What is earnings per share (EPS)? How can it help investors evaluate investment opportunities?

To help you better evaluate stock investments, we added EPS charts to our platform.

What is EPS: Earnings Per Share (EPS) is calculated by dividing net income available for common shareholders by the number of shares outstanding. Since different companies may have different number of outstanding shares, EPS allows investors to compare different companies (usually within the same industry) normalized to a per share basis. Furthermore, a company’s EPS trend that consistently meets or exceeds expectations can also signal the health of the company and the quality of the management.

EPS data has its limitations as well. Companies have the option to buy back their own shares, reducing their number of shares outstanding and therefore increasing the EPS without increasing net income. Further, EPS does not indicate the debt level of the company.

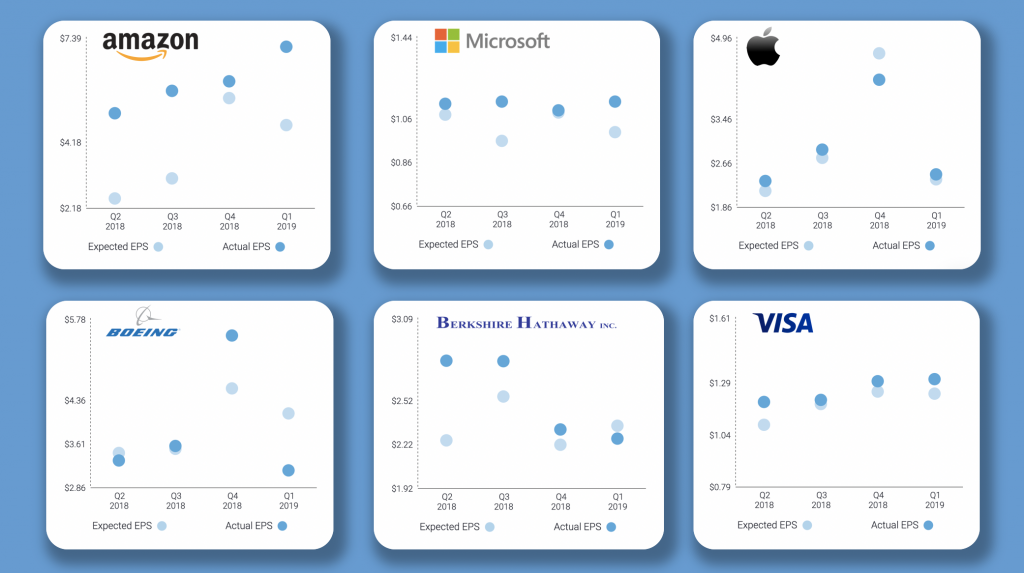

The image shown above shows EPS charts for several companies. The EPS chart shows Actual EPS (what the company achieves in a particular quarter), compared to Expected EPS (what analysts expect, derived by averaging multiple analyst estimates). Note: Analysts are people who closely examine a small group of companies to provide investment recommendations to their clients. As a part of their analysis, they also provide financial estimates for the companies.

A company’s share price can be affected by its EPS. Typically, EPS is announced every quarter. When the actual EPS that a company reports is higher than analyst expectations, the share price typically goes up. The opposite is also true, if a company misses its EPS projection, its share price typically falls.

From the image above, you can see that Amazon crushed its Q1 earnings. As a result, the share price went up after the earnings announcement. In contrast, Boeing, after beating its Q4 2018 earnings expectations, came short in Q1 2019, due to the issues the company is experiencing with its 737 MAX planes. Meanwhile, Microsoft continues to be a strong performer, beating its expected EPS in the last four quarters.

Thanks for reading!