In this Blog, we discuss Genesis’ bankruptcy (and the potential implications for GBTC), Google’s layoffs (which the market likes), and poor infrastructure quality (as part of China’s Belt and Road Initiative).

Let’s get to it.

Genesis: The latest crypto lender to go bankrupt.

Although crypto has undergone many boom and bust cycles in the past decade, this latest bust cycle is unique in that it is triggered by the rapid increase in interest rates (no more cheap money for speculation). This led to cascading failures of many firms (Celcius, 3AC, FTX) due to over-leverage.

The latest domino to fall in the crypto winter is Genesis. This past week, Genesis filed for bankruptcy.

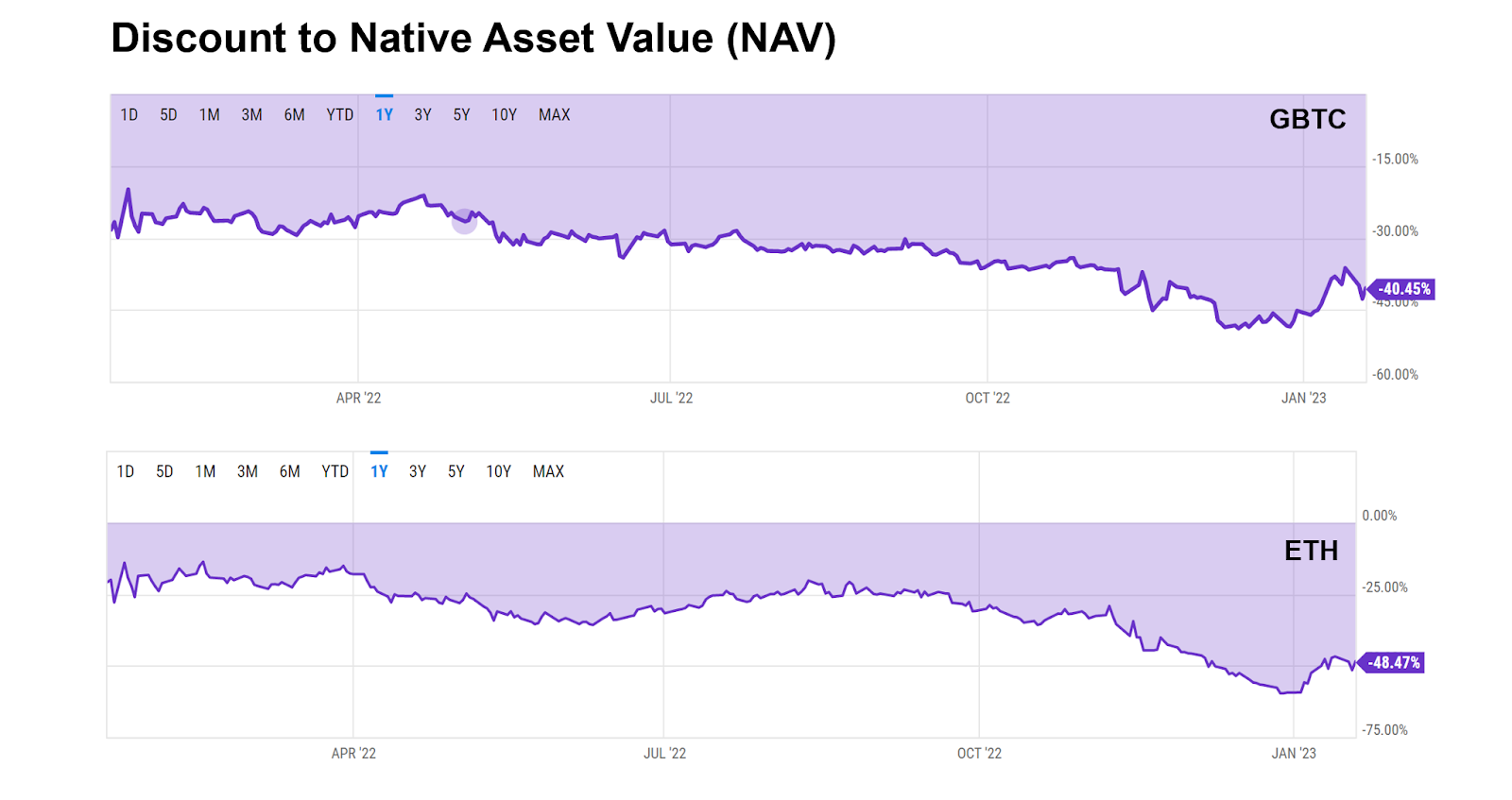

Of particular interest to the retail investors is the impact of this bankruptcy on GBTC and other Grayscale funds. Specifically, will this lead to the liquidation of GBTC and other Grayscale funds, which would free them up from the massive discounts from NAV that they are trapped in? (as of this writing, GBTC and ETH are trading at 40.45% and 48.47% discounts respectively)

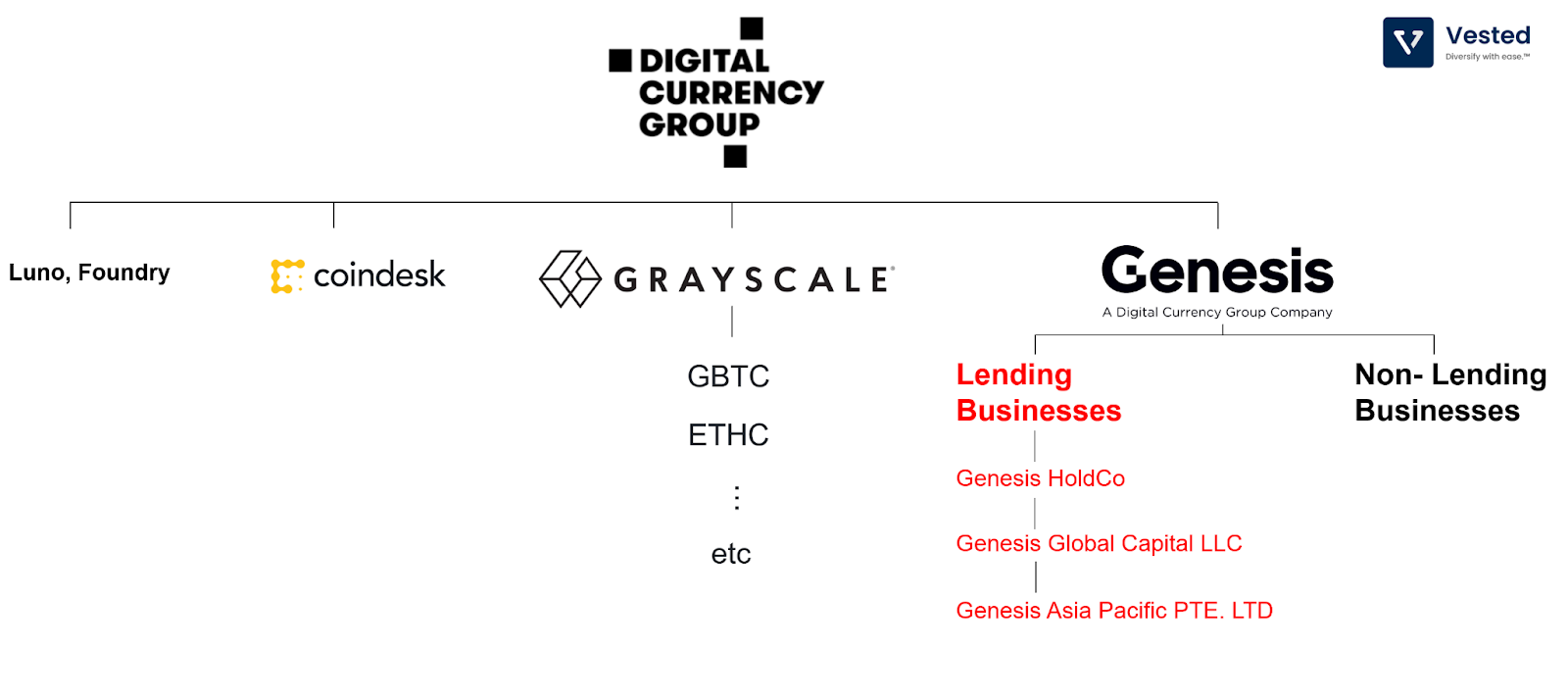

To answer this question, let’s look at a simplified corporate structure diagram of the affiliated entities related to Genesis (see Figure 2 below).

As you can see above, DCG has quite a complex structure. The Genesis arm itself comprises multiple subsidiaries conducting different types of activities. The bankruptcy filing filed in NY last week was explicitly for the lending businesses (in red). Its non-lending businesses will operate as usual.

The bankruptcy filing was preceded by months of speculation of solvency, which first started when Genesis halted withdrawals from its lending products in November 2022. The bankruptcy filing reveals that Genesis owes its top 50 creditors roughly $3.5 billion (it only has about $150 million in cash). The top creditor is Gemini, a crypto exchange owned by the Winklevoss twins (who are in a Twitter spat with DCG’s CEO), which it owes $765 million – an amount impacting more than 340,000 retail investors.

The separation of entities typically means that whatever assets remain from the lending businesses will be auctioned off to pay the creditors. Considering the whole size, creditors should expect cents to the dollars owed. The key question is whether creditors have a claim on other assets outside Genesis’ lending businesses, specifically the Grayscale trust.

- If they do not have a legal claim, then there’s no forced liquidation of GBTC and the other trusts

- If they do, GBTC can be liquidated, forcing the shares to converge to the NAV of the underlying BTC.

Most in the market believe that creditors do not have a claim on GBTC assets. The Winklevoss twins, of course, disagree. They have threatened to sue DCG to get more.

To complicate matters, there are related-party transactions that may further muddy the waters:

- In an investor letter, Barry Silbert, CEO of the parent company, DCG, noted that DCG borrowed ~$575 million from the now-bankrupt Genesis to buy back shares from insiders.

- To shore up Genesis’ balance sheet, DCG assumed ~$1.1 billion of liabilities from Genesis (in the form of a promissory note – not cash!), which it incurred from the 3AC collapse.

It is still unclear what will happen next. The matter will play out in court over the next few months. One thing is clear, though. Genesis’ proposed bankruptcy roadmap is to distribute existing assets from the bankrupt entities to creditors, and if that falls short, creditors will receive ownership interests in the reorganized entity post-bankruptcy. They do not plan to liquidate their Grayscale products.

For investors looking to capitalize on the short-term return from GBTC investments closing its NAV discount, the chances of this happening are quite slim.

Google: The latest tech giant to announce layoffs

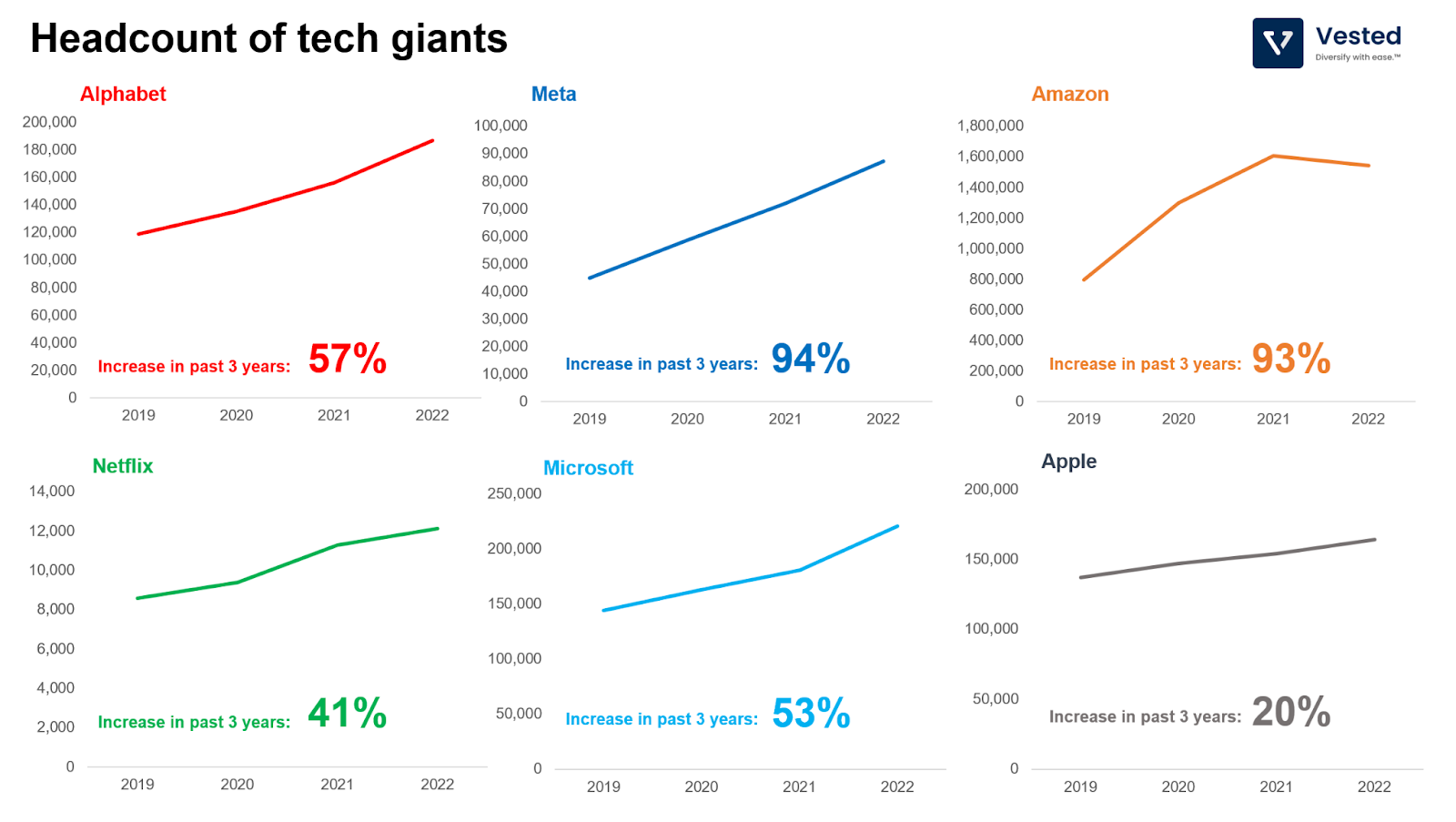

Alphabet (Google) announced that it is laying off 12,000 workers. This is the first mass layoff that the company has ever done. But this is only a small decrease (about 6%) in the company’s overall headcount.

In the past three years, the majority of the tech giants have undergone significant headcount expansion (see Figure 3 below). Since the end of 2019 (before the pandemic), Alphabet has increased its headcount by about 57%, while the workforce at Meta (FB) and Amazon has almost doubled. Meanwhile, Netflix and Microsoft have increased headcounts by 41% and 53%, respectively. In contrast, Apple has experienced the most modest increase (20%).

Most of these firms were expecting covid-induced digital growth to continue post-pandemic. But this has not been the case. Most digital trends seem to have returned to pre-pandemic states. This, coupled with higher interest rates environments, has renewed investors’ focus on return on investments and cash flow. As such, such layoffs tend to generate a positive impact on short-term share prices. Shares of Alphabet jumped more than 5% after the announcement.

Similar to Alphabet, other firms announced layoffs:

- Microsoft announced two large layoffs these past few months, amounting to 5% reduction of its workforce

- Netflix cut 4%

- Amazon has reduced its workforce by about 1.2%

- Meta, the company that has grown the most, reduced its headcount by 13%

- Meanwhile, Apple has not announced any layoffs

These tech layoffs are not representative of the overall US job market however. The US labor market is still tight, with unemployment levels at 3.5%, a multi-decade low.

Made in China: Infrastructure edition

There was a time when “Made in Japan” was synonymous with cheap and poor-quality items. However, over the past decade, Japan climbed up the quality ladder and is now synonymous with high-quality exports (which has allowed them to charge higher prices).

More recently, China has also climbed the quality ladder. Made in China is no longer associated with poor quality (at least in the US). But something that the world is increasingly learning is that infrastructure made in China and built in other countries may not have the same imputed quality.

WSJ recently reported how infrastructure projects, part of China’s Belt and Road Initiative – where China provides financing for infrastructure projects that are carried out by Chinese construction companies in various emerging countries – are falling apart:

- Thousands of cracks have emerged from the $2.7 billion Coca Codo Sinclair hydroelectric plant in Ecuador. The dam is only seven years old

- Another hydroelectric plant in Pakistan was shut down last year, after cracks in a water tunnel were discovered. The plant was only four years old

- A similar observation was made in Uganda, in a two-year-old plant

These issues could be because achieving operational excellence when operating abroad is much more difficult, as graft and corruption are much more difficult to monitor.