Zoom will be publicly listed on the NASDAQ this week [week of April 18 2019], at an initial market cap of roughly US$ 9 billion, or nine times that of its most recent private market valuation.

And we are excited to announce that we have added the stock to our platform.

What Does Zoom Do?

Zoom is a provider of video and voice communication platforms across mobile devices, desktops, telephones and in-room systems. It competes with Google’s Meets, Microsoft’s Skype, Cisco’s WebEx and many others. What separates Zoom from the pack is that despite competing in an area crowded with other offerings, the company is still growing at an unprecedented rate.

The company provides access to its platforms with a freemium model. Users can download and use their platforms for free, on a limited basis. Zoom charges subscription fees for premium features. The company relies on its proprietary technology to deliver superior quality and reliability (the S-1 mentions that it can continue to work even with 40% packet loss). Zoom’s superior product offering then converts free users into paying customers.

The product is also inherently viral. It spreads through calendar/meeting invites. To receive a Zoom call, the recipient either has to download the software or use the online version of the platform. This mechanism allows Zoom to spread virally (note that the company also employs a sales force and engages in strategic partnerships to augment this virality). The combination of virality and the SaaS business model has enabled Zoom to grow its revenue rapidly and efficiently.

So, let’s look at it’s S-1 (IPO documents) and see how this growth is reflected in its numbers

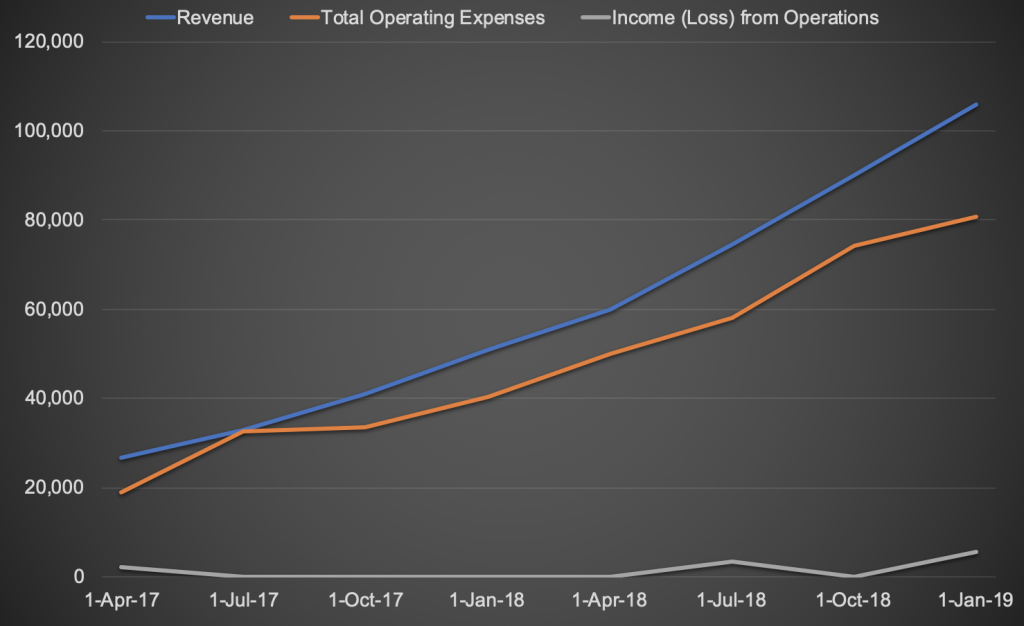

Unlike many upcoming unicorns, Zoom is actually profitable. Figure 1 shows the revenue, operating expenses and profit (loss) from the previous 8 quarters. Zoom’s growth has been quite efficient, the pace of its revenue growth is outpacing the growth rate of its expenses.

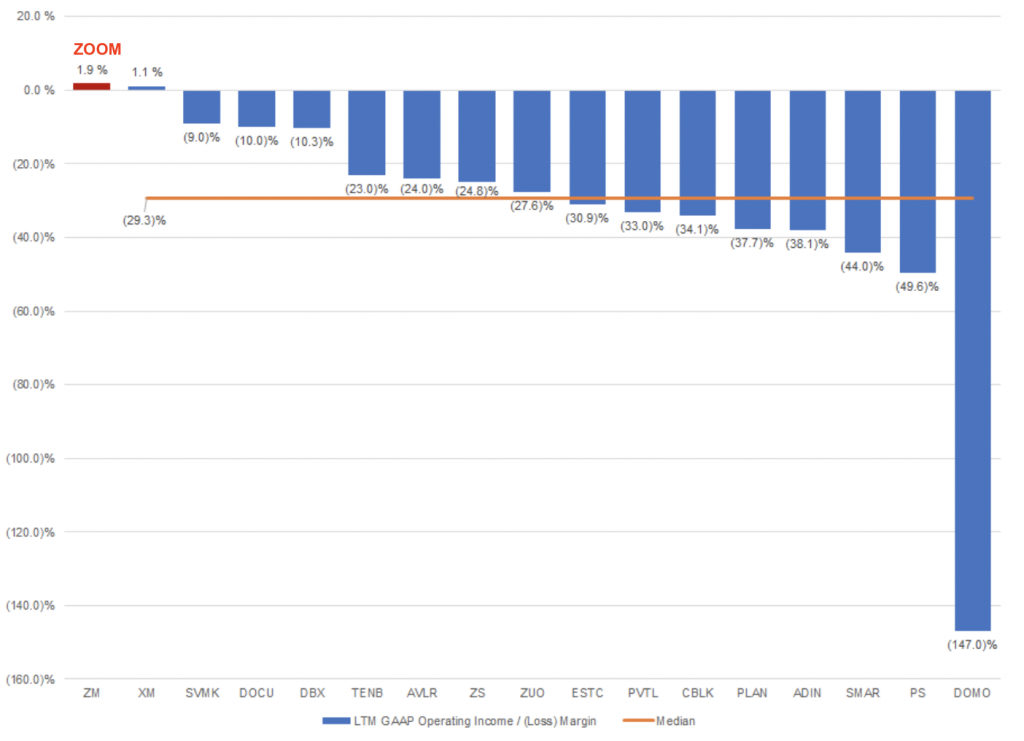

In fact, it reported a profit in the quarter that ended in January 2019. This is uncommon for SaaS (Software as a Service) companies. SaaS companies typically incur costs upfront (research and development, sales, engineering, etc), while revenue is recognized over the term of the subscription. As a result, a typical SaaS company will double down on upfront investments to propel growth, at the expense of profitability. Figure 2 shows Zoom’s IPO compared to other SaaS companies that IPOd in the past year. Zoom was the leader of the pack at 2%, on a GAAP basis, in the past 12 months [source: Alex Clayton].

Ok, so the company is slightly profitable. But is it doing so at the expense of growth?

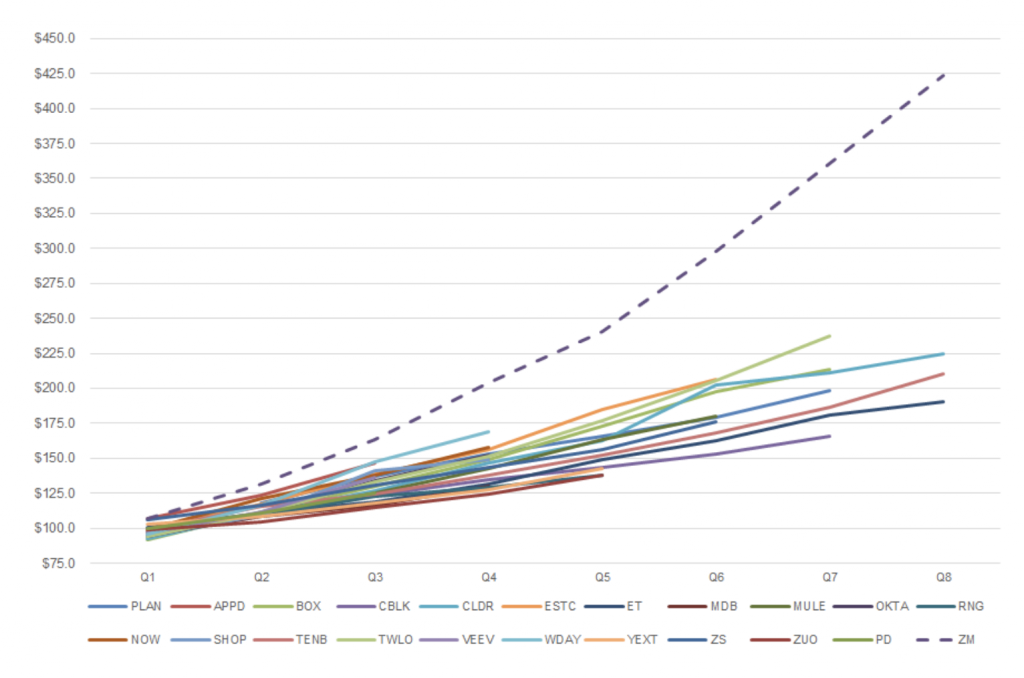

It appears not. After hitting a subscription revenue run rate of US$ 100 million (subscription revenue run rate = a particular quarter’s revenue multiplied by 4 to assume a full year’s recurring revenue), its revenue run rate growth far surpassed other fast growing SaaS companies. The numbers in Figure 3 are taken from the 6 – 8 revenue quarters reported in the respective company’s S-1.

Revenue Growth is driven by two things

Revenue growth is powered by two factors: (1) Sales to new business customers. (2) Existing customers paying more subscription fees (increasing usage).

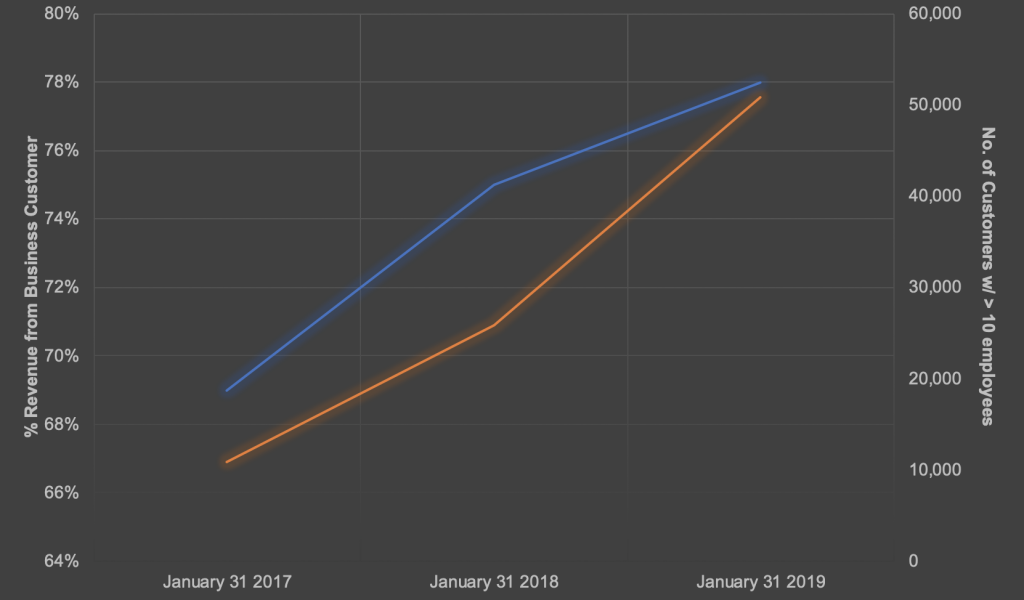

Revenue Driver 1 The number of business customer is growing

Zoom sells its products to individuals (personal use) and to businesses. But increasingly, its revenue comes from business customers. This is important because business customers tend to be more sticky. Zoom’s revenue from business customers went from 69% to 78% of total revenue for fiscal years ending in January 31st 2017 2018. Furthermore, for the same time period, the number of business customers (defined as customers with more than 10 employees) increased 5X, from 10,900 to 50,800 customers (rounded down to the nearest hundred). See Figure 4.

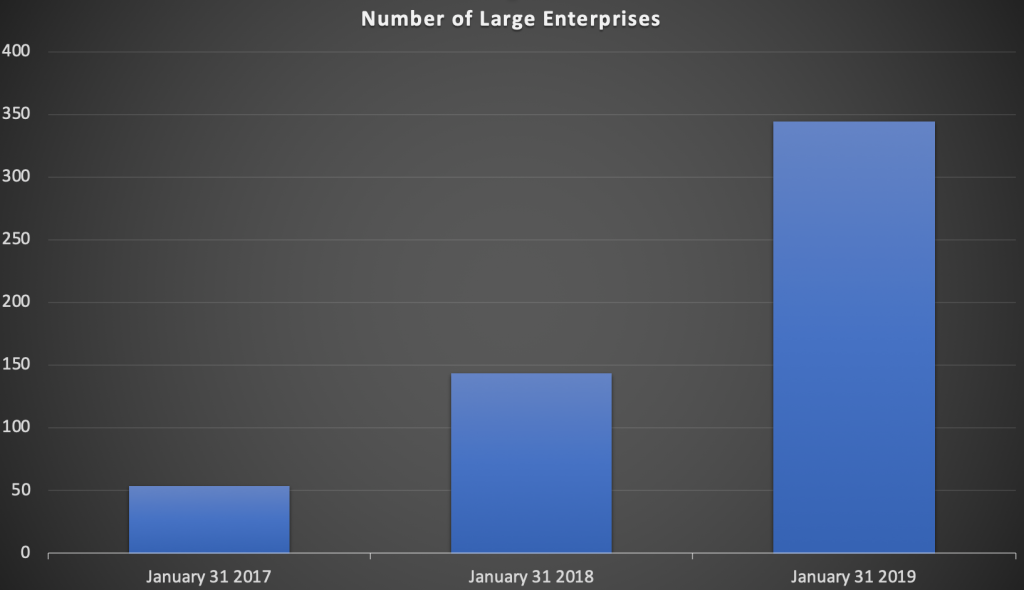

Zoom is focused on growing its large enterprises segment (defined as customers that contribute more than US$ 100,000 of annual revenue for Zoom). The number of enterprise customers has gone up 6.4X, from 54 at the end of January 2017, to 344 at end of January 2019. See Figure 5, Note that these customers are a subset of the customers with greater than 10 employees mentioned above.

Revenue Driver 2 Not only is the number of business customer growing, the usage, and therefore revenue from each customer is also increasing

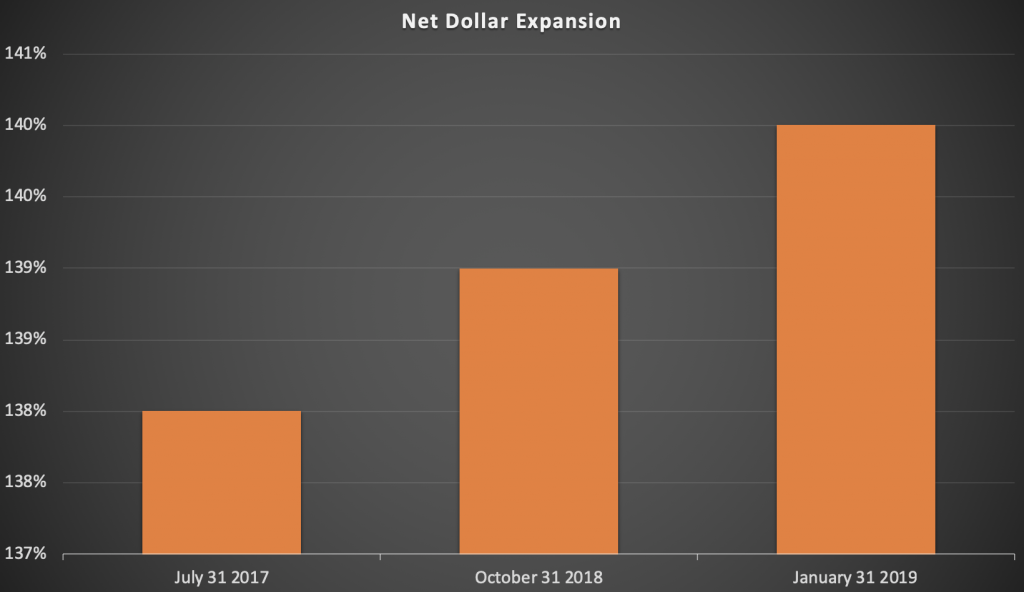

Once Zoom is in a company, it expands. The company reports a 12 month trailing net dollar expansion rate for business customers that increased from 138% (July 2018) to 140% (January 2019). An expansion rate of more than 100% means that growth of revenue from your existing customer base offsets any losses due to subscription downgrades or attrition. This means that if a customer spent US$ 1 in January 2018, that customer would have spent $1.40 in January 2019. See Figure 6.

The business is not without its risks however

Yes, it is profitable now, but this may not be sustainable. In the software subscription business, costs are incurred upfront while revenue is recognized later. As a result, if growth stalls, the costs incurred upfront may not be able to recouped.

Further, it faces many well known competitors (chiefly: Microsoft, Google, and Cisco) but also potential new entrants such as Amazon and Facebook, who have made investments in this field and may have larger marketing budgets and more established relationships with large enterprises.

And finally, the company may face integration risk. For its system to work properly, Zoom has to have integration and interoperability between iOS, Android and Windows. It is possible that Zoom’s competitors may degrade Zoom’s service performance by making integration more challenging on their operating systems.