In today’s edition

- For Google, Apple’s user base is crucial

- Amazon ventures into automotive sales

- Amazon and Meta unite to enable direct Amazon purchases through ads

- SpaceX’s Starlink division is considering a potential future public offering

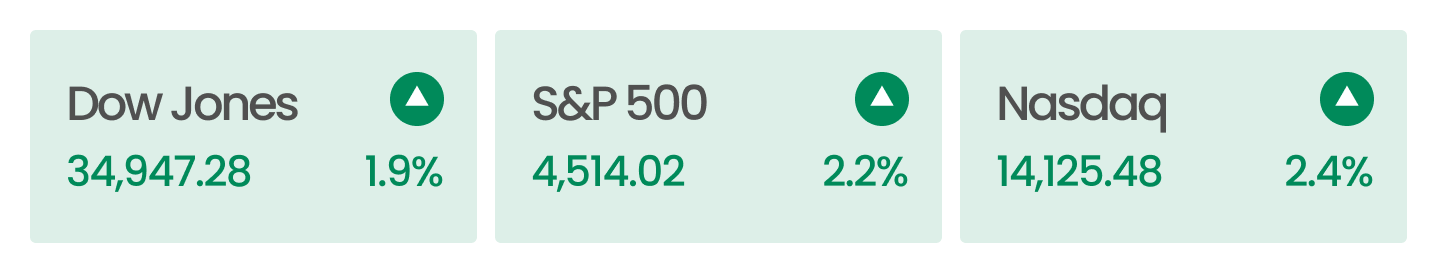

Market Snapshot

The S&P 500, Nasdaq Composite, and Russell 2000 Index closed with gains for the third week, reaching new 3-1/2-month highs. This upward trend was driven by investor optimism about the Federal Reserve potentially ending its rate hikes.

For the week, the S&P 500 rose 2.2%, the Dow Jones increased by 1.9%, and the Nasdaq Composite went up 2.4%.

Retail stocks, boosted by Gap’s 30% surge, and energy stocks, driven by a 4% rise in WTI Crude Oil futures, were among the top performers. Despite a predicted slowdown in trading due to the Thanksgiving holiday, key earnings reports from NVIDIA, Zoom, Best Buy, and others are expected in the upcoming week.

News Summaries

In a recent Google’s antitrust trial, it was disclosed that Google pays Apple 36% of the revenue earned from search advertising via the Safari browser, a figure unintentionally confirmed by University of Chicago professor Kevin Murphy and later by Google’s CEO Sundar Pichai. This significant percentage underscores the value Google places on being the default search engine for Apple’s Safari browser, recognizing the high worth of Apple’s customer base and the importance of maintaining default status. The disclosure highlights Google’s strategic decision to invest heavily in retaining Apple users, even if it means paying much of its revenue, indicating the critical nature of this partnership in Google’s business model. This deal illustrates the competitive dynamics in the tech industry, where even a 100% revenue share offer from a competitor like Microsoft wouldn’t outbid Google’s commitment to its position with Apple.

Amazon is stepping into the automotive retail market by partnering with Hyundai to sell new vehicles on its platform, marking its first venture into car sales. This move is significant given Amazon’s dominance in e-commerce and the complexity of car sales, which involve various factors like trade-ins, financing, and warranties. The arrangement will also integrate Amazon’s Alexa into Hyundai vehicles from 2025. While the financial details of this partnership are not disclosed, it’s expected to have a notable impact on the industry, as evidenced by the decline in stock values of major used car sellers like Carvana and CarMax following the announcement. This venture highlights Amazon’s potential to disrupt the automotive market, although it still relies on dealership participation due to existing franchise agreements in the automotive industry.

Amazon and Meta Platforms are experimenting with a feature enabling users to purchase Amazon products directly through ads on Facebook and Instagram. This collaboration, which involves linking Amazon accounts to social media profiles, aims to enhance Meta’s appeal to advertisers and expand Amazon’s customer base beyond its traditional web store. The initiative will offer US shoppers real-time information on pricing, delivery, and product details within these ads. The potential of this partnership lies in its mutual benefits: Meta will gain improved ad tracking and performance, while Amazon will see increased sales volume. This synergy could transform product discovery, leveraging Meta’s strength in reaching consumers early in the buying process and complementing Amazon’s existing success in intent-based search advertising.

Reports of SpaceX’s plans to spin off its satellite internet division, Starlink, into a public company by late 2024 have been met with Elon Musk’s denial. Despite this, Starlink remains a crucial factor in SpaceX’s increased valuation, soaring from $28 billion in 2018 to $150 billion in 2023, attracting significant investor interest. Prominent investors, like Ron Baron, project SpaceX’s worth to reach $500 billion by 2030, largely due to Starlink’s growth. Musk has previously stated that Starlink’s public offering would be considered once its cash flow becomes predictable, a milestone apparently reached earlier this month, as Musk announced the unit’s breakeven cash flow on social media.