US is another step closer from delisting Chinese companies from US Exchanges

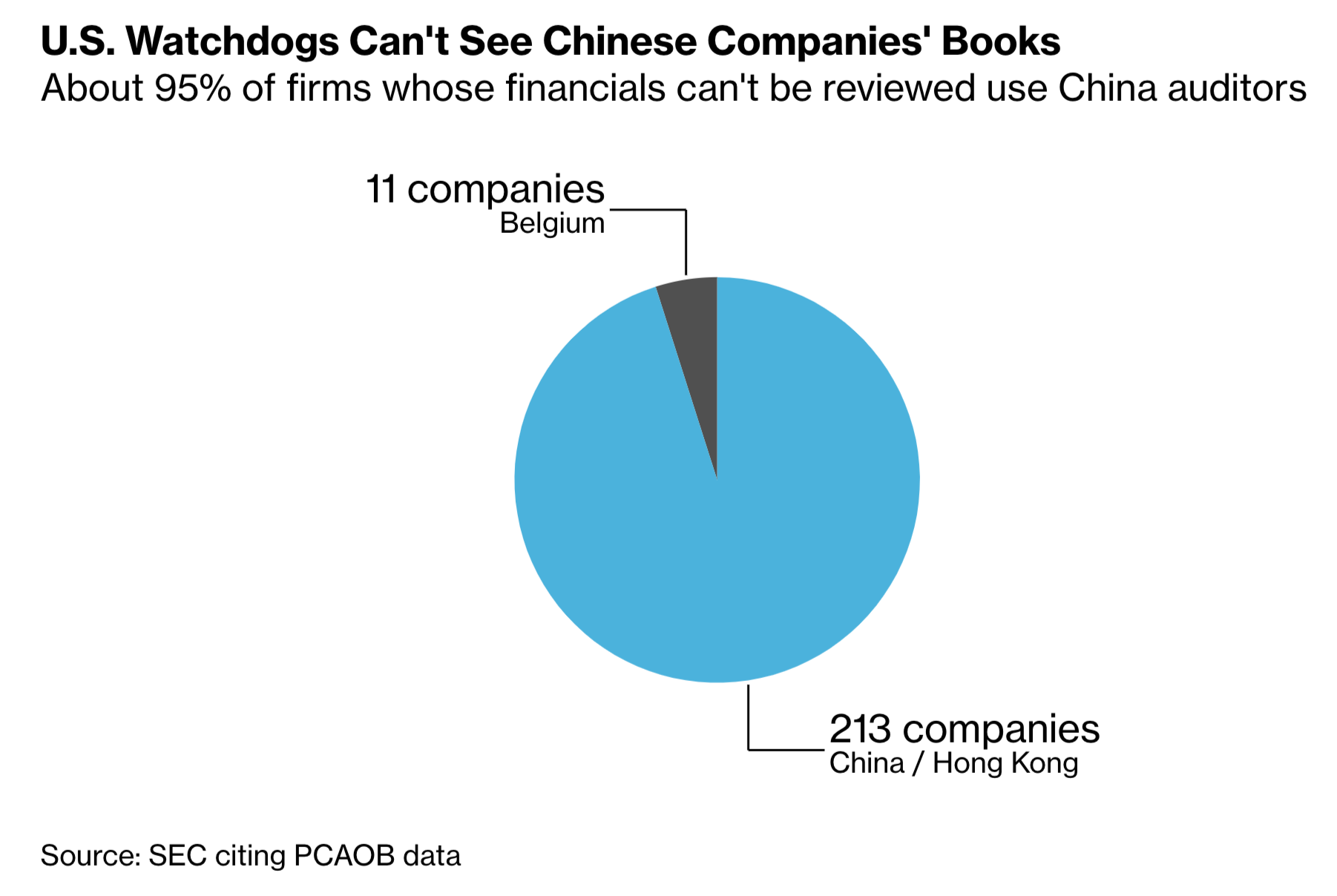

The US government is making inroads to release a bill that will de-list Chinese companies from US exchanges if the company cannot show that (1) it is not under the control of the Chinese government or (2) the Public Company Accounting Oversight Board (PCAOB) is not able to audit the company for three consecutive years.

PCAOB is an accounting oversight agency that was originally established by the US congress in 2002 (in response to the Enron scandal). The purpose of this agency is to examine accounting audits to prevent fraud. The crux of the issue here is that China has thus far refused to allow PCAOB to examine audits of Chinese firms even though these firms’ shares are traded in US exchanges.

In the wake of the increasing hostility between the US and China, and the accounting scandal involving Lucking Coffee, the US government has renewed its efforts to impose accounting oversight. A bill that was created to de-list Chinese companies passed the US senate several weeks ago. A similar bill is being processed in the House of representatives and is expected to pass the House very soon. Once that happens, it will go to Trump’s desk to be signed into law.

Here’s what is likely to happen If the bill passed into law:

- There will be a grace period for firms to respond to disclosure requirements

- However, it is unlikely that the Chinese government will relent (using state-secrecy laws as an excuse) – since the prohibition against disclosing comes from the central government

- The Chinese central government has been luring its large tech giants to list on exchanges at home, with limited success

- If the ban actually ends up happening, there will be a massive sell pressure on US exchanges. These companies will then be taken private (they do this by delisting US shares at a low buyout price and then relisting in China, likely at a much higher valuation)

Note that although this bill is targeted towards China, it applies to all foreign companies (see Figure 1).

Zoom’s Earnings

It is no secret that Zoom (ticker: ZM) is one of the biggest beneficiaries of the global lockdown. The company who was previously known as a provider of video conferencing has been propelled into the mainstream consciousness (so much so that the company’s name is now a verb). Thus, Wall Street had high hopes for Zoom’s earnings report, which the company just released. Did it live up to the hype?

It did. Here is some quick data from the quarter that ended April 30th 2020:

- Revenue jumped 170% when compared to the same period last year.

- Projected sales for 2020 is US $1.8 billion (almost double the forecast from March)

- The number of B2B customers with more than 10 employees increased 4X from same period last year

- The company also 2X the number of corporate customers (B2B customers that have paid more than US $100,000 within the past 12 months) from the same period last year

Zoom’s share price doubled in 2020, and with a P/E TTM of 2,312 (as of the writing of this piece), investors have very high expectations for the company. In our analysis of the company’s IPO, we comment on how efficient the company is. The company has famously had a very high net-dollar-expansion ratio (even when compared to other software companies). Currently, the net-dollar-expansion ratio is 130%, which means that every $1.00 a customer spends today will translate into $1.30 a year from today. This makes the business very efficient and means that the revenue benefit that Zoom accrued from the accelerated growth will continue into the future.

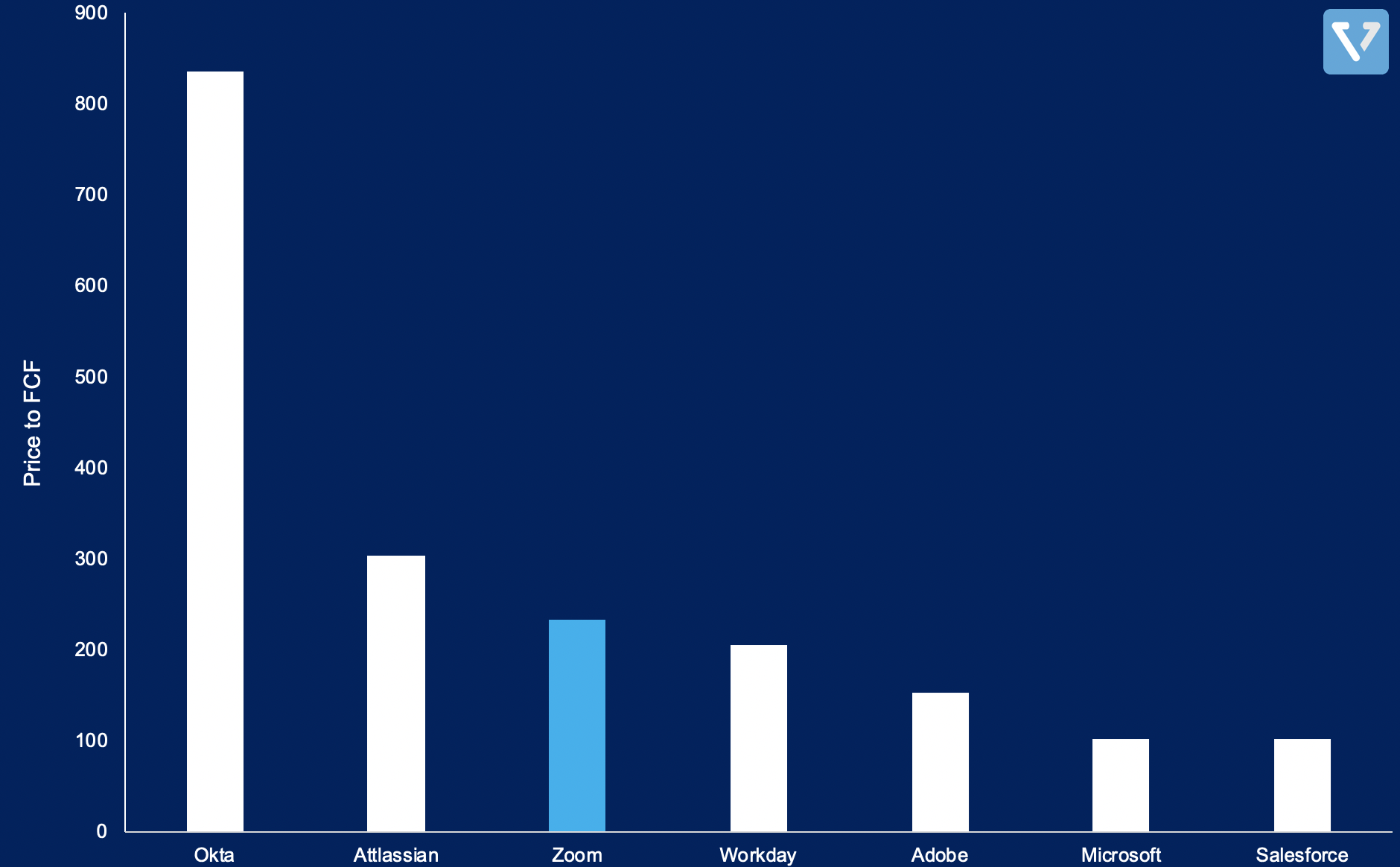

Since the company has a software as a service business model (SaaS), instead of relying on trailing P/E, perhaps it is more appropriate to look at the valuation by comparing it against its free cash flow.

So, is the company’s valuation considered high when compared to other SaaS companies? See Figure 2 to view a comparison between Zoom and other SaaS companies.