TSMC, Intel, Netflix and the importance of volume in a high fixed-cost business

US, China and the battle for technology’s soul

The tit for tat between the US and China continues. This time, around the strategic importance of semiconductor technology, the foundational layer of all technology products. This week, the US imposed anew rule prohibiting companies using US technologies in production and design of their chips from selling to Huawei without prior approval.

This has severe implications for Huawei, as it largely relies on TSMC (a Taiwan-based semiconductor manufacturing company, ticker: TSM) to manufacture its most advanced chips that go into its smartphones and network equipment. After this order, TSMC was reported to have stopped taking new orders from Huawei.

As a result, China promises to retaliate against the US by placing US companies with business in China on the “unreliable entity listâ€. Companies such as Qualcomm, Intel, Cisco, Apple, and Boeing. Some of these companies may be more susceptible to the Chinese government retaliation than others, and of these companies, Apple may be least at risk, as the company directly and indirectly (through its suppliers) contributes to the employment of 4.7 million workers in China.

A tale of two chip makers

TSMC and Intel (ticker: INTC) are two of the most advanced semiconductor manufacturers in the world (the third is Samsung, which largely makes chips for its own use). Both employ very different strategies.

The primary difference in the business models between TSMC and Intel is what they make for whom. Intel makes an integrated chip based on its own designs (the X86), which powers almost all personal computers and CPUs found in servers, while TSMC manufactures customers’ own designs for various applications.

One very important aspect of the semiconductor business is that the largest cost to produce chips is the fixed cost, which primarily comes from R&D and CapEx, used to:

- design new architecture

- develop tools and manufacturing methods to make said new architecture (the manufacturing method changes with new technology nodes. This is why China has struggled to create their own homegrown manufacturing solution)

- and build new fabs (Fabs are semiconductor manufacturing facilities – costing anywhere between US $10 billion to $12 billion dollars per factory).

There are two key implications of this large fixed cost: (1) Volume is everything – the larger the volume, the more units you can spread out the fixed cost to; (2) Because of this large fixed cost, the number of players with world class capabilities dwindles over time, creating a market where the winner takes most.

Volume is king

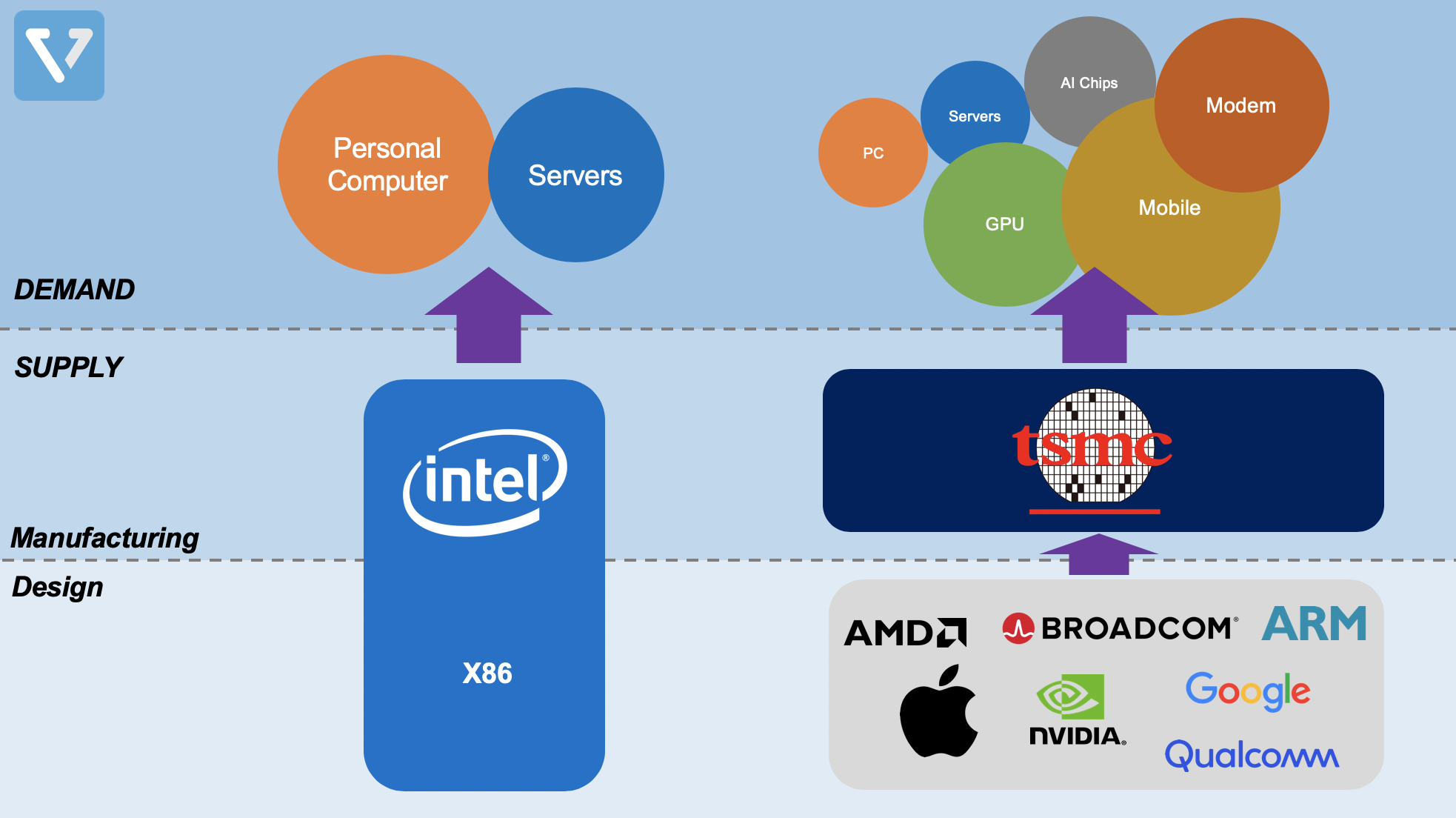

What does this mean for the business structure of Intel and TSMC? Figure 1 shows the value chains of the two different companies.

Figure 1: Value chain of Intel vs. TSMC. From the bottom to top: design of the chip, manufacturing, to the different use cases

Intel only manufactures chips it designs. Because of this integrated approach, it has market dominance in existing compute platforms (PC market and servers) and enjoys high profitability. Its computer chips, for a long time, offered the best performance for general purpose computing.

That is until the landscape of compute shifted away from PC to mobile. The PC market stagnated and has since entered into a secular decline. PC-based sales still contribute to half of Intel’s revenue, yet volume of PC sales have stagnated and have been overtaken by mobile. This means volume growth slows down. Fortunately, sales of server chips (in data centers) helped counteract this trend (Intel has about 93% market share in this space). But with increasingly higher cost of development and manufacturing, maintaining high manufacturing volume is paramount.

In contrast, TSMC has alway employed a pure foundry strategy. Over the years, it has enabled other companies to design and manufacture their own chips. This has resulted in a cambrian explosion of new companies building chips in various applications: Nvidia with its graphic processing units and AI chips, Google with its tensor processing units for its AI applications, Apple with its custom chips for the iPhone, Qualcomm with its state-of-the-art modem, and many more. What this means:

- Generally, TSMC’s business model can be more resilient as it produces semiconductor for various applications

- TSMC can better generate large manufacturing volume that in turn sustains the very expensive R&D and capital expenditures necessary for manufacturing next generation chips

The spending continues

As both companies race to make the latest generation chips, both have announced higher capital expenditures for 2020. TSMC’s capital expenditure is expected to be US $15 billion, while Intel plans to spend US $17 billion.

As staggering as that sounds, Netflix is spending that much at the bottom of their value chain as well – on content (US $17 billion for content creation in 2020). As manufacturing has done for Intel and TSMC, what software has enabled Netflix to do is to distribute this expensive content globally at relatively low marginal cost (distribution) to hundreds of million of subscribers. So, like Intel and TSMC, it is the large volume/demand that spreads the large costs that helps Netflix gain competitive advantage over its rivals.

Similarities between semiconductor and direct-to-consumer content

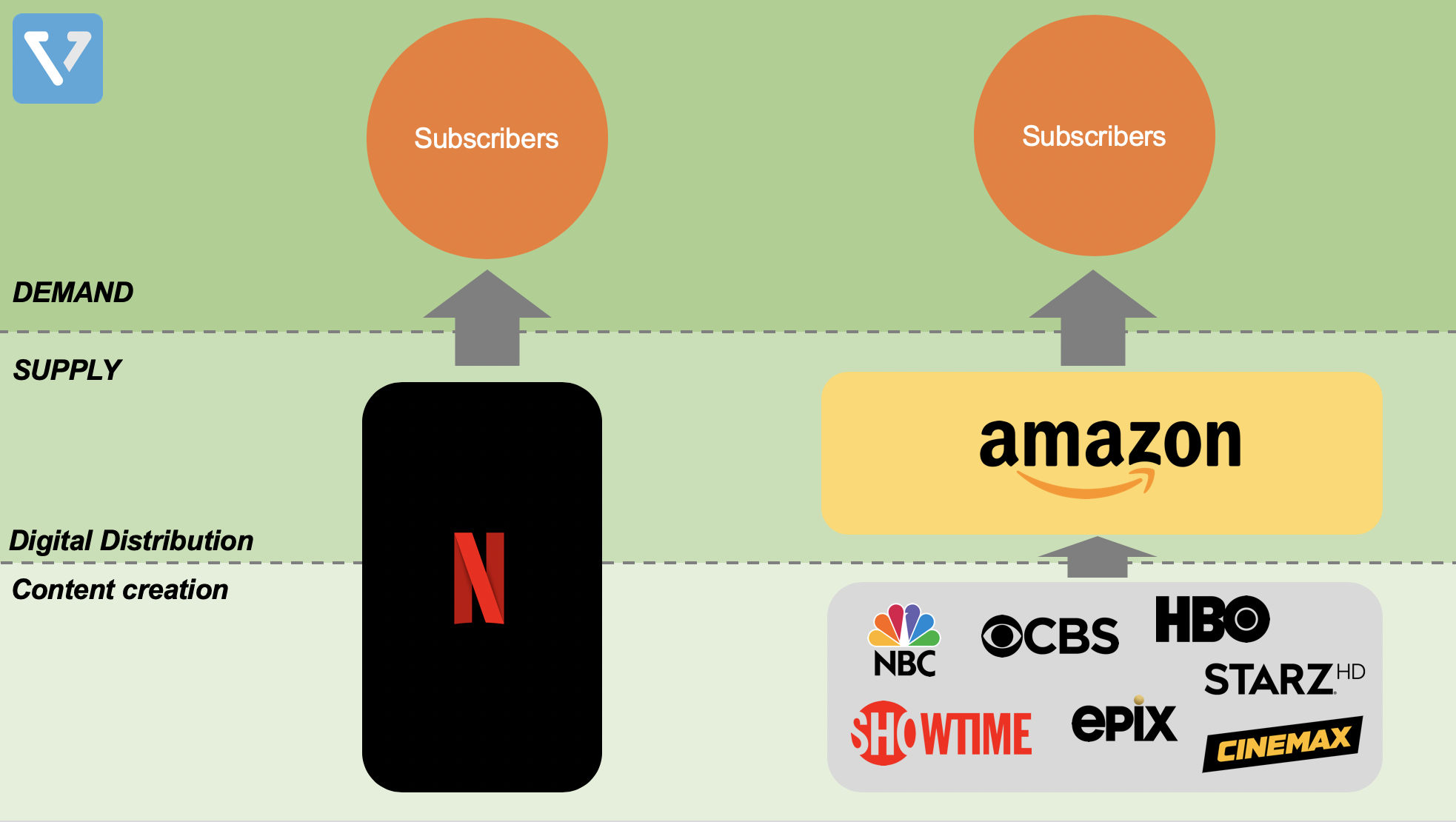

Software might be eating the world, but so far, it is largely eating distribution. Netflix’s dominance in streaming technology does not help the company create content at a cheaper cost. It is likely that the per hour of content cost for Netflix is similar to its competitors’. The cost at the supply side (at the bottom of the value chain) is still staggeringly high.

As such, similar to the value chain presented in Figure 1, Netflix is vertically integrating, creating its own content. The company is spending tens of billions annually on content (fixed costs) and spreading the large fixed costs to an ever expanding global user base (large volume). In a way, this is similar to Intel’s integrated strategy (Figure 3).

So how can one compete against Netflix’s scale? Perhaps adopting a similar strategy as TSMC.

With the rise of direct-to-consumer content channels (DTC) such as Netflix, Disney+, Apple TV+, HBO MAX, Showtime, CBS All Access, NBC Peacock, and many more, the opportunity to aggregate these DTC channels have arisen. And that is what one key player is doing.

Figure 2: Amazon Prime Video Channels allows you to subscribe to other D2C streaming services without leaving Amazon.com

Amazon (ticker: AMZN), through its Prime Service, has become the preeminent way for users to sign up to these DTC streaming services (Figure 2). This means that Amazon has yet another way it can monetize its 140 million prime subscribers:

- Amazon makes more money from Prime subscribers from membership fees

- It earns more because Prime members spend more (an average $1,400 per year in the US) when compared to non-members (an average of US $600 per year)

- And now, because of Amazon’s partnerships with the various non-Netflix DTC streaming channels, Amazon gets a cut when these users sign up to these streaming services through Amazon’s platform

Figure 3: Netflix vs. Amazon Prime content value chain

This is why Amazon continues to spend heavily on one-day shipping, even at the cost of short-term profitability: to entice more people to sign up to become Prime members, to reduce friction so that they spend more on the platform, and, most importantly, so that these members develop a habit of visiting Amazon.com as their default starting point for shopping and media consumption.