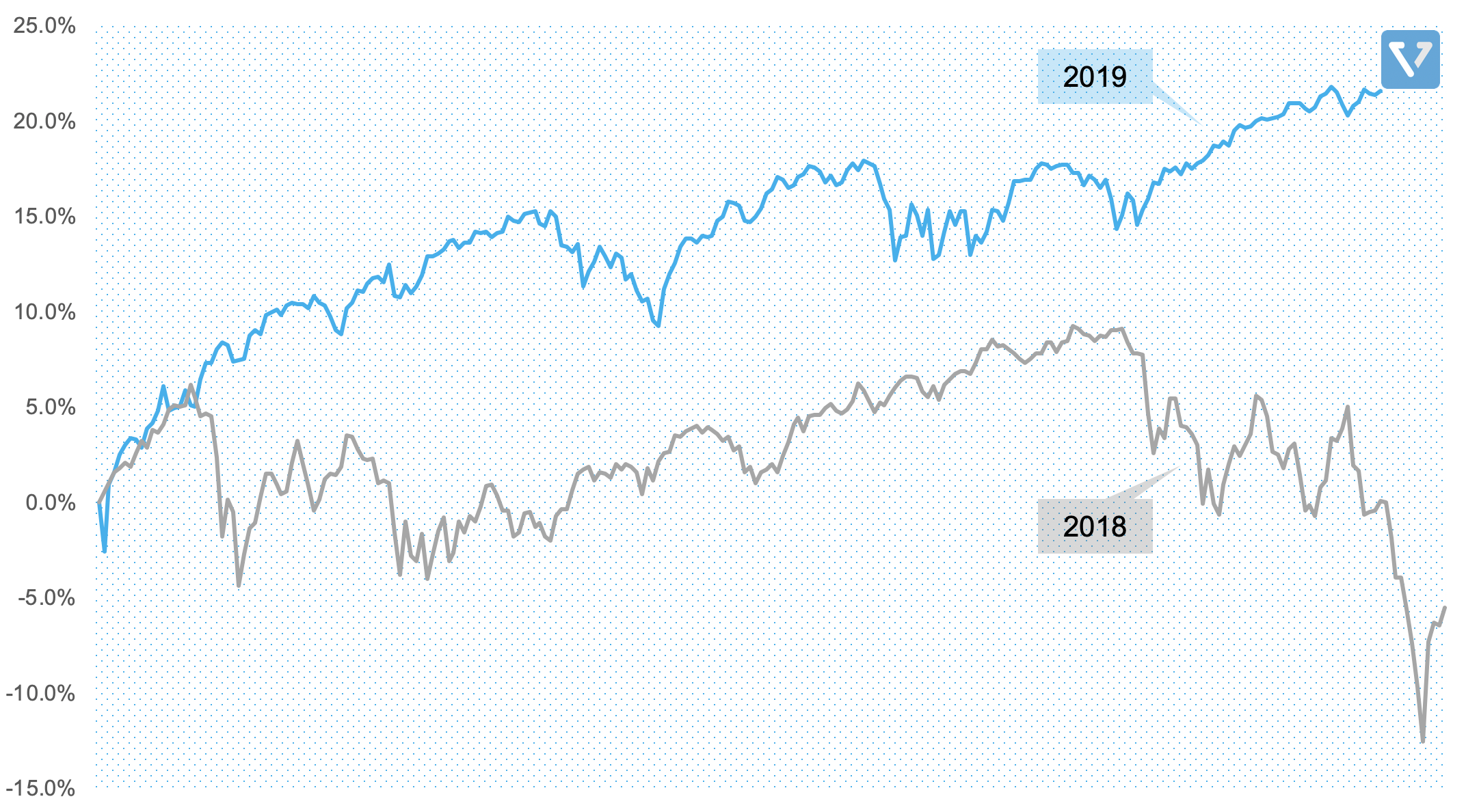

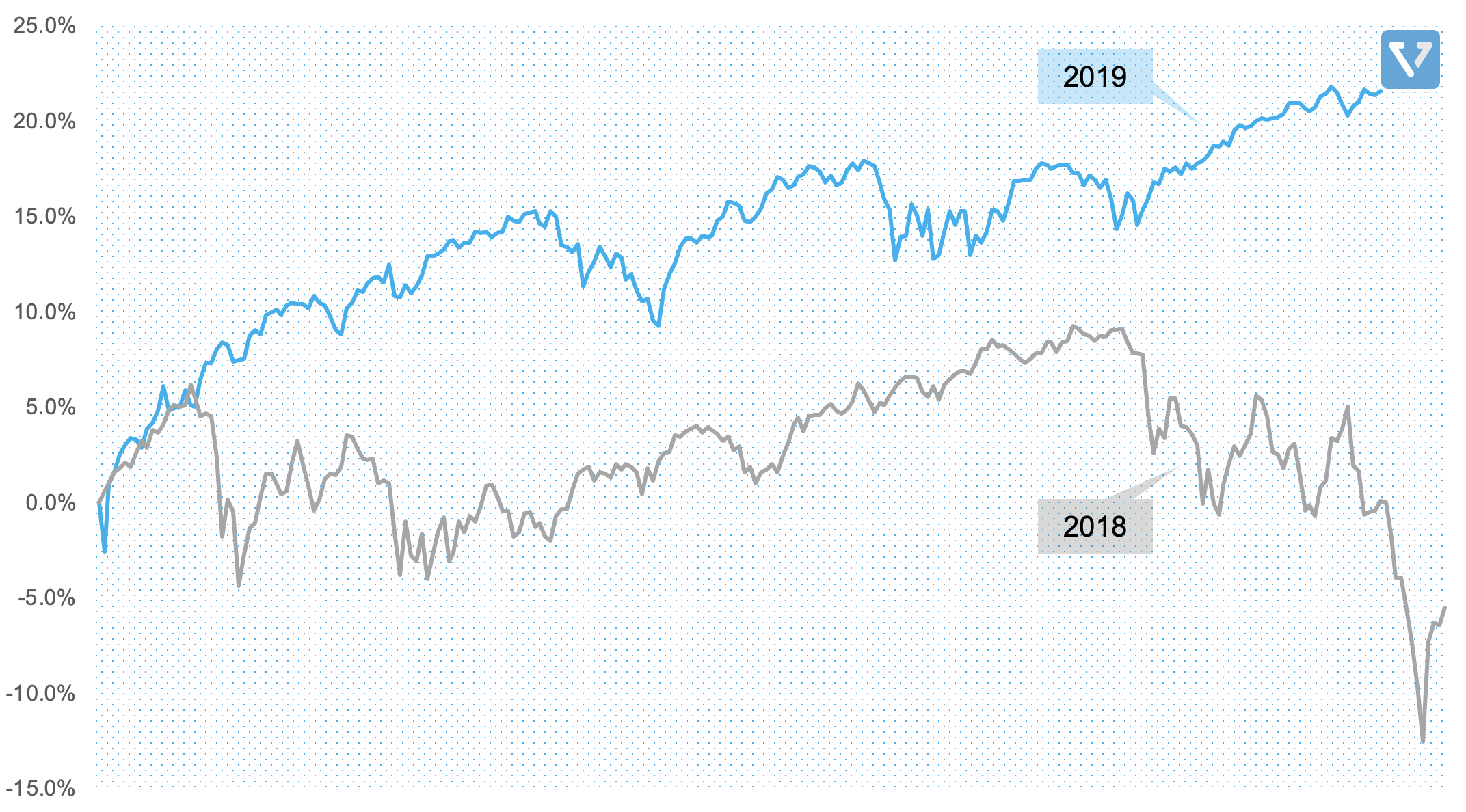

Amazon‘s (AMZN) share price performance has lagged the broader US market in 2019. This is largely due to the company’s decline in profitability. Investors who were only just getting accustomed to Amazon’s profits are now reeling from the decline in profitability.

Amazon’s quarterly profits peaked in Q1 2019, at US $3.56 billion. Since then, profits have been in decline. This decline is largely due to the company’s increased investments in logistics. In April 2019, Amazon announced that it was rolling out one-day shipping to its prime subscribers. This audacious goal required heavy investment. In Q2 2019, one-day shipping cost the company US $800 million, a figure that will increase 1.9X by Q4 2019.

Figure 2: Amazon’s Quarterly Shipping Cost Change. Source: the company.

Why is Amazon investing in one day shipping?

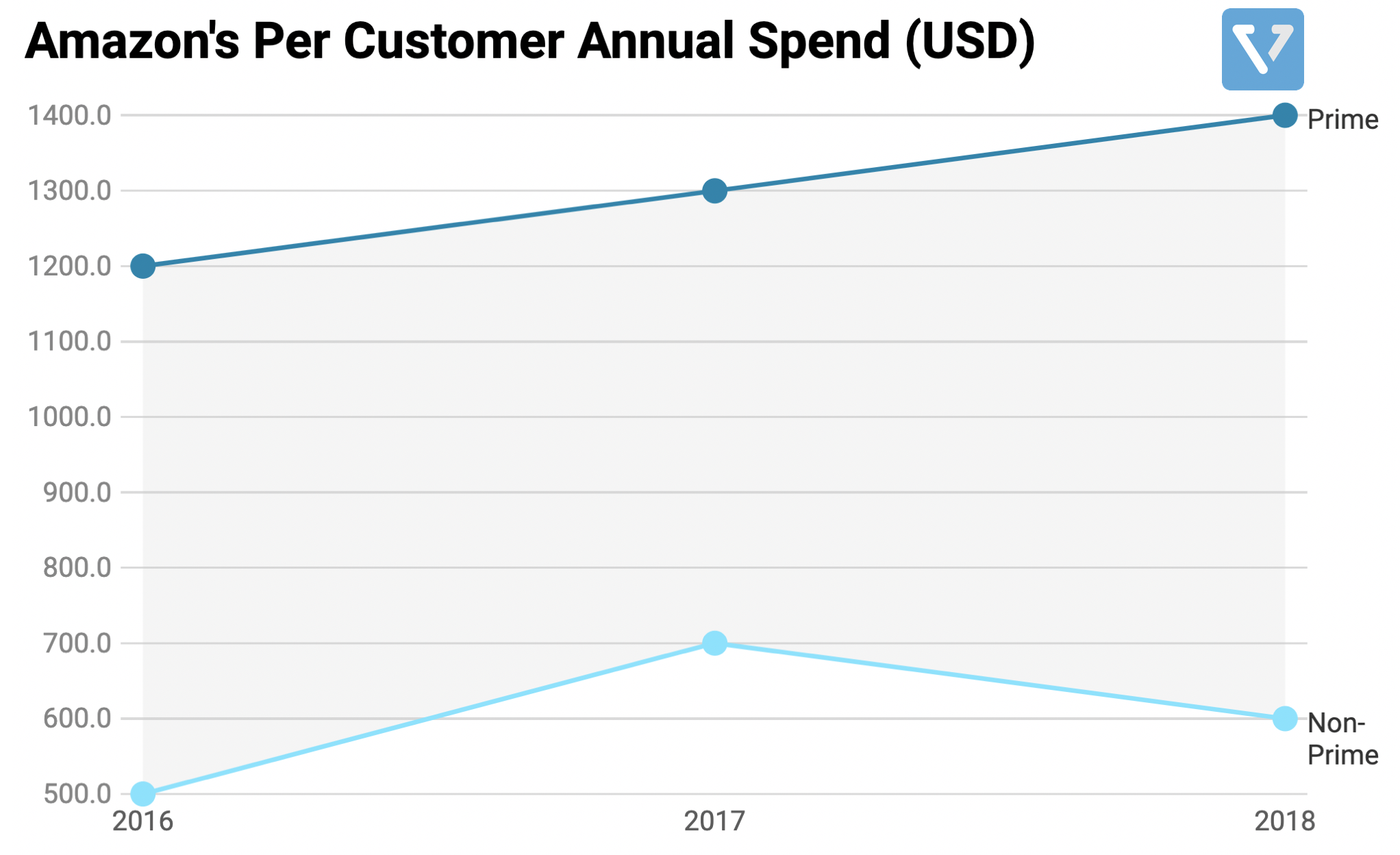

- Instant gratification. Shortening shipping time has conditioned Prime members to use Amazon as their default shopping destination. Even though Prime members buy the same number of items and spend approximately the same amount per visit, they, on average, shop at Amazon almost twice as frequently. This leads Prime members to spend more on the site (see Figure 3). On average, Prime members spend more than 2X than that of non-Prime members, and the gap seems to be increasing.

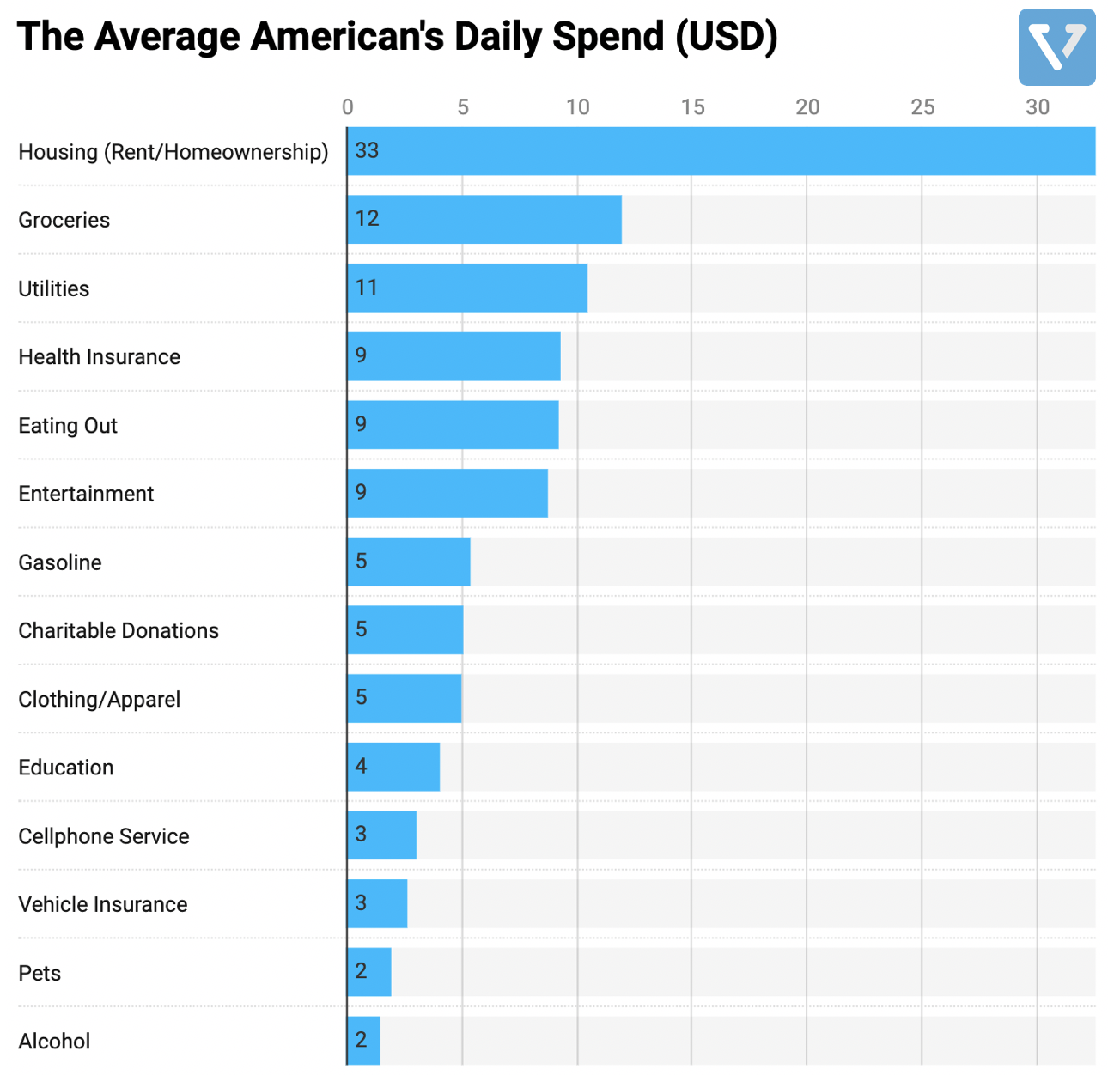

Figure 3: Amazon’s Per Customer Annual Spend. Estimated by CIRP. - Amazon wants a larger share of consumer spending. Despite the company’s dominance in online commerce (around 49% of all online spend in the US), Amazon only has about 5% of all retail. The average American spends $12 per day on groceries, which represents the second largest daily expenditure, second only to housing/rent (Figure 4). To increase its share of consumer spending, Amazon must be able to sell groceries and food products. Over the years, the company has experimented in this space, through Amazon Fresh (a food delivery service for prime members that is available in limited locations) and its Whole Foods acquisition. To successfully deliver an on-demand grocery service, however, the company must be able to deliver food products within one day, and the one-day Prime delivery service is essential to achieving this.

Note that Health Insurance represents the 4th largest expenditure for the average American (Figure 4). It is no surprise that the company has been developing its capabilities in this space as well, from the acquisition of PillPack (an online pharmacy), to the launch of its own healthcare solution. Again, one-day shipping likely will play an important role in prescription delivery, if/when Amazon enters the foray.

Figure 4: The average American’s daily spend. Data Source.

In a way, this strategy to forego short-term profitability for long-term strategic moat is the forte of the Amazon of old. In fact, the recent increase in profitability is the aberration (mostly due to the strong growth of Amazon Web Services). For the past 22 years, Jeff Bezos has been able to convince public investors to be patient. It’s yet to be seen if he can continue to do so.