In today’s edition:

- ASML’s Q1 performance

- Tesla reported a decline in profits

- Cannabis industry and $100 billion impact

- Netflix discontinues DVD-by-email service

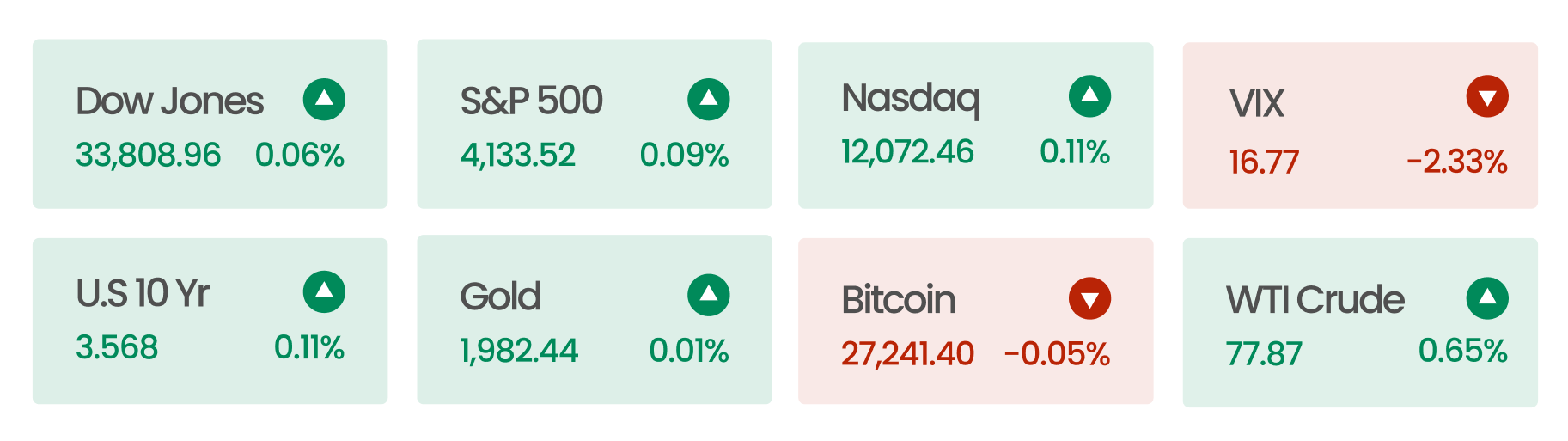

Market Snapshot

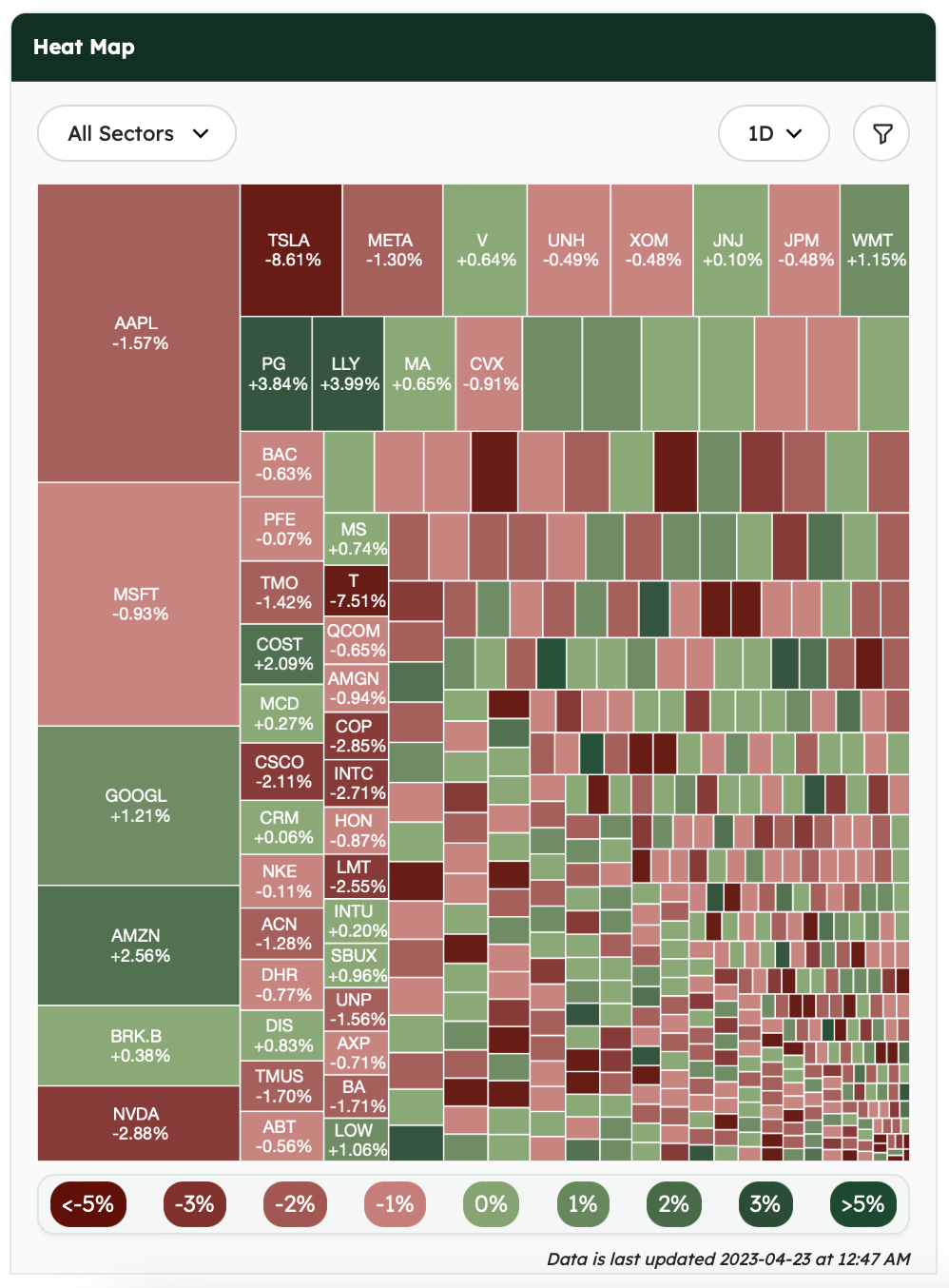

On Friday, the major US stock indexes experienced a slight increase as investors balanced concerns about the banking sector and the recession with optimism for the remaining first-quarter earnings season. However, despite the slight upward movement, the indexes remained lower for the week.

Investors anticipate next week’s results, which will include several well-known companies, including Microsoft, Alphabet, and Amazon.

News Summaries

Tesla’s stock (TSLA) was heavily traded during the after-hours trading session after the company reported a 24% drop in profits for Q1 2023, compared to last year. The drop in profits is due to its decision to lower car prices in the face of rising interest rates, which make monthly payments more expensive and make cars less affordable. Despite the profit drop, vehicle sales rose, with Tesla delivering 422,875 vehicles during the first quarter, a 36% increase from the prior year. CEO Elon Musk explained the strategy, saying that pushing for higher volumes and a larger fleet is the right choice over lower volume and higher margins and that the company expects its vehicles to generate significant profit over time through recurring software revenue.

ASML Holding (ASML), a key supplier to computer chip makers, has reported Q1 2023 net sales of $7.4 billion, with a gross margin of 50.6% and net income of $2.2 billion, a 3x increase from the previous year. The demand for ASML’s extreme ultraviolet lithography machines, capable of manufacturing the most advanced chips, accounted for 54% of total system sales in Q1. ASML is well-positioned to weather the economic downturn, especially when compared to its competitors – Nokia, Nikon, AMAT, and KLA Tencor. This is due to ASML’s high EUV market share of over 75%, increased demand for chips from the gaming and AI industries, and management’s prediction of the end of the export ban.

The cannabis industry is projected to add over $100 billion to the US economy in 2023; by 2027, the industry could add more than $160 billion. Despite being illegal under federal law, many states have legalized cannabis for various reasons. The legal status at the state level allows cannabis businesses to operate in the open. For these states, cannabis helps generate tax revenue and reduce law enforcement costs associated with prosecuting cannabis-related crimes. Per a recent report, for every $10 spent on cannabis, $18 is added to the economy, much of it injected locally. But being illegal at the federal level means that cannabis businesses cannot rely on the US banking system as most big banks and card networks shun them. They operate their business mostly in cash, increasing costs and operational risks.

Netflix (NFLX) is shutting down its DVD-by-mail business after over 20 years of shipping more than 5.2 billion DVDs. CEO Reed Hastings had predicted the downfall of the DVD division as early as 2009, and the company has since shifted its focus to streaming and original content. The DVD business has steadily declined, with revenue falling from over $1 billion to just $146 million last year. Despite marking the end of an era, Netflix’s subscription model and algorithmic recommendations, introduced through the DVD service, played a significant role in shaping the company. To learn more about Netflix’s evolution over the years and its business strategy, read this.