In today’s edition:

- Tesla’s Supercharger Triumph: GM and Ford embrace Tesla’s charging standard

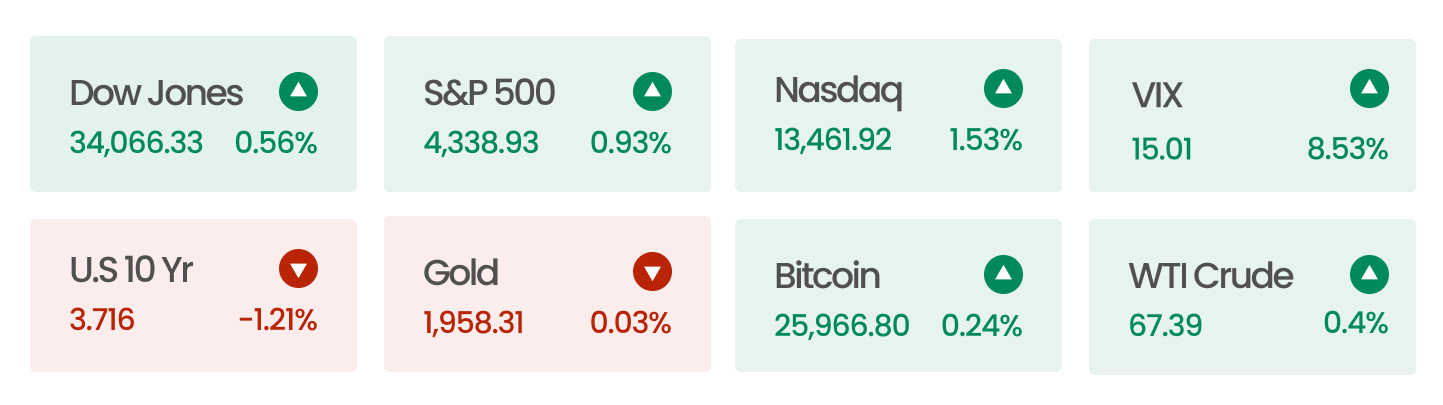

Market Snapshot

The S&P 500 and Nasdaq Composite indices have reached 14-month peaks, as market participants anticipate a standstill in the Federal Reserve’s rate-hiking policy at the upcoming Federal Open Market Committee (FOMC) meeting, along with monthly inflation data.

Data as of market close 12th June 2023

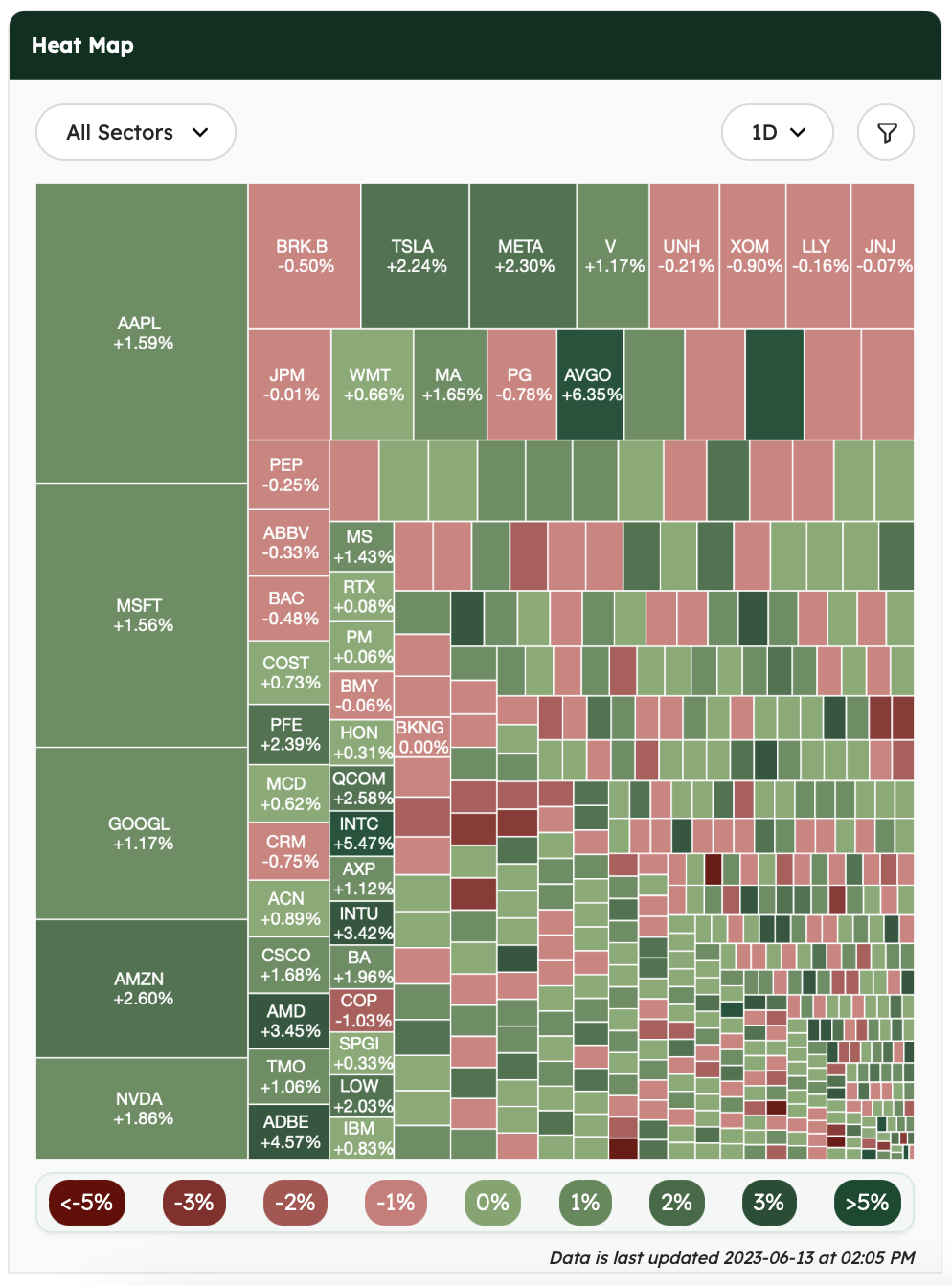

Source: AlphaScreener

Tesla’s Supercharger Triumph

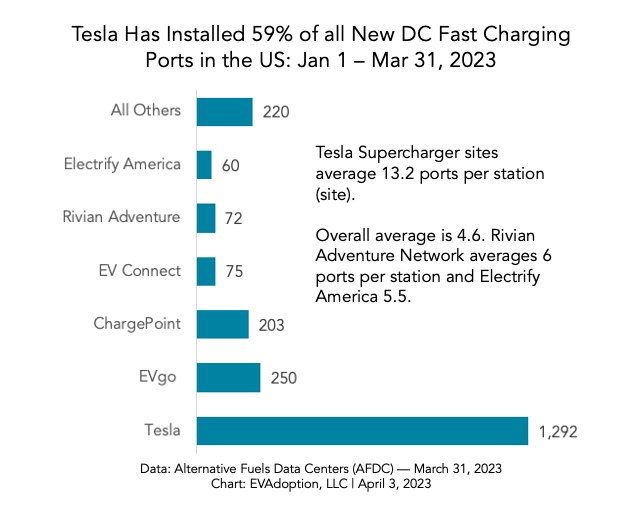

In a significant development for the electric vehicle (EV) industry, General Motors Co. (GM) has followed Ford Motor Co.’s (F) lead by announcing a partnership with Tesla Inc (TSLA). Both companies agreed to adopt Tesla’s Supercharger network, finally ending the debate over EV charging standards. With 17,740 individual ports in the US, Tesla has the largest EV charging network by a wide margin (see Figure 1 below). Following their deal with Tesla, both Ford and GM will begin equipping their EVs with charging ports suitable for Tesla’s proprietary North American Charging Standard (NACS).

Figure 1: Tesla dominates the EV charging market. Source

Despite their rivalry in the automobile industry, this partnership is a win-win scenario for all parties. It will streamline the EV charging infrastructure in the US and address consumer concerns about access to reliable charging options.

- Ford and GM get access to an improved charging network. Until now, both companies have used the often unreliable Combined Charging System (CCS). In contrast, Tesla’s NACS has a larger capacity and is cheaper to make.

- Tesla strengthens its position in the EV market by adding millions of new customers to its network. According to Elon Musk, Tesla’s charging network had profitability of roughly 10% last year. Adding more customers will boost revenue.

- EV consumers gain access to more charging stations. The availability of nearby charging options has been the greatest obstacle to EV adoption in the US. Adopting the NACS will mitigate many of the charging issues faced by consumers.

However, this deal has severe implications for other EV charging companies. Despite increasing revenues, competitors such as EVgo Inc. (EVGO), ChargePoint Holdings Inc. (CHPT), and Blink Charging Co. (BLNK) have been struggling due to a lack of profitability. Following the recent announcements, their stock prices fell sharply. These operators now face the challenge of finding new ways to remain competitive.