In this article, we discuss changes in the market as confidence continues to increase with the likelihood of Biden and the Democrats winning the election (US election is on November 3rd).

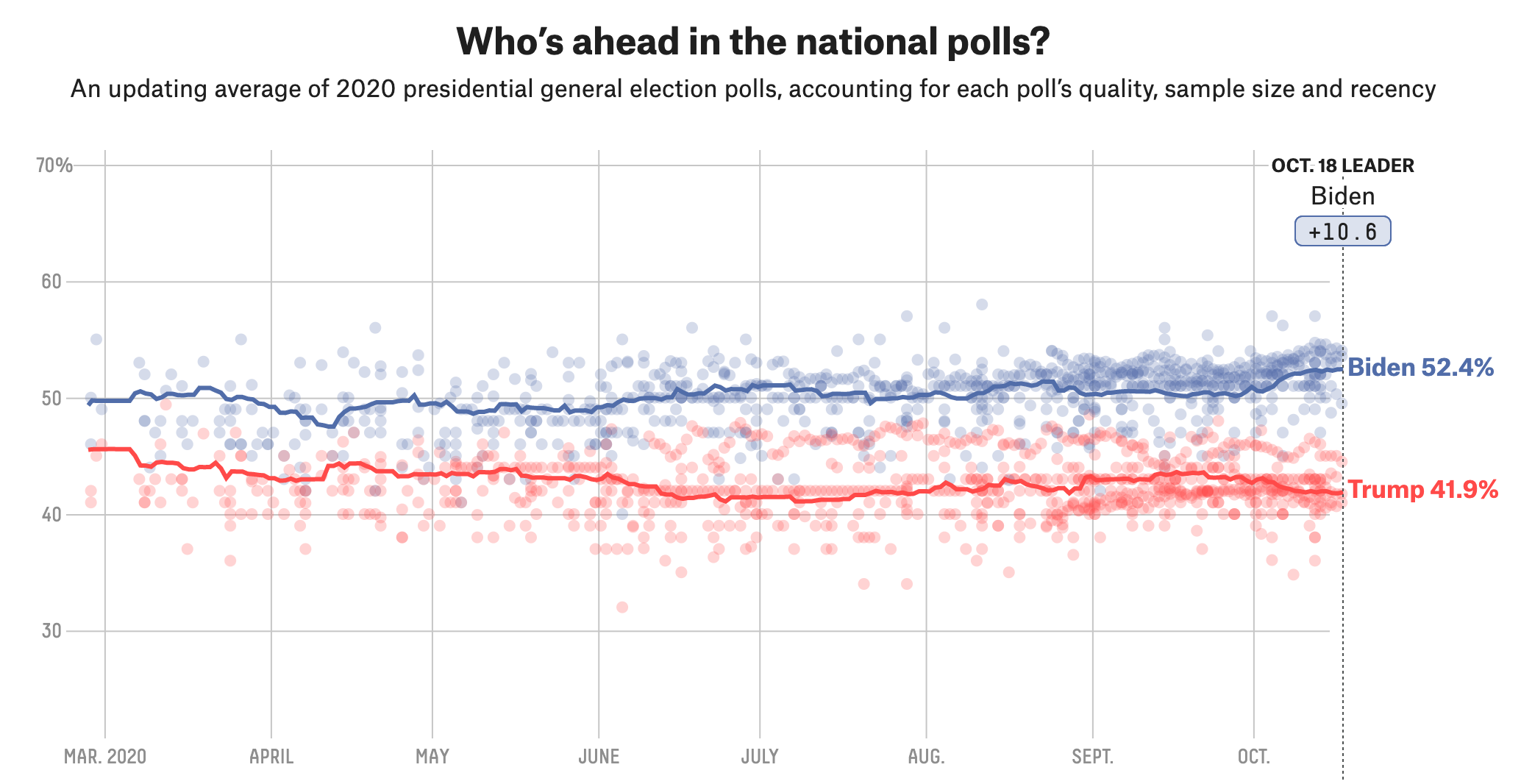

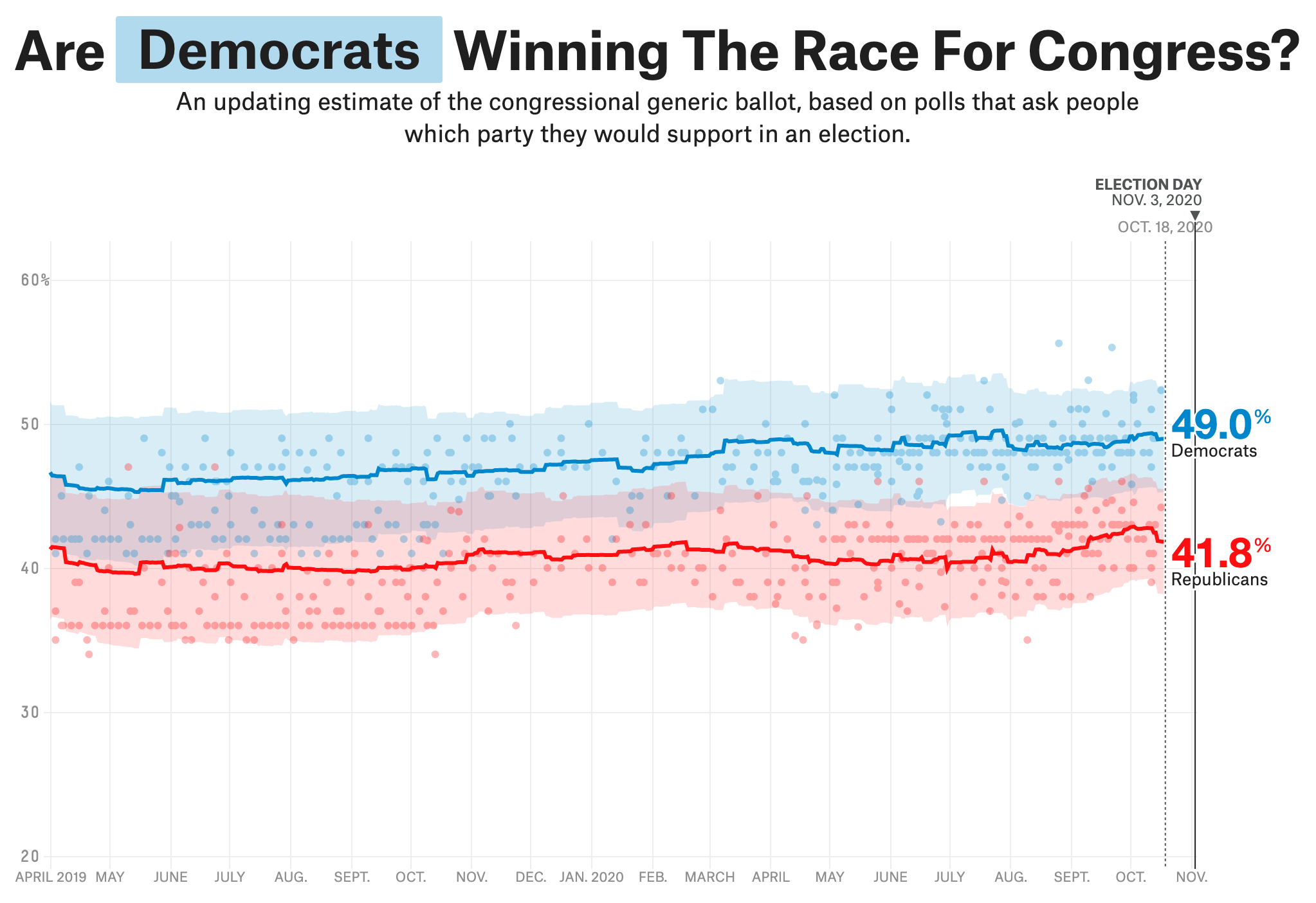

Last week, we outlined different tax and fiscal policy scenarios should either Biden or Trump win the election. And now, with less than two weeks before the election, polls suggest that the chances of Biden and the democratic party winning is becoming more and more likely. The latest data from 538 (a polling aggregator) is shown in Figures 1 and 2. Biden is leading Trump in the national polls by more than 10.6 percent.

Renewable Energy

As we outlined in last week’s post, Biden plans to spend upwards of US $1.7 trillion to:

- Modernize infrastructure: This includes introducing zero-emission public transportation systems and a network of public charging stations for electric vehicles (EVs).

- Accelerate public adoption of electric vehicles: This includes subsidizing consumers who switch to electric vehicles, providing incentives to trade in gasoline powered cars.

- Boosting renewable power: This includes subsidizing R&D into technologies such as large-scale battery power storage, carbon capture and minimization and more wind power sources.

The market consensus is that if enacted, these policies can provide tailwind in the investments in the EVs and renewable energy space.

As the possibility of Biden and the Democrats winning is becoming more likely, solar is on the rise. The sector (we use Invesco Solar ETF, ticker: TAN, to represent the sector) has outperformed both the S&P 500 and Nasdaq in recent months. The outperformance of this ETF is mainly driven by two of its largest holdings: Solaredge (ticker: SEDG) and Enphase energy (ticker: ENPH).

Marijuana reform may actually happen

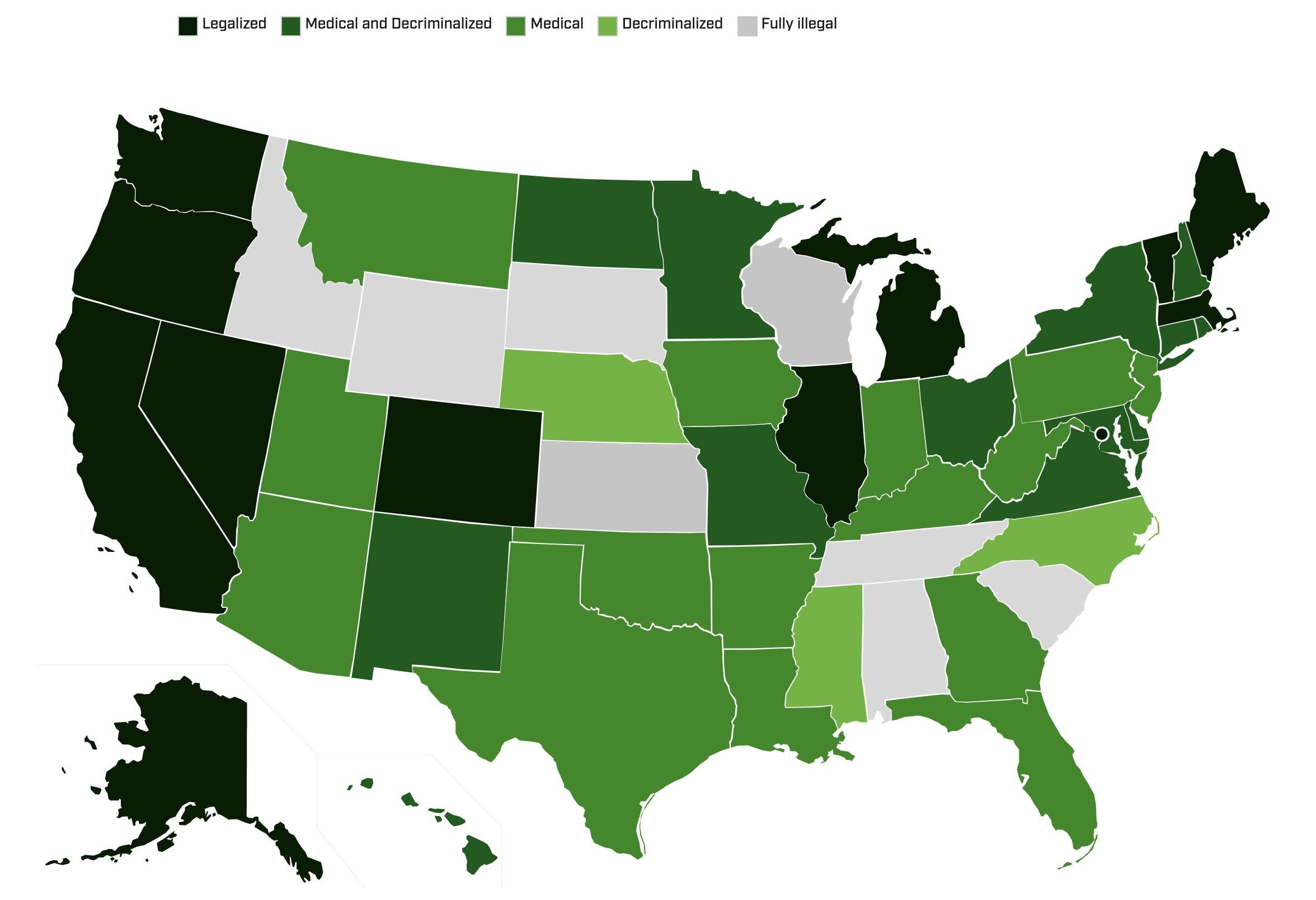

Currently, marijuana is a Schedule I drug in the US. This means that at the Federal level, the drug is illegal unless used for the purposes of research. This does not mean that marijuana is illegal in the US, however, as more and more states are decriminalizing use of the drug. As of today, 40 (out of 50) states have either made marijuana fully legal or have decriminalized use for certain medicinal applications.

Marijuana being classified as a Schedule I drug has prohibited the industry from expanding. It is extremely difficult for companies in this space to gain banking access even though the businesses are legal under state law.

Despite the lack of legal reform (the Trump administration is very much against legalization), the majority of Americans (66%) support marijuana’s legalization. This support is even stronger amongst Democrats (76%).

If Biden wins the presidency and the Democrats take over the congress, policy change to decriminalize marijuana might actually be approved. This may mean that these companies will have easier access to capital and can reduce their operational costs.

Note, however, that despite the bipartisan support from the constituents, the Democrats have not said outright that they will push for legalization. In fact, Biden has consistently mentioned that he wants to see more research before endorsing federal legalization.