Investors from India Can Gain Exposure to the Chinese Growth Story via the US Stock Market

For the savvy Indian investor, investing in Chinese companies listed in the US stock exchange could be a great way to create a global portfolio. The fast growing Chinese economy, driven by a massive user base China, fast growing middle class, and rapid technology adoption has led to the creation of some of the world’s leading technology companies. But instead of going public in China, more and more of these Chinese technology companies are choosing to list in the US. Why is that?

This trend is largely due to five reasons:

- To be listed in the Chinese stock market, a company must be profitable for an extended period of time. This is not the case for listing in the US. As such, you see many unprofitable, but fast growing Chinese tech companies listing in the US. The latest example is Nio, a chinese electric car company, which has a revenue of US$ 7M for the first half of this year, with a net loss of US$ 502M

- Listing in the US allows Chinese companies to have better access to a global and mature investor pool that understands the unique business models of technology companies.

- If a Chinese company takes in foreign investment, it cannot be listed in the Chinese stock market.

- The listing process in China is very time consuming. It can often take years just to get an IPO clearance.

- The Chinese regulatory body can interfere with market activities, going as far as contacting traders directly if they step out of line.

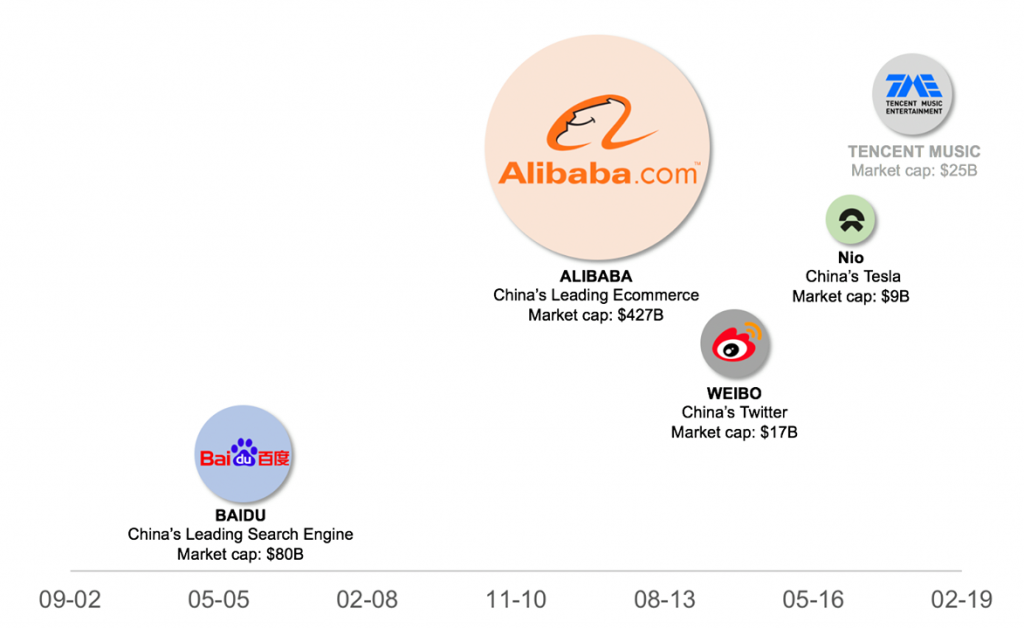

Here’s a list of the biggest Chinese tech IPOs which happened on US stock exchanges:

Figure 1: Timeline of the largest Chinese Tech IPOs in the US. Tencent Music is expected to IPO in the US in the few coming months

For Indian investors, another benefit of investing through the US stock market is that the ecosystem is very well regulated, with strict controls on financial reporting, transparency, and standardized governance practices, making it easier for the investors to evaluate the different opportunities.

In recent months however, China has been reforming its system to make it easier for Chinese technology companies to be traded on the local stock market, by creating depository receipts that represent Chinese stocks that are traded outside China. This allows domestic Chinese investors to invest in these companies without having to enter the US stock market.