Udemy vs Coursera. Google – bigger than you think.

Today we compare two recent edtech (education technology) company IPOs, Udemy and Coursera, as well as discuss how Google is bigger than most people think.

While the edtech sector in China is being crushed by regulatory pressure, edtech elsewhere is thriving. In India, the most valued startup is an edtech company (Byju’s). In the US, on the back of COVID-19 tailwinds, two of the largest edtech companies went public in 2021 (Udemy and Coursera).

Although both companies operate massive open online course (MOOC) marketplaces, the two companies have employed different strategies. Typically, marketplaces have two sides: supply and demand.

Supply side

In creating a marketplace of online courses, Udemy and Coursera employed different strategies to generate supply of online courses.

Coursera, founded by prominent AI engineers and computer scientists from Stanford, Andrew Ng and Daphne Koller, is focused on generating supply by signing universities and institutions as providers of the online classes. The company tries to cultivate its offerings to maintain a high standard of quality. Its supply strategy is more B2B, by creating partnerships with universities and industries.

In contrast, Udemy’s supply strategy is more B2C. Since Udemy was not founded by academics, the company took a different, more democratized approach. Unlike on Coursera, where you have to be affiliated with a university in order to create a course, anyone can make a course on Udemy.

As a result, Udemy has a more diverse and breadth of courses than Coursera, albeit with varying quality. As of the end of Q2 2021, Udemy had more than 11,000 courses, while Coursera had about 4,600. However, because of their academic and industry affiliation, Coursera can offer professional certificates and degrees.

This means that Coursera can solve for more “jobs to do†that colleges traditionally perform. Colleges typically have several functions. As Marc Andreesen eloquently summarized:

- It’s a daycare for young adults

- It’s an environment for social dating

- It provides learning opportunities

- It’s a testing gateway (a proxy for employers to filter for ability)

- It’s branding

Of all the “jobs to do†above, Coursera’s courses can solve the last three, while Udemy, with its more diverse courses but less quality control, only solves for one (the third bullet point: provides learning opportunities).

How does this translate to demand then?

Demand side

Both companies sell to users directly (individual learners) and to businesses (B2B customers).

Individual learners: Coursera has 82 million learners. Meanwhile, Udemy has about half of that (44 million as of Q2 2021).

B2B customers: Coursera counts not just businesses as customers (it has 100+ Fortune 500 companies as customers), but also governments and other universities (smaller universities can offer online courses from larger universities). The company has more than 6,000 B2B customers (mostly businesses).

In contrast to Coursera, Udemy uses a bottoms up approach in B2B sales. They leverage B2C customers as leads to upsell the organization the customer works in. In 2020, over 60% of leads came from their direct-to-consumer platform. The company has over 8,600 global business customers.

Which one is the bigger company?

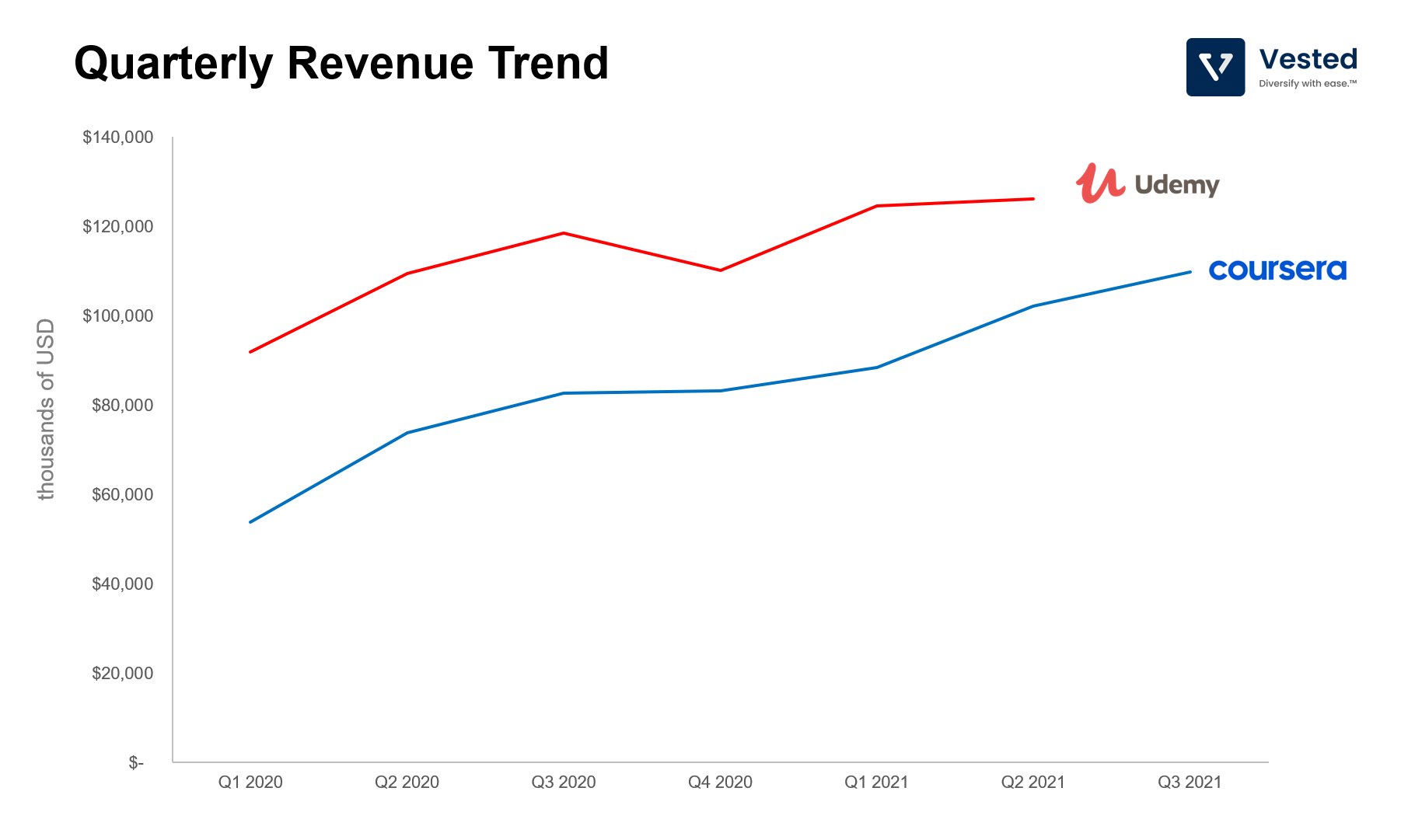

From a revenue perspective, Udemy is larger (Figure 1).

Coursera is rapidly catching up to Udemy, however. From Q1 2020 to Q2 2021, Coursera’s revenue grew 90%, while Udemy’s only grew 37%. Udemy’s direct B2C business growth is slowing down, while the B2B sales is still growing rapidly (more than doubled in the past year).

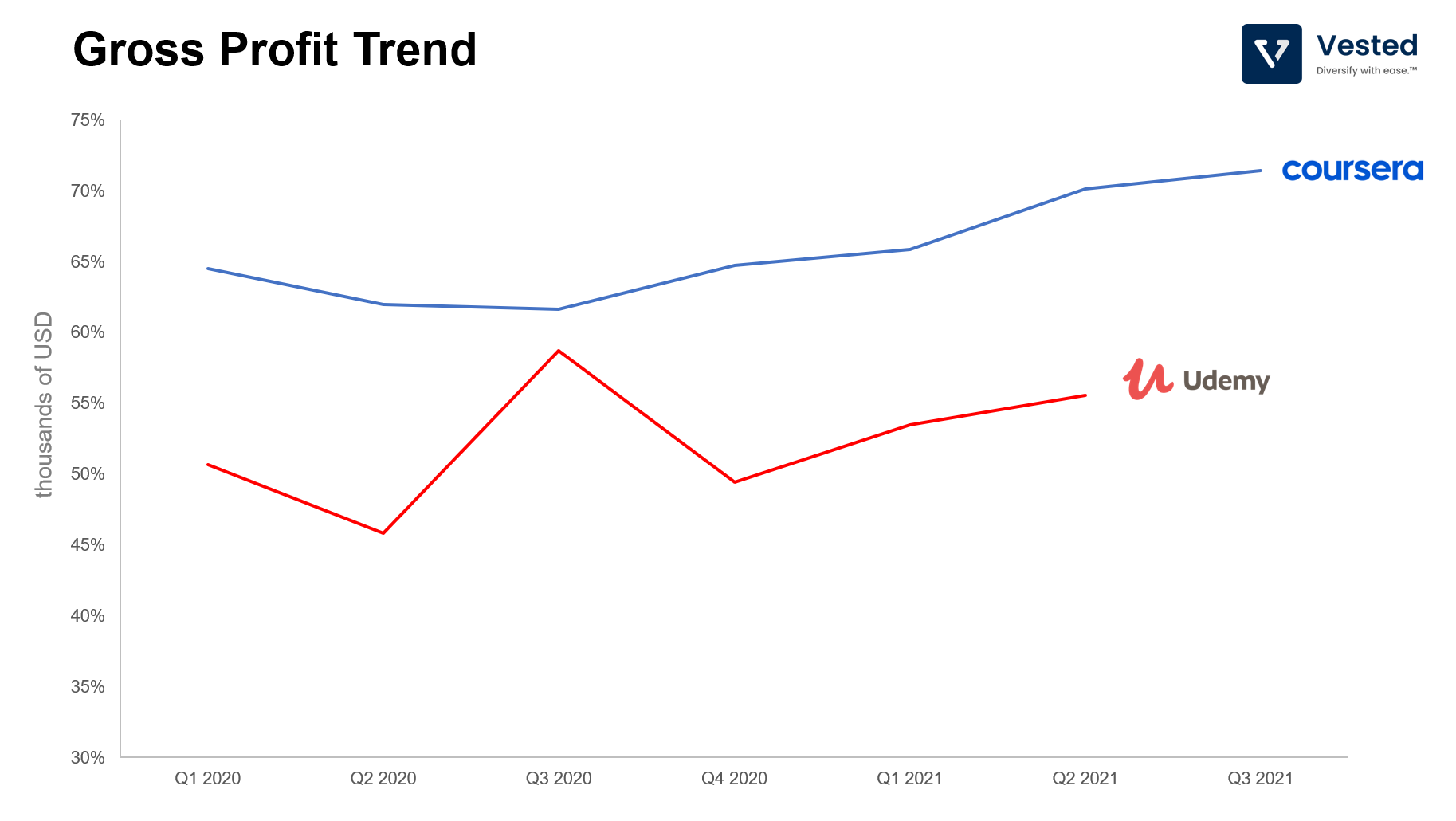

Not only is Coursera growing more rapidly, it is also more profitable (on a gross profit or EBITDA basis, neither companies are profitable). See Figure 2.

Of the two channels, B2B customers are more attractive for both companies. This is because the revenue model for this channel is recurring subscriptions, and the B2B channel also offers higher gross margins.

Upskilling vs. Higher Learning

The two companies do not have the same B2B strategies, however. Udemy curates its high quality classes and offers them to companies to upskill their workers. Coursera has a similar upskill offerings, but has an additional ‘Degrees’ program.

The ‘Degrees’ program repackages existing courses made by various universities and offers the package to other universities, enabling them to offer additional bachelor’s and master’s degrees. Because Coursera is just repackaging existing content and selling it through another channel, the gross profit margin for this segment is 100%. As of Q3 2021, the ‘Degrees’ segment is about 10% of total revenue and is growing 59% year-over-year.

Coursera can do this because it employs a different go-to-market strategy. As we outline the “jobs to do†section above, its affiliation with universities allows Coursera to position itself as more than just an upskilling platform, rather, it positions itself as a replacement for in-person higher learning.

Google is bigger than you think

It’s no secret that Google is one of the biggest companies in the world. As of this writing, the company is the 4th largest company in the S&P 500 (after Microsoft, Apple, and Amazon), at $1.9 trillion market capitalization (the stock has been on a tear lately).

But do you know…

Despite its size, it’s still growing rapidly

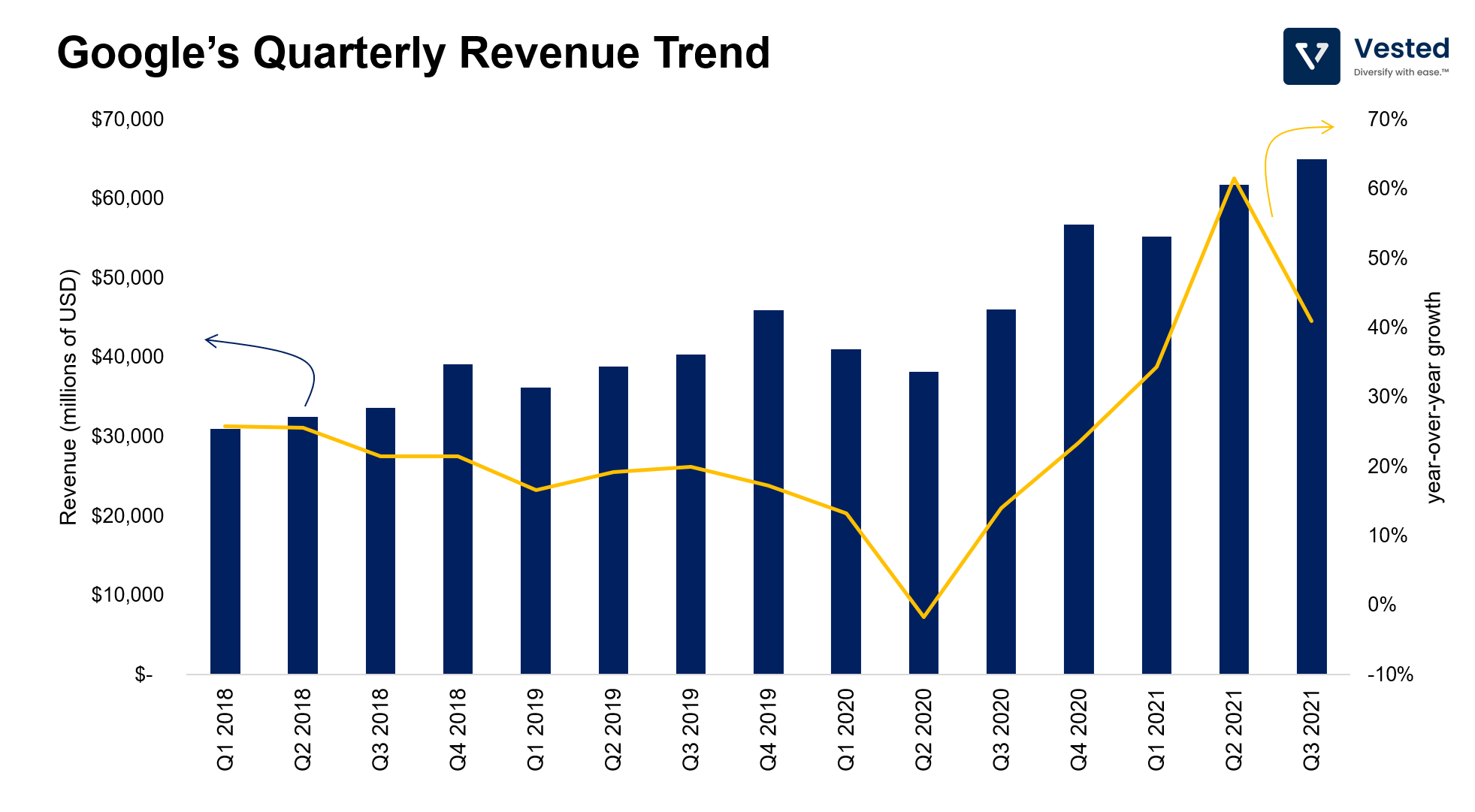

One can argue that Google’s core business is one of the best businesses in the world. The company not only generated more than $65 billion in Q3 revenue (82% of this is from advertising), but also does so at a high operating margin (32%) and is still growing fast (more than 41% year-over-year). See Figure 3.

Google is so big, there’s another FANG company within it

FAANG is an acronym for Facebook, Apple, Amazon, Netflix, and Google (this is just one permutation of a shorthand that refers to a handful of fast growing tech companies). But do you know that within Google, there’s a business segment that is growing faster than another FAANG company? Well – yes, there is.

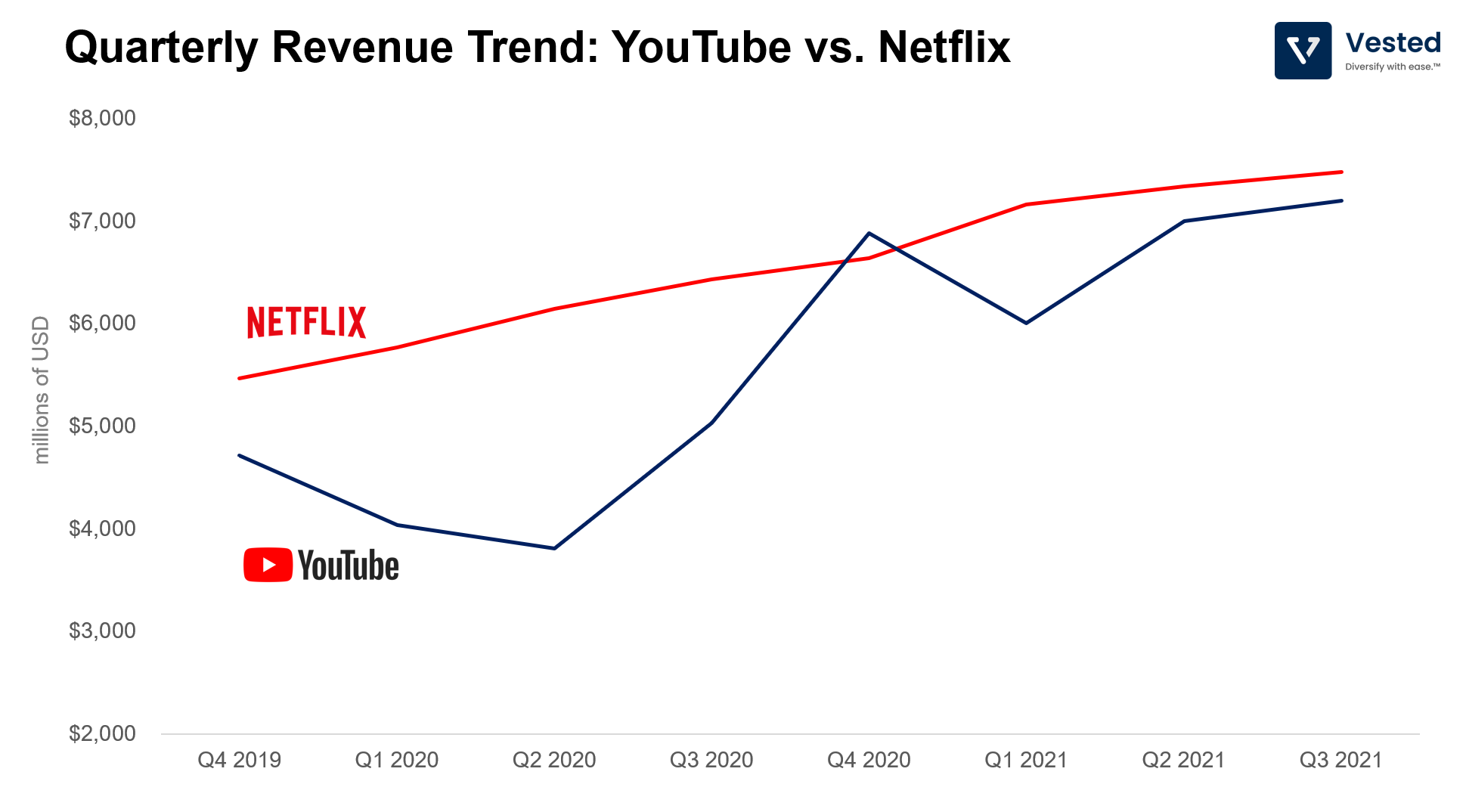

YouTube’s revenue is almost as large as that of Netflix’s, but is growing faster (Figure 4).

Clearly, Netflix’s revenue is more stable since it is subscription revenue (which is valued more by investors). But the pace of growth of YouTube’s advertising business post COVID-19 is staggering. Expect YouTube’s revenue to surpass that of Netflix in Q4 2021 since the holiday season typically translates to more ad spend.

It has so much cash on hand that it can win valuable business

In the past, we discussed how large companies can invest in smaller ones to incentivize the smaller companies to buy services from the larger ones. This way, the larger companies will get return on investment via revenue generated from the agreement, while keeping the upside of the investment.

Recently, Google performed this maneuver. It invested $1 billion (or only about 4% of cash on hand) in CME (the world’s largest financial derivatives exchange that handles trillions of dollars of trades per day). As part of the agreement, Google gets non-voting shares and a 10 year partnership where CME uses Google’s Cloud Services.

This is a big deal. Exchanges such as CME are first and foremost technology companies. They build platforms that are extremely fast, stable, and secure (afterall, the world’s financial markets depend on them). CME spends about $200 million in capital expenditures just to maintain its (mostly on-premise) infrastructure.

And now, CME plans to, eventually, outsource everything to Google Cloud.

What does this mean for CME? Or for Google? It is likely that the move will be followed by other exchanges. Last year, Nasdaq announced that it too will move to the cloud within the decade – although no specific plans have been announced yet. For CME, the move will likely reduce CAPEX over the long run. For Google, there are two potentially large implications:

- This is the first step to winning cloud businesses in the exchange segment – something the company surely needs as it is the smallest of the cloud providers (Amazon is #1, Microsoft is #2).

- While there are certainly data protection provisions within the agreement, one cannot help but wonder about the implications of the largest data company in the world also having access to the largest derivative trading information in the world…

What is for certain, however, is that for Google, this is a very good use of the $1 billion of cash. The ROI will likely exceed the short term Treasury interest rate.