Much has been speculated about how the recovery of the economy is shaped (whether it’s a ‘V’, ‘W’ or ‘L’ shaped one). The stock market is not the economy, but it appears that the stock market might have made a V shaped recovery?

Despite the heightened volatilities, retail Indian investors that have invested in US stocks through the Vested platform have preserved through the dip. In fact, most have taken the opportunity to buy into the dip.

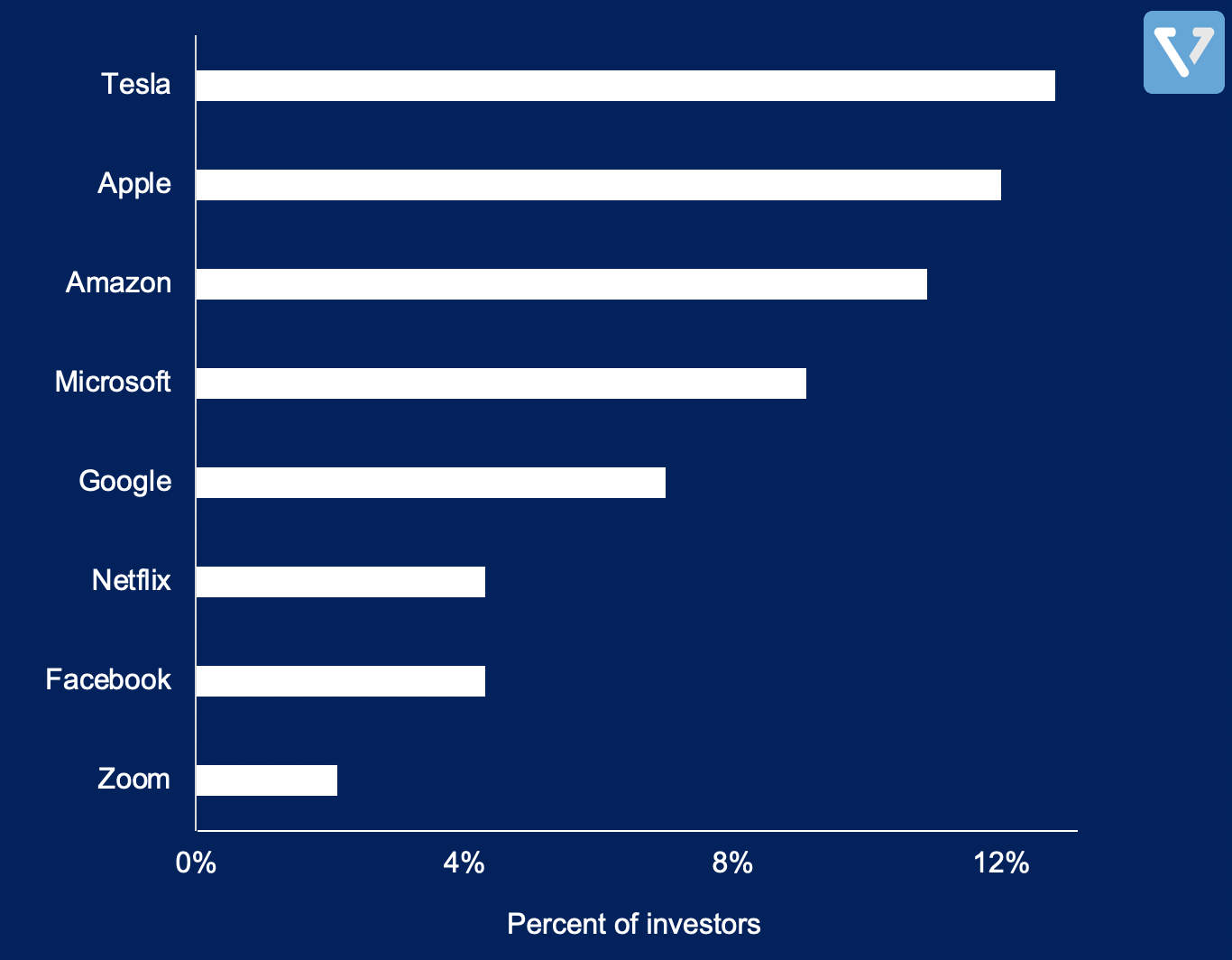

We explored the 8 most popular companies on our platform (see Figure 1)

Similar to retail investors in the US, the FAANG+M (Facebook, Apple, Amazon, Netflix, Google, and Microsoft) stocks are very popular. This popularity might be warranted since these stocks have shown resilience towards the impact of the global lockdown and have been the primary drivers of the S&P 500’s recovery.

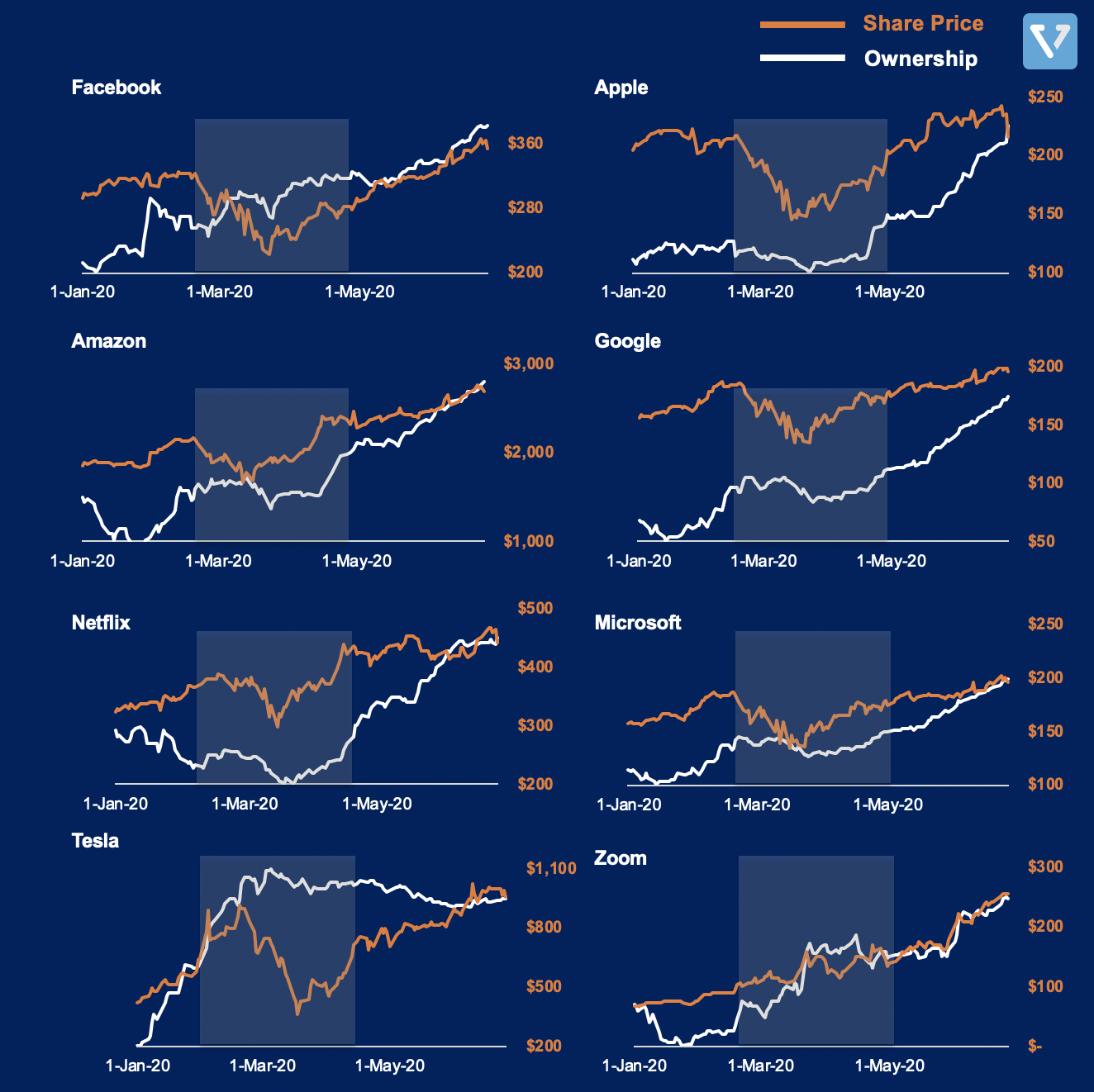

What is interesting is how the ownership of these stocks have evolved over time (for the first half of 2020). The chart below shows how the popularity of the different stocks have changed over the last 6 months. The shaded square box represents the middle of February through April 2020 – a very turbulent period for the stock market.

Key observations:

- Generally, investors maintained their ownership during the dip

- They seem to have an uncanny ability to time the bottom of the market – the proportion of investors that own the particular share increases as the share price bottoms out

- People love Tesla. Tesla is not only the most popular stock, but investors seem to not be phased by the wild swings in the share price. From the middle of February to the middle of March, Tesla’s share price declined by 60%, yet percent ownership remained relatively flat. Investors held steady to their conviction and rode the rally backup to a price of US $960 per share

[mc4wp_form id=”1064″]