NSE IFSC allows investing in certain US stocks: How does it compare with direct investing?

NSE IFSC, the NSE’s International Exchange recently started trading in certain US stocks via a unique product called unsponsored depository receipts. First and foremost, this is a big step forward for cross-border investing from India. Three years ago most investors in India did not even know that we can legally invest in US companies and now today, one of the premier exchanges in the country has their own solution offering international investing. We have come a long way! Irrespective of whether the direct or IFSC route is the best option, one thing is certain – global investing is here to stay and everyone should start thinking of adding some global allocation to their portfolio.

Now, for this article, we wanted to share a quick comparison between investing directly via a US broker vs. the new NSE solution. We will focus on four areas: Structure, Cost, Taxation, and Regulation.

One quick piece of information before we start – the NSE IFSC is based in GIFT City. GIFT city is an initiative undertaken by the Government of Gujarat to create a global financial and IT hub in India. The Gift City IFSC (International Financial Services Centre) has been established to provide global financial products to institutions and investors in India and across the globe.

Structure

Typically when you are investing in a stock, you would expect to be a direct shareholder of that company right? Well, the NSE solution works a little differently. When investing via the NSE IFSC route, you are not directly investing into Apple or Meta or Google, instead you are buying receipts (the investing jargon is – Unsponsored Depository Receipts).

What are receipts? Let’s look at an overly simplified example:

- Say you own 1 Apple share and a lot of your friends want to invest in it but there’s only one share available in the market

- Now instead of selling the share, you create a 100 ‘receipts’ for them to buy/sell amongst themselves

- Every time you receive a dividend from Apple, you will divide it into 100 parts and distribute it to all receipt holders. But none of your receipt holders can vote in company meetings because they are not actual Apple shareholders, only you are a shareholder

- Now, the price of your Apple receipts will be determined by the demand and supply in your newly created ‘market’. For example, if Apple releases bad results, there will be a lot more sellers than buyers amongst your friends and the price will drop

- But will it drop exactly as much as the price of the actual Apple share that you own? Unlikely right, because your 100-person market might behave slightly differently than the actual market for Apple shares

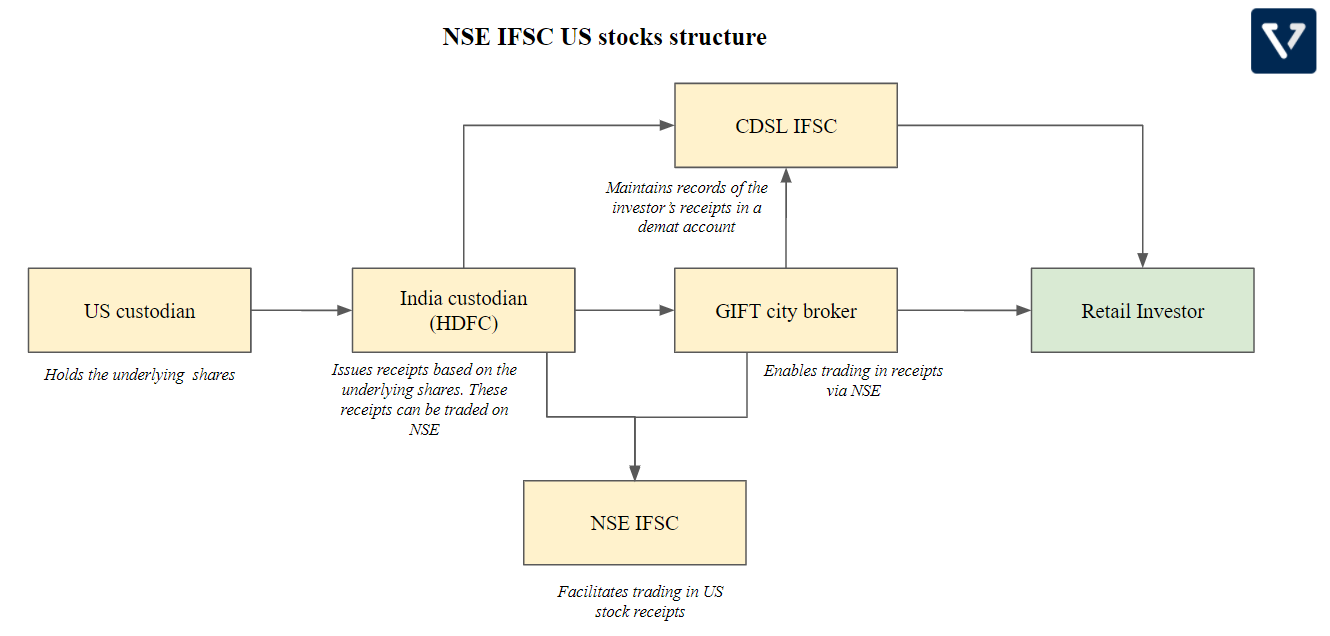

You and I cannot create such markets because the regulators do not allow it, but exchanges can and that’s exactly what NSE has done. They have created a structure wherein the underlying stocks will be held at a US custodian while they, in partnership with HDFC Bank, issue receipts that can be traded by Indian investors. The ratio for the receipts (1:100 in our example above) will be determined by NSE and HDFC in India. The platform has received approval for issuing receipts of 50 US companies (vs. 2,000+ companies if you go direct). However, for now 8 stocks will be available for trading- Amazon, Tesla, Alphabet, Meta Platforms, Microsoft, Netflix, Apple, and Walmart.

While it’s a new and innovative structure, as we saw in the example above, it is tricky for these receipts to mimic the price movements of the underlying stock. Lets look at Infosys for example – Infosys issued receipts in the US to raise money in the 90s and 2000s. Their stock is primarily traded in India but also has receipts available in the US, the inverse of what the NSE has done. Now compare the returnsgiven by Infosys receipts in the US vs. the stock in India, you will see that they always differ.

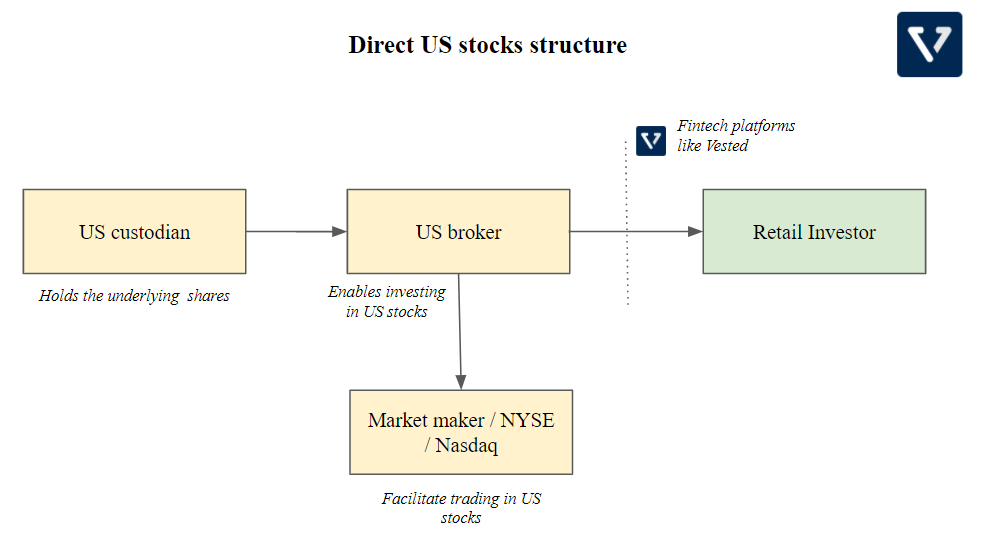

In contrast to the NSE solution, when you are investing via a US broker, you become direct shareholders in the stock that you are investing in. Even though you are able to invest in fractions, you are still a shareholder and you get all the voting rights and dividends as a regular investor.

To help you understand the differences between the two options, here are two diagramatic representations highlighting the different entities involved in both, the NSE IFSC and the direct US investing structures.

Cost

Next, let’s look at the costs involved in both processes. As you can see in the structure diagram above, the NSE solution has more entities involved in the value chain and so there are likely to be additional cost layers compared to the direct solution.

If you are investing via the direct route on Vested, the cost structure is simple – the only fees you need to pay is currency conversion. When depositing funds or converting from INR to USD, there are no fixed fees, there is only a 1.2% foreign exchange markup that you pay on the conversion rate. This is much lower than the 2-3% that banks typically charge. When withdrawing funds or converting from USD to INR, a $11 fee is charged – this will go down soon as well.

On the contrary, when investing through the NSE IFSC route here are the charges/fees you need to be aware of:

- Two types of custodian fees charged by HDFC:

- Issuance and cancellation fees of US$0.05 per NSE IFSC receipt

- 10% of your dividends

- Brokerage charged by the IFSC-based broker

- Transaction fees charged by CDSL (more clarity on the fee structure is awaited)

- Exchange fees

- Currency conversion fees when you convert INR to USD and vice versa

Taxation

Here is a simple graphic to summarise how taxation works via both the solutions.

Regulation

Lastly, let us take a quick look at the regulations in place for both options. In the case of the NSE solution, it is registered in GIFT City, which is a special economic zone and India’s first International Financial Services Centre (IFSC). The regulator for IFSC is Financial Services Centres Authority (IFSCA), a unified regulator of banking, capital markets and other financial products in GIFT City.

US brokers which let you invest in US stocks are registered with the Securities and Exchange Commission (SEC), an independent agency of the US federal government. If the platform you use is based in India, they will likely have a tie-up with a US-based broker. Each account opened with a US broker has an insurance coverage of up to $500,000 provided by the SIPC in the US.

For both of these options, the fund transfer into dollars would be done under the RBI’s Liberalised Remittance Scheme (LRS), a Scheme that allows Indian residents to internationally transfer up to $250,000 per year for various purposes including investments abroad. You can read more about LRS.

Alright, so that wraps up our comparison between two options investors have to add US stock exposure to their portfolio.