In today’s edition,

- X’s advertising decline

- Tesla’s China challenges

- Klarna’s pre-IPO numbers

- Stablecoin market dynamics

Market Snapshot

The stock market just had its worst week in 18 months, with significant losses. This drop was driven by ongoing economic uncertainties and a steep decline in the semiconductor sector. Additionally, August’s U.S. job growth fell short of expectations, adding only 142,000 jobs instead of the anticipated 160,000. Revisions to the previous months’ figures further heightened concerns about the strength of the labour market.

This disappointing jobs report made Wall Street more sensitive to economic weaknesses. It led investors to favour defensive sectors like real estate, health care, and utilities. These sectors outperformed the technology and discretionary sectors. Meanwhile, the semiconductor sector faced a significant setback after Broadcom’s weak earnings. As a result, the PHLX Semiconductor Index (SOX) fell nearly 12% for the week.

Reflecting the cautious investor sentiment, major indices fell sharply. The S&P 500 dropped 3.7% to 5,408.42, the Dow Jones Industrial Average decreased by 2.5% to 40,345.41, and the Nasdaq Composite tumbled 5.4% to 16,690.83.

Stock market closing data for the week of Sep 2nd to Sep 6th, 2024

News Summaries

The trend of advertisers pulling away from the social media platform X is intensifying. According to a global survey by Kantar, a net 26% of marketers plan to decrease their advertising budget on X in 2025, the largest reduction seen across major platforms. This decline follows Elon Musk’s acquisition in 2022, after which he relaxed content moderation policies, leading to a significant drop in the platform’s perceived brand safety; only 4% of marketers now consider ads on X “brand safe,” compared to 39% for Google. Despite X’s claims of a 99% brand safety rate verified by third-party agencies and an increase in consumer ad preference, the decreased advertiser trust and Musk’s confrontational stance with the industry, including threats of legal action against major advertisers, paint a bleak picture for the platform’s advertising revenue prospects. The shift away from X began years ago but has accelerated under Musk’s leadership, with industry leaders like TikTok and YouTube seen as more innovative and trustworthy.

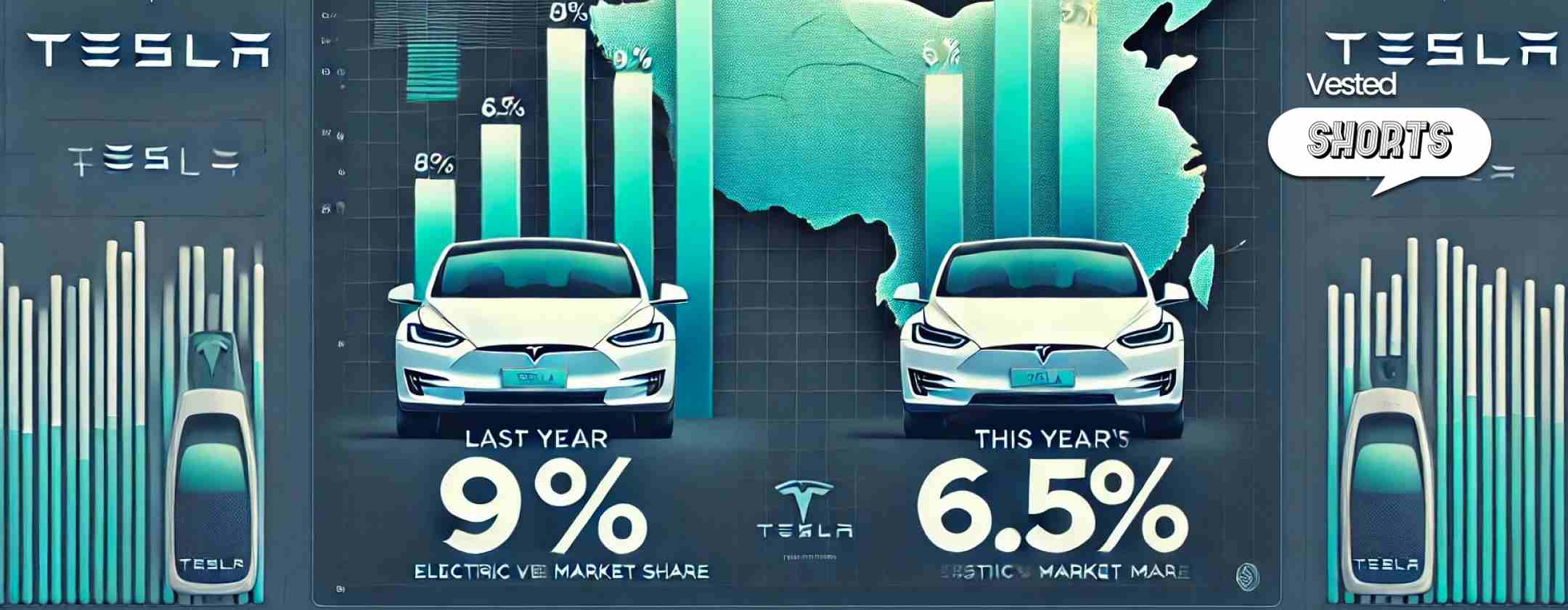

Tesla’s share of China’s EV market has fallen from 9% to 6.5% over the past year, as reported by Shanghai consultancy Automobility. This decline in sales is linked to the company’s lack of new electric vehicles (EVs) since 2019. Meanwhile, competitors are rolling out over 100 new models this year. Furthermore, the rise of plug-in hybrids has impacted Tesla’s market. These vehicles, which blend battery and traditional engines, get significant government support. They are popular in smaller cities with limited charging options. This support eases worries about long-distance travel. Chinese companies like BYD have seized the opportunity to launch hybrids with longer ranges than Tesla’s. Meanwhile, Tesla is combating falling sales by promoting its semi-autonomous driving technology. The goal is to tap into new revenue streams and gain regulatory approvals to stabilize its market position.

Klarna reported a financial turnaround in H1 2024. It posted an adjusted operating profit of 673 million Swedish krona ($66.1 million). This is a big improvement from a 456 million krona ($44.6 million) loss in the same period last year. This growth came from a 27% rise in revenue to 13.3 billion krona ($1.3 billion). A 38% surge in US sales, fueled by aggressive merchant onboarding, drove it. The buy now, pay later leader touts its adjusted operating income as the true measure of success. AI-driven cost cuts and efficiency gains fuel profitability, setting the stage for a likely U.S. IPO. Klarna’s financial services expand with the new “Klarna Balance” account. Meanwhile, the company sharpens its focus by selling off its checkout technology arm. This strategic shift positions Klarna to double down on its primary strengths in the evolving fintech landscape.

From the World of Crypto

The stablecoin arena is buzzing with activity!

From tech giants to financial entities and even a U.S. state, a wide range of players is diving into the creation of stablecoins. Recently, companies like Mercado Libre, Banking Circle, and Paxos International have announced plans for their own stablecoins. This trend coincides with a recovery in the crypto market. Now, stablecoins have hit $169 billion in circulation, fueled by the earlier peaks of Bitcoin and Ethereum.

Despite this impressive growth, the actual everyday use of stablecoins remains somewhat limited. These digital assets aim to mirror stable currencies like the U.S. dollar. They mainly facilitate easier crypto trading. However, they aren’t yet using digital cash for daily transactions. Visa’s data shows that most stablecoin transactions are for automated trading. This use far exceeds that of stablecoins for everyday purchases.

On the flip side, the financial incentives for issuing stablecoins are clear.

Stablecoins are typically tied to the dollar. Their issuers earn interest on reserves, often in U.S. Treasuries. This approach has proven profitable. For example, Tether, which controls 70% of the market, made $5.2 billion in the first half of this year.

However, without distinct features to distinguish them from established giants like Tether and Circle, many new entrants might struggle to find their footing in an already saturated market.

As we watch this space evolve, the question remains: will stablecoins break beyond their niche in trading to become a staple in our wallets? Only time will tell.