Central to every financial entity, be it banks, agile non-banking financial companies (NBFCs), or asset management firms, is a foundational element: trust. This trust isn’t just an abstract feeling; it’s built on the solid ground of operational excellence and stringent adherence to best practices.

Trust in these institutions stems from their rigorous due diligence and consistent operational practices. When they stick to these, they signal reliability, thereby earning the trust of their patrons. When individuals or businesses invest their hard-earned money, it’s not just blind faith; it’s a reflection of their confidence in the institution’s ability to conduct rigorous checks and balances, ensuring safety and ethical operations.

For instance, Peer-to-Peer (P2P) lending, a modern player in finance, thrives on this very principle. When individuals invest or borrow through P2P platforms, they do so with an understanding that these platforms are maintaining stringent standards and doing their homework on every transaction.

The importance of trust can’t be stressed enough. Beyond just a feel-good factor, trust has tangible benefits. It propels growth in the financial sector. A system viewed as trustworthy attracts more participants, stimulating investments, enhancing liquidity, and contributing to overall economic well-being.

However, the flip side is equally impactful. When trust wavers, the consequences are severe. It can trigger a domino effect, leading to withdrawals, panic-selling, and general hesitation to invest. Regaining this lost trust isn’t just challenging; it’s time-consuming, sometimes spanning years or even decades. Past financial debacles, like bank collapses or investment frauds, underscore the devastation that ensues when trust evaporates.

In essence, trust and due diligence are two sides of the same coin in the financial world. Trust is earned through meticulous due diligence and transparent operational practices. And when institutions uphold these standards, they foster an environment of confidence and security for everyone involved.

P2P lending ecosystem and the trust factor

Due Diligence on borrowers

Peer-to-Peer (P2P) lending platforms have transformed the traditional lending landscape by connecting individual borrowers with individual lenders directly, removing the intermediation of institutional banks (see Figure 1). At the heart of this system is trust, and due diligence is the process that establishes and maintains it. For P2P lending platforms, conducting thorough due diligence on potential borrowers is imperative for a variety of reasons:

- Risk assessment: It enables the platform to assess the creditworthiness of borrowers, evaluating their ability to repay the loan. This involves checking credit scores, employment history, income statements, and sometimes, even social behaviors. By understanding the potential risks involved with each borrower, the platform can assign appropriate interest rates or even decline high-risk loan applications.

- Maintaining platform reputation: The reputation of a P2P lending platform rests on the reliability of its borrowers. Frequent defaults can tarnish the platform’s reputation, leading to decreased trust from potential investors and future borrowers.

- Regulatory compliance: Due diligence ensures the platform is compliant with local regulations and laws. Failing to adhere to these might result in legal repercussions and penalties.

From the investor’s perspective: Trusting the platform’s due diligence

On the flip side, investors are entrusting their capital to P2P lending platforms in the hope of receiving attractive returns. The investor’s trust, in this case, is not only placed in the individual borrowers but significantly on the platform itself. For an investor, the due diligence conducted by the platform is critical for several reasons:

- Capital preservation: Investors want assurance that their principal amount is safe. By knowing that the platform conducts rigorous checks on borrowers, investors can be more confident about the prospects of repayment.

- Informed decision-making: The outcomes of due diligence often translate into risk grades or interest rates for potential loans. Investors rely on these indicators to make informed lending decisions that align with their risk appetite.

- Consistent returns: Platforms that are thorough in their vetting processes and maintain a low default rate can offer investors more consistent returns over time.

- Transparency and accountability: Proper due diligence reflects a platform’s commitment to transparency and accountability. Investors are more likely to trust platforms that are open about their processes and show evidence of their diligence efforts.

Checks by the P2P lending platforms

In the financial world, the process of loan approval is complex, where the moves are dictated by intricate rules, historical data, and the borrower’s financial behavior. While the credit score plays the starring role in this act, it’s only a piece of the puzzle. For P2P lending platforms, which directly connect individual borrowers with lenders, this procedure becomes all the more nuanced. These platforms, which bypass traditional banking systems, employ a multifaceted approach to assess a borrower’s credibility.

In the P2P lending landscape, due diligence is carried out meticulously in three pivotal areas:

- Filtering out borrowers: Identifying which potential borrowers meet the platform’s criteria.

- Prioritising borrowers: Ranking borrowers based on their creditworthiness and reliability.

- Loan recovery process: Implementing mechanisms to ensure loans are repaid or recovered effectively.

Let’s delve deeper into each of these areas

Filtering out borrowers

When borrowers apply for a loan on Peer-to-Peer (P2P) lending platforms, having a high credit score isn’t the only thing that matters. While a good credit score can give an initial impression of the borrower’s financial responsibility, lending platforms dig deeper to get a clearer picture of the borrower’s complete financial history.

One of the primary methods they use is the “Bureau Check.” Think of this check as a detailed background investigation of an individual’s credit history, conducted by credit bureaus. This check provides insights beyond just the credit score. It delves into how consistently the individual has repaid past loans, if they’ve ever defaulted, how many loans they’ve taken recently, and more.

Within the Bureau Check, there’s a concept called “hard exclusions.” These are like deal-breakers for the lending platform. If a borrower fails any of these non-negotiable criteria, they’re immediately deemed unfit for a loan. These criteria aren’t chosen at random. They’re based on significant indicators of a borrower’s financial health and behavior, like if they’ve recently moved to a new location or had past loan defaults.

Surprisingly, despite many borrowers having good credit scores, about 85% don’t pass the Bureau Check because of these hard exclusions. In essence, while a good credit score is beneficial, the Bureau Check’s comprehensive examination ensures that only the most reliable borrowers get approved on P2P platforms.

A stellar credit score—often the crown jewel of a borrower’s financial profile—is commonly believed to be the golden ticket to loan approval. However, the reality is far more intricate, especially in the realm of Peer-to-Peer (P2P) lending platforms. Like their counterparts in the traditional banking sector, these platforms delve deeper, aiming to capture a comprehensive snapshot of an applicant’s financial discipline and stability.

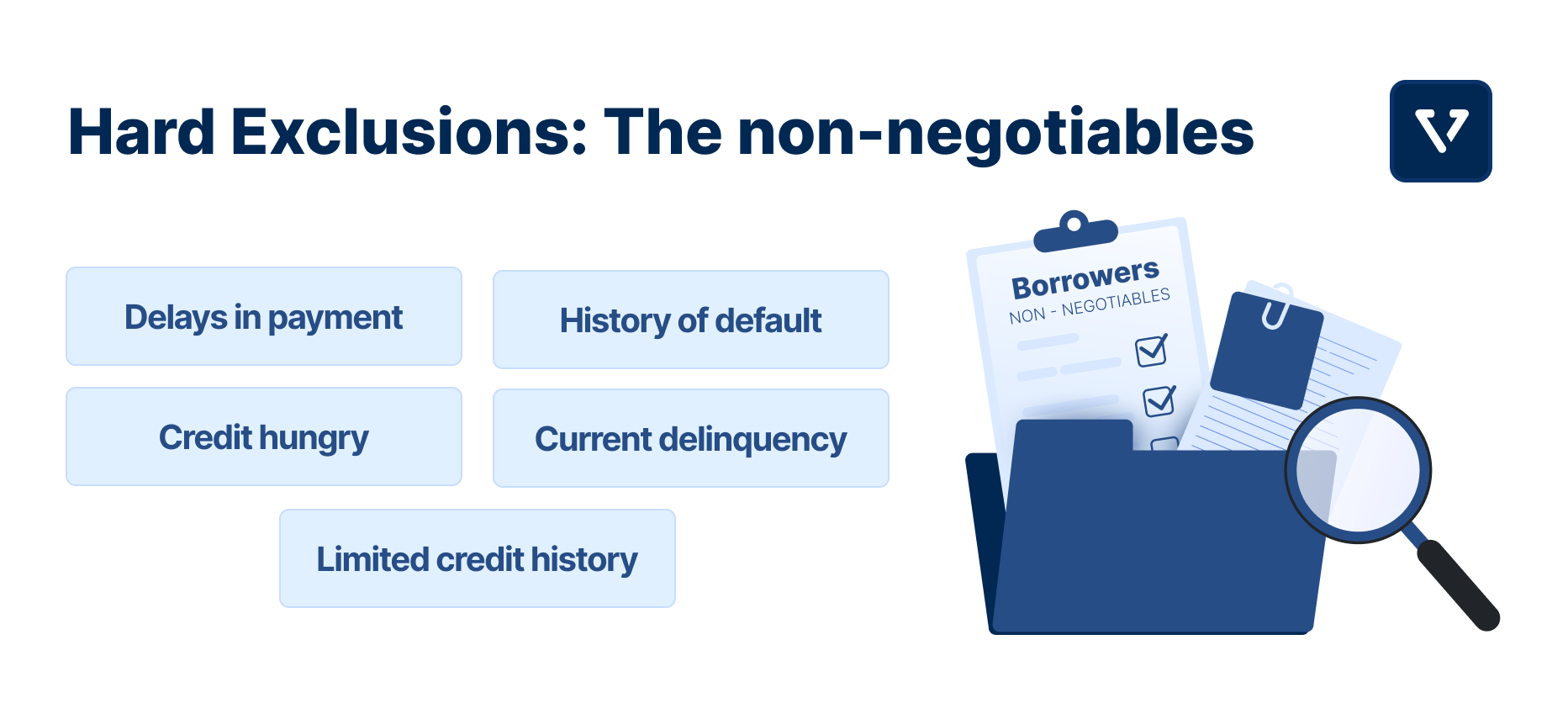

Hard Exclusions: The non-negotiables

Here are some of the non-negotiables, the factors that will immediately disqualify the borrower from getting that much-needed loan:

New to the state: Mobility within India, whether for work or personal reasons, is common. However, if you’ve recently relocated to a new state, your chances of securing a loan via a P2P platform might be slim. This exclusion gained traction especially after the COVID pandemic, which saw massive internal migrations and an unstable economic environment. The risk associated with the unknowns of a borrower’s new location can make lenders wary.

History of default: In the P2P world, past behaviors often indicate future actions. A previous default is viewed as a significant risk, signalling potential future repayment challenges.

Current delinquency: Not settling your dues within the past 90 days is a glaring red flag. For P2P platforms operating in India, current delinquencies are indicative of immediate financial distress or mismanagement, making you a high-risk candidate.

Limited credit history: A comprehensive credit history provides a lens into your financial behaviors over time. For businesses, a lack of credit data for at least three years, or two years for salaried individuals, is concerning. It suggests either a lack of exposure to credit or an avoidance of it, both of which make assessing risk difficult.

Credit hungry: In India’s credit landscape, applying for loans from multiple institutions simultaneously is frowned upon. It suggests desperation or an attempt to secure multiple loans potentially without the intent or capacity to repay. P2P platforms view this behavior as indicative of potential financial instability.

Delays in payment: Timeliness in repaying debts is crucial. Even a delay of over 30 days in payments within the last year can tarnish your profile. It’s a sign of either financial strain or a casual approach to financial commitments, neither of which sits well with lenders.

Prioritizing borrowers

After the Bureau Check and hard exclusions, there’s one more step that’s interesting and unique to certain financial institutions: prioritizing borrowers. They match the demand (borrowers) with supply (lenders) based on various factors, ensuring that those who are most likely to repay loans without issues get prioritized.

1. Home Loans & Service: Top of the List

Firstly, financial institutions absolutely love lending to people who already have a home loan and have paid off 24 months of EMIs without any default. Why? Because this group is perceived as trustworthy, stable, and less likely to default in the future. Essentially, if you’re good with your home loan, you’re golden in the eyes of lenders.

2. Personal and Business Loans: The preferred choice

The second priority is reserved for people who have taken out either personal loans or business loans. This category is crucial because it often captures customers who have a good three-year credit history, which is a big green light for lenders. In simpler terms, if you’ve had a loan for your personal or business needs and you’ve been consistent with repayments, you’re considered a quality borrower.

3. Auto Loans: You’re still in the race!

If you’ve managed to pay off your auto loan for at least 24 months without defaulting, you’re third in line for loan consideration. Again, this is all about establishing a track record. If you can manage an auto loan well, there’s a good chance you’ll handle other financial commitments responsibly too.

4. Credit Cards: Not forgotten, but not the favorite

If you’ve had a credit card and you’ve managed to maintain a clean slate for 12 months, you’re not entirely off the radar, but you’re not a top priority either. The logic here is that credit cards are often seen as less of a commitment than other types of loans, so they hold less weight in the grand scheme of things.

5. Other Loans: The leftovers

Consumer loans, gold loans, and other trade lines fall into the final category. Most lending institutions don’t focus much on these because their primary interests are usually exhausted in the first three categories.

Loan recovery process

It’s an open secret that effective collection and recovery strategies are the backbone of any successful financial institution. After all, whether you’re a small lending firm or a large-scale bank, you need to have a streamlined process to ensure that loans are repaid promptly. But how do these organizations manage to stay ahead of the curve when it comes to debt collection?

The four-tier system

Tier 1: The captive call center

The first line of defense, so to speak, is the in-house call center. Most large banks and non-banking financial companies (NBFCs) have captive call centers. These teams are trained to reach out to borrowers who are falling behind on their payments.

These call centers use an early warning system in collaboration with credit bureaus. These systems monitor borrowers monthly and flag any signs that might indicate future default. These could range from a dip in the customer’s credit score, taking on additional debt, changing contact information, and more. Customers who trigger these warnings are moved up the priority list for immediate engagement.

Tier 2: The field team

When customers can’t be reached via phone, the mission is passed onto the field team. These agents visit the customer’s residence to confirm their presence and urge them to make the necessary payments. Various agencies across the nation collaborate with financial institutions to carry out these field operations efficiently.

Tier 3: The legal team

If the field team’s efforts prove to be futile, the baton is passed to the legal team. Contrary to what you might think, the primary aim of the legal team isn’t to slap lawsuits on defaulters. Instead, they focus on debt resolution, albeit they are fully equipped to go the whole nine yards—issuing legal notices, and even triggering legal actions if necessary.

Tier 4: Skip tracing

Last but not least, we have skip tracing, the James Bond of collection and recovery. This is essentially data analytics on steroids. Thanks to the growing volume of digital footprints that customers leave behind—shopping data, utility bills, and even cylinder relocation data from the government—it’s almost impossible for anyone to borrow money and simply vanish.

Lending companies can access this data, and based on the data, the P2P lending platform can try and collect money by following Steps 1, 2, and 3.

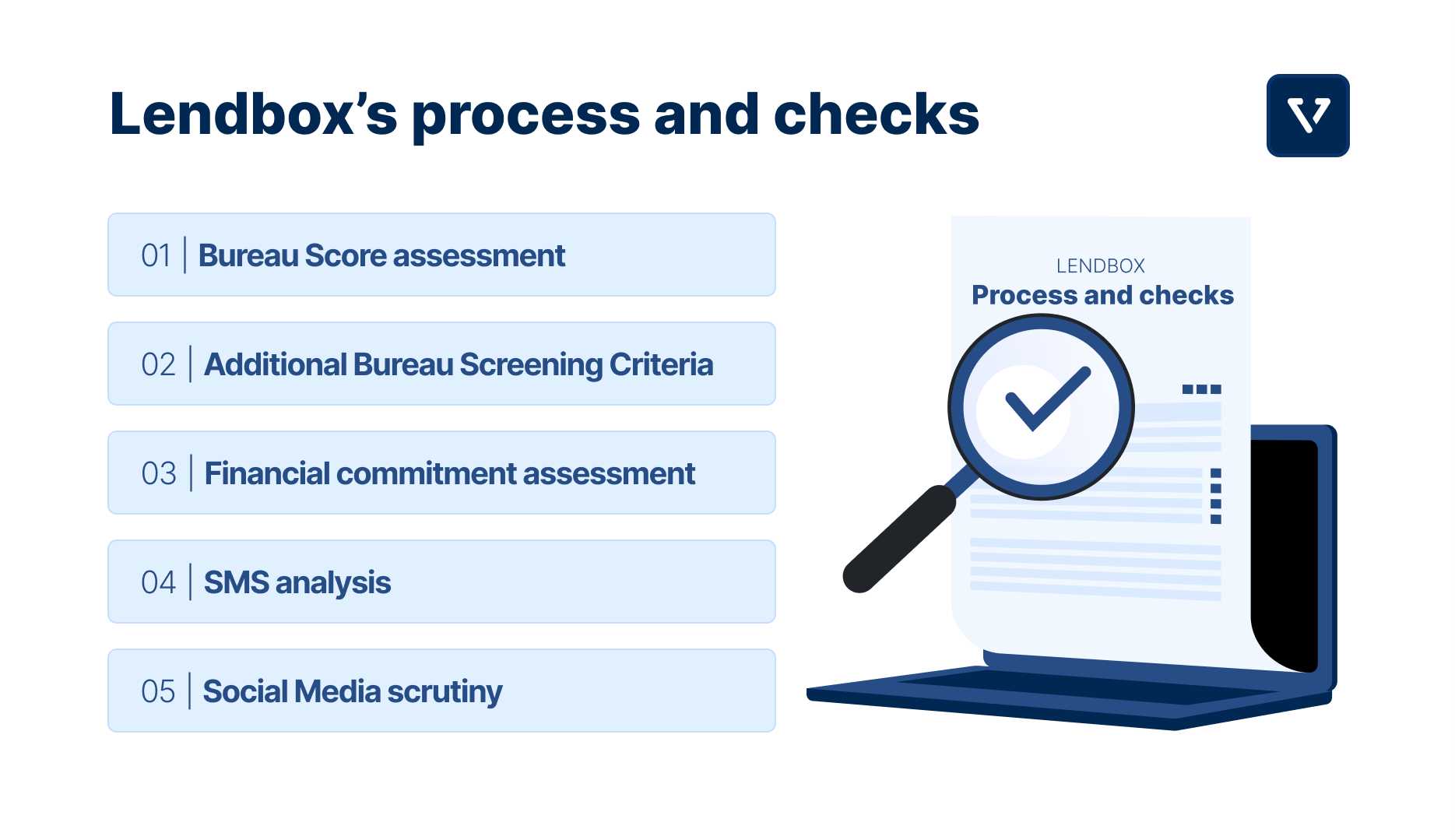

Example: Lendbox’s process and checks

Lending platforms have to institute rigorous criteria and screening methods to determine the creditworthiness of borrowers. Lendbox, for example, has adopted a multi-pronged approach to evaluate potential borrowers meticulously. Here’s an overview of the checks it undertakes, delineated for clarity:

1. Bureau Score assessment:

Lendbox uses the Bureau Score to assess the risk profile of a borrower. Depending on the duration of the score and its range, Lendbox decides the maximum amount that can be lent:

- Bureau Score [For loans <= 3 months]

- < 300 or NTC [new to credit]: up to Rs. 5,000

- 300-549: Reject

- 550 – 599: up to Rs. 10,000

- 600 – 649: up to Rs. 10,000

- 650 – 699: up to Rs. 25,000

- = 700: up to Rs. 50,000

- Bureau Score [For loans > 3 months]

- < 300 or NTC: up to Rs. 25,000

- 300-549: Reject

- 550 – 599: Reject

- 600 – 649: up to Rs. 50,000

- 650 – 699: up to Rs. 2,50,000

- = 700: up to Rs. 10,00,000

2. Additional Bureau Screening Criteria:

To dive deeper into the borrower’s credit history, Lendbox also scrutinizes for:

a. Defaults, Substandard Accounts, or Loss Events in the last 12 months:

This checks if a borrower has defaulted on any loans or if they have any accounts that have been categorized as “substandard” by credit bureaus. A “substandard” categorization often indicates an account that has been in default for a prolonged period. Similarly, “loss events” mean that lenders have marked an account as a probable loss, indicating the borrower has shown no intention or capacity to repay.

b. Signs of Stress (SMA) in the past 24 months:

“Special Mention Accounts” or SMAs are accounts showing early signs of weakness not severe enough to categorize them as Non-Performing Assets (NPAs). They indicate potential future payment issues. Having more than one of such accounts can be a red flag.

c. Payments overdue by more than 60 days in the past 6 months:

This is a more immediate red flag. If a borrower has any payments overdue by more than 60 days within the last half-year, it shows a recent inability or unwillingness to service their debts.

d. Overdue payments in the last 6 months:

If a borrower has multiple accounts where payments are overdue by at least 30 days, or if the cumulative overdue amount across all accounts is more than 5000, it highlights liquidity issues or poor financial management in the recent past.

e. Suits filed against the borrower:

Legal actions, like suits filed against a borrower, can be indicative of severe financial indiscretions or disputes. They not only signal potential financial stress but also raise ethical considerations.

f. Settled or written off accounts in the past 24 months:

Accounts that have been “settled” mean the borrower and lender have agreed on a reduced amount to clear off a debt, usually indicating the borrower couldn’t pay the full amount. “Written off” means the lender doesn’t expect the money back anymore. Either scenario signals a significant risk.

g. High-Risk loans like payday loans:

Payday loans are short-term, high-interest loans usually taken by borrowers to meet immediate financial needs. Having multiple of such loans can indicate chronic financial stress and dependence on high-cost borrowings.

h. Opening multiple new loan accounts in the last 6 months:

If a borrower has opened more than two new loan accounts in a short span (excluding credit cards), it can be a sign of “credit shopping,” where they might be seeking loans from multiple sources due to financial distress.

Each of these criteria allows platforms like Lendbox to build a more nuanced understanding of a borrower’s financial health, past behaviors, and potential future risks. They aren’t merely looking at numbers but are piecing together a story about the borrower’s financial journey and habits.

3. Financial commitment assessment:

Lendbox calculates the Fixed Obligation to Income Ratio (FOIR) to gauge the repayment capacity. Borrowers with a ratio of less than 75%, indicating that their existing EMIs and commitments are less than three-quarters of their income, are considered favorably.

4. SMS analysis:

Lendbox leverages SMS data to glean information about the borrower’s financial behavior, including overdue notifications, risky transactions with suspicious platforms like gambling websites, and the general health of their financial contacts.

5. Social Media scrutiny:

In an era where online footprints can reveal a lot about an individual, Lendbox performs checks on borrower’s social profiles, including LinkedIn and Facebook, to gather more qualitative insights into their lifestyle, reliability, and financial habits.

By implementing these comprehensive checks, Lendbox aims to maintain a low default rate, ensuring a more secure platform for its lenders and reinforcing the fundamental principle of trust in P2P lending.

Checks by the investors thinking to invest via P2P lending platforms

For the discerning investor, P2P lending platforms present a modern avenue for diversifying one’s portfolio. But, like all investments, it’s not devoid of risks. To navigate the dynamic world of P2P lending, investors must arm themselves with the right knowledge. From understanding the platform’s operational ethics to its track record and transparency protocols, there are several critical facets to consider before committing one’s capital. Below content will equip potential investors through the essential checkpoints they should consider, ensuring a more informed and secure investment journey in the realm of P2P lending.

Understanding Key Metrics in Peer-to-Peer (P2P) Lending

When considering an investment in the P2P lending landscape, it’s crucial to comprehend certain metrics that define the health and performance of loans on these platforms. One such critical metric is the Non-Performing Assets (NPA) percentage. Let’s delve deeper into its components and understand why it’s essential for investors:

1. Non-Performing Assets (NPA %):

This is a ratio that indicates the health of the loans disbursed.

The formula is given by:

NPA% = Gross Non-Performing Amount / Gross Disbursement Amount * 100

Where:

- Gross disbursement amount refers to the total amount of loan money given out during a specific period, covering all types of loans.

- Gross non-performing amount is the total principal amount that’s overdue from borrowers. Specifically, it includes loans which have not been repaid for more than 90 days (90+DPD).

2. 90+DPD (Days Past Due)

These are loans where repayments are overdue by more than 90 days. A high 90+DPD indicates potential defaults, suggesting borrowers are struggling to repay.

3. Types of Loans:

- Term Loan: These are standard loans that have a set tenure ranging from a month to 36 months. They’re structured and have specific monthly repayment schedules.

- Daily/Weekly/Fortnightly: These are short-term loans, typically with a tenure of less than a month. They might require frequent repayments, such as daily, weekly, or fortnightly.

- Write-off: Loans that are deemed unlikely to be recovered are ‘written off’. For P2P platforms, any loan with a DPD of more than 365 days, i.e., a year overdue, is considered a write-off.

Why should investors consider these metrics?

Risk assessment: NPA % gives a snapshot of the loan default rate. A high NPA suggests many borrowers are not repaying, indicating higher risk.

Return on investment (ROI) potential: A lower NPA % generally means a better return on investment since more borrowers are repaying their loans.

Platform’s credit assessment quality: A platform with a consistently low NPA % indicates that it has a robust mechanism for assessing the creditworthiness of its borrowers.

Capital preservation: By understanding the write-offs and 90+DPD, investors can gauge the likelihood of their capital being preserved and not getting stuck in bad loans.

Diversification strategy: By knowing the types of loans and their performances, investors can diversify their investments across different loan types, balancing risk and returns.

Effective strategies for investors when deciding a P2P platform

Evaluate the platform’s credit assessment mechanism

It’s paramount to prioritize a platform that thoroughly vets its borrowers. Since direct personal interactions with borrowers are absent in P2P platforms, it’s crucial to grasp how the platform determines their creditworthiness. A rigorous and comprehensive credit assessment methodology can increase the likelihood of partnering with reliable borrowers, subsequently minimizing risk.

Scrutinize borrowers’ credit profiles

Once confident in the platform’s assessment system, take the initiative to personally review the credit profiles of potential borrowers. Delve into the data and insights provided by the platform to gauge both the willingness and capability of the borrower to honor their obligations.

Spread investments across various borrowers

Diversification remains an age-old wisdom in investment circles, and its relevance extends to P2P lending. Rather than placing all your eggs in one basket, allocate funds across a diverse spectrum of borrowers. This approach not only spreads the risk but also offers a safety net against potential defaults.

Prioritize platforms with robust loan recovery systems

Despite the best precautions, defaults can occur. To protect your investment, it’s wise to gravitate towards platforms that provide robust support for loan recovery. This added layer of security ensures that, in case of unforeseen defaults, there’s a structured mechanism to aid in reclaiming your funds.

Advocate for complete transactional transparency

When you’re on the cusp of committing your funds, beyond assessing a borrower’s credentials, demand transparency in the lending process. Opt for platforms that champion clear and unequivocal transaction policies, ensuring that you remain well-informed about the destination and status of your investment at all times.

Key Takeaways

- Trust is the essential foundation for financial systems, including P2P lending. It ensures security, growth, and regulatory compliance.

- Due Diligence in P2P Ecosystem:

- Platform’s perspective: Risk assessment, maintaining platform reputation, and regulatory compliance are vital reasons for thorough due diligence on borrowers.

- Investor’s perspective: Importance lies in capital preservation, informed decision-making, consistent returns, and transparency.

- Basis of rejection includes hard exclusions like history of default, current delinquency, limited credit history, and others.

- Borrower prioritization ranges from those with home loans being top priority to those with other loans like gold loans being least prioritized.

- Four-tier system includes captive call center, field team, legal team, and skip tracing for loan collection and recovery.

- Understand key metrics like NPA%, 90+DPD, and types of loans for risk assessment and ROI potential.

- Strategies for investors include evaluating credit assessment mechanisms, scrutinizing borrower profiles, diversifying investments, prioritising robust loan recovery systems, and advocating for transactional transparency.