In this week’s post, we will be covering one of the bright spots in the US economic recovery (the housing market) and Shopify.

Housing Rebound

Despite the pandemic-induced recession, the housing market is recovering rapidly in the US. This is because of several factors:

- Supply constraint: even before the pandemic, there has been a lack of home supply in the US. This is because home builders had not built enough new homes to keep up with demand.

- Demand increase: the pandemic has increased consumer interest in homes in the suburbs (to avoid densely populated city centers). This, coupled with really low interest rates has increased demand for detached single family homes.

As a result, the industry outlook is very positive (as measured by The National Association of Homebuilders monthly confidence index, which is at its highest level in 9 years).

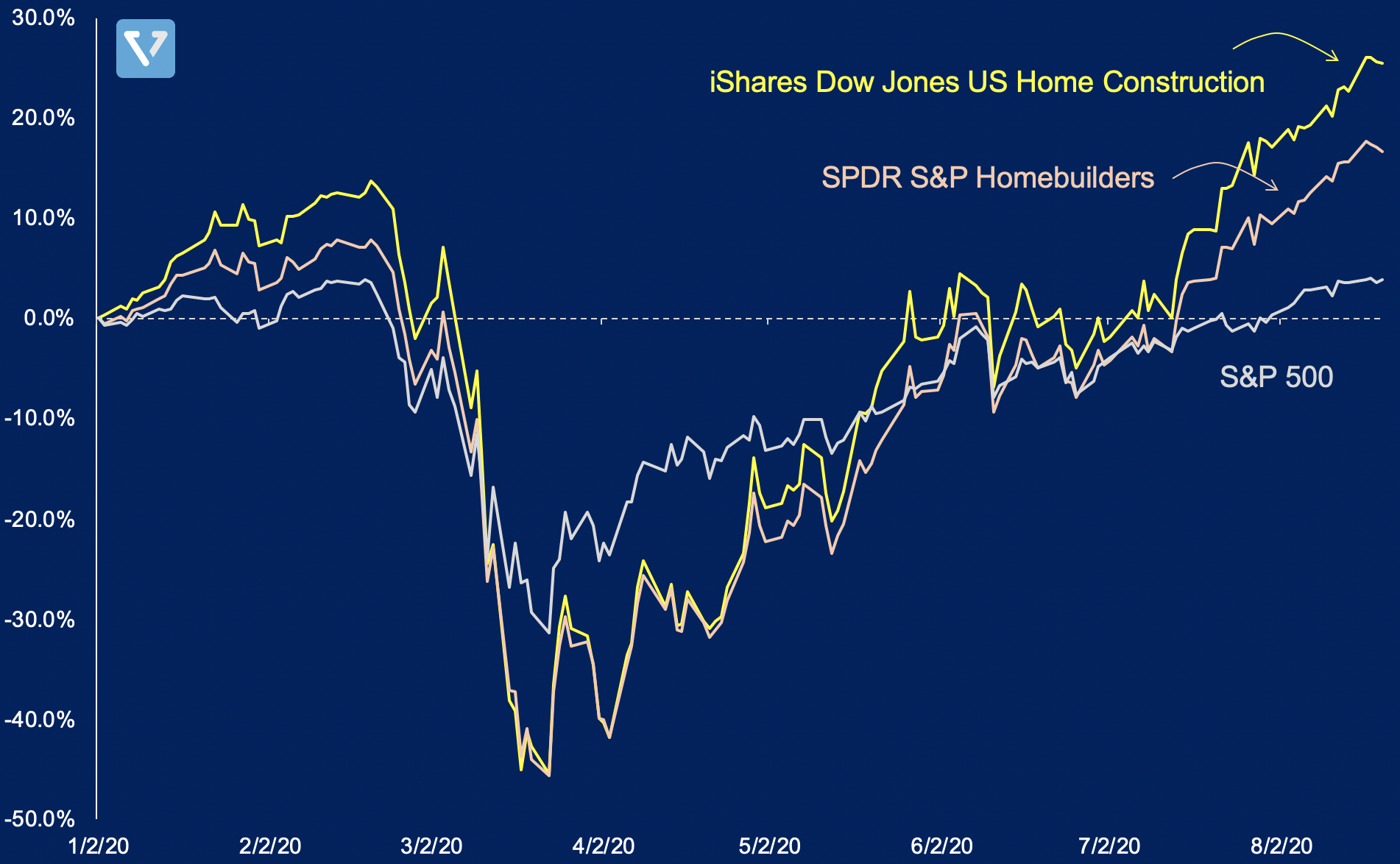

Shares of companies that build homes have rebounded more rapidly than the overall market. See Figure 1 for returns of two Home Builders Indices when compared to the S&P 500.

Shopify – ecommerce for everyone

What is Shopify?

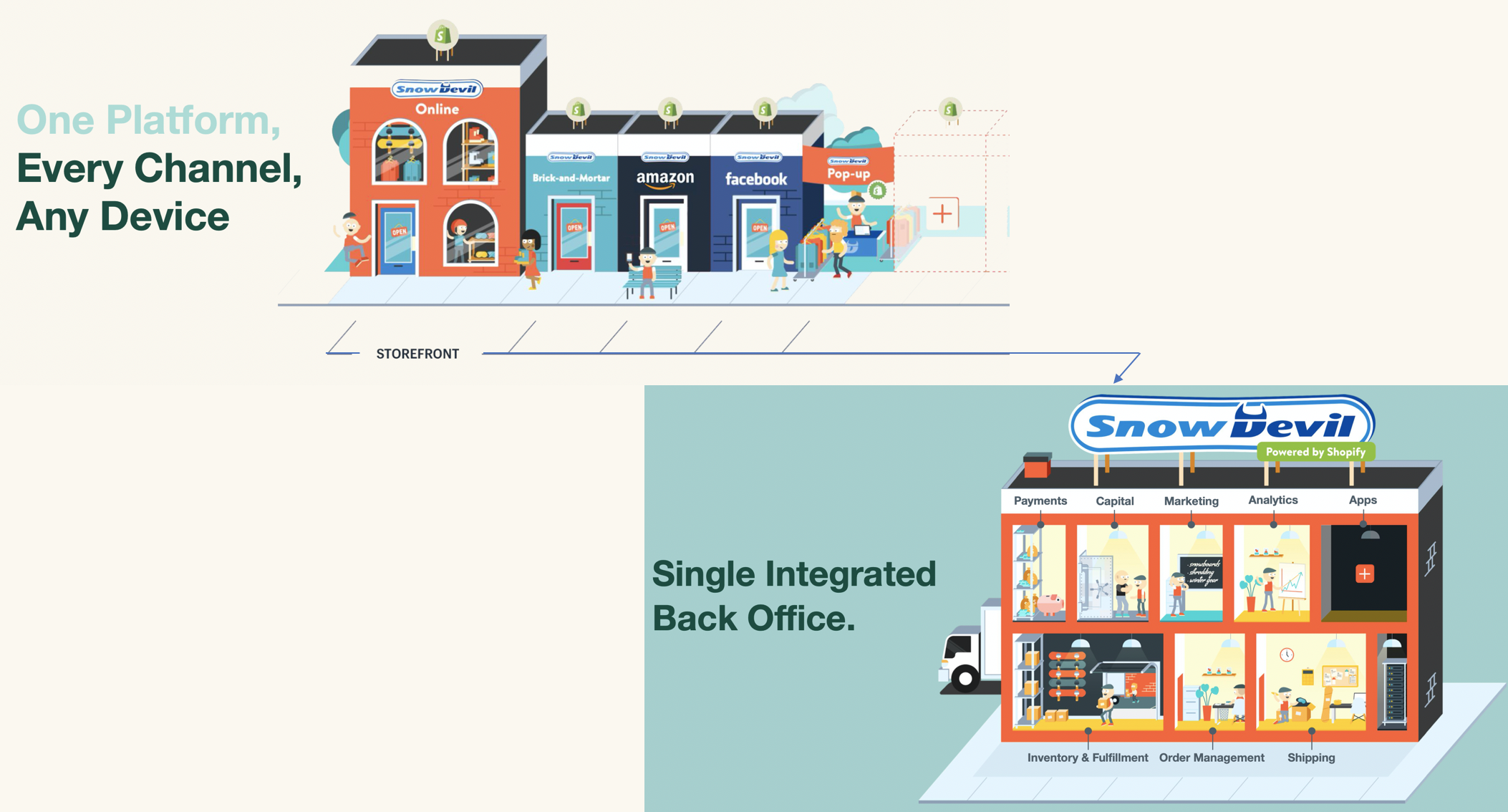

Shopify is an ecommerce platform. Unlike other ecommerce platforms (such as Amazon, eBay or Walmart). Shopify does not sell any merchandise. It provides a host of software, logistical and financial solutions to enable small businesses and large enterprises to run their own ecommerce platforms. Its vision is to be the backoffice provider regardless of where your ecommerce storefront is located (see Figure 2).

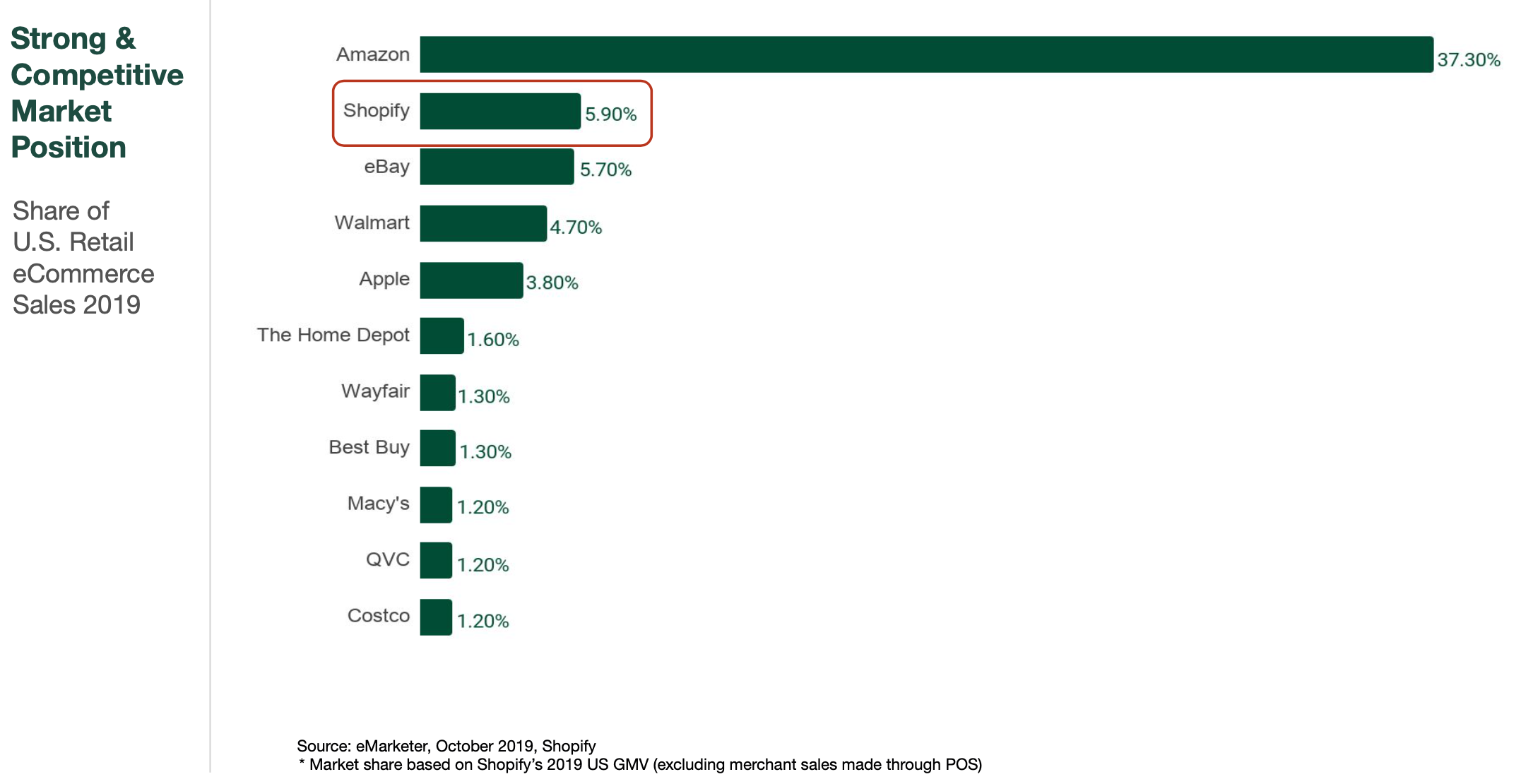

Based on gross merchandise volume (GMV), Shopify is the second largest ecommerce platform, second only to Amazon (note Amazon’s market dominance).

How does Shopify make money?

Shopify has two primary business units:

- Subscription solutions: this business unit provides software (online store, analytics, inventory management) and logistical solutions for small, medium and large businesses (Allbirds, Gymshark, PepsiCo, Staples, and others).

- Merchant solutions: this business unit is actually a fintech play. It is a global payment processing provider that offers automated recurring billing, mobile payment capabilities, real-time transaction results, web-based reporting, PCI compliance and fraud management.

In other words, Subscription solutions makes it easy for anyone to start an ecommerce store at multiple channels, while Merchant solutions makes it easy for merchants and buyers to transact with one another. The more ecommerce businesses Shopify helps create, the more revenue the company generates from processing payments, creating a flywheel effect.

Which business is growing faster?

Subscription solutions has a software-as-a-service recurring revenue stream – therefore the relevant key performance indicator for this business line is the monthly-recurring revenue (MRR). In contrast, Merchant solutions generate revenue as a percentage of gross merchandise value (GMV – or total volume of transactions in USD).

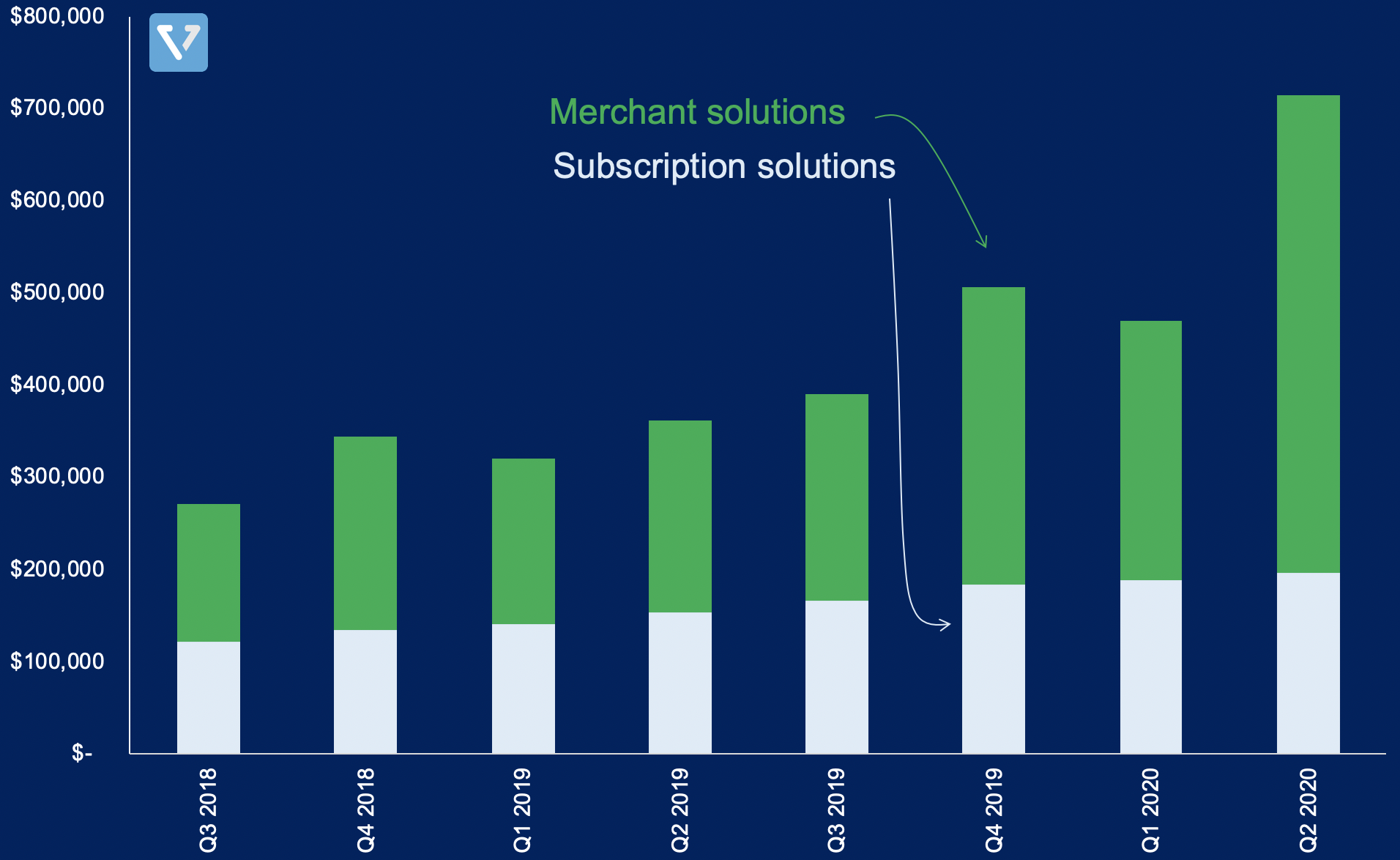

Figure 4 shows the revenue growth of both business units. Although both have been growing in the past eight quarters, the growth rate of Merchant solutions has been outpacing Subscription. Shopify’s revenue mix is now largely from Merchant solutions (72.5:27.5 Merchant to Subscription solutions vs 60:40 in Q1 2020).

In terms of predictability of revenue, you can see Subscription revenue increasing in a steady fashion, while Merchant solutions revenue is more seasonal (it typically jumps up in Q4 due to holiday shopping, and in the most recent quarter, a large increase occurred because of increased ecommerce volume due to COVID lockdowns).

Which one of the businesses is more profitable?

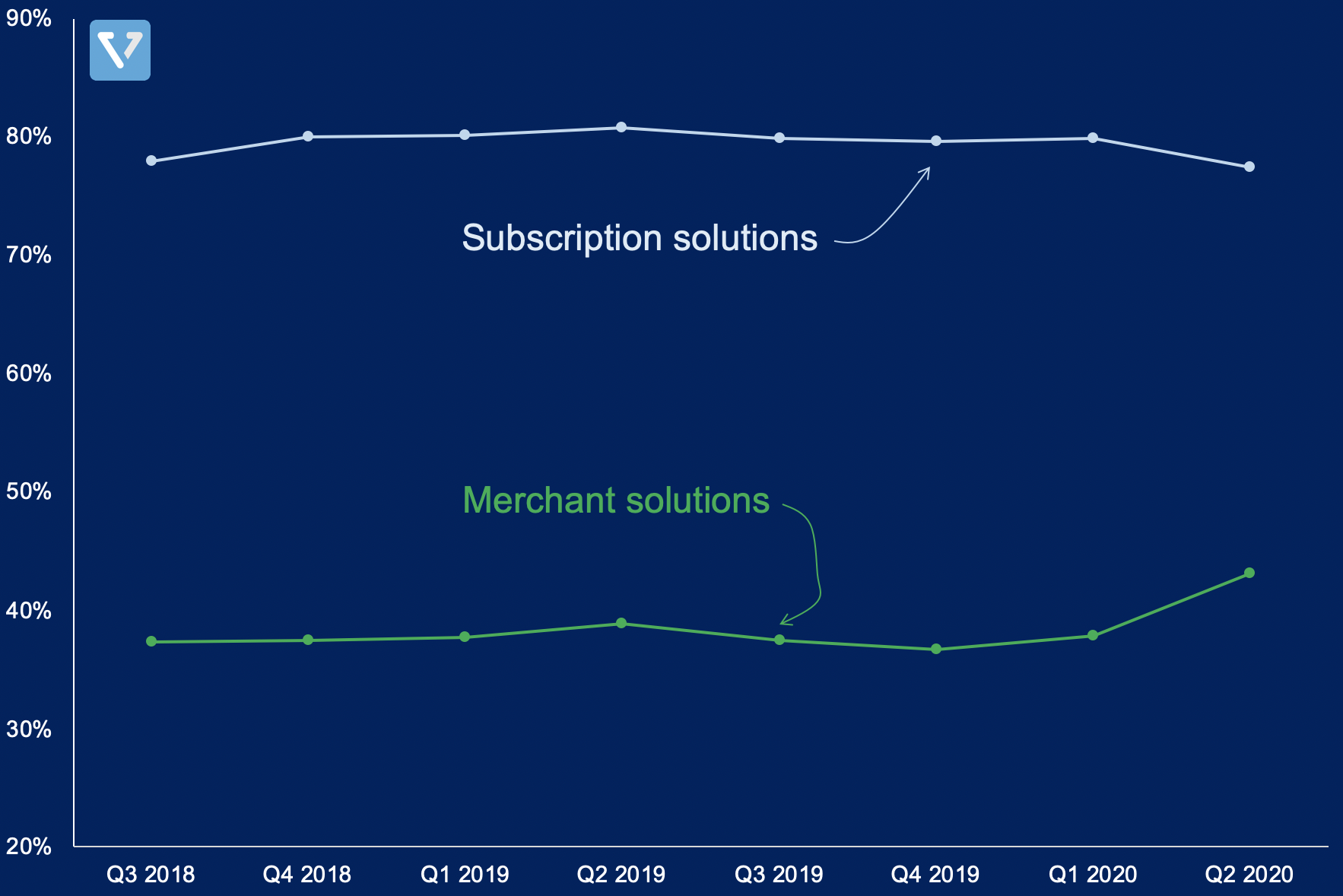

The core Subscription business has more typical software-as-a-service characteristics. It requires R&D and sales and marketing investments – so higher upfront fixed costs, but almost zero variable costs.

In contrast, the gross profit margin on delivering Merchant solutions is lower than Subscription solutions. The Merchant solution has higher variable costs since Shopify relies on third-party partnerships to facilitate payments, but less upfront sales and marketing or R&D costs. There is less sales and marketing needed since Shopify tries to convert the existing Merchant solutions customers. This is Shopify’s flywheel strategy.

See Figure 5 for the gross margins of Shopify’s two business lines.

Both businesses working in tandem help the company gain operational leverage. But since Subscriptions is growing much faster, the overall profitability of the company will decline.

Valuation and Risks

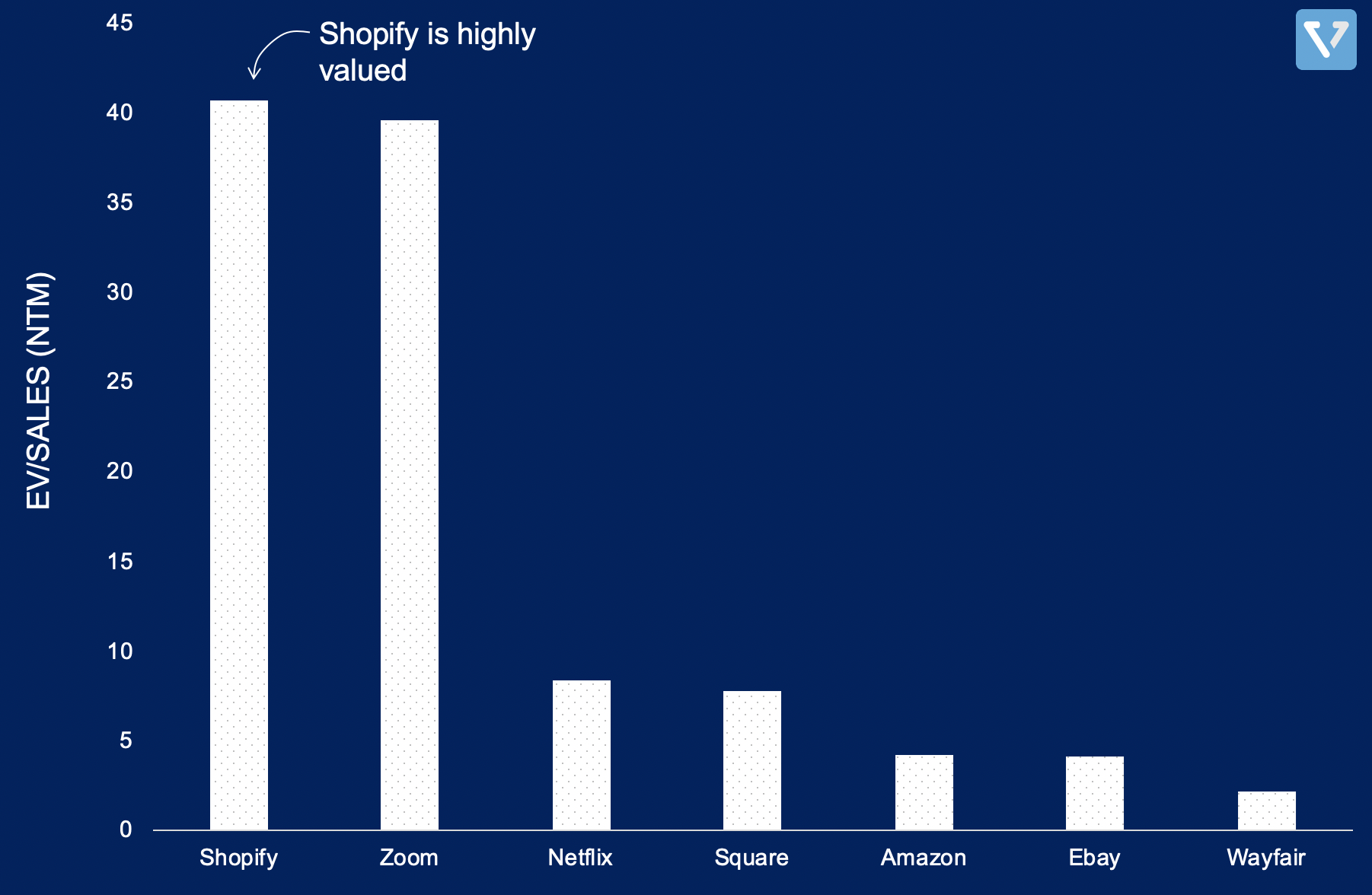

Shopify has been one of the few companies whose growth has been accelerated by the global lockdown. As a result, its share price and valuation has sky-rocketed. See Figure 6 for its valuation multiples (EV/Sales) compared to other companies who have also grown through the lockdown.

Nevertheless, the company is in a space where significant growth is expected, and considering ecommerce penetration for small and mid-size merchants is still low, there is still significant runway for growth. Due to the high valuation and high expectations for growth, investing in Shopify is not for the faint of heart. The share price is much more volatile than the overall market (the beta of Shopify is 1.58 at the writing of this article).